Renewable energy company Revolve Renewable Power Corp. (TSXV:REVV; OTCQB:REVVF) announced the proposed acquisition of development rights to a 30-megawatt peak (MWp) solar project in Alberta.

Revolve subsidiary Revolve Meadows Solar GP Inc. and the project developer entered into an asset transfer agreement dated September 14, the company said. The transaction is expected to be completed on or before November 15.

"The transaction is consistent with our M&A strategy of targeting projects under 30MW in the U.S. and Canada, where we continue to see excellent opportunities to acquire, develop, build and operate quality assets with attractive returns," said Revolve Chief Executive Officer Steve Dalton. "In addition to the Vernal BESS and Primus Wind projects, Revolve is now expecting to have 100MW of utility scale assets ready to build over the next 18 months. The project will also add to our Canadian development portfolio and our operational, Alberta-based 6MW Box Springs Wind Project and BC-based interest in two 'run of river' power projects."

Revolve said under the terms of the purchase, it will pay an upfront consideration of CA$100,000, which includes the reimbursement of certain development costs incurred by the project to date. Revolve has also agreed to pay further consideration and reimbursement of historical development costs of up to CA$790,000, subject to the "final installed capacity of the project and linked to the successful completion of various milestones including the commencement of construction and the commercial operation date of the project," it said in a release.

The company was formed to capitalize on the growing global demand for renewable power and develops utility-scale wind, solar, and battery storage projects in the US, Canada, and Mexico. Its second division, Revolve Renewable Business Solutions, installs and operates sub-20MW "behind the meter" distributed generation (or "DG") assets.

Its portfolio includes 11MW (net) of operating assets under long-term power purchase agreements across Canada and Mexico covering wind, solar, battery storage, and hydro generation; a 3MW CHP project and a 450 Kilowatt peak (kWp) rooftop solar project that are both under construction and expected to be operational later this year; and a diverse portfolio of utility-scale development projects across the U.S., Canada, and Mexico that have a combined capacity of over 3,000MWs, as well as a 140MW+ distributed generation portfolio that is under development.

Project Will Enhance Revenue, Cashflow Profile of Co. 'Substantially'

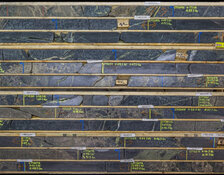

The Alberta project, located south of Edmonton on non-prime agricultural land, is expected to be developed in two phases of 20MWp and 10MWp.

Revolve said it has been under development for two years and considered to be "at mid stage of development with site control completed along with various other permitting and interconnection works."

When fully commissioned, the first phase of the project is expected to generate annualized revenue between CA$3 million and CA$5 million and EBITDA of between CA$1.8 million to CA$3 million, Revolve said.

"Revolve intends to build, own and operate the project, which, once operational, will substantially enhance the revenue and cashflow profile of the company," it said.

The company reported renewable energy generation of 3,877,342 kWh for the three-month period and 4,822,522 kWh for the nine-month period ending March 31, 2024.

During that quarter, Revolve completed the acquisition of WindRiver, a Canadian-based renewable energy operator and developer, enhancing its portfolio with additional hydro and wind projects.

The company said it has developed and sold over 1,550MW of projects so far. Going forward, Revolve said it is targeting 5,000MW of utility-scale projects under development and is rapidly growing its portfolio of revenue-generating DG assets in parallel.

"We still have a pretty big pipeline," Dalton has told Streetwise Reports.

The Catalyst: Surge in Demand Coming Soon

Experts say a surge in power demand is coming and soon. The nation's largest utility companies are warning the surge could be unlike anything seen since the widespread adoption of heat pumps and air conditioners pushed demand sky-high in the 20th Century, according to a June 30 piece by Spencer Kimball for CNBC.

The engine of growth will come from power-hungry artificial intelligence (AI) data centers, electric vehicles (EVs), and the expansion of computer chip manufacturing, he wrote.

"In absolute terms, the growth in electricity demand from these two segments, EVs and data centers, is equivalent to the total electricity demand of a country such as Turkey, that the U.S. has to take on," said Rystad Energy analyst Surya Hendry in a June release on the issue. "This growth is a race against time to expand power generation without overwhelming electricity systems to the point of stress. If you envision cleaner roads and sustainable AI for the future, renewable energy is the key to meeting this demand and providing the scalability needed for U.S. power systems to endure."

Rystad Energy's research predicted that data centers and EVs alone will add 290 terawatt hours (TWh) of new demand by 2030.

"The tandem push of federal investments flowing into clean energy and pull of decarbonization demand from public and private entities have never been stronger," Deloitte wrote in its 2024 renewable energy outlook. "Moving into 2024, these forces could enable renewables to overcome hurdles caused by the seismic shifts needed to meet the country’s climate targets. The uplift and obstacles shaping the year ahead have set the stage for a variable-speed takeoff across renewable technologies, industries, and markets."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Revolve Renewable Power Corp. (TSXV:REVV;OTCQB:REVVF)

"As renewables become a larger part of power generation and the portfolio of technologies grows, perceptions could start catching up with the reality that renewables can enhance grid resilience," Deloitte added.

"The power mix will increasingly be defined by renewable energy growth and declining coal generation," Rystad analysts noted. "Most states are embracing renewable energy and natural gas in comparison to coal plants in an effort to become greener and achieve climate goals. Overall, natural gas will continue to dominate much of the U.S. power mix for the next decade, but renewable energy will play an increasingly important role."

Ownership and Share Structure

About 60% of the company is owned by insiders and management, Revolve said.

Top shareholders include Joseph O'Farrell with 13.21%, Roger Norwich with 12.15%, the CEO and Director Stephen Dalton with 6.01%, President and Director Omar Bojoquez with 4.82%, and Jonathan Clare with 1.84%, according to Reuters and the company.

The rest is retail.

Revolve has a market cap of CA$16.39 million with 63.04 million shares outstanding and 38.08 million free-floating. It trades in a 52-week range of CA$0.50 and CA$0.20.

| Want to be the first to know about interesting Renewable - Wind, Renewable - Geothermal and Renewable - Solar investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Revolve Renewable Power Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.