Soma Gold Corp. (TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU) presents a rare opportunity in the junior gold market by offering a dual advantage: stable production from its high-grade mines and significant exploration upside from its prospective land holdings.

With 100% ownership of the El Bagre mine in Colombia and a rich portfolio of exploration projects in both Colombia and Brazil, Soma Gold stands out as a compelling speculative investment for those looking to benefit from rising gold prices while capturing the potential of new discoveries.

Production and Growth Potential

- El Bagre Mine – Steady Production

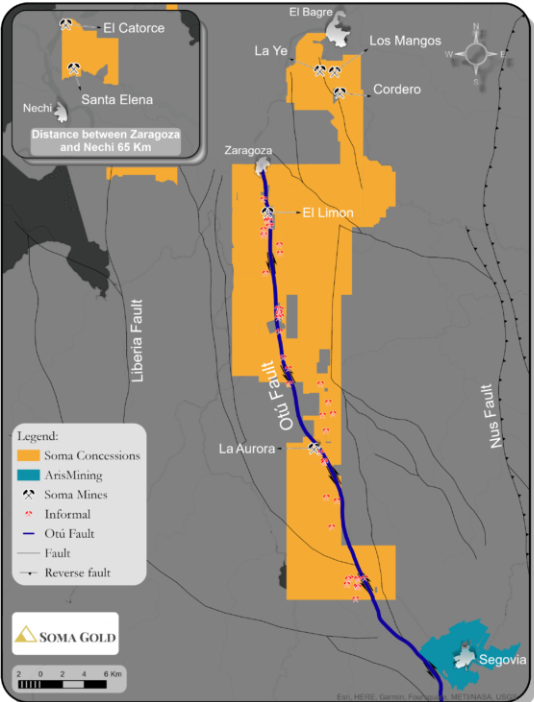

Soma Gold's flagship asset, the El Bagre mine in Antioquia, Colombia, spans 41,000 hectares and is a proven producer of high-grade gold. The operation is supported by two Merrill Crowe mills with a combined operating capacity of 725 TPD, expandable to 1,400 TPD. This existing infrastructure, coupled with scalability, provides Soma Gold with the flexibility to increase production as additional resources are discovered and developed. With production already generating strong cash flow, Soma is well-positioned to enhance its output as new exploration targets are brought online. - Aurora Mine – New Growth on the Horizon

The Aurora Mine, part of Soma's Colombian assets, is expected to begin production in Q3 2024. This project has been accelerated by recent funding, with $3 million secured through an amended offtake agreement. The development of Aurora will further bolster Soma's production profile, making it a key asset in driving revenue growth in the near term.

Exploration Upside and Strategic Expansion

Soma Gold isn't just a producer; it is also heavily invested in exploration, setting the stage for substantial future discoveries.

The company holds prime land in some of the world's most geologically promising regions, providing investors exposure to both steady income from production and potential upside from exploration success.

- Otu Centro Properties

In Colombia, Soma's 100%-owned Otu Centro properties contain mineralized quartz veins with significant exploration potential. Recent geological interpretations have identified new veins along the Otú Fault, like the structures found at the neighboring Segovia-Remedios mine. Soma is actively drilling across multiple targets, aiming to significantly increase its resource base in this underexplored yet highly prospective area. - Brazil's Tucuma Project

In addition to its Colombian assets, Soma Gold's 100%-owned Tucuma Copper-Gold Project in Brazil's Carajás province is currently under option to Ero Copper Corp. This provides additional exposure to copper and gold, diversifying Soma's asset base and offering further exploration upside outside of Colombia.

Geological Potential in Prolific Regions

Soma's exploration projects are in some of the most historically productive gold regions in the world, especially the Central Cordillera of the Andes in Colombia. The Otú Fault, a critical geological structure that controls high-grade gold mineralization, runs through several of Soma's projects. This region has historically produced over 18 million ounces of gold, and informal mining may have contributed much more. Soma's assets are primed to build on this legacy, with numerous high-grade targets already identified.

- Nechí and Bagre Projects

Near its primary operations, Soma continues to identify promising gold-bearing zones. The Nechí Project has already seen successful test mining and exploration efforts at the Bagre Project aim to expand the known resource along high-grade quartz vein systems. - Zara and Otu Projects

The Zara and Otu Projects, covering tens of thousands of hectares, hold vast exploration potential. These projects include artisanal mining areas with high-grade gold occurrences, and Soma's aggressive exploration plans for 2024 include 10,000 meters of diamond drilling and comprehensive geophysical surveys.

Financial Strength and Insider Alignment

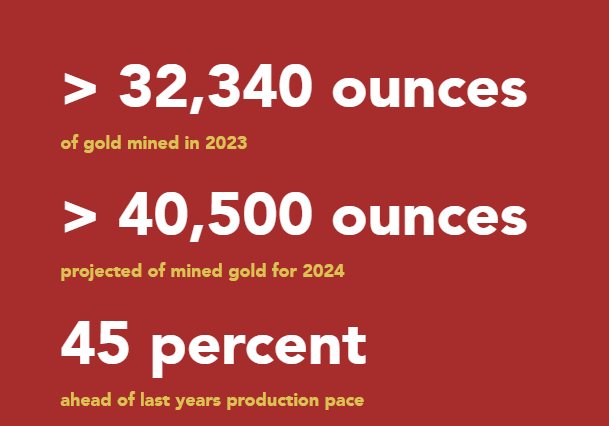

Soma Gold's financial performance underscores its stability in the junior gold market. In 2023, the company generated over $28 million in income from its mining operations despite sub-$2,000 gold prices.

With gold now trading near $2,500 per ounce, Soma's margins are set to grow even more. The company's strong cash flow allows it to fund exploration without diluting shareholders excessively. Management and insiders own approximately 67.45% of the company, demonstrating a high level of confidence and alignment with shareholder interests. You can see the latest financials here.

Jurisdictional Advantage

Colombia offers a relatively stable and supportive environment for mining companies compared to other regions. Soma has developed strong relationships with local authorities and communities, mitigating the risks often associated with mining in emerging markets. The country's rich history of gold mining and supportive regulatory framework make it an attractive destination for both production and exploration.

Technicals

The shares of Soma Gold Corp. have been moving sideways for four years and have built a powerful base. Inside this typical consolidation pattern is a technical pattern that suggests there could be an explosive move in the shares on a breakout, which can happen when the market recognizes the value being built by the team at Soma Gold Corp.

With the shares of Soma Gold trading at the lower end of the trading range, we believe the shares offer terrific value here and are rated as a Buy.

Conclusion

Soma Gold offers a unique value proposition as both a gold producer and an exploration company. Its existing production generates consistent cash flow, while its expansive land package in highly prospective regions provides ample opportunity for discovery.

With an experienced management team, a diversified portfolio, and a strong financial position, Soma Gold is well-positioned to capitalize on the continued strength in gold prices. For junior exploration investors seeking both stability and upside potential, Soma Gold represents a compelling opportunity in the gold sector.

Therefore, Soma Gold Corp. is a Buy.

Soma Gold Corp website.

Soma Gold Corp. (TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU) closed for trading at CA$0.47, US$0.35035 on September 6, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Soma Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Soma Gold Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Soma Gold Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.