My favorite market historian and newsletter writer was Richard Russell. A native New Yorker, he moved to La Jolla, California, later in life, where he wrote Dow Theory Letters until his death in 2015 at age 91. Not only was he a superb technical analyst, but he also truly understood the language of markets and did his best to convey to his subscribers the subtle differences between standard "charting" and "real" technical analysis. In fact, it was Russell who taught me at a very early stage of my career to ignore the "breakouts" and "breakdowns" in the gold and silver markets and instead heed the volume patterns in the precious metals for clues to future price action. He had little trust for the tape action in the metals as he deemed it to be "phony."

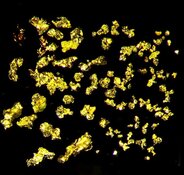

So, with gold hitting record highs this week, I am wondering what the master might be thinking about as he gazes down at us from his lofty vantage point in the heavenly clouds. Richard Russell created what he emblazoned as "The Perfect Portfolio," consisting of one part bonds, one part stocks, one part real estate, and one part gold. Never did he ever exclude gold in his assessment of market conditions as he urged his followers to use gold as a barometer of future events.

As an investor, I try to use gold as a Divining Rod of sorts, the one financial asset that can sniff out either geopolitical or financial turmoil by way of its behavior as opposed to what the mainstream media puts into print or broadcasts via cable television or the internet. If I were sitting down with RR tonight, enjoying an adult beverage with him and looking out at one of those gorgeous West Coast sunsets, I would ask him what he thinks a gold price at US$2,610 might be telling us.

Would his answer be an acceleration of the conflict in Ukraine, where Western missiles are being lobbed into Russian Federation territories with increasing frequency and brazen disregard for their sovereignty? Could gold be hinting at a complete sacrifice of the purchasing power of the USD and the JPY as a means of dealing with sovereign debt default? Could it be gold's way of telling portfolio managers to expect accentuated risk regimes descending upon the global financial arena?

I sit back tonight in the heart of American Camp, an isolated little archipelago in eastern Georgian Bay full of spritely bass and ornery pike (and lots and lots of rocks), and wonder what RR would be telling us. Richard Russell loved discussing stocks and bonds, but he also loved gold. As a firm believer in the disciplines imparted upon me by the Jesuit Fathers in the 1970s, I adhere to the principles of sound money, where fiscal and monetary restraint, best illustrated by the American Founding Fathers in their original Bill of Rights, ruled the early years of the American republic. Requiring governments to back their fiscal endeavors with gold demanded a discipline not present in today's profligate and habitual practices.

Central bankers and treasury bosses around the world are fixated on the "wealth effect" created by the perpetual levitation in equity prices that is now a biannual ritual endorsed and, in fact, celebrated by the political enablers that make it happen, with certainty and predictability by way of the perfection of the "Art of Forward Guidance."

Rising stock prices are today, in 2024, the "Guiding Light" that makes it easier for the poor and disenabled to spend all available cash reserves with full confidence that said cash reserves will soon be replenished by way of stock market profits. Now, it does not matter whether or not the poor owned NVidia or whether the disenabled owned shares in Gamestop. Bankers, be they of a central or investment persuasion, care not a drop about the sanctity of money because the more money sloshing around, the more fees can be charged.

In other words, gold prices are now finally responding to the discovery by the global investment community of the inevitability of currency debasement and not by choice or due to some random event. It was always the plan to "kick the can down the road" and to forego any dire policy shift that might disturb the wealth effect. Now that the interest payments on the U.S. debt monster exceed the defense budget, America no longer enjoys the leadership role it once used to bully smaller nations into line with that being full acceptance of the U.S. dollar as the world's "reserve currency."

They actually blew that privilege in 2022 when they sanctioned Russia for their Ukraine adventure by confiscating Russian dollar reserves (some US$300 billion), an act that has now forced fiduciary responsibility upon those individuals acting on behalf of sovereign treasuries the world over. As a means of self-defense, they buy gold.

The gold chart posted above is about as "letter perfect" as one could ever ask for. It took off in February once the Fed convinced the world that they would be cutting rates in earnest.

I believe that gold buyers are also looking at the two political parties in the U.S. election race and recognizing that neither party will do anything to solve the debt problem — which is really a spending problem — which brings into question the entire efficacy of using American dollars as a "safe haven" destination.

Whatever the case may be, the price of gold is headed higher, and the only fear I have is that the trend of ascent moves from gradual to vertical, which always marks the terminus of the move.

A Watershed for the Junior Miners

Millennials and GenEXers have been completely ignoring all shapes and manner of junior resources issues in favor of tech, meme, crypto, and every imaginable type of "story stock" since the arrival of that silly flu bug back in 2020. Once those wonderful "stimmy" cheques started flooding into the kiddies' bank accounts, the Wall Street "story creators" dove into a literary endeavor and before long, the Fast Money Gang of CNBC was spewing out anything and everything related to "artificial intelligence" in the same manner that they convinced the retail buyers to own anything "blockchain-related" back in 2016. I watched junior miners shifting their business models to "blockchain-guided exploration" purely to capture the attention of the kiddies who were using their student loan money to buy those garbage "stories."

Last week, we entered a watershed of sorts for the junior miners, developers, and explorers. There has never been any kind of "story" tied to the juniors since at least 2011, when the gold market last entered bear market territory.

My subscribers and I have suffered miserably all through the 2020-2024 period during the singular most inflationary period in world history watching the Wall Street spin doctors selling stocks as the primary inflation hedge of choice while disparaging gold and silver as "Grampa's choice." However, I think that the kiddies are now all aligned in the final recognition that a commodity bull market is soon to replace those wonderful "story stocks" that have dominated the small-cap space in recent years.

If I am right, then high-quality juniors who have been growing their resource base over the years while being paid little or nothing for their efforts are soon to be (FINALLY) rewarded.

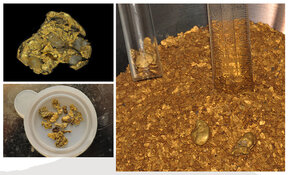

One such company that is I am sure familiar to many if not all of my followers is Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) whose recent revised MRE (mineral resource estimate) came in at 2,319,100 ounces, an 18% increase over the 2023 number, With around 205 million shares issued and US$0.1243 share price, it values their resources at US$10.95 per Getchell share.

In the 2002-2011 bull market in commodities, ounces in Nevada could be acquired for not much less than US$100/ounce. High-grade ounces fetched over US$200/ounce in some instances. I have told this story before and I know you have all heard it before.

Nonetheless, it is one hell of a cheap stock and a perfect proxy for higher gold prices.

Copper

The copper market has been roiled around by the Wall Street spin doctors who are so loaded to the gills with treasuries that they will resort to any and all tactics in order to bludgeon the Fed into cutting rates and juicing their losing bond positions. Since May, when copper was leading the inflation-scare charge, the big banks have all offloaded their copper positions (led by Goldman Sacks) and are now all falling into line with their revised forecasts calling for a "Structural Deficit" to arrive "after 2025" as opposed to Q1/2024 which was their mantra all through Q1/2024 as the shorts got throttled in the move to US$5.199.

As a result of this shift, all I can do is look at the chart to give me some idea as to near-term direction. This market has now completed a perfect correction, falling approximately 25% since the May 21 top. Not only was that a correction, but it threw the copper market fully into bear market territory, and with it, every armchair, late-coming copper "savant" that pivoted from uranium and lithium to their next favorite non-precious metal, staying oh-so-politically-correct by staying within the electrification movement.

Those late and very trapped longs puked out their positions in the early August rout, leaving the table crumbs for opportunists like me that put out the "BUY" (or shall I say "re-BUY") on my favorite copper-gold senior, the mighty Freeport-McMoRan Inc. (FCX:NYSE), which I pitched overboard in May with tears streaming down my cheeks and boxes of Kleenex nowhere to be found.

I am now fully loaded again with the finest mining company on the planet, run by a bunch of senior citizens who understand more about mining copper and gold in their little fingers than the rest of the global mining industry combined. Freeport bottomed in that fateful "Carry Trade Crash" that took copper prices down to US$3.92/lb. and FCX down to US$39.08, which gave me the chance (which I had prayed for) to reacquire the massive stock and option positions that I threw off the high-diving board in May.

Men of "high sensitivity" have recurring dreams of being dusted by their high-school or college sweetheart, usually in the same recurring loop of attenuating circumstance and pain. Well, every night since May, I would wake up at three in the morning in a cold sweat, dreaming that the stock I have loved for at least three years had taken the cue from Elvis and "left the building without me," trading at US$100 per share while I had no invitation to the "Milestone Party." These are the types of psychopathic behaviors that affect people like me.

FCX is an incredible "Buy" here at any and all prices under $50 per share. If one can put pencil to paper sans calculator and simply walk one's self through the leverage assessment of $6.00 copper versus $4.00 copper and $3,000 gold versus $2,100 gold, you become mesmerized with the elasticity of price with the only question mark being the cost structures that usually start with diesel fuel and work downwards. If energy prices stay low for the next few quarters, moving all that rock from underground or from the pits will inflict a much lower cost threshold upon the big miners like FCX. Adding in the recovering prices of the rocks they sell, you arrive at a critical juncture where not owning these miners (especially FCX) carries more risk than owning them.

As for the "China Factor," I make it a habit of listening to Bloomberg far more than I do CNBC, and the international flavor, especially within the Asian coverage, is simply superb. I listen carefully to what I think is "money talking" because, as networks, the only revenue they get is from the financial sector or from corporate issuers (listed companies), but what impresses me is the commentary from India, where analysts versed in multiple languages explain why the India demographic is rapidly vaulting ahead of the China demographic and where both China and India are quantum leaps ahead of Japan. The reason I mention this is that the "China Factor" gets all the headlines, but with a rapidly aging population base now all overly leveraged in domestic housing (and losing gobs of money), it is the Indians who are experiencing robust growth while rapidly re-populating the globe. The Indian economy is growing far more rapidly (+7.00% GDP YTD) than China, and if any of the bottle-swigging rocket scientists at the big banks think that 1.4 billion people in a society that praises and rewards education are not going to become massive consumers of copper, then I throw up my arms in protest and disbelief.

I told subscribers in 2020 that the two dominant metals in this decade would be copper and gold. Thus far, that forecast has been correct, albeit not without starts and stops, which is the result of Fed-initiated speed bumps. I continue to believe that within that sub-sector of investment opportunities, the real jewels of the looming commodity SuperCycle are going to be the micro-cap juniors, developers, and explorers. In this business, being "early" is no different than being "late" because, in both cases, you are guaranteed to lose both credibility AND clients. However, being "early" affords you the functionality of "time" that can easily (or uneasily) rescue you, and that is precisely where we are in mid-September 2024.

Gold is on a tear and silver has finally gotten its strongly-worded "memo" while copper has grabbed a solid bid all while the oil market is in full retreat. All these effects will have immense impact upon valuations across the entire spectrum of junior resources with gold developers at the helm and copper explorers ripping up the rear.

Perfecting the art of inflicting pain on people's backsides is an art form rather than a serendipitous event. I take no accolades from it. My father came back from WWII with twenty cents in his jeans and asked his grandmother for a $5,000 loan to buy a piece of property on the banks of the Credit River as it emptied into Lake Ontario, which was around 10 acres in total.

She turned him down and reprimanded him for his "wildly speculative" investment style. Family members would sit around and ask, "Hey Bill, how's that Port Credit deal working out?"

Today, that piece of real estate would be worth tens if not hundreds of millions of dollars. He was proven wrong in the short term and outrageously "right" in his visionary thinking. Only a WWII veteran exposed to death on a daily basis can think in terms of decades rather than minutes. Like a WWII vet, I look at the junior mining space in the same manner. Junior resource companies with large and growing resources (like Getchell) are "ten acres on the Credit River."

Junior explorers with qualified land packages located proximitous to existing mines or discoveries are going to be worth many multiples of where they are valued today. I will keep repeating that message until the kiddies claim bragging rights for their Facebook posts in 2025. When that happens, I will run for the exits — but that is several months and 10 to 20 multiples away.

| Want to be the first to know about interesting Critical Metals, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.