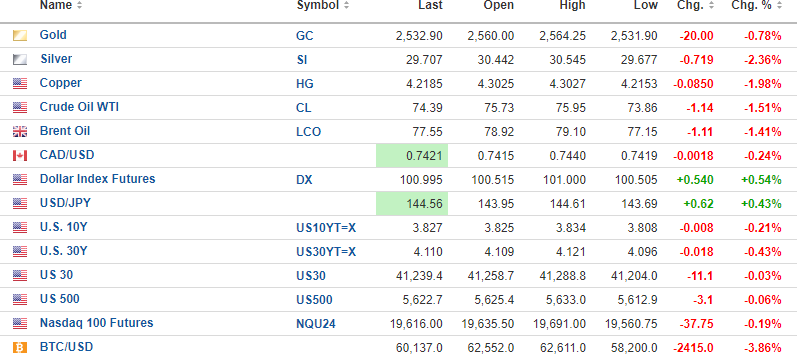

As of 8:20 am, the heavily oversold USD Index futures are up 0.43% this morning with 10-yr. (-0.21%) and 30-yr. (-0.43%) yields slightly lower.

Gold (-0.78%), silver (-2.36%), and copper (-1.98%) are all lower.

Oil is down 1.51%. Stock futures are backing off very slightly, while risk barometer Bitcoin is off 3.86% to $60,137.

December Silver is running into the same formidable resistance in the zone above $30 that has capped it since February 2022. However, RSI at 59.56 is anything but overbought, and MACD, MFI, and TRIX are all on "buy signals," suggesting that a test of the May peak at $33.50 may be in the cards.

Gold continues to demonstrate a very bullish pattern of higher lows and high highs as it ascends the "Wall of Skepticism" at a perfect 45° angle, which should drag silver to new highs by the end of the year.

Only a liquidity squeeze brought on by another equity market drawdown can derail the metals in here which means the month of September is where you need to exercise caution.

Three trading sessions (including today) left in the month of August, with drill programs expected to fire up next month at Buen Retiro for Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) and at Illapel for Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE), both in Chile and both in the hunt for copper-gold.

The long-awaited revised mineral resource estimate for Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) is expected as well, followed by a Preliminary Economic Analysis for the Fondaway Canyon project that will include a detailed look at the metallurgy which was a major query all through the 2020-2022 drilling programs.

There are other corporate developments brewing that will continue to fortify the Getchell story, so adding to what is already a monstrous position (thanks to the 10:$1 warrant position that sprung off the 2023- 2024 debenture issue) seems like a solid move. Buying gold ounces in Nevada for $9.03 per ounce with gold at $2,525 is a ridiculous "steal."

Of course, you have all been hearing that from me since 2020, and that is how long the junior gold developers and explorers have been in the doghouse. I can see the catalyst for a re-rating on the immediate horizon for all juniors but emphatically for a resource like the one at Fondaway Canyon.

| Want to be the first to know about interesting Critical Metals, Silver, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of: All.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.