Allegiant Gold Ltd. (AUAU:TSX.V; AUXXF:OTCQX) has started a new drilling program at its Eastside property, located near Tonopah, Nevada. Allegiant's primary objective is to build upon the current National Instrument 43-101 pit-constrained inferred resource of 1.1 million ounces of gold and 8.8 million ounces of silver within the McIntosh zone.

The drilling initiative will initially consist of 3,000 to 4,000 meters of reverse circulation (RC) drilling and an additional 1,000 meters of diamond core drilling (DDH). Allegiant plans to test the high-grade zone (HGZ), discovered in 2021 and followed up in 2022, including hole ES-239, which contained 111.3 meters of 1.45 grams per tonne (g/t) gold, with 3.1 meters at the bottom of the hole grading 39 g/t. The program will also explore the South Hill area, situated approximately 500 meters south of the McIntosh pit zone.

Peter Gianulis, CEO of Allegiant Gold, expressed the company's excitement, stating in the news release, "Our goal is to continue adding ounces and derisking Eastside. We plan to drill a total of 5,000 meters of RC and DDH near the McIntosh zone, including testing an area proximate to hole ES-239, one of the best holes we have ever drilled at Eastside. Success at either of these two locations has the potential to be significant."

Digging Into Gold and Silver

According to Yahoo! Finance on September 3, the market for gold and silver mining has experienced significant momentum in 2024. Analysts from Goldman Sachs were quoted in the report as expressing how investors should "go for gold" given its recent. The firm projected US$2,700 per ounce as its 2025 target of and issued a "long gold" recommendation. Central bank purchases, which hit a record in early 2024, further fueled demand. Altogether, this contributed to gold's status as the world's second-largest reserve asset behind the US dollar, according to analysts from BofA.

Allegiant Gold's ongoing exploration at its Eastside property reflects this sector's positive outlook. The company's efforts to expand the McIntosh zone come as gold continues to trade above US$2,500 per ounce. As highlighted earlier, Allegiant's CEO, Peter Gianulis, pointed out the significance of their current drilling. As noted by Reuters on September 10, market participants have been consistently buying on dips, resulting in gold gaining 21% year to date. Given that fact, Allegiant's drilling program is well-timed to take advantage of favorable market conditions.

Concurrently, the silver market has also seen advancements, particularly in industrial applications. A recent breakthrough in self-healing silver technology, as reported by Kitco on September 10, highlighted the metal's expanding role in electronics. This development positions silver for broader use in high-tech industries and aligns with Allegiant Gold's efforts to explore silver resources alongside gold at the Eastside property.

Allegiant's Catalysts

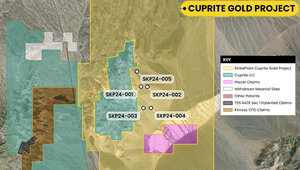

Allegiant's Eastside drilling program is a critical component of its ongoing efforts to expand its resource base. The company's McIntosh zone focus has been bolstered by previous discoveries, one of the most promising drill results to date, hole ES-239. Additionally, Allegiant is exploring several new targets in the largely untested northern third of the property. These targets include gold-mineralized rhyolite domes and areas with anomalous gold, arsenic, and antimony.

The company believes this exploration program will benefit from detailed drone magnetometer and resistivity surveys. These surveys, completed in late 2022 and early 2023, have identified large magnetic lows potentially indicating hydrothermal alteration. With a comprehensive plan to test both the McIntosh zone and new targets, Allegiant might find significant resource growth at Eastside.

Experts Talk Allegiant

Some analysts have expressed optimism about Allegiant following its latest 5,000-meter drill program announcement at the Eastside District.

According to Ben Pirie and Nicholas Cortellucci of Atrium Research, Allegiant has established itself as a compelling investment opportunity with a "Buy" rating and a target price of CA$0.50. This would represent a potential 186% return from the price at the time of the analysts' report.

They noted Allegiant's farm-out strategy and how it has proven highly effective, allowing the company to bring in approximately CA$7.5 million over the last five years without diluting shareholders. The analysts highlighted the company's clean capital structure. They also pointed out that Allegiant has no outstanding warrants.

Pirie and Cortellucci emphasized the company's potential, stating that "the Eastside District shows strong potential of growing to a multi-million-ounce deposit and ultimately becoming an attractive takeout target for the several major miners in the region." This strong endorsement aligns with Allegiant's goal of resource expansion at Eastside, which currently hosts an inferred resource of 1.4 million ounces of gold and 8.7 million ounces of silver.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Allegiant Gold Ltd. (AUAU:TSX.V; AUXXF:OTCQX)

Atrium Research also praised the management team. The analysts valued Allegiant using an EV/oz methodology, assuming US$25 per ounce on its 1.4 million ounces of gold resource. Despite this conservative valuation approach, the analysts see significant upside for the company as it continues to advance its exploration and expansion efforts at Eastside.

Ownership and Share Structure

According to Refinitiv, 17.01% of Allegiant is owned by management and insiders. Of those, President and CEO Peter Gianulis owns the most with 10.50%, Director Shawn Nichols owns 4.70%, and CFO Sean McGrath has 1.20%.

0.48% is with institutional investor U.S. Global Investors Inc..

The rest is retail.

Allegiant also has 88.06 million free float shares, a market cap of US$13.9 million, and trades in the 52-week range between US$0.0677 and US$0.1606.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.