I have been following Goliath among other juniors for a few years and even though they have made a very good gold discovery, I have not suggested buying the stock because the junior market has been so bad.

However, I believe this will soon change, and Goliath has been gaining traction but is still well below 2018 $5 highs and 2022 $1.80 high.

The junior explorers, measured by the venture index above, had a nice rally underway since the 2023 bottom. The climb to the top in May around 620 was a +21.5% rally so qualifying as a new bull market.

Sadly, pretty much all the gain was wiped out, first with golds correction from May Comex highs of $2520 down to $2350 in June and then the recent whack in August with the market mayhem with the Yen carry trade unwinding.

It was like a Bam! Bam! Almost a -14% decline, so technically, it's a bull market correction. This is a temporary correction, and as I have said in the past, we need the index to reach 660 to start the ball rolling downhill. As you can see on the chart, volume just started to pick up in April and May from dismal levels of over 2 years.

Goliath Resources

Recent Price - $1.15

52-week range - $0.60 to $1.26

Shares outstanding 119 million

- Management 19%

- Crestcat Capital 18.4%

- Rob McEwen 5.05% and Eric Sprott 3.5%

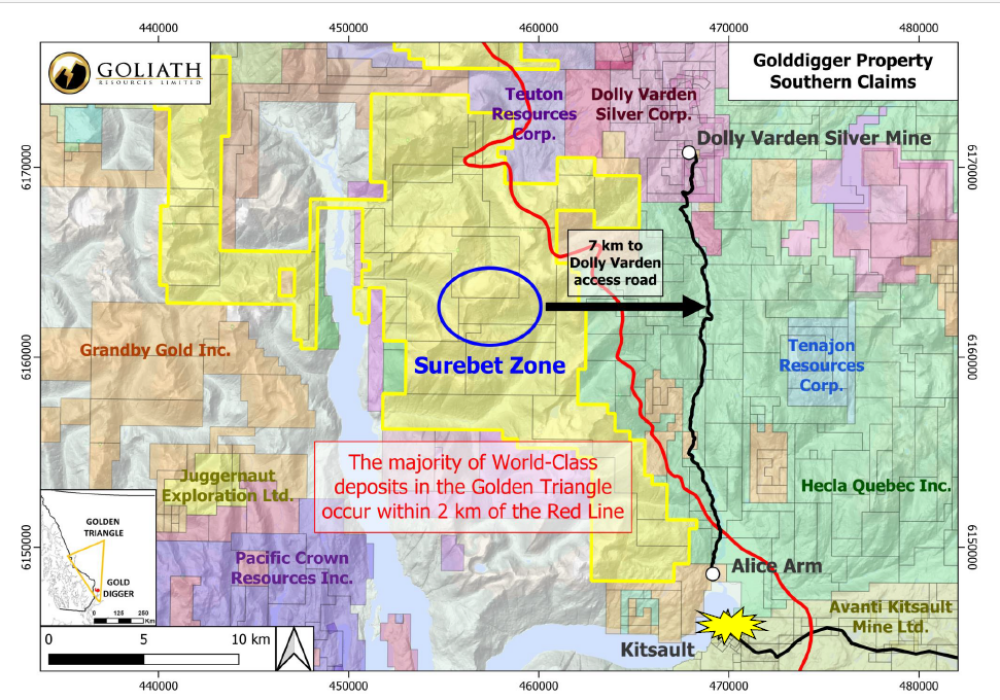

Goliath Resources Ltd. (GOT:TSX.V; GOTRF:OTCQB; B4IF; FSE) has a whose who for shareholders, and that is because they are in the Golden Triangle and are on the cusp of making a second huge discovery.

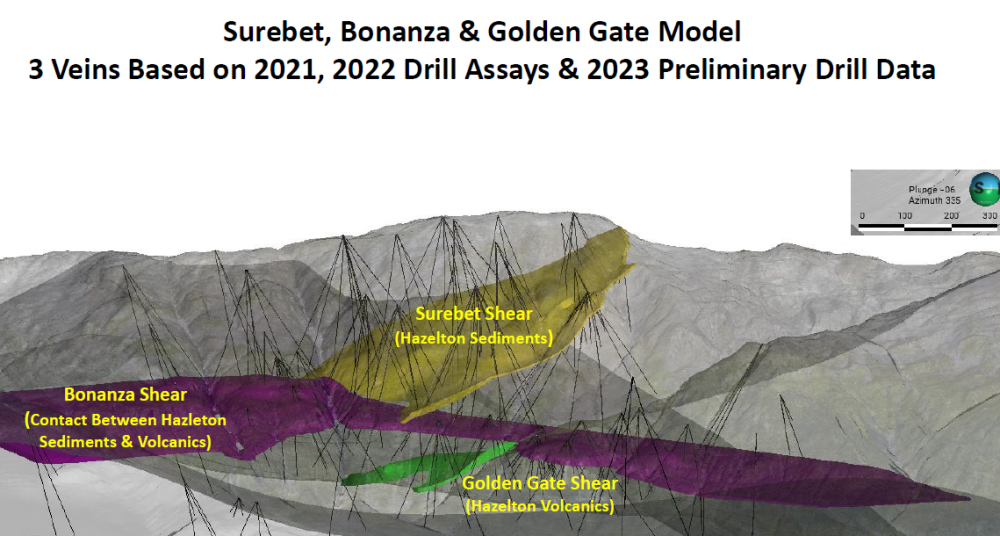

They first discovered the Surebet Zone in 2019, as it outcrops at the surface and made dozens of high-grade intersects with drilling in 2021, 2022, and 2023.

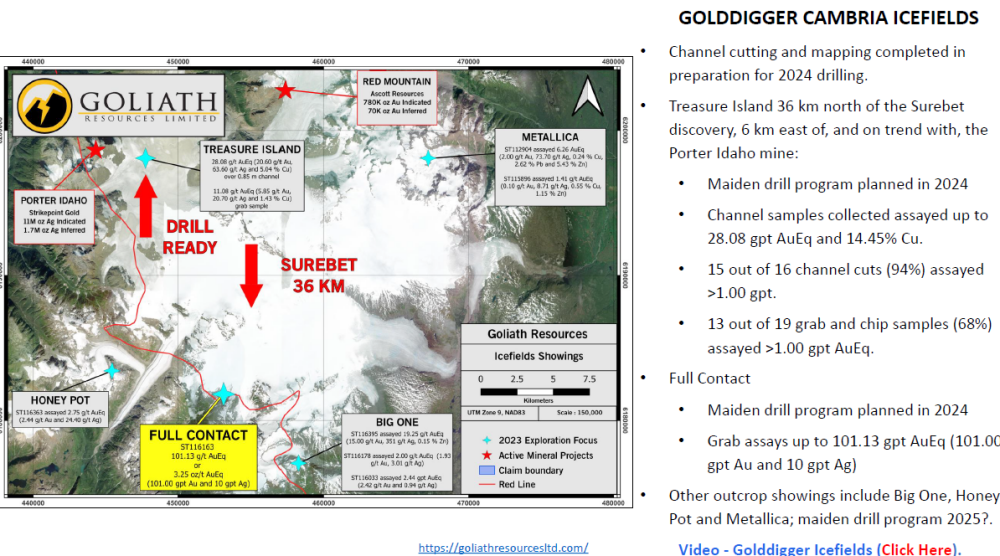

And then, with glacier retreat, they made a second on surface discovery called Treasure Island, located 36 km north of their Surebet discovery. Their Golddigger property is 100% controlled, covering an area of 66,608 hectares (164,592 acres), and is in the world-class geological setting of the Eskay rift, within three kilometers of the Red Line in the Golden Triangle of British Columbia.

This area and proximity have hosted some of Canada's greatest mines, including Eskay Creek, Premier, and Snip.

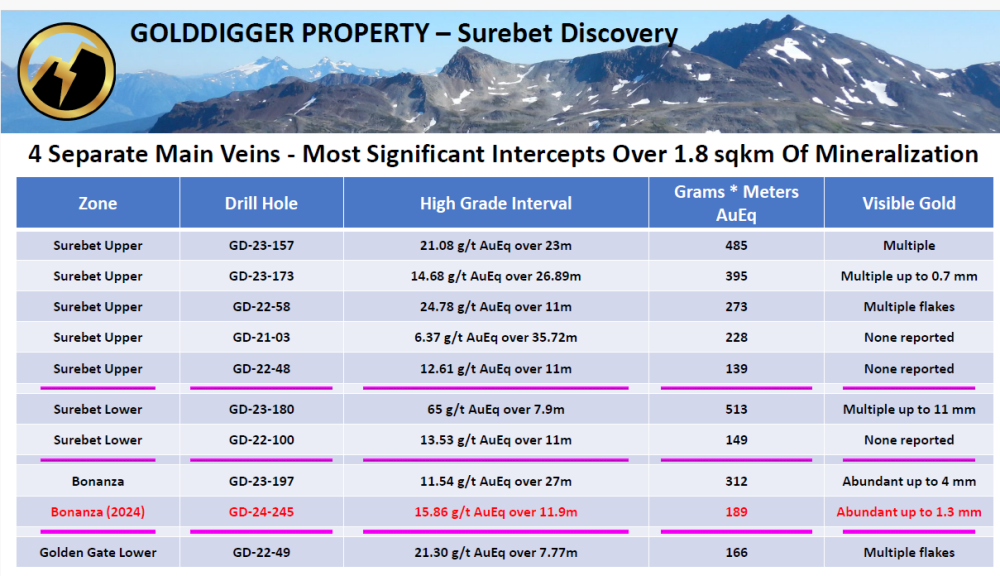

The next graphic shows a number of the high grade hits on four veins. And the hits keep on coming in 2024, with more drill intersects reported on July 30.

Drilling this year has continued with two rigs and a planned 15,000 meters. The first drill holes, high grade intercepts of 2024 were reported July 30.

Drill hole GD-24-235, which intercepted abundant visible gold and high-grade mineralization, returned 35.04 (g/t) gold equivalent (AuEq) or 1.13 ounces per ton (oz/t) (34.16 grams per tonne gold (g/t Au) and 34.15 g/t silver (Ag)) over 6.34 meters (approximate true width) within 15.86 g/t AuEq (15.40 g/t Au and 17.11 g/t Ag) over 11.9 meters. This was drilled into the Bonanza shear zone and the newly discovered Mothership feeder zone.

Hole GD-24-236 (180 degrees of 200 degrees/dip of minus 45, EOH at 351.0 m), collared from GoFor-Gold pad above the main Surebet zone, intercepted high-grade gold mineralization containing 4.14 g/t AuEq (3.02 g/t Au and 63.55 g/t Ag) over 6.0 meters, including 6.79 g/t AuEq (4.96 g/t Au and 78.03 g/t Ag) over 3.04 meters interpreted to be the Surebet Upper zone.

The drill program will focus on testing the potential feeder source at depth below the valley floor, while positioned to also drill through known zones to discover new additional veins/shears, expanding the footprint of the 10 known veins and increasing the continuity of the veins/shears. The Surebet discovery will see the bulk of the meters planned. The balance of the drilling will be used to test two new strongly mineralized gold-copper targets: Jackpot and Treasure Island.

"Goliath Got Gold" is my pun for this baby, and here is some info on management.

Roger Rosmus, MBA Founder, CEO & Director, has over 25 years of investment banking experience in the public and private sector. He has acted as lead on over 30 M&A transactions and, through his previously owned Exempt Market Dealer (EMD) firm, completed many financings. Mr. Rosmus is the Founder & President of Aberdeen Capital Markets Ltd., which provides corporate advice encompassing strategic and operational strategies to private and public companies in multiple sectors. He has owned and operated several businesses in a wide variety of industries. Mr. Rosmus holds an MBA from The University of Western Ontario, Richard Ivey School of Business.

Dr. Quinton Hennigh, Technical Advisor, is an economic geologist with 25 years of exploration experience, mainly gold-related. Early in his career, he explored for major mining firms, including Homestake Mining Company, Newcrest Mining Ltd., and Newmont Mining Corporation. Dr. Hennigh joined the junior mining sector in 2007 and has been involved with a number of Canadian listed gold companies, including Gold Canyon Resources, where he led exploration at the Springpole alkaline gold project near Red Lake Ontario, a 5-million-ounce gold asset that was recently sold. In 2010, Dr. Hennigh helped start Novo Resources and began assembling its Australian exploration portfolio. Dr. Hennigh obtained a Ph.D. in Geology/Geochemistry from the Colorado School of Mines.

Bill Chornobay, Senior Exploration and Corporate Development Consultant, is a businessman with over 30 years experience in negotiations, identifying and acquiring undervalued assets, corporate finance, corporate development, team building, and managing exploration programs in the Americas. He has held board and senior management positions and has been instrumental in raising over $150 million in the resource sector. Mr. Chornobay is a leader, team, and company builder who has provided the overall corporate vision and building blocks that are required to grow successful companies. He has extensive experience in project generation, acquisition, and management of several successful exploration programs, resulting in discovery.

Treasure Island Property

It is like an island popping out of an ice field. There is a nice YouTube video on the 2023 discovery.

The Treasure Island outcropping mineralized target is 36 km north of the Surebet discovery, 6 km to the east of, and on-trend with, the Porter Idaho mine, and 9 km east of Stewart, British Columbia. The target has recently been exposed as a result of glacial abatement and will be drill-tested for the first time during the 2024 field season.

The planned 2024 program at Treasure Island includes 11 holes from 4 drill pad locations with one diamond drill rig for 1,600 meters; additional drill holes will be designed based on mineralized intercepts. The Treasure Island discovery consists of multiple shear-hosted, polymetallic zones covering an area of approximately 550 by 450 meters and is NW-SE trending. The extent of mineralization is currently open in all directions.

Channel samples collected assayed up to 20.60 over 0.85 meters or 28.08 g/t AuEq (20.60 g/t Au, 63.60 g/t Ag and 5.04 % Cu).

Widespread grab and chip samples assayed up to 11.08 g/t AuEq (0.04 g/t Au, 126.00 g/t Ag and 7.15 % Cu); and 8.00 g/t AuEq (5.85g/t Au, 20.70 g/t Ag and 1.43 % Cu).

A noteworthy 13 out of 19 grab and chip samples (68%) were taken on Treasure Island over a wide area assayed >1.00 g/t AuEq. An exceptional 15 out of 16 channel cuts (94%) assayed >1.00 g/t AuEq.

On August 12, they announced four drill holes from Pad 1 at Treasure Island had hit mineralization with assays pending: • TI-24-01, Pad 1: A 9.8-meter interval of mineralization containing quartz stockwork and breccia hosting massive chalcopyrite (up to 8%) and pyrite (up to 10%); the zone remains open, and assays are pending:

- TI-24-02, Pad 1: The 2.74-meter interval of mineralization contains quartz-carbonate breccia, consisting of blebs of pyrite (2%) and trace chalcopyrite (<1%); the zone remains open; assays are pending

- TI-24-03, Pad 1: The 1.77-meter interval of mineralization contains quartz-carbonate breccia with small blebs to semi-massive pyrite (1%) and minor chalcopyrite (<1%); the zone remains open; assays are pending

- TI-24-04, Pad 1: The 5.46-meter interval of mineralization contains stockwork, quartz breccia hosting semi-massive to massive pyrite (2%) and trace chalcopyrite (<1%), together with subordinate malachite, the zone remains open; assays are pending

Roger Rosmus, Founder and CEO of Goliath Resources, stated, "While most of our drilling is focused on the Surebet gold discovery, part of our plans include regional exploration on other areas of our Golddigger Project (66,608 hectares in size) which was until recently covered by glaciers and permanent snowpack. Our maiden drilling at our Treasure Island target is off to a great start and showing signs that it could be a second important discovery. Our team of geologists and drillers are doing a fantastic job completing drill holes and we are delighted with our early results and look forward to an expanded drill campaign."

Financial

The last Statements on March 31 show $4.6 million in cash and no long-term debt.

Since then, they brought in $1.8 million from the exercise of warrants, mostly from strategic investors. On August 9, they announced a $3 million financing at $1.11 per share and flow-through shares at $1.28 with Crestcat Capital as the lead order.

They will have ample funding for this year's exploration programs.

Conclusion

Goliath has made a major discovery and has been announcing very good drill results in the past two years, but it has been falling on deaf ears, a very weak junior market.

The company has strong financial support and is in Elephant Country for high-grade gold/silver deposits. They already have a major discovery with about 60,000 meters of drilling in almost 200 drill holes. Goliath had a nice slide in their presentation, a comparison with two other high-grade discoveries in Canada, Great Bear (we did very well with) and Newfound Gold (we own). Both these companies made their discovery in better markets in 2019 and 2020, where they hit around 60,000 meters of drilling. Both had a valuation about 3 times better than Goliath has now at about the same stage of discovery.

Since that comparison, Goliath has moved up some in the past month from $117M market cap to $136M but still a long way to catch up. Here is that slide.

The chart is interesting and at an important cross road. It is in a nice up trend (blue lines) but is now in a resistance area. If the stock could break above $1.35 it could start moving quickly. Meanwhile, the pullback and consolidation provide a good entry point.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.