Another wild trading day will have large volatility in so many markets.

Maybe there is a recession coming, but it doesn't seem that way. Maybe there is WWIII, please Israel and Iran, along with Lebanon, possibly engaging.

The Yen carry has dominated commentary, but it has been after the event. The Yen broke a 50-year uptrend a few years ago and seems to be heading much lower still.

All the attributes of a depreciating currency are there :- debt, rising interest rates, budget deficits, etc.

The rally in the Yen has probably peaked, certainly, for now.

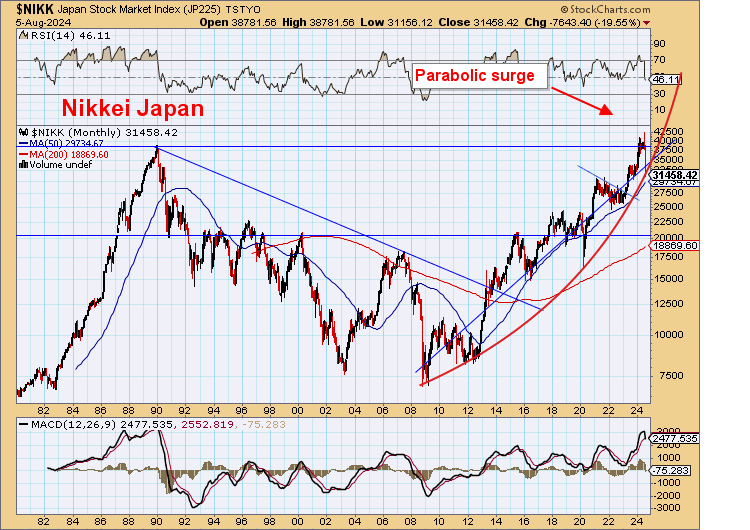

The Nikkei may still be in this parabola.

And the absurdity of 10-year bonds falling to 0.75%.

Just a back test, before going much higher.

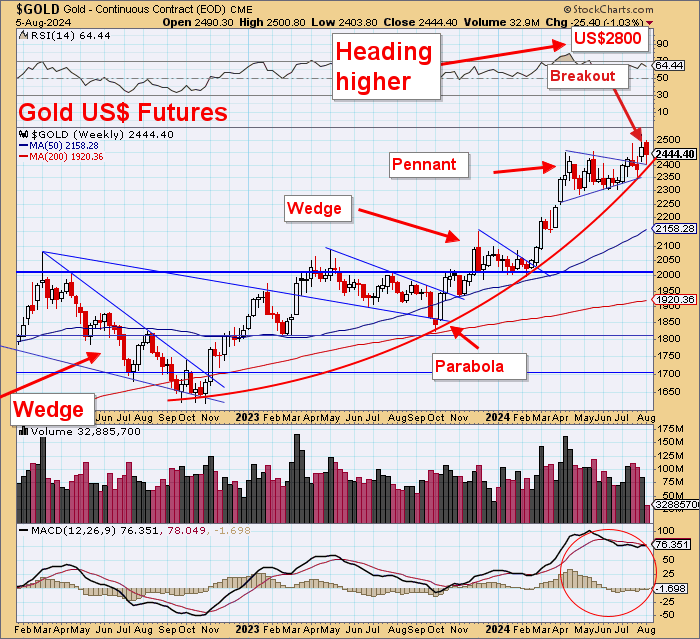

Gold

Wave count intact.

The parabola looks strong.

Gold Stocks

Island reversal here?

Pretty obvious here.

Intraday looks like an island reversal and a hammer.

Bonds

Sharp fall in yields. Targets reached.

Ready to bounce higher.

Bond prices need a breather too.

Currencies

There is some evidence for the US$DXY to weaken further into a cycle low over the next month.

But still in a bull market.

The Yen and Swiss Franc seem to have finished their run-ups, but there is time for the Euro with 57% of the DXY, to amble higher to about 112, then head down again.

This just doesn't look like a bull market here but it is now likely to head up to 112.

Stocks

S&P 500:

Normal sharp pullback.

Market sentiment is not right for this long-term bull to end in just a whimper.

And the bears came out in extraordinary force over the weekend.

Small caps still look robust.

Bitcoin

Horrendous market action. A short-term rally is coming.

Then lower it would appear.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.