The nation's largest utility companies are warning of a coming energy demand surge from electric vehicles (EVs) and artificial intelligence (AI) could be unlike anything seen since the widespread adoption of heat pumps and air conditioners pushed demand sky-high in the 20th Century, according to a June 30 piece by Spencer Kimball for CNBC.

Uranium expert and former Paladin Energy Chief Executive Officer Alex Molyneux, strategic advisor to the OAM Uranium Opportunity fund, said that spot prices for the nuclear fuel have not plateaued yet despite hitting more than US$100 per pound earlier this year. The price was US$84.25 on July 31.

"We haven't had the spike yet," Molyneux said.

At Paladin, one of the world's largest public-listed uranium producers, Molyneux completed a US$700 million recapitalization of the company, which now has a market cap of US$2 billion. After he started his career as an investment banker, he worked with mining financier Robert Friedland and spent five years with Ivanhoe Mines Group in various leadership roles. In June of this year, Paladin, who runs a producing uranium mine in Namibia, announced a friendly takeover of Fission Uranium Corp. (FCU:TSX; FCUUF:OTCQX; 2FU:FSE). Fission holds the development-stage PLS uranium project at the southwestern margin of the Athabasca Basin.

Molyneux, who was a founding investor in North Shore Uranium Ltd. (NSU:TSX), talks to Streetwise Reports about the present and future of the uranium market and why he likes North Shore and the eastern Athabascan Basin area where it is exploring.

The Catalyst: The World Needs Nuclear Energy

The need for more energy is real, and experts agree nuclear will be a part of it. Rystad Energy predicted that data centers and EVs alone will add 290 terawatt hours (TWh) of new demand by 2030.

"Overall, the combined expansion of traditional and AI data centers, along with chip foundries, will increase demand cumulatively by 177 TWh from 2023 to 2030, reaching a total of 307 TWh," noted Rystad, an independent research and energy intelligence company. "Despite data centers currently representing a relatively modest portion of total electricity demand in the U.S., this marks a more than two-fold increase compared to 2023 levels, which stood at 130 TWh, highlighting the efforts of the U.S. to position itself as a global data center hub."

Rystad said the reliance on coal in the U.S. has diminished. This is expected to continue while overall power generation is expected to rise.

IG Bank noted that Morgan Stanley has estimated a nuclear renaissance could be worth US$1.5 trillion through 2050 in the form of capital investment.

Uranium's Advantages

Molyneux said the uranium market always fascinated him as a banker and was something he wanted to have in his portfolio.

He said two reasons he likes the commodity is that it is not pro-cyclical with the economic cycle, and it has a positive yield on the forward curve.

"If you're exposed to other commodities, like copper, like iron, they're pro-cyclical," he said. "If the Chinese economy slows dramatically, the copper (and) iron ore prices will drop . . . They'll keep the reactors running, and nothing will happen to uranium."

And on the forward curve, "the positive yield always gives you a tailwind at any given spot price, the forward price is always higher," said Molyneux who compared that facet of the uranium market to gold.

"Uranium is a very unique commodity in the resource inventory sense, and one of the reasons is because it was such a strategic commodity after nuclear power and nuclear weapons were industrialized, and there were huge government-led exploration programs," he noted.

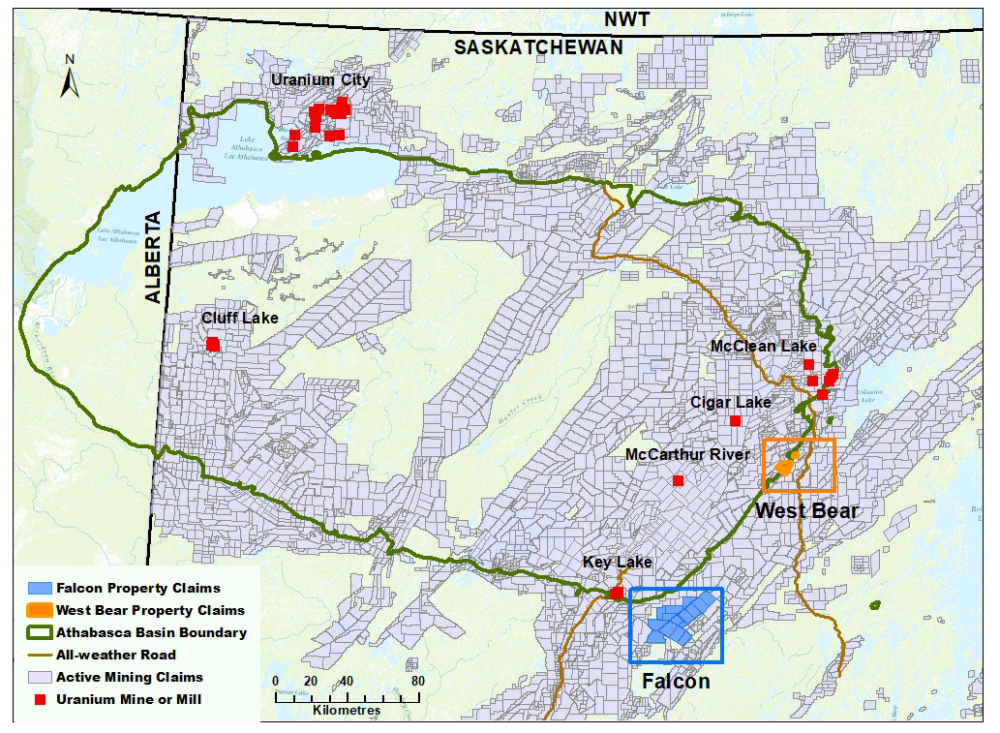

Molyneux said, "I got involved in North Shore at the seed stage because the real game for uranium exploration is in the Athabasca Basin in northern Saskatchewan where North Shore is searching."

The basin is ranked second in world uranium production, producing about 7,380 tonnes in 2022. It is home to the world's largest and highest-grade uranium mines and major operators like Cameco and Orano. Cameco's McArthur River Mine is currently the world's largest high-grade uranium mine, and their Cigar Lake Mine is the world's highest-grade mine.

Still More Room in Eastern Basin

All of the producing mines and most of the historic uranium mines are in the eastern part of the Athabasca Basin. While the western side is on track to become a uranium producer again, it has its own issues, Molyneux said, including a lack of mills and higher capital outlays.

"These are hugely capital-intensive projects, and there's a real risk for them to start up," he said.

But he said there's still more room for discovery in the eastern basin.

"A company like North Shore has picked up prospective tenements on the eastern margin of the basin that are outside of the areas that are dominated by Cameco Corp. (CCO:TSX; CCJ:NYSE) and Orano and other major groups, and it can make a discovery," he said. "And all they have to do is discover something that's a bit better than what Cameco and Orano have in their inventory, and then, boom, it's going to attract a lot of attention, potentially with the majors."

The private company that ultimately became North Shore acquired its initial tenements from several prospectors and added neighboring tenements that are now part of the company's Falcon Project from Skyharbour Resources Ltd. to complement its prospective land package.

"It's still very early days for North Shore," Molyneux said. "It hit uranium mineralization in the first two drill holes. There's all the right stuff indicating uranium mineralization on the North Shore tenements. Brooke is now looking for that combination of scale, grade, and geometry to make a discovery viable."

Analyst: Positive First Step

North Shore recently announced it was gearing up for a follow-up drill program at Falcon. The company says they are also laying the foundation for a potential future drill campaign at its West Bear project located 90 km northeast of Falcon.

Spanning over 55,000 hectares, Falcon saw its first drill program completed earlier this year. Key targets were identified using historical data including results from airborne geophysical surveys conducted in 2006, 2007, and 2022. Analyst David Talbot of Red Cloud Securities noted that the initial drill program identified structures and alterations typical of basement-hosted uranium mineralization, calling the results a positive first step.

Near-surface mineralization was discovered at two targets, PO3 and PO8, located 1.3 kilometers apart. At PO3, a sub-vertical graphitic brittle fault zone was encountered, with five intervals showing over 100 parts per million (ppm) U3O8 and three samples exceeding 300 ppm U3O8. At PO8, near-surface uranium mineralization was found between 42 and 47 meters, with a 4.7-meter interval averaging 316 ppm U3O8 and a peak value of 572 ppm.

The last significant drilling at West Bear was conducted by Denison Mines Corp. in 2015. Limited historical drilling has been done on the property, and about 1.5 kilometers north of West Bear, Uranium Energy Corp. has the only cobalt-nickel resource in the basin, as well as a uranium reserve.

Talbot noted that as the company continued to execute its exploration strategy at Falcon and West Bear, the stock had the potential to rerate.

District's Story Will Evolve

Much like the uranium market itself, which Molyneux said he expects will start to heat up later this year and early next year after utilities adjust to the new U.S. ban on Russian uranium, the story in the eastern part of the basin "will ramp up."

"I think these stories take time to evolve, and I think this whole eastern margin play will take time to evolve," he continued.

And with President and Chief Executive Officer Brooke Clements, who Molyneux called "a real explorationist," at the helm, he thinks the company has a good chance of being at the center of that story.

"North Shore has the same quality of ground as some of the best players at the eastern margin, " Molyneux said. "Discoveries will evolve … or someone will just have a drill hole that knocks everyone's socks off. And then, suddenly, there'll be more consolidation happening within that part of the basin."

North Shore Ownership and Share Structure

Insiders and founding investors own approximately 45% of the issued and outstanding shares. Clements owns 3.51% or 1.29M shares, Director Doris Meyer has 2.11% or 0.78M shares, Director James Arthur holds 1.45% or 0.53M shares.

Most of the rest is with retail, as the institutional holdings are minor.

North Shore has 36.84M outstanding shares.

Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- North Shore Uranium Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of North Shore Uranium Ltd. and Cameco Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.