First Nordic Metals Corp. (FNM:TSX; FNMCF:OTCQB), born from the recent merger of Gold Line Resources and Barsele Minerals, is quickly positioning itself as a leading force in European gold exploration.

With a strategic focus on highly prospective regions in Sweden and Finland, First Nordic's flagship project, the Barsele gold project, is in a joint venture with industry giant Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE).

This merger has not only strengthened the company's asset base but also brought together a management team with a proven track record of creating shareholder value through successful transactions and strategic growth.

The Vision: Creating Europe's Next Major Gold Producer

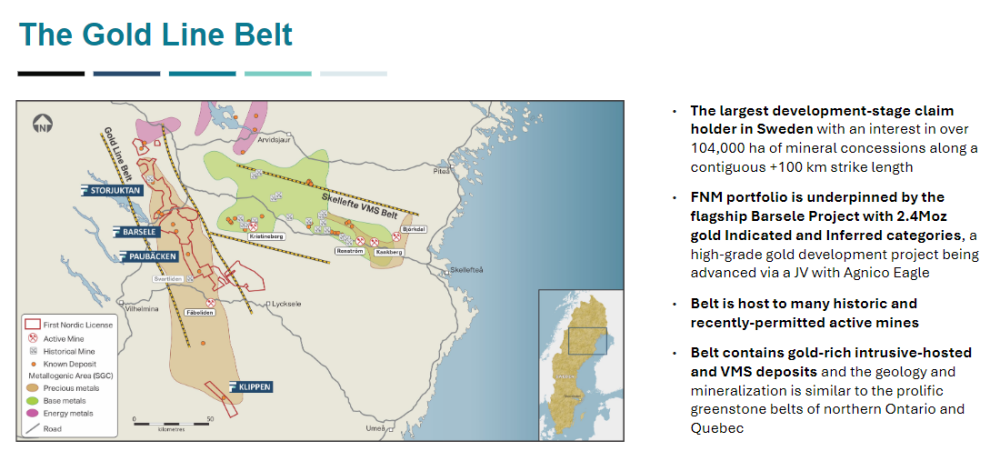

The vision of First Nordic Metals is ambitious yet grounded in the strong fundamentals of its assets and management expertise. The company aims to create Europe's next major gold camp, leveraging the significant gold resources already identified and exploring the vast, underexplored regions along the Gold Line Belt in Sweden.

With an Indicated Resource of 324,000 oz gold and an Inferred Resource of over 2 million oz gold at the Barsele project, First Nordic is off to a solid start.

The Merger. Strategic Synergy and Asset Consolidation

The merger of Gold Line Resources and Barsele Minerals was a strategic move to consolidate a 100 km stretch along the Gold Line Belt, one of the most promising underexplored gold regions in the world.

By combining their assets, (once both companies combined had market capitalization of great that 300 million), First Nordic now controls a district-scale land package that is rich in exploration potential. The Barsele project, with its significant gold resources, serves as the cornerstone asset, while the surrounding district offers numerous targets for future discoveries.

Management Expertise: A Team Built for Success

The management team at First Nordic Metals is one of its strongest assets. The team, led by Taj Singh and Adam Cegielski, brings decades of experience in mining exploration, project development, and capital markets.

Their track record includes leading companies to successful exits, such as the sale of Orko Silver for $250 million and GT Gold to Newmont for $400 million. This experience is crucial as First Nordic embarks on its journey to become a major player in the European gold sector.

The Barsele Project: A Gold Mine in the Making

Located in Sweden, the Barsele project is the crown jewel of First Nordic's portfolio. The project, which has been extensively drilled with over 165,000 meters of exploration, shows strong potential to grow beyond its current resource base.

Singh's due diligence revealed that even without assuming any upside, the existing 2.5 million ounces of gold could justify a mine at today's gold prices. The project's geology suggests the possibility of expanding the resource to 4-5 million ounces as deeper drilling and further exploration are conducted.

Beyond Barsele: Exploring the Untapped Potential of the Gold Line Belt

While the Barsele project is the immediate focus, the true value of First Nordic lies in its extensive land holdings along the Gold Line Belt. This greenstone belt, which shares similarities with the prolific Abitibi Belt in Canada, has the potential to host multiple large-scale gold deposits.

With 100% ownership of 100 km of this belt, First Nordic is in a prime position to make additional discoveries that could significantly increase its resource base.

Finland: The Underexplored Frontier

In addition to its Swedish assets, First Nordic holds the entire Oijärvi Greenstone Belt in northern Finland, another underexplored region with high potential.

The company is currently evaluating options for this asset, including potential joint ventures or sales, to unlock additional value for shareholders.

A Stable and Mining-Friendly Jurisdiction

Sweden and Finland offer some of the most stable and mining-friendly environments in the world. With clear mining laws, secure tenure, and supportive governments, these countries provide an ideal backdrop for First Nordic's exploration and development activities.

The recent shift in Sweden's government towards more pro-mining policies further enhances the company's prospects.

Financial Strategy: Protecting Shareholder Value

First Nordic's financial strategy is centered on protecting shareholder value. The company has been cautious with its capital, raising funds strategically and minimizing dilution. Insiders own 21% of the company, demonstrating their commitment to driving value for all shareholders.

With about $3.1 million in cash and plans to raise more capital as market conditions improve, First Nordic is well-positioned to fund its exploration programs without unnecessary dilution.

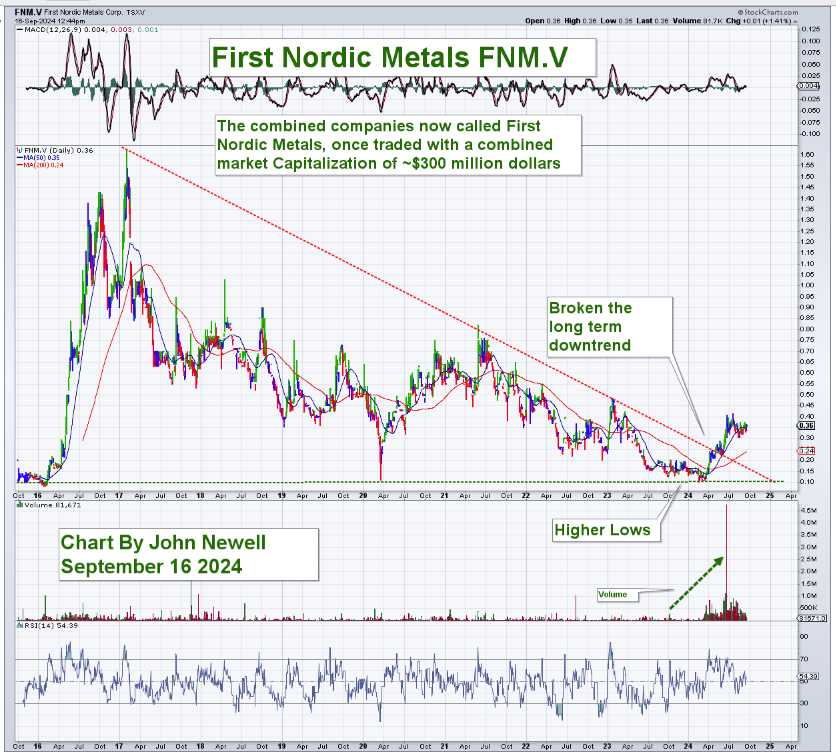

Technicals

The shares have drifted downward for more than five years and have now broken the long downtrend line. Inside this chart formation is a very rare technical formation that can be very explosive when certain conditions are met.

We saw the same formation in Cayden Resources, a company that a member of the management team was a part of. We see a renovation of great assets assembled here, and for both fundamental and technical reasons, I rate First Nordic as a Strong Buy.

Conclusion: A Compelling Investment Opportunity

First Nordic Metals represents a compelling opportunity for investors looking to gain exposure to gold exploration in a stable and underexplored region. With a strong management team, a flagship project with significant upside potential, and vast land holdings in one of the world's most promising gold belts, First Nordic is poised for growth. As the gold market continues to gain momentum, having just made new all-time highs that have never been higher highs, First Nordic's assets and strategic vision could translate into substantial returns for its shareholders.

Therefore, First Nordic Metals Corp. is a Buy.

Investors seeking to capitalize on the next wave of gold discoveries should keep a close eye on First Nordic Metals as it advances its projects in Sweden and Finland.

First Nordic Metals Corp. (FNM:TSX; FNMCF:OTCQB) closed for trading at CA$0.355 , US$0.263 on September 13, 2024

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$2,500.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.