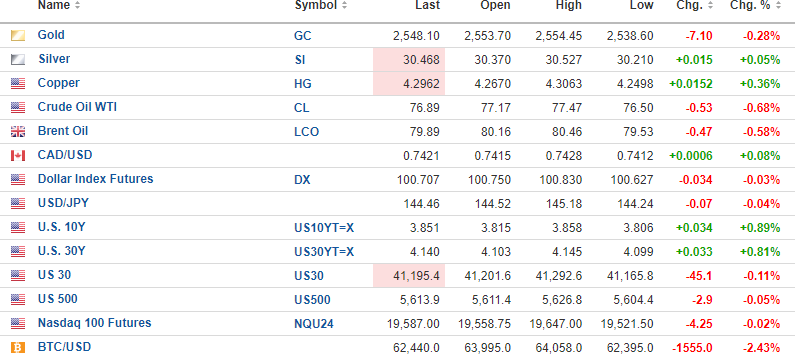

USD Index futures are down 0.04% this morning with 10-yr. (+0.89%) and 30-yr. (+0.81%) slightly higher.

Silver (+0.05%) and copper (+0.36%) are up, while gold (-0.28%) is modestly lower.

Oil is down 0.68%. Stock futures are backing off, with the DJIA down 0.11%, S&P 500 down 0.05%, and the NASDAQ -0.02%. Risk barometer: Bitcoin is off 2.34% to $62,440.

Overbought Conditions

Normally, I would gauge the market's overbought/oversold condition using the relative strength index ("RSI").

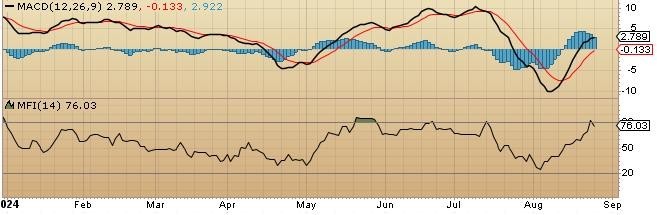

While it is still significant, two other indicators can signal an impending short-term sell-off in stocks and they are MACD and MFI.

These are the charts of the MACD and MFI for the S&P 500 as of last evening's close. You can see that the MFI is now above the 80 level, which has triggered corrections in the past. MACD lines along, with the histogram, are pressing up into levels where they too have signaled weakness (or at the very least profit-taking), so I am now even more confident in my selection of the 2x Long VIX Futures ETF (UVIX:CBOE) as a near-term hedge against a sell-off.

Also interesting are the same two indicators for the Invesco QQQ ETF (QQQ:NASDAQ), where the MACD histogram is now higher than it was just before the "carry trade crash" in early August.

While I am not sure that the QQQ September $455 puts ($3.45) will be sufficient time to benefit from a September swoon, the fact that September is seasonally the weakest month of the calendar year makes those puts very tempting. I am going to wait to see if the RSI kicks into overbought status with a move into the 70s before the downside action begins, and while I run the risk of paying up for the puts, it will give me a tad more confidence in my defensive posture.

Freeport-McMoRan Inc. (FCX:NYSE)

The same analysis of the MACD-MFI indicators tells me that it is not nearly as overbought because MFI is still under 80, and the MACD is not even back above the zero line. With an RSI in the 55 range, it looks higher still so with the 50-dma and 100-dma at $46.17 and $48.45, I will stay in the saddle until I see how it acts as it probes those two resistance levels.

With all indicators still not overbought, the downside here is limited, so for those subscribers who long this trade, hang in there with a view to adding on weakness.

Freddie's Corner

I had a long chat last evening with my old friend Freddie ("Freddie's Corner") on markets and life and aging as we reflected back on some of the campaigns upon which we embarked in the 1990s while riding the resource wave dominated by stock-buying baby-boomers with their insatiable appetite for exploration risk. We both agree that the "rules of engagement" have changed dramatically over the years, but what has not changed is the predominance of greed as a driver of markets.

Show any demographic a reasonable risk-reward opportunity in any era, and you will find a stream of money flowing quickly into line. Whether it was cannabis in 2016, crypto in 2019, or artificial intelligence in 2023-2024, every generation carries a love of speculation into the stock market arena, with the only difference between 1994 and 2024 being where the money flows.

Technology dominated in the late 1990s and then went dead until 2003, after which metals and energy came to like and kept running, albeit nothing like the 1990s until 2011. Freddie sees interest building in the resource sector within his network and while it is still in its infancy, he expects a full rotation to occur within a few months.

In the meantime, he has highlighted Focus Universal Inc. (FCUV:NASDAQ) again as "one to watch" in the $0.18 range, so after watching GeoVax Labs Inc. (GOVX:NASDAQ) scream from $1.20 to $11.18 in three short weeks, I figured that I better own a few shares.

Perhaps subscribers might wish to take a "punt" for a week or two to see if lightning can be captured in a bottle by the Oracle of the Ozarks.

Want to be the first to know about interesting Technology, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.