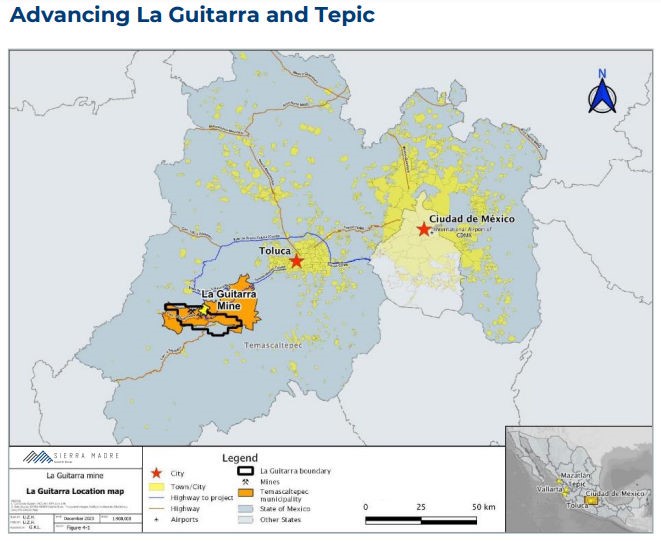

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) is on track to be a mid-tier silver producer. The company has two properties in Mexico, with the flagship 100% owned La Guitarra property, which was acquired from First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) in 2023, being not far west of Mexico City in Mexico State in the southeast of the Mexican silver belt and the lesser Tepic exploration property being further west, close to the coast.

The first slide from the company's new investor deck shows the location of La Guitarra within Mexico State, west of Mexico City, and in the inset, you can just make out the location of the Tepic property to the northwest.

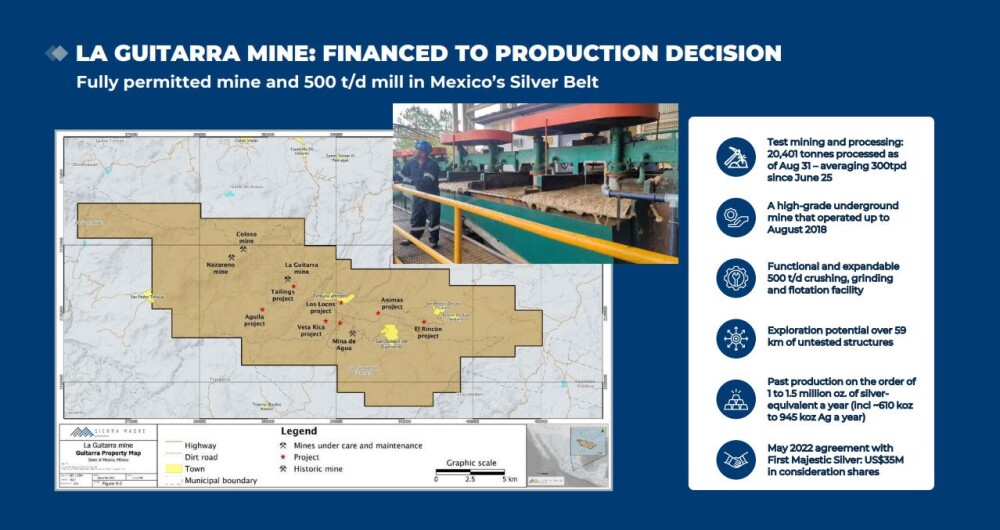

La Guitarra is an extensive District Scale property, being 40,000 hectares in area, and contains five main gold and silver bearing systems. The extensive work already done at La Guitarra puts the company in an exceptionally advantageous position.

The property contains three past-producing high-grade silver and gold mines, La Guitarra, Coloso, and Nazareno, which were in production but put on care and maintenance in 2017 with the other two systems, El Rincon and Mina de Agua, capable of being turned into producing mines.

No less than 1400 drill holes have been made on the property, totaling 236,000 meters of the core and data, which constitutes a huge resource that can be tapped for information at little expense.

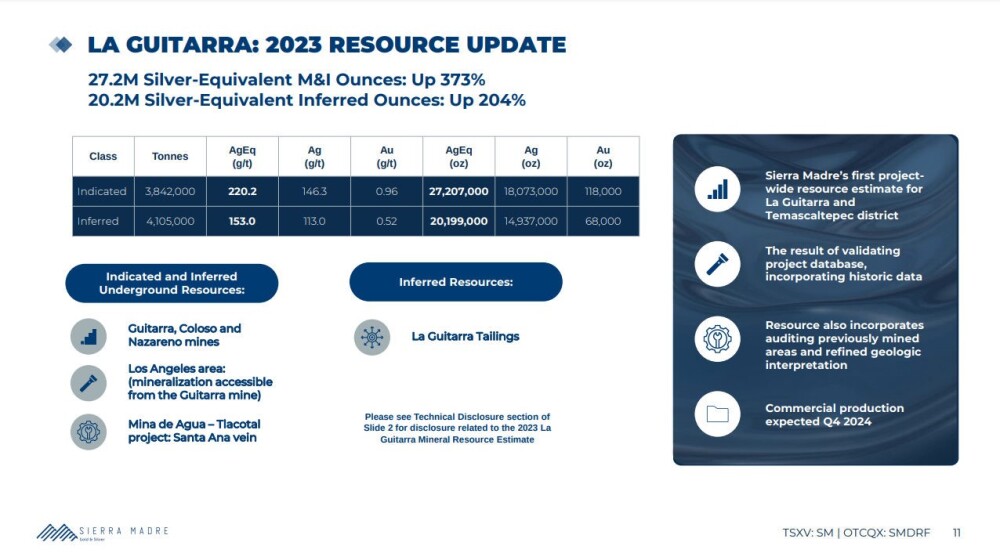

This slide shows the 2023 resource update for La Guitarra.

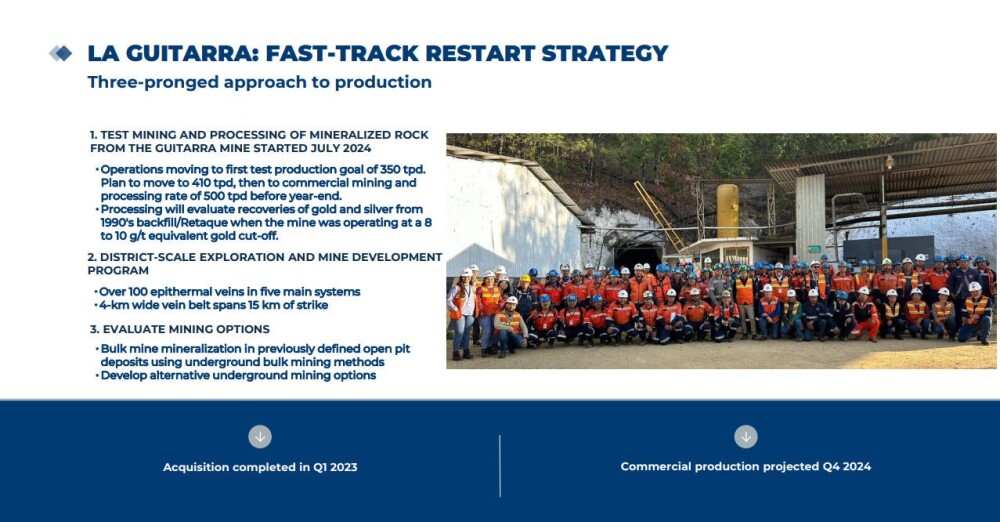

The restart strategy for La Guitarra is set out on the following slide — and it's almost there

More information on the progress toward the restart is set out on the following slide, and of particular note, are the licensing and extensive permitting already in place.

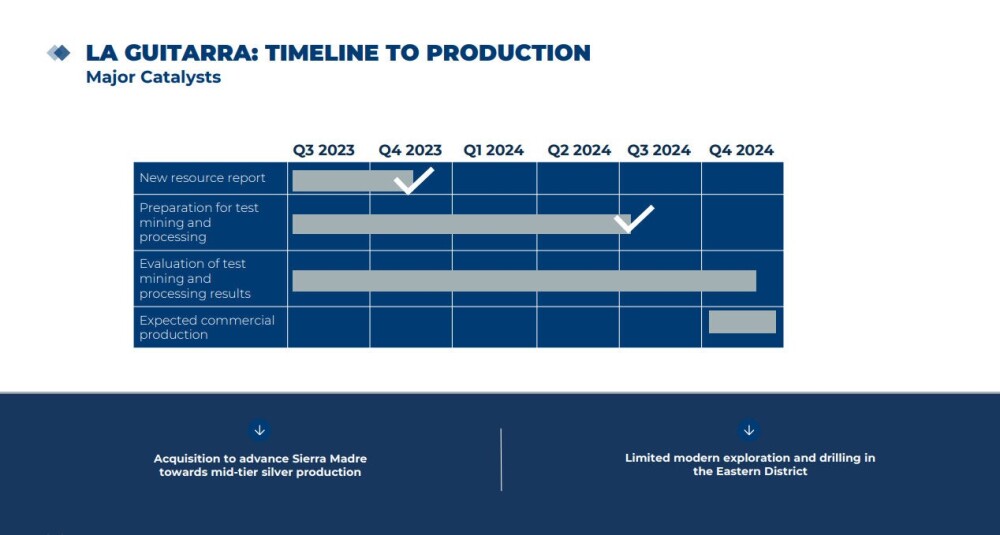

The timeline to production is shown on the next slide and as we can see, it won't be long until another big white tick appears on this chart with the mine going into production.

While Sierra Madre was recommended a little early from a timing point of view a few months back, we are now up on positions opened then thanks to the rally of the past few days.

On the fifth of this month, the company revealed that the test mining and processing at the La Guitarra mine complex is going well and on target to process 500 tonnes of material per day by year end, making it more commercially viable with the projected continued increase in the price of gold and silver set to make it even more so.

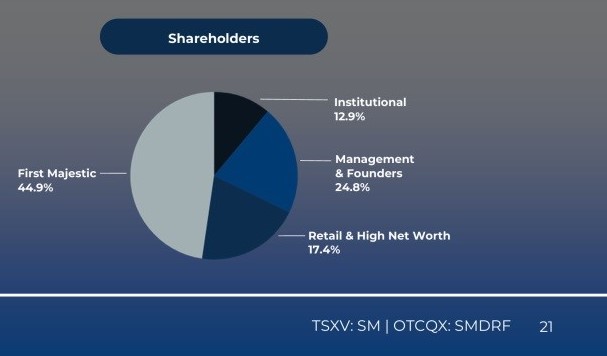

A very important point is that Sierra Madre has the backing of First Majestic Silver which is now a big shareholder and we can be quite sure that First Majestic wouldn't be around if the company didn't have substantial potential.

First Majestic's big interest in the company is set out on the following slide.

Back in July Sierra Madre announced a $5 million loan from First Majestic to be used for finalizing preparations for La Guitarra. Also in July the company announced that an offtake agreement for 100% of the concentrate from La Guitarra was signed so it has an assured market for its output for 24 months from that date.

Much more recently, Sierra Madre announced a private placement for $500,000 some days ago, which was swiftly taken up entirely by one existing investor in the company and announced closed on the 18th, which is certainly a vote of confidence.

While mill throughput at La Guitarra is scheduled to reach 500 tonnes before the end of the year, the company is planning a new ball mill that will increase this to between 750 and 1000 tonnes and in addition the company is investigating the commercial viability of processing the big tailings hill on the site, shown below.

The last slide shows the share structure of the company and as already referenced above, it shows that First Majestic Silver has a huge stake.

Turning now to the stock charts for Sierra Madre we see that they look entirely positive, which is hardly surprising given the positive track that the company is on against the background of a rapidly brightening outlook for gold and silver.

The 16-month chart enables us to grasp The big picture of what is going on. On this chart we can see that since the stock started trading (again) in June of last year it has essentially tracked sideways marking out a large Head-and-Shoulders base pattern. This pattern is now believed to be complete and all the signs are that an upside breakout from it is imminent.

In particular, the marked buildup in upside volume in recent days as the price has advanced sharply, that has driven the Accumulation line steeply higher, is a strong sign that an upside breakout from the pattern will probably occur soon with the bullish alignment of moving averages and improving momentum (MACD) supporting this scenario.

The 6-month chart shows recent action in more detail. On it, we can see the point indicated where it was last recommended, which turned out to be a little early as it dipped in August to make the Right Shoulder low.

Nevertheless we are now up on that purchase with the timing looking better to buy or add to positions here as a breakout is in the works!

Sierra Madre is therefore rated an Immediate Strong Buy for all time horizons.

Sierra Madre Gold & Silver's website.

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) closed for trading at CA$0.51, US$0.386905 on September 19, 2024

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sierra Madre Gold and Silver Ltd.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.