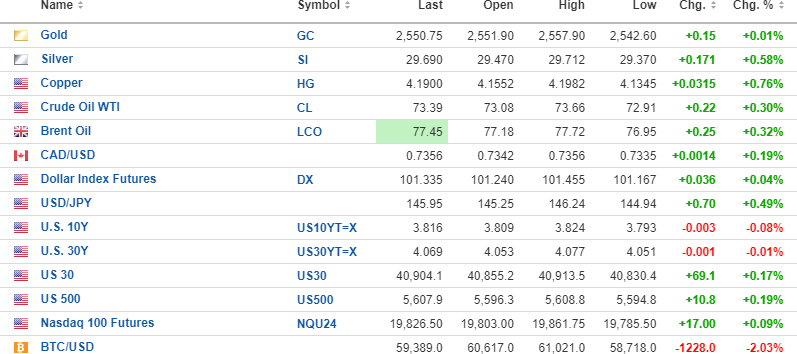

USD Index futures are rallying modestly (+0.49%), with bond yields flat. Gold (+0.01%), silver (+0.58%), copper (+0.031%), and crude oil (+0.30%) are all slightly higher.

Stock index futures are up (+0.09-0.19%), but risk barometer Bitcoin is down $1,228 (-2.03%) to $59,389.

Eight trading days left in the month of August as the summer doldrums are soon to be in the rear-view mirror. Fortunately, my basket of juniors is holding up well for the most part.

While I cannot go into detail, I believe there might be something brewing that could finally change the fortunes (and share price) of Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), whose Fondaway Canyon resource of 2,059,900 ounces gold (Au) has been largely ignored for most of gold's $600/oz. rise since last October.

I continue to see the resource calculation revised upward next month when the PEA is released, along with a breakdown of the metallurgy, which includes recovery rates applicable to the resource. Without any step-out drilling to depth or along strike, I see a slight increase to 2.3-2.5 million ounces valued at a minimum of $50 per ounce. In the past, I have always used $100-200/ounce for Nevada gold deposits, but until we get into the mania associated with true gold bull markets, I will set a benchmark at $50/ounce.

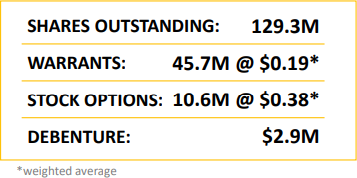

On that basis, the valuation for Fondaway should be in the $115-125 million range. Using the capital structure taken from the March/2024 corporate presentation (see below) of 185.6 million shares issued, I arrive at a figure of $0.62-0.67 (CA$0.84-0.91) per share.

This is not the number I use as a target price, but it is a number applicable in the event that the mid-tier producers start hunting down ore bodies in a favorable jurisdiction like Nevada in order to bolster their balance sheets.

That is exactly what I expect now that the gold and silver M&A cycle has begun in earnest, evidenced by the Gold Fields Inc. 60% premium offered for Osisko Mining on August 16.

With gold now ascending away from the psychological barrier at $2,500, there is going to be a price point where the senior and mid-tier gold producers start to panic and begin bidding for deposits.

As soon as their share prices start scraping the stratosphere (as we saw in the 2002-2011 bull), they will begin to use their inflated shares as currency and go on a buying binge.

Getchell Gold is perfectly positioned to take advantage of such a development, and while I own shares as low as CA$0.10 and as high as CA$0.45, a sale of the Fondaway asset for $125 million would provide a rate of return upon exit that I would readily accept.

Getchell Gold is a Buy.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.