Sernova Corp. (SVA:TSX.V; SEOVF:OTCMKTS; XETRA:PSH) is a clinical-stage biotechnology / medical device company that is developing therapeutic cell technologies for chronic diseases, including insulin-dependent diabetes, thyroid disease, and blood disorders that include hemophilia A.

Sernova is currently focused on developing a functional cure for insulin-dependent diabetes with its lead technology, the Cell Pouch transplant system, a novel implantable and scalable medical device with immune-protected therapeutic cells. A key feature of the trademarked Cell Pouch transplant system is that it protects the therapeutic cells from attack by the immune system.

On implantation, the Cell Pouch forms a natural, vascularized tissue environment in the body, allowing long-term survival and function of therapeutic cells that release essential factors that are absent or deficient in patients with certain chronic diseases. Sernova's Cell Pouch transplant system has demonstrated its potential to be a functional cure for people with T1D in a continuing Phase 1/2 clinical study at the University of Chicago.

Sernova partnered with Evotec to develop an implantable off-the-shelf iPSC-based islet replacement therapy. This partnership provides Sernova a potentially unlimited supply of insulin-producing cells to treat millions of patients with insulin-dependent diabetes (Type 1 and Type 2). Sernova's development pipeline that uses its Cell Pouch transplant system also includes: a cell therapy for hypothyroid disease resulting from thyroid gland removal and an ex vivo lentiviral Factor VIII gene therapy for hemophilia A.

If Sernova is successful in bringing its functional cure for insulin-dependent diabetes to the stage where it can go into commercial production, the global market for it will be massive, and some analyses already have a CA$3.00 target for the stock.

Whilst Sernova's stock has been in a severe bear market from its start of 2022 peak, technical action in the stock in recent months coupled with major positive fundamental developments strongly suggest that the stock is about to reverse to the upside, which is why we are taking an interest in it here.

Amongst recent developments, we have the appointment in mid-July of Jonathan Rigby as Executive Chairman. Note the use of the phrase "carefully curated management and board transitions" in this news. I have never encountered this phrase before, and it must be regarded as a new level of sophistication with respect to presenting the changes that went on in the nicest possible way.

Mr Rigby went on several weeks later to become CEO of the company. This is significant for two reasons — he has a track record of turning companies into success stories, and in addition, as a Type 1 Diabetes sufferer himself, it is reasonable to assume that he has more than usual motivation to see the company's diabetes treatment advanced to become commercially successful.

Also regarded as a positive is that despite an earlier financing being pulled "due to current market conditions" at that time, a later substantial financing was not just successful but oversubscribed.

Then, at the 2024 European Association for the Study of Diabetes (EASD) annual meeting in Madrid, Spain, Sernova announced new positive data from its Phase 1/2 trial regarding islet survival and function, with Sernova's CEO commenting, "We believe this first-in-world data is significant for Sernova and, more specifically, provides tangible hope for T1D patients that we are a significant step further in our mission of providing a functional cure for this terrible disease; as a Type 1 diabetic myself, I could not be more determined to drive our program forward and ultimately onto the market."

So the fundamentals of the company certainly seem to be heading in the right direction which is a big reason that the stock is considered to be very undervalued here given its huge potential in this market.

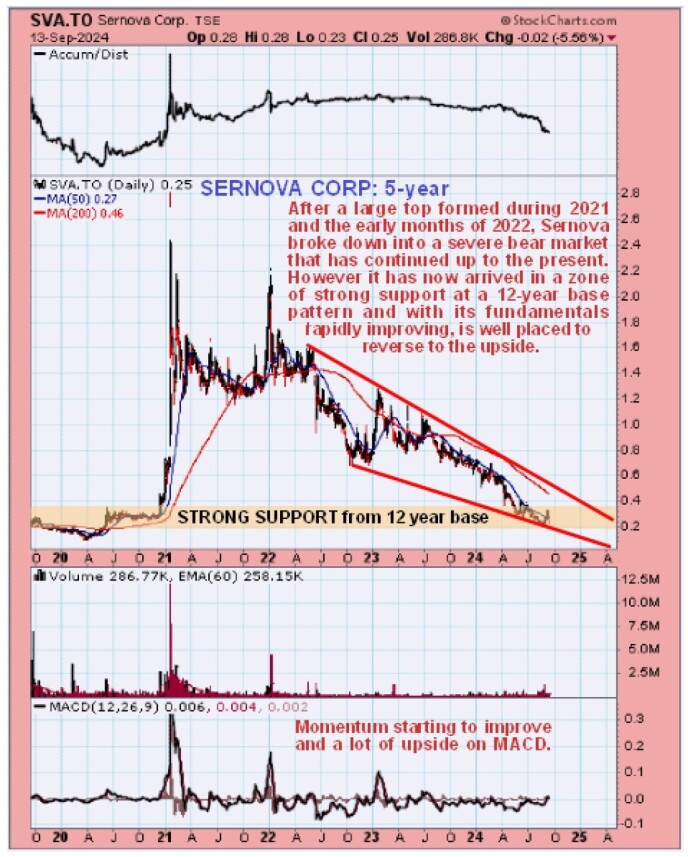

Turning now to the charts and starting with the 5-year chart, we see that Sernova had a huge spike late in 2020 and early in 2021 that saw it rocket up from about CA$0.30 to briefly touch CA$2.80. This spike followed a very long base pattern that had built out for about 12 years.

Following the spike a large top pattern formed through mid-2022 that led to a breakdown into a severe bear market that continues to this day. The downtrend has taken the form of a Falling Wedge which shows that selling pressure is slowly abating, which has bullish implications and as it has now brought the price down into a zone of strong support in the base pattern that generated the major spike at a time when the fundamental outlook for the company is rapidly improving, a reversal to the upside is looking more and more likely soon.

On the year-to-date chart we can see that although the downtrend still remains in force with moving averages in bearish alignment, there is strong evidence that a reversal to the upside may be occurring. The persistent heavy volume since late July is an indication that a bottom may be in, made more likely of course by the price now being at a low level after prolonged decline with it currently trying to hold a break above the 50-day moving average with momentum (MACD) now trending higher and rapidly improving.

Normally we would expect some base building after such a long and deep decline, but fundamental outlook for the company is improving at such a rate that it may not tarry long in this area before the stock appreciates significantly, hence the reason for our interest here.

Sernova is therefore viewed as a good stock to accumulate in this area, between the current price and recent lows.

Sernova Corp.'s website.

Sernova Corp. (SVA:TSX.V; SEOVF:OTCMKTS; XETRA:PSH) closed for trading at CA$0.255, US$0.1866 on September 13, 2024.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals and Medical Devices investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sernova Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sernova Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.