Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB) has reported the results from its first-ever heap leach column tests at the Flat Gold Project in Alaska. The metallurgical tests, conducted on a mix of oxidized and non-oxidized fresh mineralized rock, achieved gold recoveries of 96% and 91%. This marks a major milestone in the project's development and validates the potential for cost-effective heap leach processing at Flat. It also positions the project as a strong candidate for large-scale mining operations.

Key findings and highlights from the news release:

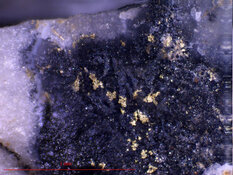

- Exceptional gold recovery: 96% and 91% gold recoveries were achieved from coarse three-fourths-inch material, representing a mix of oxidized and non-oxidized mineralization from nine drill holes at the Chicken Mountain intrusion.

- Rapid leach kinetics: More than 80% gold recovery was realized within 29 days for the higher-grade composite column and 36 days for the lower-grade composite column.

- Heap leach validated: The column test results confirm the potential for heap leach processing at Flat, including both oxidized and non-oxidized fresh mineralization.

- Non-oxidized fresh mineralized rock amenable to heap leaching: Results show that gold recoveries are not significantly impacted by the presence or absence of oxides, indicating heap leaching suitability across different types of mineralization.

- No agglomeration required: Tests showed that agglomeration was unnecessary, potentially improving processing efficiency and lowering costs.

- Potential for run-of-mine heap leaching: Similar to Kinross Gold's Fort Knox mine, gold at Flat is fracture-controlled, allowing for efficient leach solution access and fast recovery on coarse material, indicating the potential for uncrushed run-of-mine material to be heap leached.

The company noted that these results reinforce the potential for a cost-effective, large-scale mining operation at Flat, solidifying its importance in Tectonic Metals' portfolio.

Strong Gold Market Driving Mining Opportunities

According to 321Gold, on September 17, gold was positioned in a "sweet spot" where both risk-takers and investors saw value in maintaining or increasing their positions. Analysts from Goldman Sachs echoed similar optimism. The feeling is that a forecasted rise in ETF buying could significantly influence high-net-worth investors and funds.

The gold market's ongoing strength has also led to increasing interest in mining stocks. On September 18, Kitco reported that gold prices above US$2,600 an ounce were "creating significant value in the mining sector," with Warwick Smith stating that mining stocks could be the biggest beneficiaries as investors recognized their potential for growth. Smith also noted that, while high gold prices are important, the sector required a "risk-on" sentiment for sustained growth.

Jeff Clark of The Gold Advisor praised Tectonic Metals for their strategic drilling efforts, stating in a September 19 newsletter that "multiple layers of geological evidence stacked on top of one another" indicated that "it's time to drill here."

In addition, Stockhead highlighted on September 13 that the rally in gold prices, reaching a new high of US$2,568 per ounce, had spurred significant movement in the gold sector.

Mergers and acquisitions were shaking up the domestic gold market in Australia, such as Antipa Minerals' sale of its interest in the Citadel gold project to Rio Tinto. These deals are providing juniors like Tectonic Metals with a framework for potential future growth and exploration acceleration.

A report from BullionVault on September 16, written by Gary Tanashian, emphasized that gold's ability to outperform cyclical commodities during deflationary periods could further strengthen the fundamentals of gold mining companies. Tanashian pointed out that despite the ongoing positive trends in the gold market, gold miners were not yet unique in their positioning. He suggested that the sector might face future vulnerability in broader market corrections but also noted that this could pave the way for longer-term bull markets for miners that are well-positioned for future growth.

Advancing Toward Large-Scale Mining at Flat Project

According to the company's investor profile, Tectonic Metals views these metallurgical results as pivotal for advancing the Flat Gold Project. The successful tests open the door for further exploration and development, while the ability to process both oxidized and non-oxidized mineralization adds flexibility to future operations. The investor update highlights the strategic importance of the Flat project, describing it as "Alaska's next tier 1 gold opportunity."

Additionally, the Flat project's similarities to the Fort Knox mine, including its heap leach potential, offer Tectonic a significant edge in bringing this project into production. With a proven leadership team that has a track record of transforming ventures into profitable operations, Tectonic is positioning itself for continued growth in Alaska's gold sector.

Analysts Highlight Growth Potential in Gold Mining

Jeff Clark of The Gold Advisor praised Tectonic Metals for their strategic drilling efforts, stating in a September 19 newsletter that "multiple layers of geological evidence stacked on top of one another" indicated that "it's time to drill here." His positive outlook highlighted Tectonic's strong geological foundation and the potential of their Flat Gold Project.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB)

BullionVault further emphasized the company's strong positioning within the sector. According to Gary Tanashian on September 16, the gold mining fundamentals for companies like Tectonic Metals were "doing quite well." He noted that Tectonic's progress within the current cyclical bull phase, combined with improving fundamentals, placed them in an advantageous position for future market growth.

Ownership and Share Structure

According to Refinitiv, 22.57% of Tectonic Metals is owned by Institutions. Of those, Crescat Capital LLC owns the most with 18.81%, Konwave A.G. owns 2.45%, and Mackenzie Financial Corporation has 1.31%.

Management and Insiders have 1.74%. Of those, President and CEO Antonio Reda has the most with 1.26%.

Strategic Instution Doyon Ltd holds 8.55%. The rest is retail.

Tectonic has a market cap of US$16.92 Million with 342.61 Million Free Float Shares. Their 52-week range is US$0.045 - 0.17

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.