Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) appointed Colin Burge, a retired exploration geologist with a 30-year career, as an adviser to the company starting immediately, it announced in a news release.

"Colin brings a wealth of porphyry knowledge and expertise to our team," President and Chief Executive Officer Peter Bernier said in the release. "We look forward to Colin's expert engagement and assistance in guiding exploration at the Cyprus project and future development opportunities for the company."

Burge's expertise lies in using geophysical techniques to discover porphyry copper and volcanogenic massive sulphide (VMS) deposits mostly using geophysical techniques.

Discovery-oriented Burge was part of Inmet Mining Corp.'s corporate development team that led on-site geological activities that resulted in the discovery and delineation of 30,000,000,000 pounds of copper at the Cobre Panama project in Panama. Subsequently, First Quantum Minerals Ltd. (FM:TSX; FQM:LSE) acquired Inmet for US$5 billion (US$5B) in 2013.

Previously, Burge managed exploration activities at the Cayeli copper-rich VMS deposit in northeast Turkey and conducted project work in Peru, Australia, Nevada and Greece, for various companies, including Falconbridge Copper Ltd. in British Columbia. He has a bachelor of earth science degree from the University of Waterloo.

Since retiring in 2016, Burge has been evaluating properties for senior and junior mining companies in Canada and the U.S.

In other news announced in the release, Prosper granted 150,000 stock options to its chief financial officer and an aggregate of 350,000 options to certain of the company's advisers and employees. Options may be exercised, over the next years, at CA$0.15 per share. They will vest equally every six months over a two-year period.

District-Scale Exploration

Prosper Gold, headquartered in Vancouver, British Columbia (B.C.), is a minerals explorer concentrating on high-grade gold vein systems and bulk tonnage syenite-hosted gold targets, according to its website. Modeled after its predecessor Richfield Ventures, bought out after defining a multimillion-ounce resource, Prosper pursues "the right type of projects at the right time in an improving market."

The company has two potentially district-scale, exploration projects in Canada: Cyprus in north-central B.C. and Golden Sidewalk in Ontario.

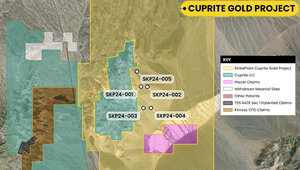

Cyprus, the focus of a current exploration program, is a porphyry copper-gold project comprising 623 square kilometers (623 sq km) of contiguous claims in part of an Eocene porphyry belt. It is next to American Eagle Gold Corp.'s (AE:TSX.V) NAK Project, 60 km to the south in the same metallogenic belt, Technical Analyst Clive Maund reported in an Aug. 16 report. The three known copper prospects at Cyprus are Kaza, Northstar and Big-Time. Historically, the property showed 138 meters (138m) of 0.55% copper.

Most recently, a property-wide ZTEM survey was conducted, which outlined six high-priority porphyry copper-gold targets, named Targets A through F, under cover, in areas with little to zero outcrop. They were shown to have multikilometer footprints extending to depth.

Of the sextet, Target A is the highlight as it "represents a very attractive porphyry target." Next to a regional fault, Target A is a 2-by-4 km conductivity anomaly coinciding with a pronounced magnetic low.

"The recent ZTEM (Z‐Tipper Axis Electromagnetic) survey results are encouraging given the characteristics of the anomalies and the presence of copper-gold mineralization elsewhere on the project," Burge said in the release.

Prosper's Golden Sidewalk is an Archean orogenic gold project covering 160 sq km of contiguous mineral claims and mining leases in the western Birch-Uchi Greenstone belt, about 60 km east of Ontario's Red Lake. Three mineralized trends of have been identified at the property.

The Canadian exploration company also boasts "an experienced and outstanding management team," as described by Maund. CEO Bernier, an experienced prospector, and Dirk Templeman-Kluit, a renowned research geologist, as Richfield Ventures, delineated a significant bulk tonnage deposit whose initial resource estimate was 4,200,000 ounces of gold in the Indicated and Inferred categories. New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) acquired Richfield in 2022 for US$550 million.

"The fact that people like Peter Bernier are on the management team of Prosper Gold means that there is a very good chance of it making a significant discovery or discoveries, for the simple reason that if it didn't, he probably wouldn't be there," Maund wrote. "If Peter Bernier can do what he did with Richfield Ventures once, he can do it again."

Demand for Copper "Unstoppable"

The global copper market is expected to grow in value by 2030 to US$259B from US$170B in 2022, according to Statista.

"Copper has become indispensable," Marin Katusa of Katusa Research wrote in a recent article. From electric vehicles to renewable energy systems, its role in the global economy is critical. The ongoing electrification of the world depends heavily on copper, and this dependence is only set to grow.

This is good news for copper exploration companies, particularly those with a copper-gold porphyry deposit. These deposits, according to Investing News Network, are "among the world's most valuable deposits" because they contain the largest known exploitable concentrations of copper.

INN explained in another article, "Due to their size and scope, copper porphyry deposits have the potential to become large-tonnage, low-cost operations based on mineralization."

According to Katusa, demand for "the engine of the green economy" is "unstoppable," and a supply crunch is inevitable, as indicated by three metrics. They are the rapid decline in days of forward consumption of copper, the long-term global market balance for copper moving toward a deficit and a slowing of global mine production of copper. From 2015 to 2023, only 18,000,000 (18 Mt) of copper were discovered versus 28 Mt in 2014 alone.

While demand for the red metal is increasing, supply remains constrained. Joe Austin, senior analyst at Chaikin Analytics, reported that the copper supply is expected to start declining after peaking at some point in the next two years, according to the International Energy Agency. The agency estimates a copper shortfall of about 7 Mt by 2035, about a third of output forecasted for that year.

"By 2040, the available supply of copper will be roughly two-thirds of what we produce today. But by then, the demand for copper will have soared far higher than where it is today," Austin wrote.

This anticipated tightening of the copper market is likely to cause a price surge, Katusa purported. In fact, the outlook for the copper price, important for Prosper Gold, is favorable, Maund wrote on Sept. 10.

"The recent reaction appears to have run its course," noted the analyst. "It now looks like it is shaping up to begin another major uptrend, which is hardly surprising given the huge copper supply deficit that is right now starting to bite and is set to get a lot worse as this decade unfolds."

The Catalyst: Exploration Progress

Along with the now completed ZTEM survey, the work planned for Prosper's in-progress, 2024 exploration program includes 2,500m of drilling, trenching and regional exploration, according to the company's September 2024 Presentation.

Results of any of these components could push up the explorer's share price.

Stock is Immediate Strong Buy

The stock charts indicate Prosper Gold is positioned now to break out of its consolidation pattern and begin a new upleg, Maund wrote. This anticipated rally could be better than the last one.

Therefore, Maund rated the stock immediate Strong Buy for all time horizons and indicated he intends to remain long in it.

"The strongly positive results from this ZTEM survey make the stock even more of a Buy than it was before," he wrote.

Ownership and Share Structure

According to Reuters, four insiders own 7.78%, or 3.48 million (3.48M), shares of Prosper Gold. They are, from most to least stake held, President, CEO and Chairman Peter Bernier with 6.61% or 2.95M shares, Director Jason Hynes with 1.02% or 0.45M shares, Director James Miller-Tait with 0.10% or 0.04M shares and Chief Operating Officer and Director James Hedalen with 0.06% or 0.03M shares.

Retail investors own the remaining 92.22% of the company. There are no institutional investors at this time.

Prosper has 44.69M outstanding shares and 41.22M free float traded shares.

It has a market cap of CA$4.28M and a 52-week trading range of CA$0.09–$0.20 per share.

| Want to be the first to know about interesting Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |