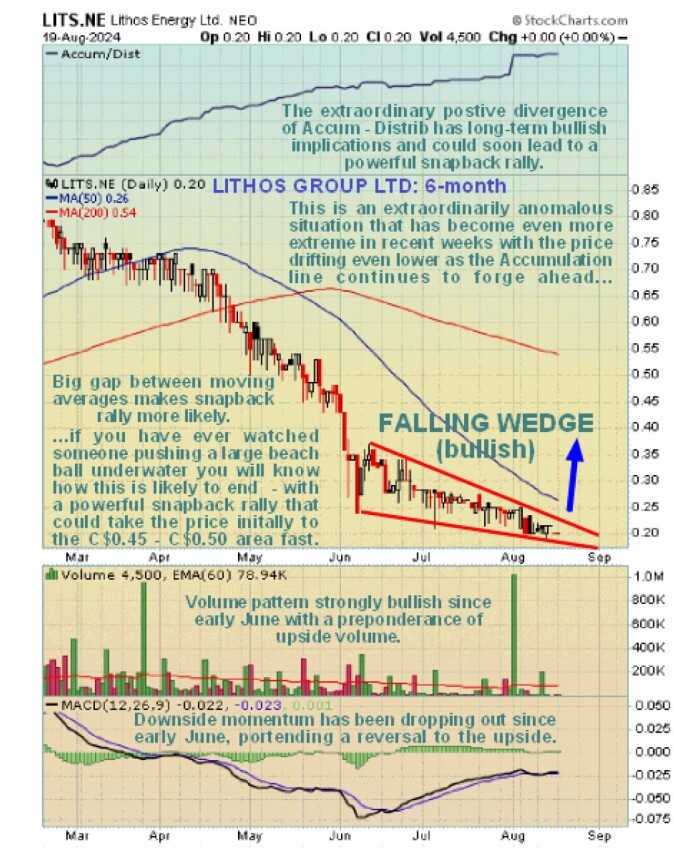

We have highlighted the anomalous behavior of Lithos Group Ltd. (LITS:CBOE.CA; LITSF:OTCMKTS; FSE:YU8; WKN:A3ES4Q) stock on several occasions this year, with the stock continuing to drift lower and lower, yet all the while, its Accumulation line has continued to forge ahead, creating a positive divergence that promises a reversal into a major bull market.

A reversal in the stock was called early in July but to no avail — it just continued to fall, but the rate of decline has slowed markedly, as we can see on its latest 6-month chart below, so that downside momentum (MACD) has been dropping out with the preponderance of upside volume — especially in recent weeks with more aggressive buying evident — driving the Accumulation line relentlessly higher.

The technical situation can thus be compared to someone pushing a large beach ball completely underwater, and we know how that ends — with the ball suddenly breaking free and bursting to the surface.

It is thus interesting to see the positive news released by the company just this morning that could cause the stock to break dramatically to the upside. This news is that LiTHOS Announces Positive Results from AcQUA™ Technology Lithium Brine Tests with SQM on Salar de Atacama Brines. This news is a really Big Deal because it means that the technology that the company has been developing to make possible the efficient production of lithium without the need for traditional evaporation ponds actually works and can be implemented. Here are some of the most important paragraphs from the news release:

Key Achievements:

Exceptional Purity: AcQUA™ technology has achieved interesting rejection rates of Magnesium, Boric acid (HBO3), Calcium (CaCl), and Sulfates (S04), requirements that are essential for producing high-purity lithium, crucial for battery manufacturing.

Innovative Technology: Unlike traditional methods, AcQUA™ uses a patent-pending, hybrid electropressure membrane process that increases lithium concentration without the use of freshwater and harmful chemicals, marking a significant step forward in sustainable mining technologies.

Environmental Benefits: By eliminating the need for evaporation ponds, AcQUA™ technology substantially reduces the footprint of lithium mining. This aligns with global environmental standards and supports the industry's shift towards sustainable practices.

"The positive outcome from our latest tests on SQM field brines with AcQUA™ technology affirms our dedication to collaborating and validating our technology with SQM, which is a leading global lithium producer focused on sustainability," said Scott Taylor, CEO of LiTHOS. "These achievements not only differentiate us within the industry but also enhance our competitive position, demonstrating our potential to meet the increasing demand for high-purity lithium crucial for renewable energy technologies."

Operational and Technological Advantages:

The efficacy of AcQUA™ technology has been validated, strengthening LiTHOS's capability to meet the growing global demand efficiently. These advancements support the company's mission to enhance sustainability and operational efficiency in lithium extraction.

Environmental Impact and Strategic Positioning:

Committed to minimizing environmental impacts, LiTHOS's use of AcQUA™ technology can eliminate the need for traditional evaporation ponds, significantly reducing the footprint associated with lithium mining. This strategic approach adheres to stringent environmental standards and positions LiTHOS to leverage opportunities in a market that increasingly values sustainable practices.

Holders of Lithos Group should, therefore, stay long and may want to add to holdings, and the stock is rated an Immediate Strong Buy here. It is available to U.S. investors on the OTC market where it trades in healthy volumes.

Lithos Group's website.

Lithos Group Ltd. (LITS:CBOE.CA; LITSF:OTCMKTS; FSE:YU8; WKN:A3ES4Q) closed at CA$0.20, US$0145 on August 19, 2024.

Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Lithos Group Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lithos Group Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.