A cornerstone of Canada's role as the fifth-largest gold producer in the world continues to be the Red Lake camp in northwestern Ontario.

Gold was first discovered 1897, but the area's remoteness prevented exploration until about 20 years later. Since large-scale mining began in 1938, more than 26 million ounces gold (Moz Au) have been produced from underground mines there. The area enjoys excellent access to infrastructure, including a highway as well as gas and power lines, according to Ian Burron, writing for Geology for Investors.

According to DigiGeoData, in the last 12 months, 3,627 claims were staked in the area. You can view an interactive map of this area here.

"The area is known for exceptionally high-grade Au, with one famous sample, the Campbell Mine Whopper, containing 431 ounces in a football-sized rock," Burron wrote. "Red Lake is also known for challenging geology, giving mines in the area a checkered history of spectacular success and stunning failure."

Nearly a century later, "the last few years have seen the tide once again turn in Red Lake's favor," Burron wrote.

Major Evolution Mining has made big investments in the Red Lake, he wrote. Renewed exploration efforts have increased its resources to 2.9 Moz at 6.9 grams per tonne (g/t), with a further 5.7 Moz at 7.7 g/t indicated and 5.3 Moz at 6.49 g/t inferred.

"Mine life is now estimated to be at least 12 years, and efforts are underway to greatly increase production while also reducing costs," Burron noted. "Evolution also acquired the Bateman Project from the former Rubicon in 2021 and plans to put the now properly evaluated and redeveloped project into production in the near future."

The area can be compared to Nevada in the United States, which calls itself the "Silver State" after the discovery of the Comstock Lode in the 19th century, but is now one of the largest sources of gold in the world and continues to see new development and discoveries.

"Red Lake is the next Nevada," said Nav Dhaliwal, president, chief executive officer, and director of Renegade Gold, which has its flagship Newman Todd deposit in the camp.

In 2018, Nevada produced 5.6 million troy ounces of the yellow metal, representing 5% of the world's production.

Throughout the state, prospectors are searching for the next big discovery, Engineering and Mining Journal reported in May.

"Nevada remains under-explored," said Dr. Simon Jowitt, Director for the Ralph J. Roberts Center for Research in Economic Geology for the Nevada Bureau of Mines and Geology, told the publication. "We have had a lot of success with Carlin-type and epithermal gold, silver, and lithium, but there's opportunities in all sorts of other areas, base metals, for example, and in both greenfield and brownfield environments."

Miners are also seeing new opportunities in Red Lake, known as the "Jewelry Box of Canada," as well.

"Perhaps the most exciting recent development is the Dixie Project," wrote Burron with Geology for Investors. "No official resource estimate is yet available for the project, but Kinross, which recently acquired it from Great Bear Resources, believes it contains at least 8.5 Moz of near-surface high-grade Au."

"Red Lake is the next Nevada," said Nav Dhaliwal, president, chief executive officer, and director of Renegade Gold, which has its flagship Newman Todd deposit in the camp.

'Bull Case for Gold Remains Intact'

Gold hit its highest price ever of US$2,483.35 last month, and some believe it is already in a bull market. Bloomberg Senior Commodity Strategist Mike McGlone has predicted that it will only be "a matter of time" before gold hits US$3,000.

After consolidating in the US$2,300s for much of the rest of July, it rose to US$2,446.11 on July 31 and was at US$2,407.22 on Monday.

But why is the yellow metal a great investment?

"Gold is an asset that many like to own for inflation protection," Fortune's Kimberlee Leonard wrote on August 5. "Rising prices tend to erode the purchasing power of a currency like the U.S. dollar while gold generally increases in value over the long term."

Also having a major effect this year is the increasing role of central banks in buying the metal. The World Gold Council's 2024 Central Banks Gold Reserves Survey showed four in five respondents expected reserve managers to increase their gold holdings in the next year, the website reported, according to a report by Stockhead on June 18.

Seventy central banks were polled by the Council. Nearly 30% said they are planning to add to their own gold reserves this year and 57% said gold will account for a higher proportion of global reserves within five years.

According to analysts at J.P. Morgan, the "bull case for gold remains intact."

"Gold's resurgence has come earlier than expected, as it further decouples from real yields," said Gregory Shearer, head of base and precious metals strategy at J.P. Morgan.

"We have been structurally bullish (on) gold since the fourth quarter of 2022, and with gold prices surging past US$2,400 in April, the rally has come earlier and has been much sharper than expected. It has been especially surprising given that it has coincided with Fed rate cuts being priced out and U.S. real yields moving higher due to stronger labor and inflation data in the U.S."

Evolution Mining Ltd.

Just four years ago, Australian miner Evolution Mining Ltd. (EVN:ASX; CAHPF:OTCMKTS), a major with an AU$7.8 billion market cap, bought the original Red Lake mine from Newmont for just CA$375 million.

On its website, the company said, "An operational plan is underway to restore Red Lake to a premier Canadian gold mine with a 15-plus-year mine life targeting 200,000 ounces per annum and expansion once justified."

However, the company has hit some hurdles. Production has repeatedly fallen short of expectations at the historic mine, "most recently due to materials handling constraints," Executive Chair Jake Klein told The Wall Street Journal earlier this year.

"I still believe in the future of Red Lake, but it's a different future to what we envisaged when we acquired it," Klein said.

Evolution said in FY24, Red Lake is guided to deliver 125,000-135,000 ounces Au, with production stronger in the second half of the year. Red Lake's priority is to consistently deliver 1.1 million tonnes of ore a year to fill the current mill capacity and deliver increased cash generation.

The company has 1.99 billion shares outstanding, 1.96 billion of them free-float traded shares. According to Reuters, about 1% is held by insiders and management, 1% by strategic entities, and 61% by institutions. The rest is retail.

Top shareholders include AustralianSuper with 14%, Van Eck Associates Corp. with 9.11%, The Vanguard Group Inc. with 4.6%, FIL Investment Management with 3.89%, and State Street Global Advisors with 3.77%.

It trades in a 52-week range of AU$2.83 and AU$4.31.

Kinross Gold Corp.

Another major finding success in the Red Lake camp is Kinross Gold Corp. (K:TSX; KGC:NYSE), which recently acquired Great Bear from Great Bear Resources Ltd., releasing an initial resource estimate for the project last year of 2.737 Moz of indicated resources with 33.1 million tonnes grading 2.57 g/t Au and 2.290 Moz of inferred resources.

"The world-class project is a centerpiece of the company's development portfolio and has excellent potential to become a top-tier deposit that could support a large, long-life mine complex and bolster Kinross' long-term production outlook," the company said on its website. "Kinross' drilling and exploration focus for 2024 is to expand the mineralized zones, … define deep mineralization, continue exploration along strike, and identify new targets around the property."

According to a report by the Globe and Mail last month, National Bank Financial analyst Mike Parkin reaffirmed his Outperform rating for the stock, giving his share target a US$2.25 boost to US$16. On average, analysts target the shares at US$13.66, Stockwatch reported.

The company is National Bank's top pick among senior producers.

"Kinross maintains significant opportunities for growth within its North American portfolio, which will help improve its geopolitical risk profile. This includes the Great Bear project," Parkin wrote.

About 0.35% of Kinross is owned by insiders and management, about 66.03% is with institutions, and the rest is retail, according to Reuters.

Major shareholders include Van Eck Associates Corp. with 9.86%, The Vanguard Group Inc. with 3.66%, Norges Bank Investment Management with 3.57%, BlackRock Investment Management with 3.5%, and Renaissance Technologies LLC with 2.35%.

Kinross has a market cap of US$10.29 billion with 1.2 million shares outstanding. It trades in a 52-week range of US$9.45 and US$4.32.

West Red Lake Gold Mines Inc.

However, Red Lake is not solely comprised of majors. One company making "significant strides" in the district is West Red Lake Gold Mines Inc. (WRLG:TSXV; WRLGF:OTCQB), wrote John Newell of RSD Discovery Group.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Inc. (WRLG:TSXV;WRLGF:OTCQB)

"With gold trading at record highs, the company is gearing up for near-term high-grade gold production, likely starting in mid-2025, driven by a relentless pursuit of increasing resources and leveraging strategic acquisitions," Newell wrote.

The expert said West Red Lake Gold has undergone a "substantial transformation," spearheaded by new leadership and backed by legendary mining investor Frank Giustra, with support from institutions like Sprott Lending, Van Eck Funds, and Accilent Capital Management.

"A critical component of this transformation was the acquisition of the failed Madsen Mine from Pure Gold for a fraction of its sunk costs," Newell noted. "This strategic move was driven by a clear understanding of past operational shortcomings and a vision to revitalize the mine for profitable production.

Earlier last month, the company announced promising drill results from its 100%-owned Madsen Mine. The latest drilling campaign, conducted in the North Austin Zone, has identified significant high-grade gold mineralization, including intersections of 13.4 g/t Au over 10 meters and 12.21 g/t Au over 3 meters. These results are part of an ongoing effort to expand the North Austin Zone, which represents a new area of high-grade mineralization extending the current Madsen resource to the northeast. The North Austin Zone remains open down-plunge and along strike, indicating further potential for resource growth.

The drill results build on the positive outcomes previously reported in May and February of this year, reinforcing the quality of the resource area. The North Austin Zone, situated adjacent to existing underground development, could potentially be developed early during future mine restart and production phases.

Shane Williams, president and CEO, stated, "The North Austin drilling continues to deliver meaningful results, which is a testament not only to the quality of this resource area but also to our technical team's understanding of the structural controls and ore shoot geometries in this emerging part of the Madsen deposit."

According to Reuters, 2.36% of the company is held by management and insiders.

Advisor Frank Giustra owns 9% as a strategic investor and insider, and Sestini & Co. Pension Trustees Ltd. owns 1.58%.

26.06% is with institutions. Sprott Resource Lending Co. has 18.58%, Van Eck Associates Corp. has 4.46%, and Accilent Capital Management Inc. has 2.94%.

The company's market cap is CA$172.77 million. The 52-week range for the stock is CA$0.42 to CA$1.04.

Renegade Gold Inc.

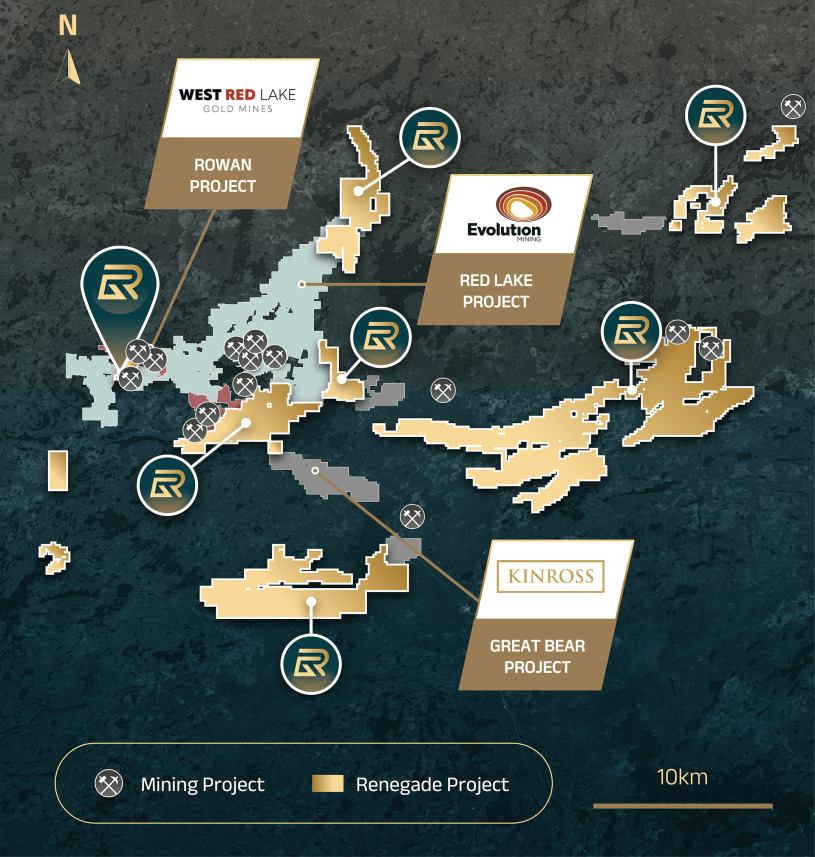

Renegade Gold Inc. (RAGE; TSX: TGLDF; OTC: 070:FSE) is on a journey to become an exploration leader to help revitalize the historic and gold-rich camp. The company holds the largest land holdings in the district and employs advanced exploration techniques.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Renegade Gold Inc. (RAGE; TSX: TGLDF; OTC: 070:FSE)

"The company's advanced Newman Todd Deposit has shown high-grade gold mineralization extending to over 750 meters," Newell wrote on June 26. "Led by experienced industry veterans Dale Ginn and Nav Dhaliwal, Renegade is well-positioned for significant growth."

"The company's exploration strategy includes drilling programs that, while initially concentrating on the upper 300 meters, have been so promising to warrant deeper exploratory efforts in the next phases," Vice President of Corporate Development Paris Sahi said. "Renegade's drilling contractor of choice is Corexplore Drilling Services, and they are using Clean-Tech Advanced Technology drilling systems to test the Newman Todd high-grade gold bearing system to depths of about 1,000 meters."

The company's properties span over 1,260 square kilometers and are strategically positioned over major regional gold-bearing structures, signaling potential that could not only enhance Renegade's valuation but also attract merger interests from neighboring entities, especially if the forthcoming deeper drilling campaigns yield success.

"The sum of Renegade Gold's assets, from its vast land position and high-grade Newman Todd Deposit to the over numerous grassroots targets across the Red Lake District, may indeed prove to be greater than the whole, positioning it as a formidable player in Ontario's gold exploration scene," Sahi said.

Renegade also announced that it recently completed a non-brokered private placement of CA$0.40 per listed share for gross proceeds of CA$3 million.

Technical Analyst Clive Maund wrote on June 20 that the company "has one of the largest land packages of highly prospective gold and critical mineral-bearing properties in the Red Lake district of Ontario, Canada."*

Upcoming catalysts for the company include results from its 25,000-meter drilling campaign at Newman Todd to generate and advance targets, the company said.

According to Reuters, about 15% of the company is owned by management and insiders and about 1% by institutions. The rest, 84%, is retail.

Top shareholders include James Starr with 14.67%, Sprott Asset Management LP with 1%, Executive Chairman Dale Ginn with 0.13%, Dhaliwal with 0.12%, and Director David Velisek with 0.07%, Reuters said.

It has 45.3 million shares outstanding with a market cap of CA$9.3 million. It trades in a 52-week range of CA$0.72 and CA$0.21.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Renegade Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Renegade Gold Inc. and West Red Lake Gold Mines Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on June 20, 2024

- For the quoted article (published on May 28, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.