Revolve Renewable Power Corp.'s (TSXV:REVV; OTCQB:REVVF) growing portfolio of projects across North America includes 11 Megawatts (net) of operating assets covering wind, solar, battery storage, and hydro generation, as well as other projects under construction and development.

Its stock offers investors exposure to all of these energy sources that are expected to power the new green economy. And with a CA$17 million market cap and millions in revenue expected in the coming years, Chief Executive Officer Steve Dalton told Streetwise Reports that it's also extremely undervalued.

Last year, the company sold two solar and battery storage projects in Arizona to ENGIE IR Holdings LLC, a subsidiary of global energy leader ENGIE S.A. The transaction included an upfront payment of US$2 million and a recent milestone payment of US$3.4 million after the recent completion of interconnection studies.

But the deal is expected to be worth possibly more than US$50 million over the coming years to the company.

"You get some kind of idea of the value uplift that those two projects can give us," said Dalton.

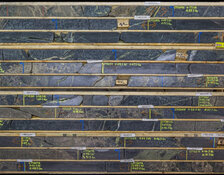

The Bouse project is a 1,000 MW (megawatt) solar and battery storage project located on about 6,155 acres of land in La Paz County, Arizona, with the capacity to provide electricity to an equivalent of approximately 1.2 million homes. The terms of the sale also included the nearby Parker Solar and Storage Project, which has the capacity to power about 300,000 homes.

In June, Revolve announced it had completed the study milestone and received the US$3.4 million payment from ENGIE. Further milestones, such as the start of construction and the start of commercial operations.

"The Bouse project is one of the largest solar and battery storage projects being developed for the Californian market, and we look forward to further progress being made towards notice to proceed in the coming years," Dalton has said.

Co. Still Has a 'Pretty Big Pipeline'

The company was formed years ago to capitalize on the growing global demand for renewable power and develops utility-scale wind, solar, and battery storage projects in the US, Canada, and Mexico. Its second division, Revolve Renewable Business Solutions, installs and operates sub-20MW "behind the meter" distributed generation (or "DG") assets.

Its portfolio includes 11 Megawatts (net) of operating assets under long-term power purchase agreements across Canada and Mexico covering wind, solar, battery storage, and hydro generation; a 3 Megawatt (MW) CHP project and a 450 Kilowatt peak (kWp) rooftop solar project that are both under construction and expected to be operational later this year; and a diverse portfolio of utility-scale development projects across the U.S., Canada, and Mexico that have a combined capacity of over 3,000 MWs, as well as a 140 MW+ distributed generation portfolio that is under development.

The company reported renewable energy generation of 3,877,342 kWh for the three-month period and 4,822,522 kWh for the nine-month period ending March 31, 2024.

During that quarter, Revolve completed the acquisition of WindRiver, a Canadian-based renewable energy operator and developer, enhancing its portfolio with additional hydro and wind projects.

The company said it has developed and sold over 1,550 MW of projects so far. Going forward, Revolve said it is targeting 5,000 MW of utility-scale projects under development and is rapidly growing its portfolio of revenue-generating DG assets in parallel.

"We still have a pretty big pipeline," Dalton said.

He also noted that the market for renewable energy in Mexico has been "looking a lot better than it has in past years" with the recent election of its first female president, former climate scientist Claudia Sheinbaum, in June.

"We feel there are going to be a lot more renewables needed in Mexico," he said.

The Catalyst: Power Demands of the New Economy

With Electric Vehicles (EVs) and a swarm of new products requiring more power, experts say a surge in demand is coming and soon. The nation's largest utility companies are warning the surge could be unlike anything seen since the widespread adoption of heat pumps and air conditioners pushed demand sky-high in the 20th Century, according to a June 30 piece by Spencer Kimball for CNBC.

This time the engine of growth will come from power-hungry artificial intelligence data centers, EVs, and the expansion of computer chip manufacturing, he wrote.

"In absolute terms, the growth in electricity demand from these two segments, EVs and data centers, is equivalent to the total electricity demand of a country such as Turkey, that the U.S. has to take on," said Rystad Energy analyst Surya Hendry in a June release on the issue. "This growth is a race against time to expand power generation without overwhelming electricity systems to the point of stress. If you envision cleaner roads and sustainable AI for the future, renewable energy is the key to meeting this demand and providing the scalability needed for U.S. power systems to endure."

Rystad Energy's research predicted that data centers and EVs alone will add 290 terawatt hours (TWh) of new demand by 2030.

"Overall, the combined expansion of traditional and AI data centers, along with chip foundries, will increase demand cumulatively by 177 TWh from 2023 to 2030, reaching a total of 307 TWh," noted Rystad, an independent research and energy intelligence company. "Despite data centers currently representing a relatively modest portion of total electricity demand in the U.S., this marks a more than two-fold increase compared to 2023 levels, which stood at 130 TWh, highlighting the efforts of the U.S. to position itself as a global data center hub."

The research firm said the reliance on coal in the U.S. has diminished and is expected to continue.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Revolve Renewable Power Corp. (TSXV:REVV;OTCQB:REVVF)

"The power mix will increasingly be defined by renewable energy growth and declining coal generation," Rystad analysts wrote. "Most states are embracing renewable energy and natural gas in comparison to coal plants in an effort to become greener and achieve climate goals. Overall, natural gas will continue to dominate much of the U.S. power mix for the next decade, but renewable energy will play an increasingly important role."

Ownership and Share Structure

About 60% of the company is owned by insiders and management, Revolve said.

Top shareholders include Joseph O'Farrell with 13.21%, Roger Norwich with 12.15%, the CEO and Director Stephen Dalton with 6.01%, President and Director Omar Bojoquez with 4.82%, and Jonathan Clare with 1.84%, according to Reuters and the company.

The rest is retail.

Revolve has a market cap of CA$17 million with 63.04 million shares outstanding and 38.08 million free-floating. It trades in a 52-week range of CA$0.50 and CA$0.20.

| Want to be the first to know about interesting Renewable - Wind, Renewable - Geothermal and Renewable - Solar investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Revolve Renewable Power Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.