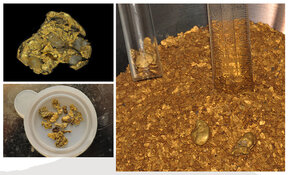

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) announced that other parties have staked claims in and around its flagship Cuprite Gold Project in Nevada, which could lead to the creation of a new gold district in the state.

StrikePoint noted in a release this week that Cuprite LLC has acquired by staking about 152 claims immediately to the west of its Cuprite project in the prospective Walker Lane Gold Trend.

In addition, StrkePoint said it has become aware that a third party has leased the 54 claims that are internal to the project.

"The recent activity validates our excitement about the Cuprite Gold Project," StrikePoint Chief Executive Officer Michael G. Allen said. "Our drill results show that the Cuprite Project hosts a large-scale mineralized system, and others are moving into this emerging gold district in Nevada where StrikePoint has a strong land position."

StrikePoint noted in the release that it "believes that Cuprite LLC is controlled by Electrum Group, a new New York-based registered investment adviser." It said Electrum makes strategic investments principally in high-quality precious metals assets and opportunities and "manages client assets on a discretionary basis."

The third party leasing the internal claims is also "potentially associated" with Electrum, StrikePoint said.

StrikePoint also recently announced that it has acquired the Hercules Gold Project, also in in the Walker Lane Gold Trend.

Hercules is just 20 kilometers east of the Comstock Gold Mine, part of the Comstock Lode that generated fortunes in the 19th century and played a role in the growth of Nevada and San Francisco. Historically, 14 million ounces (Moz) of gold were recovered in the district.

Technical Analyst Clive Maund wrote on September 3 that Cuprite was a big reason to like StrikePoint, and Hercules means "there are now two big reasons for liking it."*

Both Cuprite and Hercules are very close to other successful projects in Nevada's Walker Lane gold trend, including Centerra Gold Inc.'s (CG:TSX; CADGF:OTCPK) Gemfield deposit and AngloGold Ashanti Ltd.'s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) project.

Maund said that already lucrative neighborhood "increases the chances of big discoveries being made at Hercules," and called StrikePoint a "golden opportunity being presented to investors right here, right now."

Worth Going Overweight On?

Results released in June from an inaugural 3,100-meter drilling program by StrikePoint at Cuprite this year found gold and silver mineralization over five holes, including one hole that intersected 12.19 meters of 0.46 grams per tonne gold (g/t Au) and 10.10 g/t silver (Ag), including 6.1 meters of 0.74 g/t Au and 14.75 g/t Ag.

"These results confirm the potential of this epithermal system to host higher-grade mineralization," Allen noted at the time. "Next steps will be to use the RC chips to map clay alteration in the third dimension, further refining the targets for a potential next phase of drilling targeting higher-grade mineralization perhaps associated with feeder structures on the property."

Technical Analyst Clive Maund wrote on September 3 that Cuprite was a big reason to like StrikePoint, and Hercules means "there are now two big reasons for liking it."

Hercules consists of 1,323 unpatented mining claims and four patented mining claims covering about 100 square kilometers of prospective Walker Lane geology about one hour from Reno, the company said.

The company released some historical drilling results from Hercules, including one hole that intersected 1.64 g/t Au and 18.27 g/t Ag over 30.48 meters, including 5.55 g/t Au and 47.9 g/t Ag over 3.05 meters. Another hole found 1.12 g/t Au and 5.38 g/t Ag over 39.62 meters, including 5.04 g/t Au and 14.93 g/t Ag over 6.1 meters.

"Given the positive news of the Hercules acquisition and the bright outlook for gold itself," Maund wrote of Strikepoint, "We can expect it to generate another significant reversal to the upside."

"It is clear that investors are being presented with an exceptional opportunity here with Strikepoint Gold being at very low level and on the point of reversing to the upside," he wrote. "We, therefore, stay long, and the stock is rated an Immediate Strong Buy; in addition, this is a stock that is considered to be worth going overweight on."

The Catalyst: Gold Soars, Could Go Higher

Gold prices have been steadily rising this year and surged over 1% to reach an all-time high on Thursday, driven by growing expectations of an interest rate cut by the Federal Reserve next week following U.S. data indicating a slowing economy, according to Mint.

As of 9:46 a.m. ET, spot gold had risen 1.6% to US$2,551.19 per ounce, while U.S. gold futures climbed 1.4% to US$2,578.90.

Some experts expect gold to go even higher. In a Soar Financially YouTube video, Bloomberg Senior Commodity Strategist Mike McGlone predicted that it would only be "a matter of time" before gold hits US$3,000.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB)

According to another report by Mint, Goldman Sachs, in its note "Go for Gold," said gold has the highest potential for a near-term increase.

In contrast, weak demand from China has resulted in a "more selective, less optimistic" outlook on other commodities, the note said, according to Mint.

"Imminent Fed rate cuts are poised to bring Western capital back into the gold market, a component largely absent (in) the sharp gold rally observed in the last two years," the brokerage firm said.

Ownership and Share Structure

Reuters provided a breakdown of the company's ownership and shares structure, where management and insiders own approximately 1.49% of the company.

According to Reuters, Executive Chairman Shawn Khunkhun owns 0.44% of the company, President and CEO Michael G. Allen owns 0.72%, Director Ian Richard Harris owns 0.11%, and Director Adrian Wallace Fleming owns 0.03%.

Reuters reported that institutional and strategic investors own approximately 22.37% of the company, as 2176423 Ontario, Ltd. owns 11.31% of the company, U.S. Global Investors Inc. owns 1.04%, and Sprott Asset Management LP owns 0.95%.

According to Reuters, there are 263.89 million shares outstanding, while the company has a market cap of CA$7.92 million and trades in a 52-week range of CA$0.02 and CA$0.09.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Strikepoint Gold Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosures for the quotes from the Clive Maund article published on September 3, 2024

- For the quoted article (published on September 3, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.