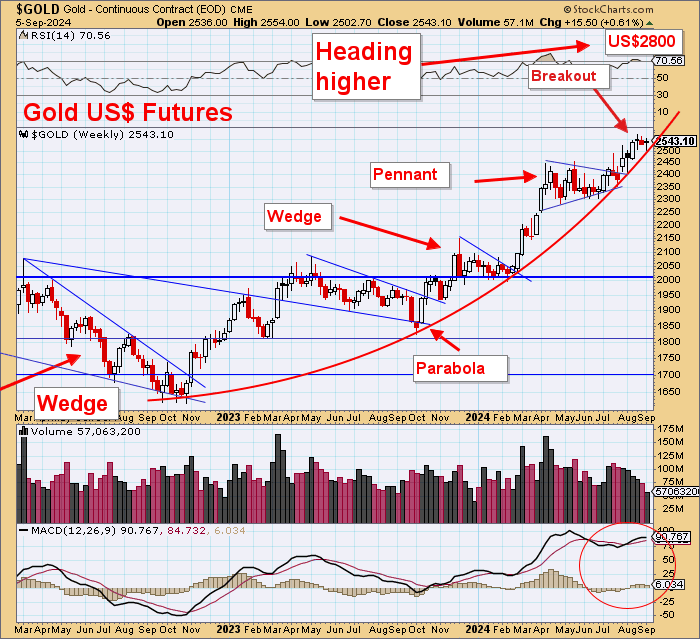

Gold has been in this little consolidation for three weeks now and it seems ready to break out on the next leg which should be at least a US$100 gain. It is interesting that this is a long and tight consolidation and quite unlike any we've seen for some time, particularly at a new all-time high.

It looks very encouraging for a 'pop' in the coming week.

This is certainly not your father's or grandfather's bull market, as we've said many times, but it is about to get very interesting.

I try to think about this market as having many, many participants and just now having many new buyers with numerous reasons for buying. The net effect of all this is to tighten the market at the margin and is likely to result in that 'pop' and possibly a runaway to something much bigger.

Gold is showing a 'hammer' on the weekly and holding nicely to this parabola.

The bigger picture is that parabola is there, but note that if it breaks higher into this new channel, gold is likely to run to the top of the channel very quickly.

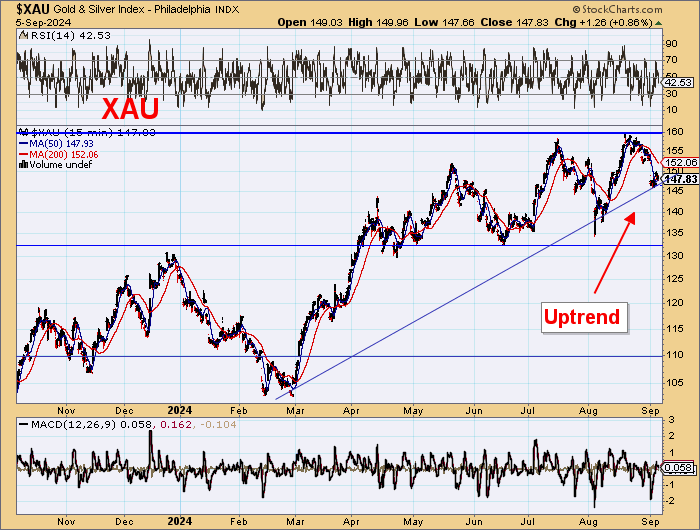

The 15-minute chart for the XAU shows an uptrend with short-term resistance at 160.

If all goes well, there should be a strong move over the next few days up to 160.

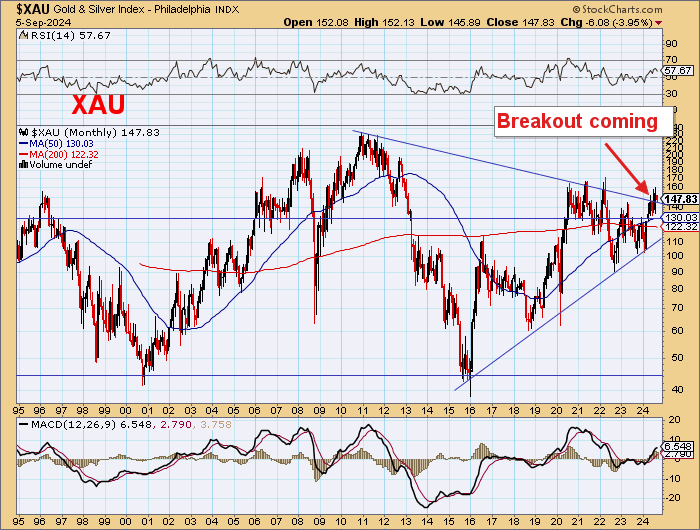

The bigger picture shows major resistance at 165.

A break of this will be very significant.

Breaks of 13-year downtrends have consequences.

You need to be on board.

Gold is the metal of Prosperity.

Who would have thought of it?

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.