In the week ending August 31, the advance figure for seasonally adjusted initial jobless claims was 227,000, a decrease of 5,000 from the previous week's revised level, according to the Department of Labor. It's pretty much in line with expectations, so it's no big deal.

The Federal Reserve's "Beige Book" report on Wednesday described employment levels as "generally flat to up slightly in recent weeks."

However, ADP job numbers came in about 40,000 below consensus. U.S. businesses generated just 99,000 new jobs in August, paycheck company ADP said, to mark the smallest increase since 2021 in another sign of a rapidly cooling labor market.

The ISM Services PMI in the U.S. edged higher to 51.5 in August of 2024 from 51.4 in the previous month, above market expectations that it would ease to 51.1, to extend the positive momentum in activity for US service providers.

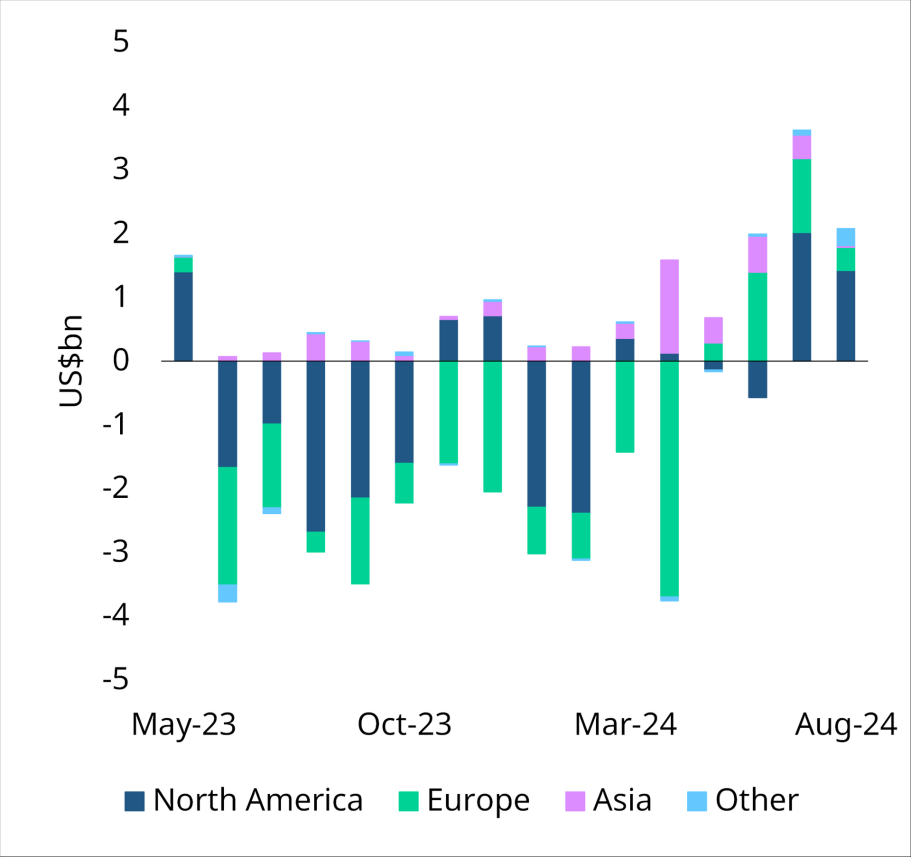

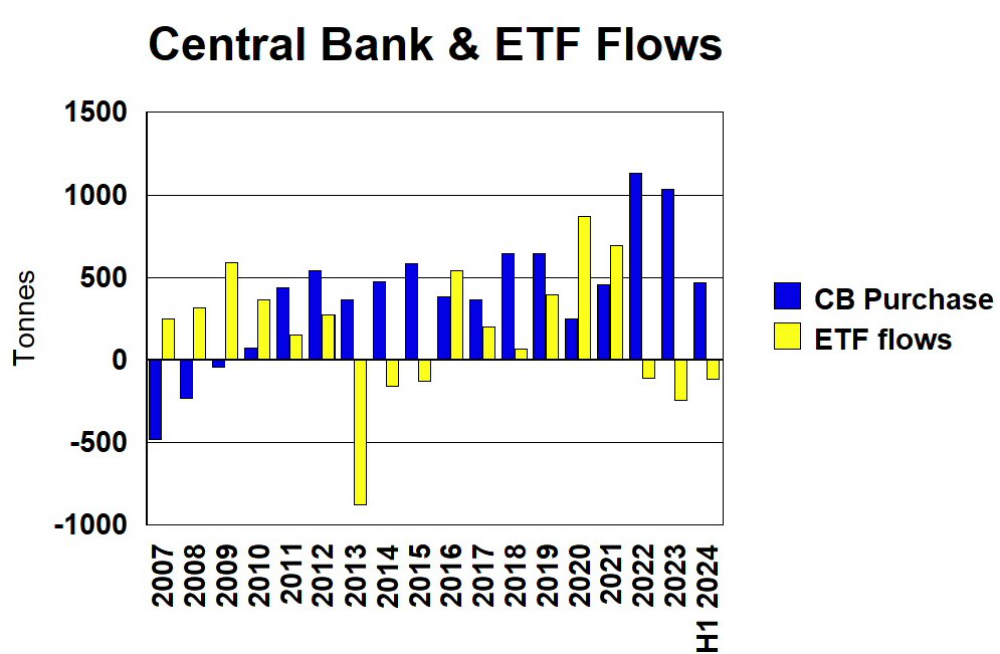

Global gold ETFs added US$2.1bn in August, extending their inflow streak to four months. Even so, these inflows are still very small, at about 100 tonnes, for 2024.

To compare, in 2020, the last time there was some investor interest in gold, the ETFs added about 800 tonnes that year.

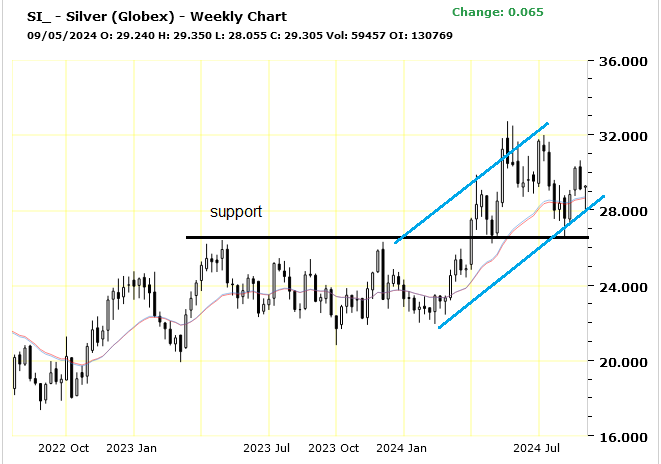

Silver is in a new bull market, climbing about 77% from the 2022 lows and currently up just over 60% from 2022.

There is really not much resistance on the chart and a close above $32, a higher high would be next.

Long term silver has broke out of a cup and handle pattern.

This is very bullish in the long run. I expect we could see a test of $50 this year or early 2025.

My April 2 report, "Silver Breakout Imminent," was perfect timing. Back then, I added Pan American Silver and Mag Silver to the selection list. They both ran up in price and are currently making decent gains.

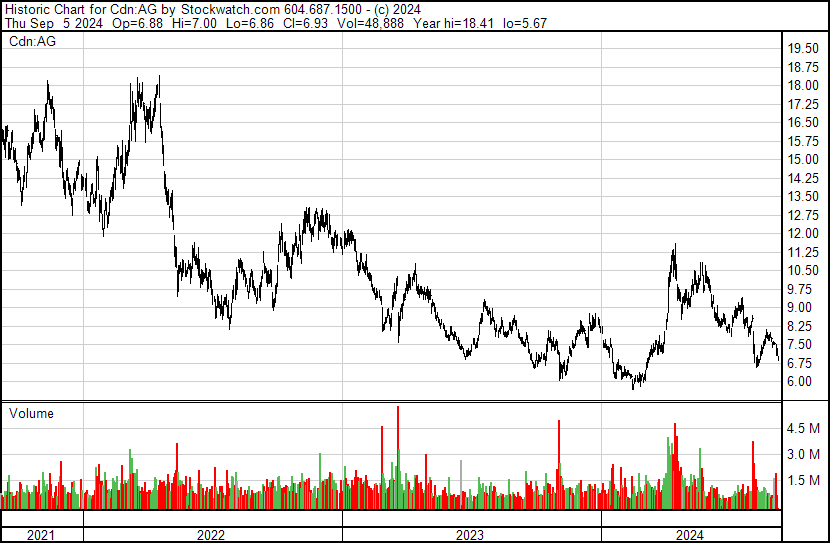

Today, I want to add First Majestic. We got stopped out of First Majestic last year at $6.90, and the stock did rally to $11 this year but has come right back down with some poor financial results and, as silver prices corrected, not holding up like gold.

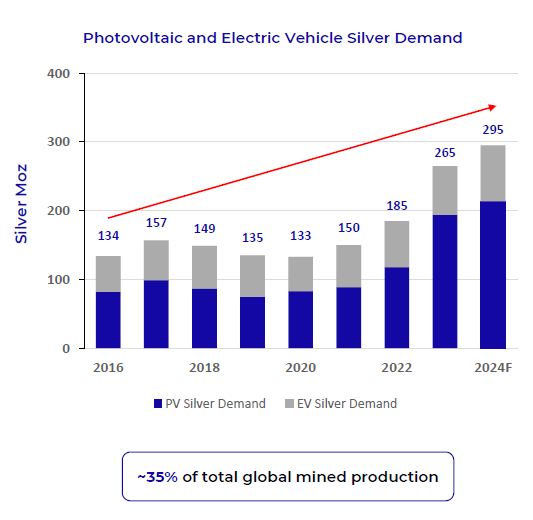

This is because Central Banks buy gold and not silver. Silver prices depend more on industrial buying and retail interest, which has been lacking this year. That will change, and when it does, silver often outperforms gold. I want to take advantage of weaker prices in First Majestic today to add back to our Selection list.

First Majestic Silver

Recent Price – CA$6.90

52-week range – CA$5.67 to CA$11.59

Shares outstanding – 298 million (post-merger 475 million)

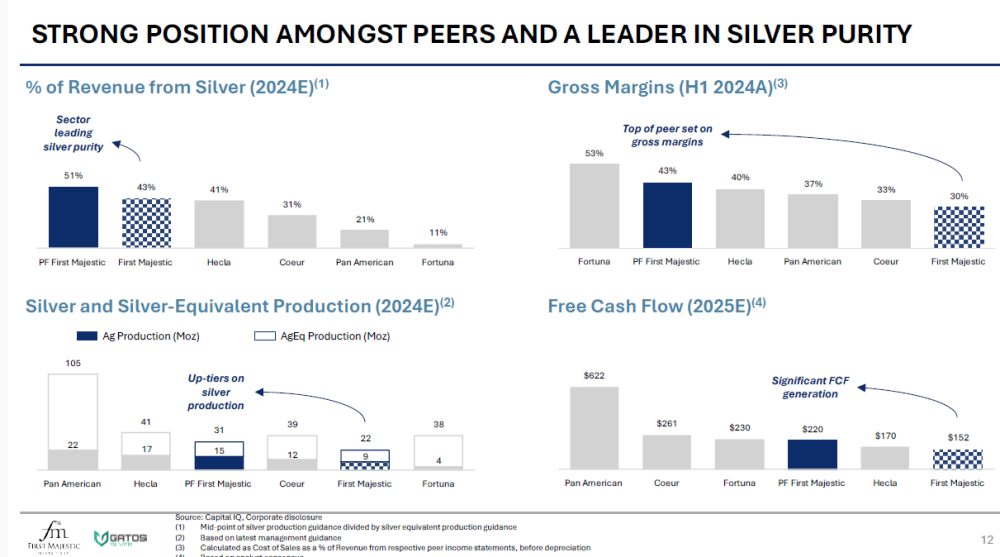

The chart above is from First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) presentation, and you can see that industrial demand is strong and growing, led by EVs and solar. Retail demand has picked up some but is still at low levels. I found my regular coin dealer is a good barometer. They are sold out of scrap silver for the first time in a couple of years at least.

Glad I bought a bit more. However, they still have fairly large stocks of Silver maple leaves and U.S. silver eagles. When these run out, I know retail demand is back.

As a refresher, here is a snapshot of AG's projects and mines. Production was suspended at Jerritt Canyon in March 2023, and the plan is to explore to increase resources for an eventual restart of the mine. The higher gold price is a definite aid as this is a gold mine and still has 1.69 million ounces of M&I resources

Sept 5, First Majestic and Gatos Silver Inc. (GATO:TSX; GATO:NYSE) announced they have entered into a definitive merger agreement, pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos. Gatos is a silver-dominant producer with a 70% interest in the Los Gatos Joint Venture, which owns the producing Cerro Los Gatos underground silver mine in Chihuahua, Mexico.

- Adds a third cornerstone, a long-life, low-cost, producing underground mine with exploration potential to the First Majestic portfolio

- Bolsters anticipated annual attributable production by approximately 6 million ounces of silver and 9 million ounces of silver-equivalent based on Gatos' 2024 production guidance

Keith Neumeyer, President and CEO of First Majestic, commented, "The acquisition of Gatos Silver is a highly compelling and transformative transaction that meaningfully enhances First Majestic's operating platform through the addition of 70% of Cerro Los Gatos - a high quality, long-life, unencumbered, free cash flow generating asset in the mining-friendly state of Chihuahua, Mexico. Mexico is a country that First Majestic has operated in for over 20 years, and we are extremely excited to deploy our operating expertise within these mining districts to deliver operational synergies and exploration success for our shareholders. We look forward to working with the operating team at Cerro Los Gatos and with our new joint venture partner Dowa Metals & Mining Co., Ltd. ("Dowa"), and we are pleased to welcome all Gatos shareholders as they transition into being shareholders of First Majestic going forward."

For Q2 2024, reported August 1st:

Quarterly revenues of $136.2 million, compared to $146.7 million in Q2 2023. The 7% decrease in revenue was driven by a 15% decrease in the total number of payable AgEq ounces sold due to higher silver inventory levels held at quarter end, lower production levels at San Dimas and La Encantada, and the temporary suspension of mining activities at Jerritt Canyon in March 2023, partially offset by increased production at Santa Elena and an increase in the average realized silver price.

The company held 712,539 silver ounces in finished goods inventory as of June 30, 2024, inclusive of coins and bullion. The fair value of this inventory, which is not included in Q2 revenues as of June 30, 2024, was $20.9 million. Improved mine operating earnings of $15.5 million compared to $1.1 million in Q2 2023. The year-over-year increase in mine operating earnings was primarily attributed to an increase in operating earnings from Santa Elena and a decrease in operating losses from Jerritt Canyon, partially offset by higher operating costs at San Dimas and La Encantada.

Operating cash flows before movements in working capital and taxes amounted to $23.8 million. Consolidated cash costs of $15.29 per AgEq ounce and all-in sustaining costs ("AISC") of $21.64 per AgEq ounce represented an improvement of 2% and a slight increase of 1%, respectively. Gatos Silver has been one of the best-performing silver stocks. They have a 70% interest in the Los Gatos Joint Venture ("LGJV"), which in turn owns the Cerro Los Gatos ("CLG") mine in Mexico. Reported Aug 8 the mine's Q2 2024 results were excellent compared to Q2 2023 (100% basis):

- Record revenue of $94.2 million, up 62% from $58.3 million

- Cost of sales $32.0 million, up 24% from $25.8 million

- Record net income of $20.5 million, up from $0.7 million

- Record EBITDA $54.1 million, up 101% from $27.0 million

- Record cash flow from operations of $54.5 million, up 59% from $34.3 million

- Record free cash flow of $40.8 million, up 107% from $19.7 million

- Silver production 2.30 million ounces, up 15% from 2.00 million ounces

- Silver equivalent production of 3.88 million ounces, up 18% from 3.30 million ounces

- By-product AISC of $6.57 per ounce of payable silver, down 54% from $14.32

- Co-product AISC of $15.26 per ounce of payable silver, down 13% from $17.55

Gatos Silver Q2 2024 results compared to Q2 2023:

- Net income of $9.2 million, up from a net loss of $3.6 million

- Basic and diluted earnings per share of $0.13, up from a loss of $0.05

- EBITDA of $8.2 million, up from a $3.5 million loss

- Cash flow provided by operating activities and free cash flow of $11.8 million, compared to cash flow used by operating activities and free cash outflow of $3.8 million

I believe the combined entity of First Majestic and Gatos will do very well. This slide is from the Gatos presentation and shows an easy to see picture of a great silver producer compared to peers.

The stock is also at an excellent buy level, driven to a double bottom with the down tic on the acquisition. It went from a bull market to a bear this year, basically driven down by poor financial results in Q1 and Q2.

A lot of the negative effects on financials are temporary, like foreign exchange losses and holding higher silver inventory. Mine operations improved in Q2 and I believe we will see further improvement and adding Gatos into the equation is going to make results much better.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of First Majestic Silver Corp.

- Ron Struthers: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.