StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) performance has not been everything I had wanted it to be since it was recommended on two occasions earlier this year, the main reason for this being drilling results released early in June that did not move the market. However, the situation looks set to improve greatly very soon for both fundamental and technical reasons.

A big reason for us liking Strikepoint was the potential of its flagship Cuprite Gold Project situated on the Walker Lane gold trend in Nevada, which is not viewed as diminished by one disappointing drill hole, but the news just out this morning means that there are now two big reasons for liking it, because the company has just announced that it has obtained the District Scale Hercules Gold Project by way of the acquisition agreement signed August 30, 2024, of all of the issued and outstanding common shares of Alcmene Mining Inc., a wholly-owned subsidiary of Elevation Gold Mining Corporation and we should not overlook the company's lesser but still significant properties in BC's Golden Triangle.

To recap what we know about the company's existing properties prior to the acquisition of Hercules, go back to the first article about it posted in February that looks at the flagship Cuprite Project or the second article posted in March that included details of the company's other significant properties in BC's Golden Triangle. Here, we are going to concentrate on the new District Scale Hercules Gold Project.

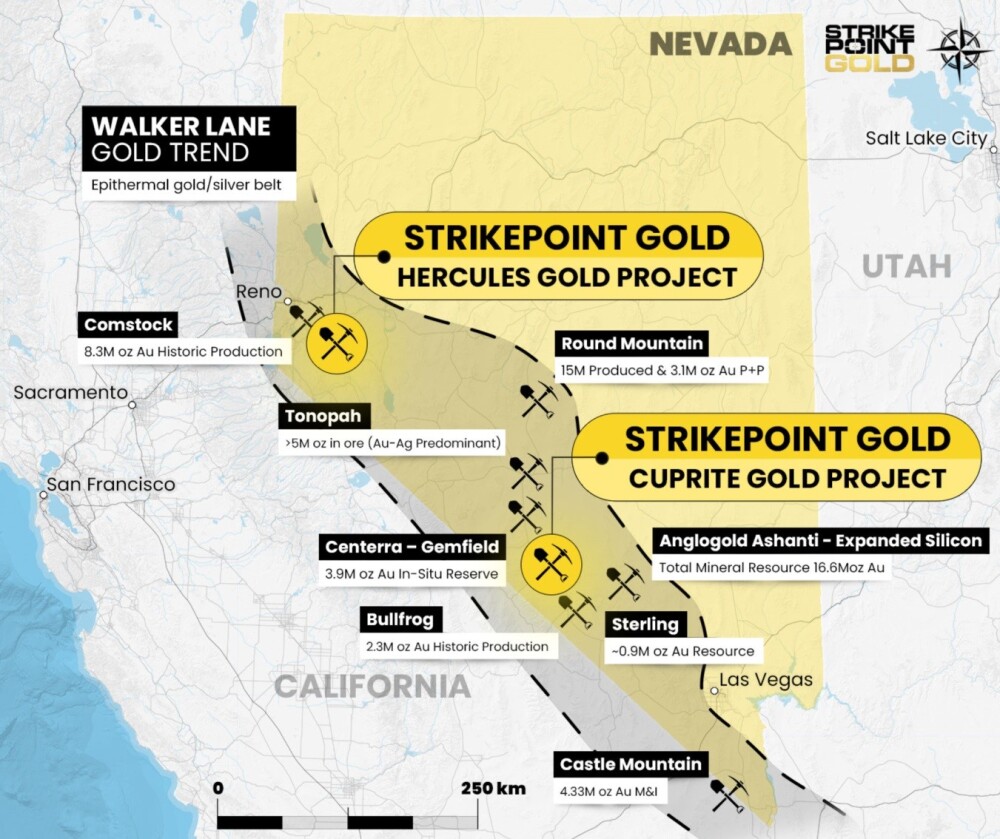

The following useful map shows where the Hercules Gold Project lies in relation to the company's existing flagship, Cuprite Gold Project — as we can see — it is further up the Walker Lane gold trend and close to Reno, Nevada.

The map also shows where the new property lies in relation to other significant projects along the Walker Lane gold trend that are owned by other companies whose presence, of course, increases the chances of big discoveries being made at Hercules.

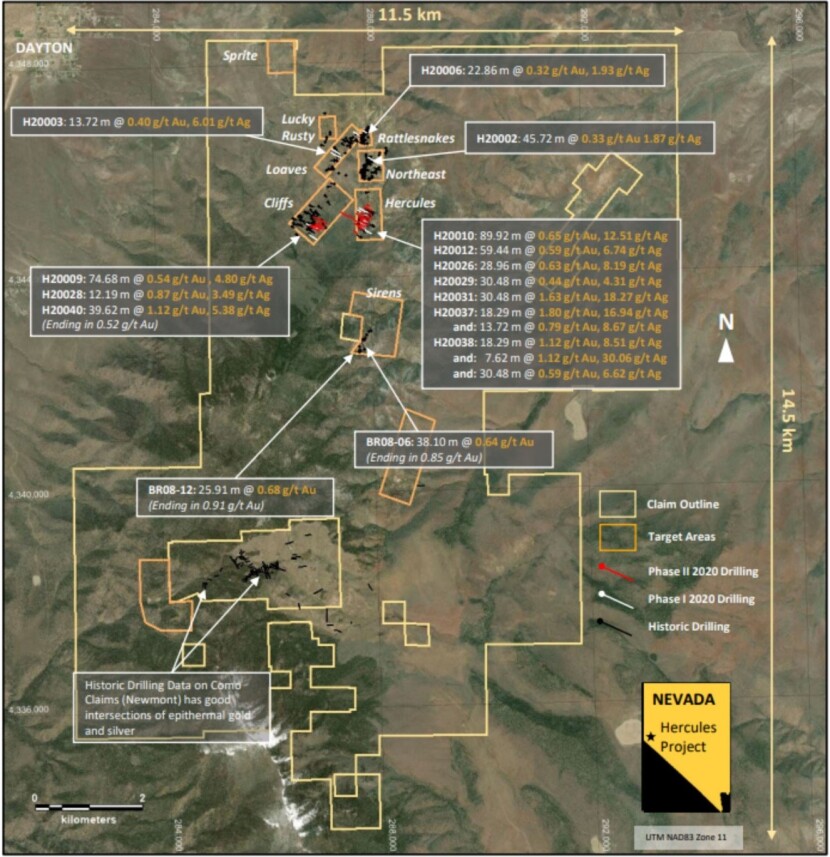

The following map shows what has already been discovered at Hercules as a result of prior drilling programs.

Now we will review the latest charts for Strikepoint Gold which make unequivocally clear the golden opportunity being presented to investors right here, right now.

On the 7-month log chart, we see how the stock got knocked down and then drifted lower in the downtrend shown on lack of interest but throughout this period upside volume predominated which drove the Accumulation line higher, which is a sign of furtive accumulation of the stock beneath the facade of weakness that normally leads to a reversal which is made more likely by the now quite large gap between the price and its 200-day average and the steadily improving momentum as shown by the MACD indicator.

So it is interesting to see that the stock appears to have found a floor at the 2-cent level in recent weeks.

Zooming out to overview the Big Picture via a 5-year chart we can immediately see why the decline has stopped at the 2-cent level, for this is a long-term cyclical low that very successfully reversed the stock to the upside back in 2020 and given the important positive news out today and the bright outlook for gold itself, we can expect it to genrate another significnt reversal to the upside.

In conclusion, it is clear that investors are being presented with an exceptional opportunity here with Strikepoint Gold being at very low level and on the point of reversing to the upside. We, therefore, stay long, and the stock is rated an Immediate Strong Buy; in addition, this is a stock that is considered to be worth going overweight on.

Strikepoint Gold's website.

Strikepoint Gold's investor deck.

StrikePoint Gold Inc.'s (SKP:TSX.V; STKXF:OTCQB) closed at CA$0.025, US$0.016 on August 30, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

This article is issued on behalf of Strikepoint Gold Inc.

- Strikepoing Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Strikepoint Gold Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.