The unit price of the world's largest cryptocurrency by market cap, Bitcoin (BTC), approached the $70,000 threshold for the first time in nearly two months on Monday morning, following a weekend like no other for digital assets in the realm of American politics. In particular, two of the leading three candidates for U.S. President, the Republican nominee, and former President Donald Trump, as well as independent candidate Robert F. Kennedy Jr., each addressed the world's largest annual Bitcoin conference in Nashville, TN. The latest polling averages calculated by RealClearPolling suggest that these two candidates control a cumulative majority of about 50.1% support among potential voters (44.3% for Trump and 5.8% for Kennedy) in a nationwide five-way race that includes third-party bids for the White House.

As MRP has previously noted, 2024 marks the first time that Bitcoin (and the regulation of cryptocurrencies more generally) has become a meaningful issue in the most crucial political election in the world. A large portion of this sudden recognition by politicians is related to dollars and cents. With Bitcoin rallying to all-time highs above $73,000 earlier this year, many American crypto investors and enterprises have been juiced with capital and have a vested interest in protecting their assets from uncertain regulatory prospects that have dogged the industry for years. Per Reuters, crypto super PACs Fairshake, Defend American Jobs, and Protect Progress have so far raised more than $110 million this election cycle, according to Federal Election Commission (FEC) records.

Trump initiated his pro-crypto offensive earlier this year, likely part of an effort to begin peeling away swing voters that remain undecided (or in support of a third-party candidate like Kennedy), as well as heavily moneyed crypto industry donors. Trump has become the first major party candidate to accept Bitcoin and crypto donations while courting potential digital asset donors in closed-door meetings with Bitcoin mining executives and experts.

Over the weekend, he held a fundraising event alongside the Bitcoin 2024 conference where seats were going for as much as $844,600, and photos with the former President will be charged at $60,000 apiece. This is largely standard practice in regard to political fundraising with megadonors, but it has rarely if ever, been done in pursuit of crypto cash before. Direct contributions to the Trump campaign in the form of crypto totaled just $3 million in the second quarter, less than 1% of the titanic $331 million haul the campaign pulled in throughout that period, but that likely understates the true impact of crypto's impact as the campaign only began accepting crypto donations halfway through the quarter in mid-May, and many donors who make their money in digital currency are likely still contributing in the form of dollars.

In their speeches at the Bitcoin conference, both Trump and Kennedy rattled off a bevy of promises to the Bitcoiners in attendance. The most prominent proposal within both speeches was the establishment of a strategic federal stockpile of Bitcoin, established by the transfer of approximately 213,000 BTC ($14.8 billion) held by the Department of Justice — acquired as part of various investigations into financial crimes — to the Treasury Department. Trump stopped there, but Kennedy promised a more bombastic policy, wherein he would sign an executive order directing the Treasury to begin purchases of 550 BTC per day (122% of the 450 BTC that is mined on a daily basis currently) until the U.S. was in possession of 4 million BTC.

That is equivalent to nearly $277.5 billion at this morning's valuation, but the cost would likely be significantly steeper if such a policy was realized in the United States. This figure was meant to "give us about the same proportion of total Bitcoin as our nation holds of global gold reserves," according to Kennedy, who referred to such a plan as forming a "Bitcoin Fort Knox."

After Trump's speech had concluded, Senator Cynthia Lummis (R-WY) took the stage to debut draft legislation that would make the strategic Bitcoin reserve a reality. Along with the establishment of the stockpile, it provides for the appropriation of Treasury assets and excess reserves at the 12 Federal Reserve banks to accumulate a sum of 1 million BTC over a period of five years. The acquired BTC would be held for a minimum of twenty years unless proceeds from a sale would be utilized to pay down the U.S.'s outstanding federal debt. Lummis plans to formally introduce the bill in the Senate in the coming days, with cosponsors to be announced.

Passage of such a bill in Congress would be necessary to put any prospect of a strategic Bitcoin reserve policy on the President's desk. A strong performance by Trump in the general election could have a positive impact on the performance of fellow Republicans in down-ballot races that decide the balance of power in Congress.

Though pro-crypto sentiments among U.S. legislators generally skew to the right side of the aisle, bipartisan support for the adoption of digital assets in the U.S. has been on the rise recently. MRP noted earlier this year that Congress is already filled with pro-Bitcoin voices in both major parties, with high-profile legislators and former Presidential candidates like Senators Kirsten Gillibrand (D-NY) and Ted Cruz (R-TX) receiving "A" ratings from the Stand With Crypto Alliance — a Coinbase-affiliated nonprofit that now boasts 440,000 members and an associated Political Action Committee (PAC). This pro-crypto dynamic recently played out in both the House of Representatives and the Senate, wherein an explicit attempt to undo the Security and Exchange Commission's (SEC) Staff Accounting Bulletin No. 121 (SAB 121) via Congressional Review Act (CRA) received the support of bipartisan majorities. This rule requires that a firm that custodies a customer's cryptocurrencies should record them on its own balance sheet — a very unorthodox accounting treatment that could have major capital implications for banks trying to work with crypto clients.

Despite the heavy Congressional backing, President Joe Biden ended up vetoing the CRA in a vote of solidarity with the SEC. That reinforced a relatively crypto-skeptic bend within the Biden White House. At times, the administration has been openly hostile toward Bitcoin mining, repeatedly proposing the implementation of a Digital Asset Mining Energy (DAME) excise tax equal to 30% of the cost of the electricity miners utilize for operations. The tax would be implemented based on faulty perceptions that Bitcoin mining causes disproportionate damage to the environment, steals electricity away from other more productive uses, and puts undue strain on already stretched electric grids. MRP has countered both of these narratives in the past, proposing that not only do Bitcoin miners utilize a much more sustainable power mix than any country in the world, but miners also seek out cheap (especially excess) electricity in areas with relatively underutilized resources, thereby incentivizing more investment and into those local grids by utilities.

Moreover, the SEC under Biden may have irreparably damaged his White House's reputation with pro-crypto voters and industry executives. We have analyzed the SEC's "regulation by enforcement" approach throughout the past several years, which has attempted to aggressively crack down on digital asset enterprises that have been widely labeled as issuers of unregistered securities, but this has yielded mixed results. Though the commission has managed to secure a spate of settlements with some token issuers and exchanges, several high-profile cases that have made it to court have not gone the regulator's way over the past year. Resentment toward the SEC has been specifically aimed at Chairman Gary Gensler, who has affirmed Bitcoin's status as a commodity but has taken a much more stringent line with other digital assets. In courting the votes of those spurned by the SEC's litigious attitude toward crypto, Trump has promised to fire Gensler. His Vice Presidential pick, Senator J.D. Vance (R-OH), has gone so far as to label Gensler the "worst person" in terms of substantive disagreements with the new VP candidate on regulation, further describing Gensler as the "complete opposite" of himself.

The President does have lone authority in nominating a Chairman for the SEC, but it is up in the air whether Trump would maintain power to potentially fire Gensler if he were to win a second term. Andrew Vollmer, a senior affiliated scholar at George Mason University, has argued that while the Constitution does not expressly give the president the power to fire, it does not expressly restrict it either.

A 2010 Supreme Court decision ruled that commissioners could not be removed by the president except for certain circumstances, qualifying as "standard of inefficiency, neglect of duty, or malfeasance." It is more likely that Gensler, who was appointed by Biden and confirmed by the Senate in April 2021, could resign if the President were to be beaten in November (particularly if Trump were to request his resignation) or serve out the rest of his five-year term through June 2026. Trump's previous SEC Chair, Jay Clayton, has a somewhat mixed record in regard to crypto, launching an ill-fated lawsuit against Ripple Labs that saw the SEC's case largely dismantled in federal court, and the former President himself has only recently become a crypto believer, arguing in the past that Bitcoin was a "scam against the dollar." That raises questions about just how far Trump would truly go in enacting a more hands-off approach to digital assets throughout a potential second term.

The reality is, however, Biden and the presumptive Democratic nominee for November's Presidential Election, Vice President Kamala Harris, will struggle to overcome the legacy of stiff regulatory scrutiny targeting the digital asset industry, as well as resiliently strong anti-crypto commentary from fellow Democrats like Elizabeth Warren (D-MA). But that doesn't mean they won't try. Last week, the Financial Times reported that Harris's advisers had approached top crypto companies to "reset" relations between the emerging industry and the Democratic party.

Sources suggested that contacted companies included leading U.S. exchange Coinbase, USDC stablecoin issuer Circle, and the aforementioned Ripple Labs. It remains to be seen whether this newfound diplomacy will bear fruit, but some voters and industry mainstays are likely to remain skeptical. Cameron and Tyler Winklevoss, co-founders of American cryptocurrency exchange and custodian bank Gemini Trust Company, have accused this supposed détente of being a "big bluff" after four years of "war on crypto." The Winklevoss brothers have recently become outspoken Trump donors, contributing a combined $8.75 million to a new super PAC backing the former President's ongoing campaign.

It is not a surprise to us that competition for crypto cash and the crypto vote is now occurring. Counter to the prevalent doom and gloom narrative, insisting that Bitcoin would be regulated harshly in the U.S. or even pushed into irrelevancy by agency and legislative crackdowns, MRP has posited for years that BTC would be more likely to eventually carry great leverage in democratic states. Political power in the U.S. is derived from the voters in an election and, in the succinct words of Microstrategy CEO Michael Saylor, "You're not going to win any votes by opposing Bitcoin."

Pro-crypto voters may not have been a major constituency in past Presidential elections, but the country has changed tremendously since the last race for the White House in 2020. Data from multiple different sources, including NYDIG and Unchained, collected throughout various periods of 2021-2023, has shown that roughly 20% - 25% of American adults/investors owned Bitcoin within that time frame. These figures are likely to rise in months and years to come, as the advent of exchange-traded funds (ETFs) backed by Bitcoin and other digital assets has dramatically increased the ease of accessibility to crypto exposure. In a February 2022 Intelligence Briefing, we wrote: "It only makes sense that democratically elected politicians will continually become more crypto-friendly when nearly one of every four potential voters is personally invested in Bitcoin," and this dynamic may now be playing out before the American public.

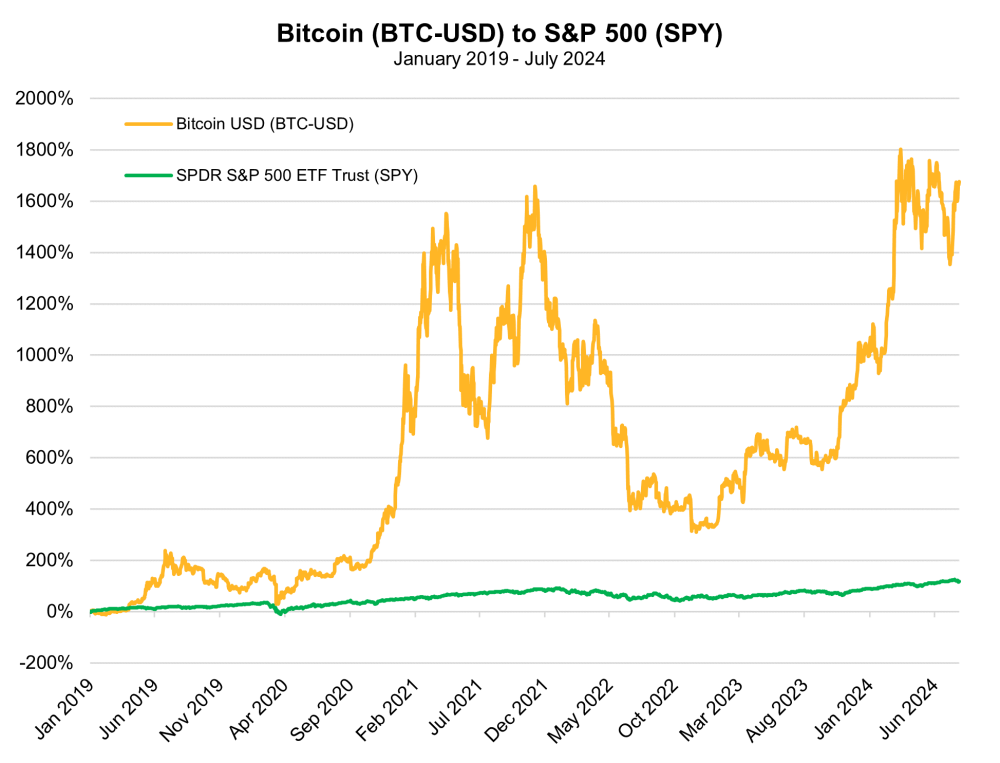

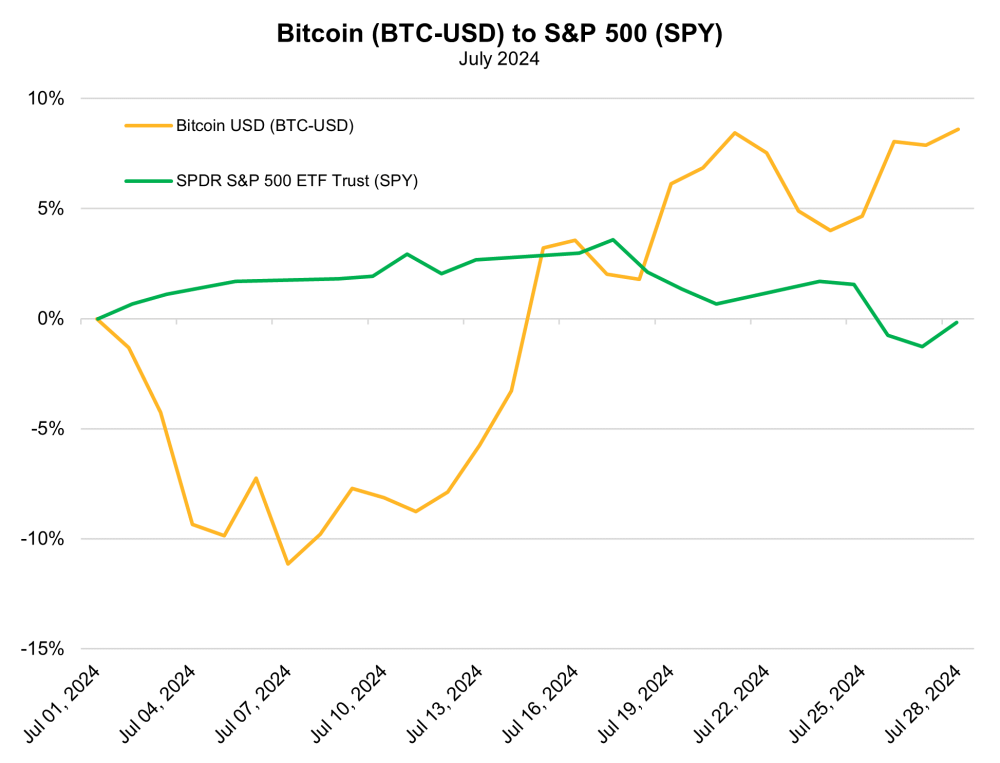

Charts

| Want to be the first to know about interesting Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.