Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) announced a non-brokered private placement for gross proceeds of up to US$500,000. This offering will consist of 1.25 million common shares priced at 40 cents per share and is being conducted with an existing investor in the company. Proceeds from this placement are expected to be allocated for upcoming marketing activities and general working capital. Pending regulatory approvals, including the TSX Venture Exchange, the offering is set to close soon. As per applicable securities legislation, all securities issued will be subject to a four-month and one-day hold period.

Diving Into Precious Metals

With gold prices reaching new record highs, the precious metals sector, particularly gold, has experienced significant upward momentum in recent months. On September 13, Stockhead reported that gold climbed to an all-time high of US$2,568 per ounce, supported by U.S. data suggesting a likely reduction in interest rates by the Federal Reserve. Lower interest rates historically reduce the opportunity cost of holding non-yielding assets like gold. In turn, this only further bolsters demand. According to ANZ in a research note cited in the Stockhead aritcle, "weak labor market data in the U.S. has raised the prospect of an interest rate cut, burgeoned by an uptick in the initial jobless claims" contributing to the strong gold rally.

Sierra Madre Gold and Silver’s ongoing work at the Guitarra mine in the Temascaltepec mining district and its exploration efforts at the Tepic property could allow the company to benefit from rising gold prices. Recent sector-wide mergers and acquisitions have also stirred activity, with the Stockhead report further noting, "M&A deals are shaking things up in the domestic gold sector at the Paterson Province in WA." This market dynamism could potentially bode well for companies like Sierra Madre, which are actively pursuing exploration and development projects in resource-rich areas.

The broader precious metals sector, including silver, is also seeing advancements. Kitco wrote on September 10 that demand for silver could increase due to technological breakthroughs, with new discoveries potentially expanding its industrial applications, adding another layer of opportunity for companies like Sierra Madre that engage in silver exploration. "Silver's unique potential for advanced applications in electronics," Kitco highlighted, "could drive further demand for the metal in the future."

Company Catalysts

Sierra Madre's strategic focus remains on evaluating the potential restart of its Guitarra mine in the Temascaltepec mining district, alongside the continued development of its Tepic property in Nayarit, Mexico. The Guitarra mine, which operated until mid-2018, is a fully permitted underground facility with a processing capacity of 500 tonnes per day. The 2,600-hectare Tepic project is home to epithermal gold and silver mineralization, boasting a historic resource. Sierra Madre's management team has a proven track record, having previously managed exploration efforts that produced over 22 million ounces of gold and 600 million ounces of silver. Additionally, they have collectively raised over $1 billion for mining ventures, underscoring their expertise in navigating capital markets and resource development.

Third-Party Expert Analysis

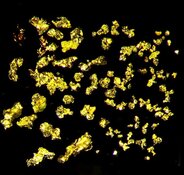

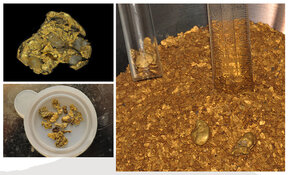

According to the Caesars Report on September 11, Sierra Madre’s mill at La Guitarra processed over 20,000 tonnes of mineralization by the end of August, producing approximately 33,000 ounces of silver and 300-400 ounces of gold. The report emphasized that there are plans to increase throughput to 500 tonnes per day by the year’s end with the mill currenly running at 300 tonnes per day during the test mining phase. In a key milestone in their ramp-up efforts, the report also noted that as the company transitioned to mining higher-grade material, total concentrate production would increase.

On September 3, Oliver O'Donnell of VSA Capital reported that Sierra Madre moved up its guidance for reaching commercial production at La Guitarra to Q4 2024, ahead of previous estimates. O'Donnell highlighted the company's achievements and sufficient funding to support its plan. He wrote that "management indicated its recently secured US$5 million is enough to reach its commercial production rate target of 500 tonnes per day." VSA Capital raised its target price for Sierra Madre from CA$1 per share to CA$1.30 per share, reflecting a potential 176% gain from the company’s then share price. O'Donnell emphasized the favorable pricing environment for gold and silver, stating, "these high prices provide strong tailwinds, mitigating commissioning risks." The analyst maintained a Buy recommendation on Sierra Madre, citing the company’s ongoing progress and exploration upside at La Guitarra.

In June, Clive Maund of CliveMaund.com rated Sierra Madre as a Strong Buy, citing the company's ongoing success and support from First Majestic Silver Corp., one of the world’s leading silver producers. Maund noted that Sierra Madre's properties, particularly La Guitarra, were expected to begin production by Q3 2024, which would expedite the company's path to profitability. He emphasized that "all the pieces are now in place after long preparation for Sierra Madre to become a highly productive and profitable precious metals mining company."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX)

Sierra Madre provided a breakdown of the company's ownership and share structure, where management and founders own approximately 24.8% of the company.

According to Reuters, President and CEO Alexander Langer owns 1.96% of the company, Executive Chairman and COO Gregory K. Liller owns 1.78%, Director Jorge Ramiro Monroy owns 1.33%, Director Alejandro Caraveo owns 1.16%, Director Kerry Melbourne Spong owns 0.43%, and Director Gregory F. Smith owns 0.16%.

Institutional investors own 12.9% of the company. Commodity Capital A.G. owns 4.4%, Reuters reported.

First Majestic Silver Corp. is a strategic investor and owns 44.9% of the company.

The rest is with retail and high-net-worth investors.

There are 152.69 million shares outstanding and 102.07 million free float traded shares, while the company has a market cap of CA$68.71 million and trades in a 52-week range of CA$0.25 and CA$0.54.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.