The big drop in the stock market late last week, specifically on Thursday and Friday, came as a shock to some investors, and the question arises whether this sharp drop marks the start of a crash or whether it is instead a buying opportunity.

To determine the answer to this question, all we have to understand is that the stock market is no longer interested in the economy — if it was it would already be much lower than it currently is — all the market cares about is that the Fed continues to create vast quantities of new money to throw at propping up both the bond market and the stock market, and that it is clearly doing.

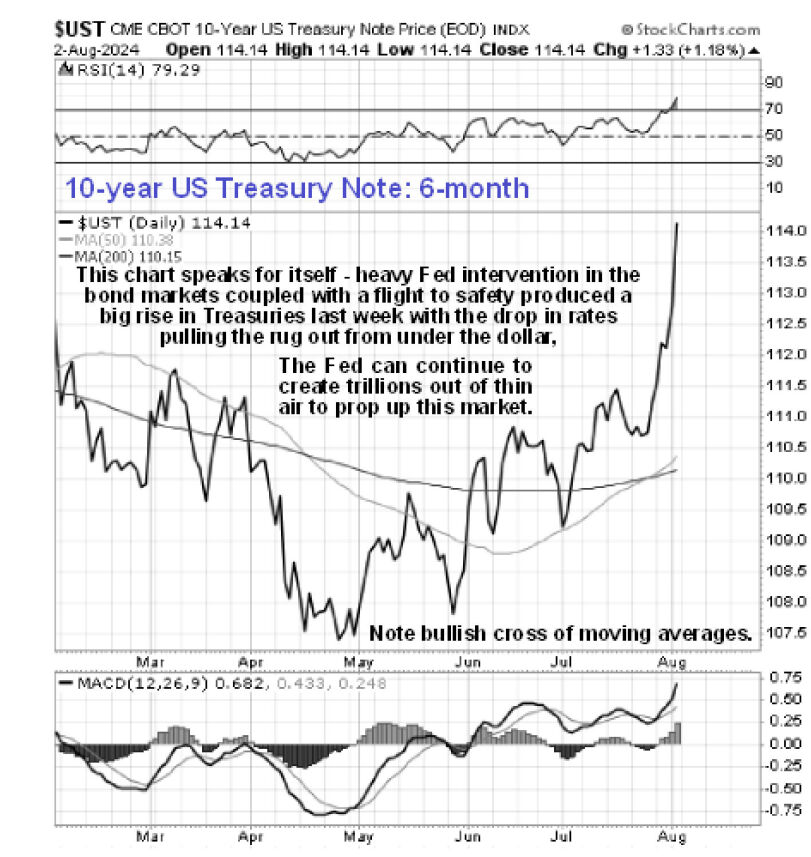

Just take a look at the big gains in Treasuries late last week on the 6-month chart for the U.S. 10-year Treasury Note — it surged thanks to big buying which clearly emanated from the Fed.

The big rise in Treasuries also meant a concomitant big drop in yields and on the following chart we see that the 10-year Treasury Yield dropped a stunning 0.4% in a week which, given the magnitude of this market, is huge.

The drop in yields, of course, makes the U.S. dollar less attractive, and so the dollar plunged on Friday.

The big drop in the dollar index last week was a serious development as it broke it below the giant Dome boundary that we had earlier delineated, which is shown on the 3-year chart for the dollar index below, opening up the risk of a really severe downleg.

Fundamentally, this will be due to the Asian trading bloc and the global south increasingly moving away from the dollar.

Gold, which is shown at the top of the dollar index chart, attained new highs last week and only dipped a little on Friday.

Two central planks of Fed policy are to prop up the bond market and the stock market as this maintains the current system and drives wealth up to the top of the pyramid, and as foreign buying of Treasuries has shriveled and looks set to continue contracting, it means they will have to continue monetizing Treasuries at an ever-increasing rate and will have to create more trillions of dollars out of thin air to accomplish this which is of course hugely inflationary.

Inflation will, therefore, continue to ramp up as the Fed continues to intervene to prop up both the debt market and the stock market at public expense — the ordinary citizen will shoulder the burden of all this as the purchasing power of money continues to evaporate.

The answer to the question posed at the outset, then, is that the stock market is likely to remain in a bull market that will very possibly continue to accelerate, so shakeouts such as we saw last week are viewed as opportunities to selectively buy. Note that, as shown on the 6-month chart for the S&P500 index above, it could first continue lower short-term to the oval target zone depicted.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.