Sienna Resources Inc. (SIE.V:TSXV; SNNAF:OTC; A1XCQ0:SWB) has significantly expanded its holdings in the Stonesthrow Gold Project in Saskatchewan. The company now controls approximately 18,350 contiguous acres of land, which are considered highly prospective for gold and cesium. This strategic expansion places Sienna's acreage directly adjacent to Ramp Metals Inc. (RAMP:TSXV) a company that recently reported multiple zones of gold mineralization. Notably, Ramp announced assay results, including 73.55 grams per tonne gold and 19.50 grams per tonne silver. Additionally, Ramp Metals has secured a strategic investment from Eric Sprott, a well-known figure in the mining industry.

Sienna's President, Jason Gigliotti, expressed optimism about the expansion, highlighting the potential of this new mining camp. "Sienna is one of the larger landholders in this exciting new mining camp, and with Eric Sprott taking a major stake in the area, it shows the promise of this new and potentially world-class mining district," Gigliotti stated in the news release.

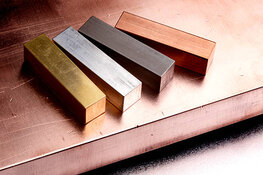

Cesium, Gold, and Overall Mining

The mining sector has faced a multitude of challenges and opportunities in recent years.

Jon Mills, CFA, in an article for Morningstar, highlighted that despite falling commodity prices, prices remained generally elevated versus the 20-year average as well as relative to cost support. He noted that elevated commodity prices encouraged miners to tilt towards growth through new developments, expansions, and mergers and acquisitions, particularly in energy transition commodities.

According to Technical Analyst Clive Maund, on July 22, Sienna Resources demonstrated significant potential for a major bull market.

Mills also observed that gold tended to capture the bulk of investor attention, but silver was an important market due to its industrial applications and investment demand.

Tom Kool, writing for Oil Price on June 20, discussed the strategic importance of critical minerals like cesium.

He pointed out that the Canadian mining sector was on a mission to create the world's most secure supply of critical minerals without Chinese involvement. Kool highlighted that cesium was so critical that its value was in the realm of the priceless, adding that North America's control over the only potential cesium mine not owned by China could be highly strategic in hindering China's potential to weaponize critical minerals.

Sienna's Catalysts

According to the company, this increase in acreage for Sienna Resources at the Stonesthrow Gold Project aligns with several catalysts that may drive the company's growth. Firstly, the strategic location of Sienna's expanded holdings next to Ramp Metals Inc. positions the company advantageously, especially following Ramp's promising mineralization results. Sienna's management is actively planning to advance this gold project at a time when gold prices are at all-time highs, indicating potential short and long-term growth opportunities.

In addition to the gold project in Saskatchewan, Sienna acquired the Case Lake West Cesium and Spodumene Pegmatite Project in Ontario, Canada. This 2,200-acre project is situated near Power Metals Corp's Case Lake cesium and pegmatite swarm discovery, which recently yielded world-class cesium results.

Expert Opinions on Sienna Resources

According to Technical Analyst Clive Maund, on July 22, Sienna Resources demonstrated significant potential for a major bull market. He observed that Sienna had been basing for a long time and showed clear signs of accumulation. Maund highlighted that despite recent flat price action, the volume pattern and indicators had been bullish, especially over the past year. He stated, "Such a positive divergence by volume indicators normally leads to a new bull market."

Maund also noted that Sienna's focus on battery metals, including lithium, gold, cesium, and uranium, positioned the company well in markets expected to experience high demand and higher prices. He remarked, "Considering the company's focus on battery metals, which are destined to be in short supply and thus command higher prices, it would be surprising if a major bull market didn't get underway in Sienna given all the positive indications we are seeing."

Additionally, Maund pointed out the strong uptrend in volume indicators since early 2016 and the recent buildup in upside volume over the past 12 months. He concluded, "Sienna Resources looks very well positioned to start a major bull market that will result in big percentage gains from the current low price and it is accordingly rated a Strong Speculative Buy here."

Ownership & Share Structure

According to Refinitive, management and insiders own 0.70% of Sienna.

The rest is retail.

Market Watch notes that the company has a market cap of CA$8.87 million, 197.11 million shares outstanding, and trades in the 52-week range between CA$0.03 and CA$0.09.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.