Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS) announced it has initiated its 2024 Phase 1 drilling program at its flagship Wingdam placer gold project in British Columbia's historic Cariboo mining district just as gold continued hitting record prices on Friday.

The program will consist of about 3,000 meters of drilling in eight diamond drill holes. The rig has been mobilized to the site, and drill pad construction is underway. The company said it would announce further details when the drills start turning.

"The exploration program is aimed at locating the hard-rock source of the rich underground paleoplacer gold found beneath Lightning Creek at Omineca's separate Wingdam underground placer joint venture project," Omineca said in a release. "From previous year's groundwork and drilling, this year's focus has narrowed substantially to a linear corridor along the northwest-striking Eureka thrust fault, which is importantly located downstream of the current underground placer workings at Wingdam."

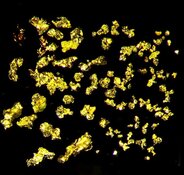

In May, the company announced it had recovered gold-bearing gravels from the project: 10.25 ounces of placer gold (Au) with 90.9% Au purity from the first 2.5 meters of advance into a paleochannel.

The Saskatoon, Saskatchewan-based junior exploration company is pursuing 2.4 kilometers of a rich, placer gold-bearing channel buried 50 meters underneath Lightning Creek in Cariboo.

Geologist Stephen Kocsis has described the channel as "containing some of the highest placer gold concentrations historically reported in all of the Cariboo mining district and perhaps British Columbia that remains unmined."

Chris Temple, author of The National Investor newsletter, wrote Friday that the company is set to "excavate on numerous fronts/areas . . . If all goes according to the present plan, we should be hearing the news as early as October of specific quantities of gold/revenues, which from then on will be ongoing."

Team Has 'Learned and Done a Lot'

Omineca said groundwork prospecting and 288-line kilometers of high-resolution drone magnetic surveying have been completed. The drone survey was flown at treetop level along tightly spaced lines over a focused 2-kilometer-by-1-kilometer area covering the shear zone along the Eureka thrust fault.

The presumed depth of the gold system has made discovery of a load source elusive, the company said. The gold mineralizing system may actually lie closer to the elevation of the placer gold-enriched paleochannel floor similar to zones drilled up to 300 meters below the valley floor elevation at Barkerville gold mines about 33 kilometers east of Wingdam.

"Permits are in hand, and drilling is getting underway," Chris Temple of The National Investor noted.

"The lode gold system may have been only briefly eroded into the paleochannel by an interglacial stream before being covered by glacial sediments and other sediments during postglacial mass wasting events, at which time the creek valley floor rose to its current elevation 50 meters above the paleochannel bedrock floor," Omineca said in the release.

The company said it has selected drill pad locations for this year that are nearer to the bottom of the Lightning Creek Valley to bring the drill rig closer to any potential lode deposit system near the paleochannel floor.

"The team has learned and done a lot in this area," Temple wrote on Friday. "As (President and Chief Executive Officer Tom) MacNeill explained to me, more examination of how outcropping rock formations have 'folded,' etc., — together with what has been found more recently as D&L has excavated channels, etc. and found gold IN the bedrock and elsewhere — has suggested that juicy targets are actually somewhat lower in elevation than thought."

"Permits are in hand, and drilling is getting underway," Temple noted.

Gold Futures Top US$2,600 an Ounce

Gold prices have been steadily rising this year. Futures topped US$2,600 an ounce on Friday for the first time on record, according to MarketWatch.

The price has been building on strong gains from a day earlier on the back of a weaker U.S. dollar as markets anticipate Federal Reserve interest-rate cuts this month, said Li Xing Gan, financial markets strategist at Exness, according to MarketWatch.

"Gold for December delivery added US$25.80, or 1%, to US$2,606.40 an ounce after trading at a record-high US$2,611.70 on Comex. Prices traded more than 3% higher for the week and were on track to mark their 34th all-time settlement high of the year," Myra P. Saefong wrote for the website Friday.

According to another report by Mint, Goldman Sachs, in its note "Go for Gold," said gold has the highest potential for a near-term increase.

In contrast, weak demand from China has resulted in a "more selective, less optimistic" outlook on other commodities, the note said, according to Mint.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS)

"Imminent Fed rate cuts are poised to bring Western capital back into the gold market, a component largely absent (in) the sharp gold rally observed in the last two years," the brokerage firm said.

Ownership and Share Structure

The company is 31% owned by insiders and management, according to the company. The rest is retail.

Top shareholders include 49 North Resources Inc. with 25.31%, Sprott Asset Management LP with 5.05%, President and CEO Thomas MacNeill with 4.34% and Chief Financial Officer/Director Andrew Davidson with 2%, according to Reuters.

Omineca has 180 million shares outstanding.

The company's market cap is CA$13.49 million, and its 52-week price range is CA$0.05−0.15 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Omineca Mining and Metals Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Lts.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.