I cannot do a better job of telling the story of MiMedia Holdings Inc. (MIMDF:OTC; MIM:TSXV; KH3:FSE) than the company has done itself in its latest investor deck (June this year — the one on the company website is dated April 2022) — to attempt to do so would not only be a waste of time but would not be any better than this deck which is clear, concise and easy to understand.

However, that said, it is worth presenting a bulleted list of the main attributes of the company and its business:

- The Cloud is still very early in its development with huge usage increase potential — it is on course to be a US$100 billion market. Understanding and penetration of this market is still very low but this is set to change rapidly.

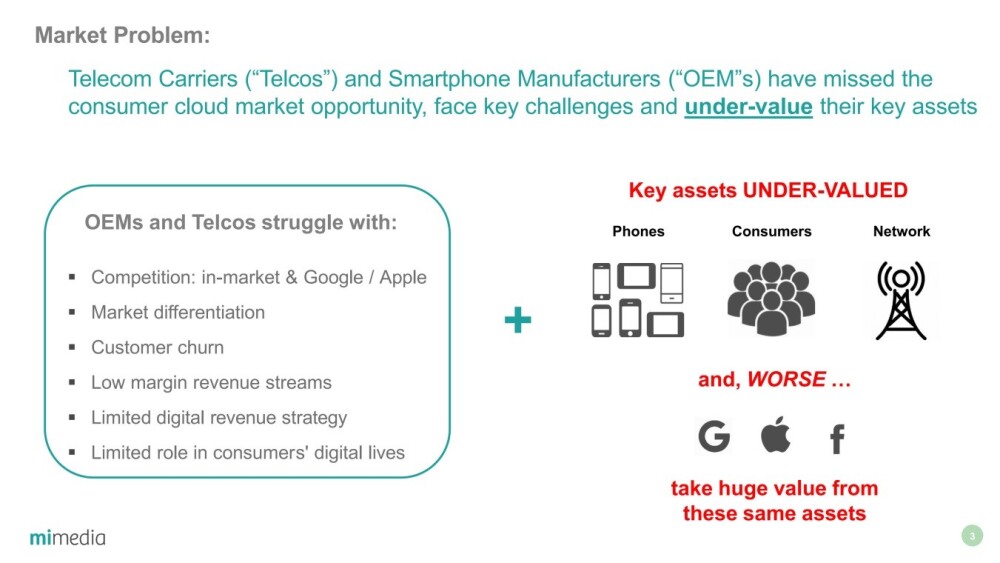

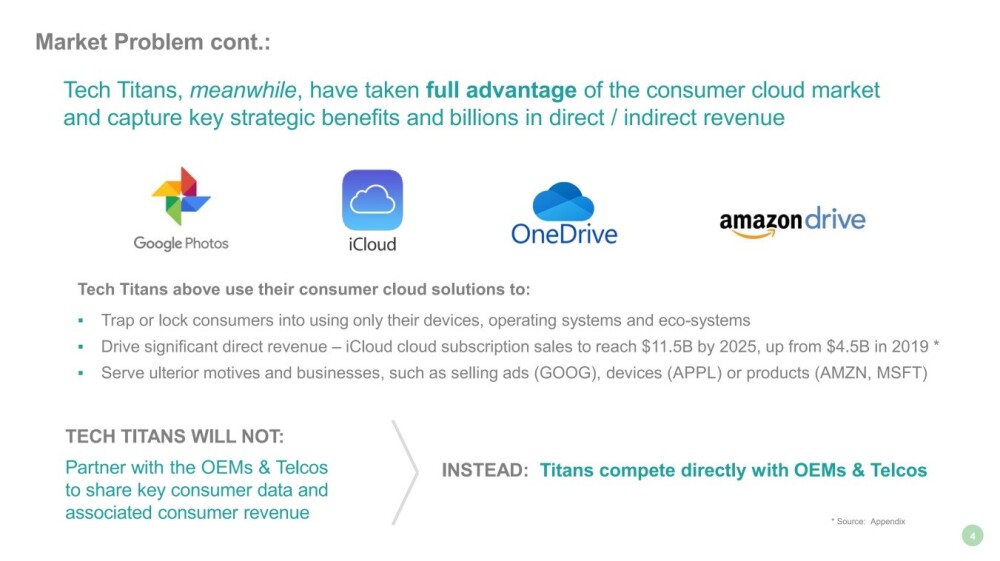

- Smartphone Manufacturers (OEMs) are hardware people and Telecom carriers (Telcos) are network people who don't do software very well and have missed the cloud opportunity and essentially abandoned the field to the Tech Titans. MiMedia's platform presents OEMs and Telcos with the opportunity to move almost effortlessly into this space and monetize it.

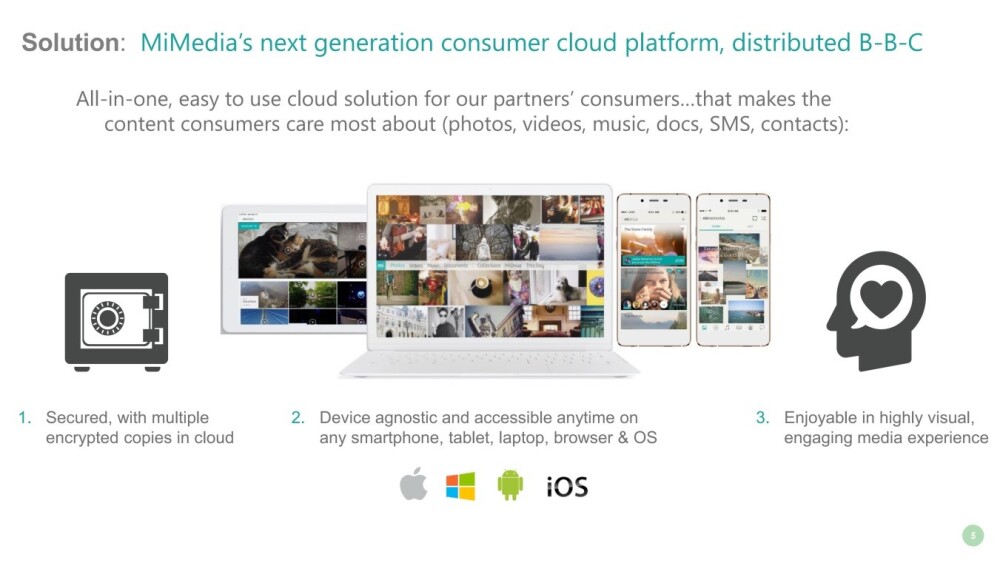

- MiMedia's platform is the complete end-to-end solution for consumers lives as it enables seven apps to be seamlessly integrated into one platform so that smartphones, tablets, PCs, web and TV all work together and it is device agnostic so that any device will work with it at any time and you can move from one phone or operating system to another without problems.

- The company has spent US$50 million developing the platform, which took six years to build with 16 issued patents — the competition would take years and over US$100 million to get something similar developed.

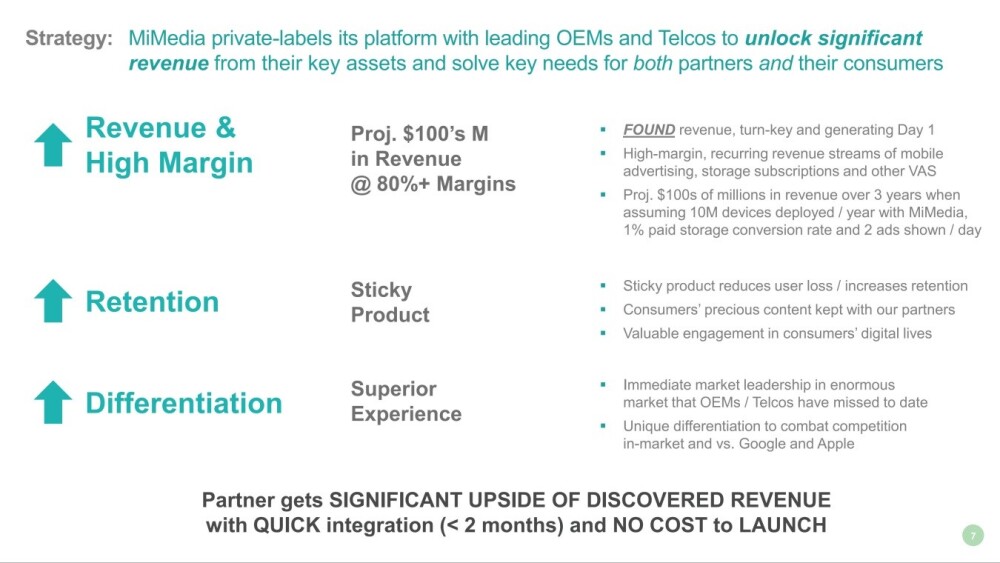

- MiMedia's platform is offered at no upfront cost to OEMs and Telcos — the company and its partners share in the revenues. MiMedia has made the platform easy to implement and can be up and running in a few weeks.

- There are three main benefits for partners — go from having no Cloud to Cloud, offer a "sticky" product — i.e. consumers will stay aboard so that customer retention increases. The platform will drive high-margin (80%) recurring revenue streams.

- The company's solution is arguably a considerable improvement on Google Photos and iCloud.

- The company's platform allows users to easily share photo galleries, etc., on the cloud.

- Users' content is secure as data is encrypted and stored in multiple locations around the world, with privacy assured.

- It is very easy to upload content and very engaging. The platform employs "resurfacing" features so that you don't lose / forget about content.

- The platform sports a unique superior gallery with adverts on Android phones, which constitute 85% of the world's phones, and the company is the first to bring advertisers into this space and monetize it.

- It is much cheaper now to integrate partners than a year ago.

- The platform is already contracted on 35 million phones, with a good chance that the amount of contracted devices double over the next year, which includes a distribution agreement with Texas-based Schok Wireless formalized in June.

- The company's stock also trades on the US OTC market, and at the end of April, it announced its listing on the Frankfurt Stock Exchange (FSE) under the symbol KH3.

Beyond this, all that is necessary is to reproduce the most important and pertinent pages from the latest investor deck. After viewing these pages, we will review the latest charts for the company's stock.

The following pages set out the central problem in this market for consumers, Telcos, and device manufacturers and MiMedia's sweeping solution, which, incidentally, cannot be encroached on because, after a lot of R&D, MiMedia's solution(s) are protected by a broad range of issued (not solely filed) patents.

The following two pages detail the central problem facing Telecom Carriers and Smartphone Manufacturers in a market dominated by the Tech Titans.

This next page lays out MiMedia's solution: its next-generation consumer cloud platform.

As the following page illustrates, this platform allows for the complete range of apps — Smartphones, Tablets, PC, Web, and Television — to be seamlessly integrated into one platform, which is device agnostic, meaning that it will work with any device, anytime.

This page sets out the business strategy.

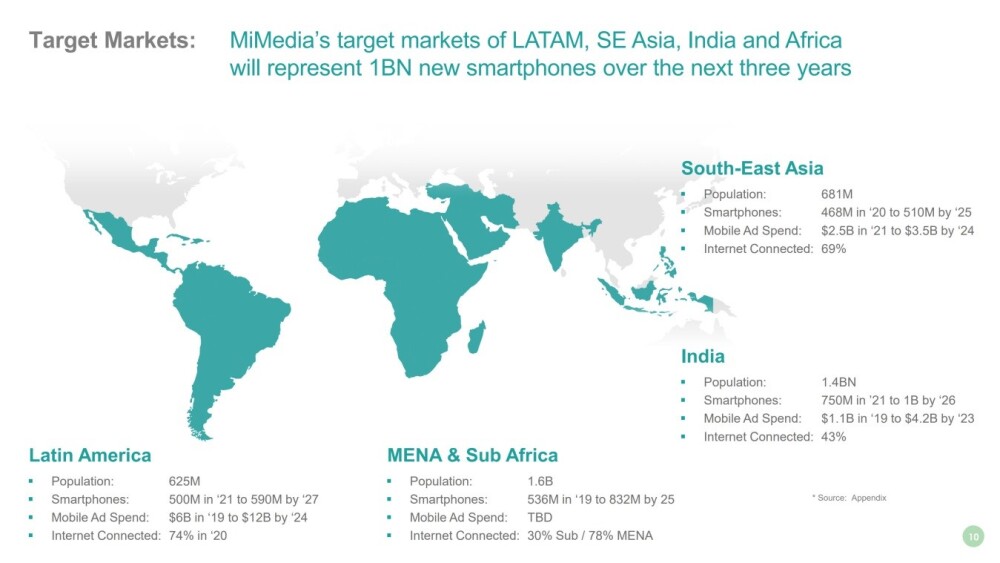

The following page shows the target markets over the next several years and as we can see, they are extensive.

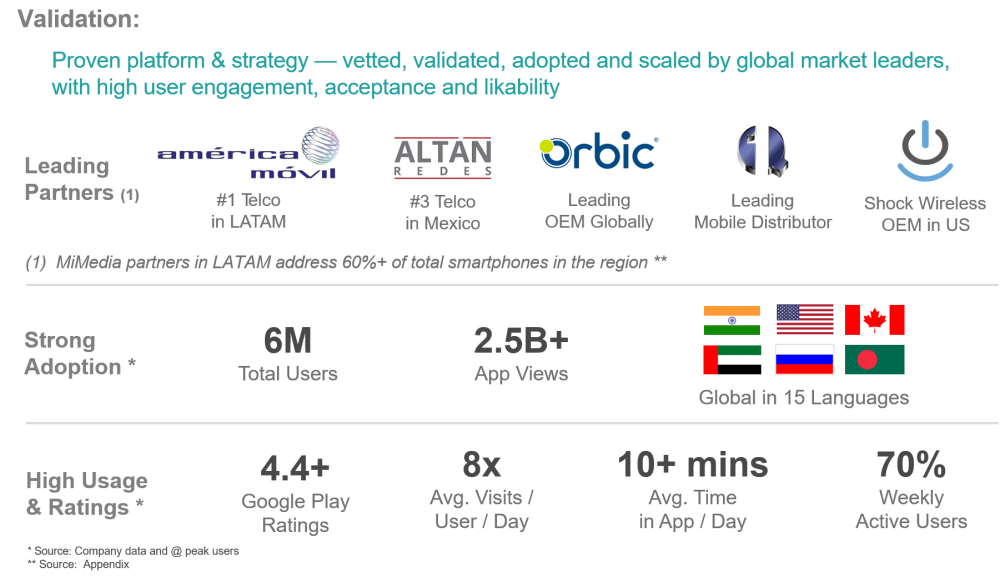

On this page, we see MiMedia's important partners in collaboration with, which the company will drive very rapid growth over the next several years. In addition, this slide shows the strong engagement and user likability metrics that the company has been able to achieve with its dynamic platform of apps.

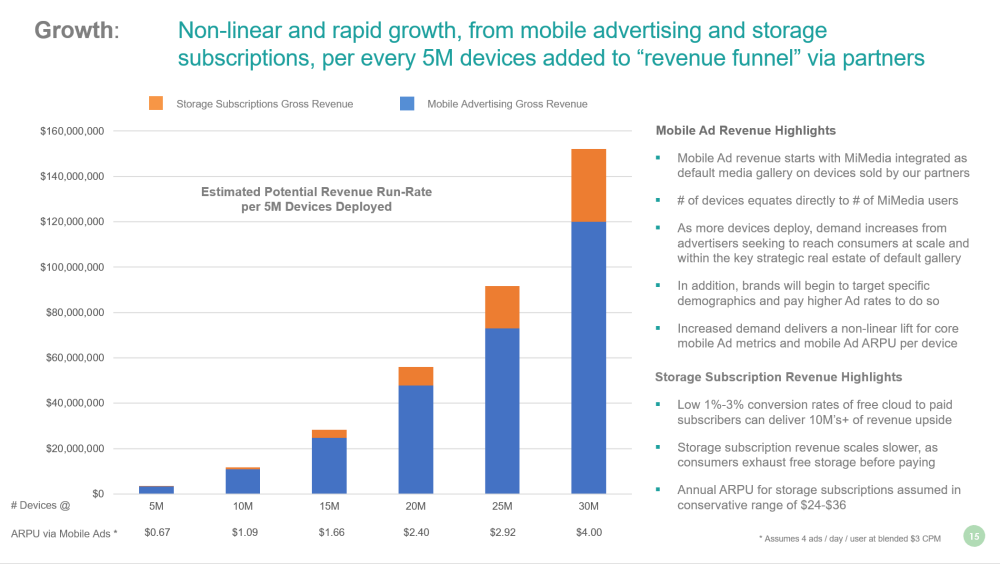

Probably the most impressive page in the deck is this, which shows how revenues and gross profits are poised to take off like a rocket over the next couple of years — and you don't need to be Bernard Baruch to figure out what this will mean for the stock price.

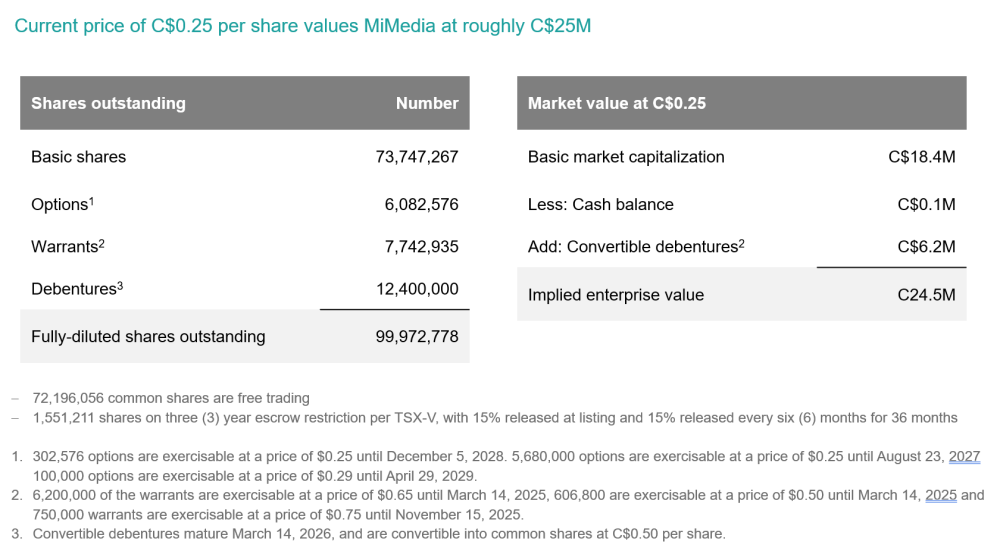

Lastly, the capitalization table shows that there are almost 74 million shares in issue, the majority of which are free trading.

Turning now to the stock charts for MiMedia Holdings, we see that although the stock price has been stuck in a large trading range all this year and has been reacting back in recent weeks, its charts show internal strength, as we will now proceed to see.

Starting with the 30-month chart, which shows all of the action since it came to market in the Spring of 2022, we see that following a dip after it started trading, it ascended in an uptrend that ended with a brief spike early last year.

After that, it became range-bound trading, most of the time between about 25 and 50 cents, with support and resistance levels becoming defined at the levels shown. However, although it has been range-bound since early last year, its volume pattern has become increasingly bullish this year, which has driven its volume indicators higher, especially On-balance Volume, which has been making new highs over the past month or two despite the price still being way off its highs — this is bullish.

We will now look at the action so far this year in more detail on a 6-month chart. On the 6-month chart, the most noticeable and important point to observe is the uptrending Accumulation line, which has even risen to higher levels as the recent heavy reaction got underway and as the price continued to sink over the past six to seven weeks, it has held up very well, as has On-balance Volume which is not shown on this chart, and it is now very close to new highs.

This marked positive divergence by not just one but both volume indicators clearly bodes well and is the direct result of the preponderance of upside volume over the past two months or so, which is clearly visible on this chart. This positive volume action indicates a high probability that the stock will advance from the base that it is now putting in, especially as it is still heavily oversold, having just bounced off an important support level an important point to note is that even if the stock only makes it back up to the top of the trading range, we are talking about it almost doubling from here and it should go on to do much more than that. The dip yesterday and today suggests that it is putting in a small Double Bottom here.

MiMedia is therefore viewed as attractive here and rated an Immediate Strong Buy.

MiMedia Holdings' website.

MiMedia Holdings Inc. (MIMDF:OTC; MIM:TSXV; KH3:FSE) closed for trading at CA$0.215 on August 14, 2024.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- MiMedia Holdings Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,250.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of MiMedia Holdings Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.