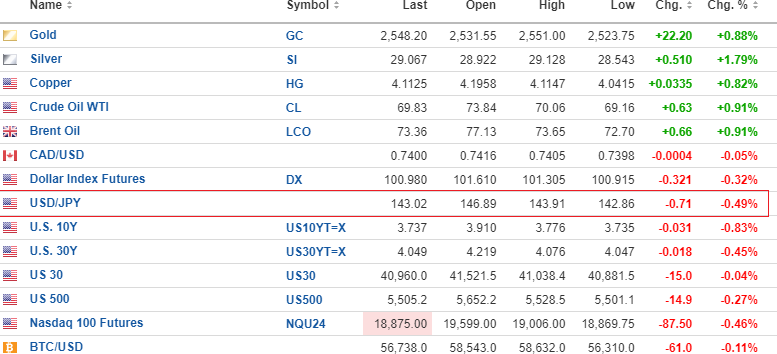

The big story this morning centers around the USD/JPY, which is testing the lows last seen on August 5 when stocks crashed as those nasty "carry trades" got violently unwound.

The USD index is weaker by 0.19%, with gold (+0.74%), silver (+1.59%), copper (+0.74%), and oil (+1.00%) all advancing.

Stocks were firm all through the overnight session until the dollar-yen buckled, taking the DJIA, S&P 500, and NASDAQ futures into the red. Bitcoin is down as well to $56,738.

The chart shown above tracks the dollar-yen (red)to the S&P 500 (green), illustrating clearly that the dollar-yen has retraced the bounce off the August 5 low after the Deputy governor of the Bank of Japan Deputy Governor Shinichi Uchida announced that the bank would refrain from further rate increases until markets "stabilized."

I would say that the 6% rally off the August 5 lows was sufficient "stabilization" so as to allow Japan's Japanese policy rates to normalize (go up). If the USD/JPY breaks below 141.68, there is a high probability that the "carry trade" pressures of a month ago will resurface.

I will be adding to my 2x Long VIX Futures ETF (VIX:INDEXCBOE)positions on the opening, hopefully into weakness, as traders appear to be far more focused on tomorrow's Non-farm Payrolls ("jobs") report.

An article on ZeroHedge highlights a massive bearish "bet" on bond prices by way of a big option purchase that only pays out if the 10-year yield moves above 4%. With the 10-year yield now at 3.73%, it would have to be a blow-out in the number and type of new jobs created, as well as a big drop in the unemployment rate, to take yields back over 4%.

However, if that happens tomorrow at 8:30 am, it will scupper the odds of a 50-basis-point September 19 rate cut and, in fact, might force Powell to stand pat. If the Fed stands pat, stocks will get hammered, and if they only move down 25-basis-points, it could still disappoint these Fed-following junkies that can only act if they think the Fed "has their backs."

Between the USD/JPY set-up and the jobs report, I am getting the impression that all rallies should be "faded" (sold) until the U.S. election is over, so I am going to take a "punt" on one of my favorite trades from the summer:

In the GGMA 2024 Trading Account:

- BUY ½ position (25 contracts) Invesco QQQ ETF (QQQ:NASDAQ) October $425 puts at $4.25 Add the balance at $3.75 if stocks rally.

Target: $25 by expiry

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.