Coppernico Metals Inc. launched a phase one core drill program targeting the Ccascabamba area at its flagship Sombrero copper-gold project in southern Peru and received conditional approval to list on the Toronto Stock Exchange (TSX), under the symbol COPR, as announced in a news release.

It will be "a billion dollar-plus idea if it works," if the company has drill success and is able to prove up even just half the resource of this single target, Steven Therrien, senior mining analyst at 3L Capital, wrote in a June 5 research report.

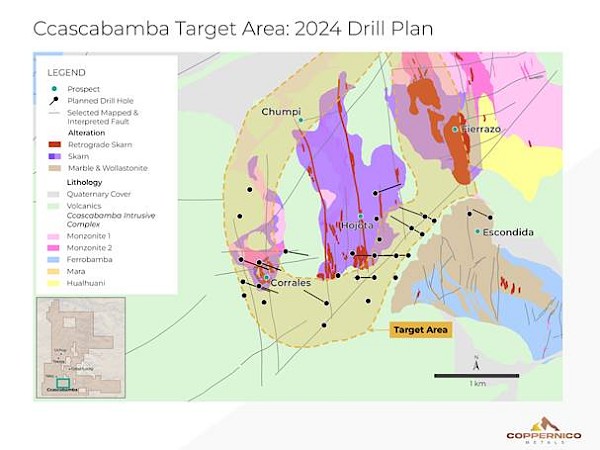

The drill campaign, to be carried out by Coppernico's subsidiary in Peru, Sombrero Minerales SAC, will consist of 16 holes over 6,500 meters placed in and around the large Ccascabamba (previously called Sombrero Main) skarn-porphyry system, typical for the Andahuaylas-Yauri belt.

"Coppernico isn't going into Sombrero with the hope of finding copper and gold mineralization at grades and widths that would be considered ore grade at other Peruvian mines; they already have them," Therrien wrote. "The question is how extensive the mineralization is at depth, along strike and where the best grades are in the system."

As such, the company will test high priority targets for subsurface zones of copper-rich skarn mineralization previously identified through other exploration work and for new mineralization along the southern margin of the Ccascabamba intrusive complex, at depth and along strike. The latter will encompass targeting about 2.5 kilometers (2.5 km) of the 7 km-long contact zone between the Ccascabamba intrusive complex and the Ferrobamba limestone, beneath the postmineralization cover.

"Drill targets are well supported by surface sampling, geophysics, mapping and interpretation," wrote Therrien.

Simultaneously, Coppernico will conduct reconnaissance work and collect samples in the unexplored areas of its Sombrero property.

Simultaneously, Coppernico will conduct reconnaissance work and collect samples in the unexplored areas of its Sombrero property.

In other news, the TSX listing committee granted Coppernico conditional approval to list on the exchange, and it is gathering the remaining documentation needed. After receiving the official green light, the company will trade on the TSX under the symbol COPR.

"Being listed on the TSX, one of the world's leading exchanges in the resource sector, will enhance the company's profile, visibility, and increase access to liquidity for both local and international investors," said Coppernico's Chief Executive Officer (CEO) and Chair Ivan Bebek.

Dedicated to Discovery

British Columbia-based Coppernico Metals Inc., spun out of Auryn Resources in 2020, is exploring for large-scale, high-grade copper and copper-gold projects in South America. While advancing Sombrero, management continues to review additional projects in South America, aiming to expand its portfolio and thereby offer more value to shareholders and reduce risk, the company said.

As for Sombrero, the concessions there span 103,000 hectares and contain several copper-gold skarn and porphyry systems along with precious metal epithermal deposits. The property sits on the western extension of one of Peru's most prolific copper belts, Andahuaylas-Yauri.

"The Sombrero project represents a unique opportunity to extend a world-class belt and hosts the potential for multiple major discoveries," said Tim Kingsley, Coppernico's vice president of exploration.

The current focus at Sombrero is on the Ccascabamba and Nioc areas, the mineralizing intrusives of which occurred during the same Eocene era as the renowned deposits on the copper belt, such as Las Bambas. Sombrero is west of and analogous to Las Bambas, which Therrien pointed out, produced 302,000 tons of copper last year alone.

As for the size of Ccascabamba, Kingsley described it in the news release as "very large," and Therrien, in his report, estimated its potential resource at 10,861,000 tons (10.861 Mt), or 23,945,000,000 pounds (23.945 Blb), of copper equivalent. The analyst calculated an estimated value of only half of the potential resource using an acquisition price range of US$0.025–0.10 per pound.

"An acquisition of this scale would fetch between US$300M to US$1.2B," the analyst wrote.

Sombrero has never been drilled for copper and gold.

"The inaugural drill program is a significant milestone for Coppernico," Bebek said in the release. "This milestone marks a key step in unlocking the potential value of this highly prospective project, which coincides with a strong outlook on the long-term price of copper."

For drilling at Sombrero, Coppernico has a renewable, three-year social access agreement with the local community, noted Therrien, and all drill permits. It has enough cash for more than a year of exploration drilling, Bebek said in a June interview. As of May 24, the explorer had CA$18M in cash following a CA$19.37M raise in May that included an CA$8.77M investment by Teck Resources Ltd. (TECK:TSX; TECK:NYSE).

Peru, as a mining jurisdiction, is the world's second leading copper producer, noted Therrien. The country is on track to invest more in mining this year than the government estimated, and the total could reach US$5.3B, according to Peru's largest commercial bank, Banco de Crédito del Perú.

"We are seeing the pace of permit approval increase and major permits being issued, such as the February 2024 Modification of the Environmental Impact Assessment approval that allows for a US$2B Antamina copper mine expansion, a positive sign for mining and exploration in the country," Therrien added.

The Coppernico team boasts a successful track record in raising capital, making discoveries, and advancing and monetizing projects. CEO Bebek, for example, has more than 25 years of experience in the private and public mining and exploration sector. His three previous companies are Auryn, Cayden Resources (sold to Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) for CA$205M) and Keegan Resources, now Asanko Gold Inc. (AKG:NYSE.MKT; AKG:TSX).

Coppernico's board of directors includes two former BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK) vice presidents, Keenan Jennings (metals and exploration) and Antonio Arribas (geosciences).

"Having two former BHP executives on the board significantly validates the integrity and opportunity that lies ahead with Coppernico," noted Therrien. "Additional project validation is supported by Teck's participation in the most recent financing."

Copper is in Bull Market

Forecasted growth of the market, increasing demand required for the green energy transition, a looming supply deficit and rising prices all make copper "a generational investment opportunity," reported a July 26 Kitco News article.

Therrien asserted that "one of the best ways to participate in a copper bull run," is by "investing in South American copper projects with the potential for large-scale discoveries (greater than 5 Mt of copper metal). South American super deposits that hit, like Filo Corp. or NGEx Minerals Ltd.'s (NGEX:TSX.V), get instant market love, and we believe Coppernico could follow a similar path with exploration success."

According to Fortune Business Insights, the global copper mining market is expected to reach US$11.86B in value by 2032, up from US$9.26B in 2024 and reflecting 3.13% compound annual growth rate.

Recent consumption and supply statistics indicate a likely supply shortfall. According to Benchmark Mineral Intelligence, global copper consumption is projected to reach 28 Mt this year, Mining.com reported. However, global copper supply from mine production was only 22 Mt in 2023, according to the U.S. Geological Survey. Consumption is expected to increase further to 38 Mt by 2032, BMI noted.

The copper price took a hit last week, dropping about 20%, to below US$9,000 per ton, from its recent high in mid-May, Reuters reported on July 26. Despite the falloff, the price should recover, climbing back to US$9,500 per ton within about three months' time, according to Citi Research, then touching US$11,000 per ton by early 2025.

"The bank attributed the expected rally to a recovery in global manufacturing sentiment driven by anticipated Fed rate cuts and expected inventory draws and deficits in H2/24," the article said.

Because copper is in a bull market, this current heavy correction "is viewed as presenting an opportunity to buy copper itself or various copper stocks that have dropped back in sympathy with copper," wrote Technical Analyst Clive Maund on July 25.

Reid I’Anson, senior commodity analyst with Kpler, recommends staying long in copper investments, he told BNN Bloomberg on July 25, despite anticipated short-term volatility because of the metal's extensive use in electric vehicles and artificial intelligence technology.

"Over the long run, we are still bullish. We think copper looks like a good investment," l' Anson said.

The Catalysts

Coppernico Metals has several catalysts on the horizon, Therrien reported. The company is expected to commence trading on the TSX soon and release drill results from ts phase one program, now in progress.

"Investors can expect a steady flow of discovery drilling news going forward, the type of catalyst that drives significant value," Therrien wrote.

On tap for next year is the second phase of drilling at Sombrero, to test more prospective targets and follow up on phase one's findings.

Ownership and Share Structure

As for ownership of Coppernico Metals, according to company estimates, strategic investors, including insiders, hold 56%.

CEO Bebek holds 3.45%, management and directors have 1.6% and close associates own 34.23%. Teck owns 9.9% and Newmont Corp. (NEM:NYSE), 6.25%.

Institutional investors own 17.75%, and retail investors hold 26.82%.

In terms of its capital structure, Coppernico has 177.2 million (177.2M) shares outstanding, 36.2M warrants outstanding and 38.8M special warrants outstanding.

The company's market cap is about CA$88.6M.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |