SAF Group Managing Partner Brian Paes-Braga has been involved as founder, chief executive officer and strategic advisor in more than US$1 billion in growth equity financings and more than US$5 billion in market value creation over the last five years.

He was founder and CEO of Lithium X Energy Corp., which was acquired for US$265 million in 2018.

SAF Group is an alternative capital provider, investing on behalf of some of the world's leading institutional investors, pensions, family offices, and individuals. Its alternative credit platform serves three distinct segments: direct lending, infrastructure credit, and special situations credit.

But the Harvard graduate and author of the Amazon No. 1 bestselling author of "8: Reflections on Building Business + Balance" said he doesn't "think like a credit guy."

Because of his work with Lithium X, the gold exploration business, including Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00), which SAF Group just invested in, "is more my kind of background."

In May, Goldshore announced that SAF Group had bought more than 19 million common shares of the company in a private transaction after Michael Henrichsen joined Goldshore as its new chief executive officer and director.

"I've been in building companies now for the past of 10 years in my life," Paes-Braga said. "I feel that the only way we build companies at the pace we do is by the quality of the people, I believe Michael is a high integrity, high quality, brilliant geologist."

Henrichsen said Goldshore was excited by the "strategic placement of an additional 7% of our outstanding shares into the control of long-term supportive shareholders."

"SAF Group and Brian Paes-Braga are delivering as strategic advisers, shareholders and board members as we accelerate the advancement of the Moss gold deposit in this new gold environment," Henrichsen said. "We believe the scale, grade and location of Moss gold, combined with our growing execution and financing team, make it a clear candidate for continued advancement."

Substantial Growth Potential

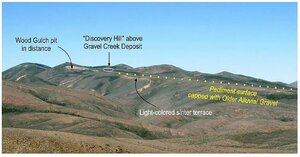

Goldshore just announced the start of its 2,500-meter summer drilling program at its Moss Gold Project. The company is targeting the highly prospective Moss Block area, which spans 8 kilometers by 6 kilometers and contains 91% of the project's total Mineral Resource Estimate (MRE).

The Moss project continues to be a focal point for Goldshore Resources, driven by its significant mineral resource potential.

According to the company, the 2024 updated NI 43-101-compliant MRE for the project has expanded to 1.54 million ounces (Moz) of Indicated gold resources at 1.23 grams per tonne gold (g/t Au) and 5.2 Moz of Inferred gold resources at 1.11 g/t Au. This expansion only covers 3.6 kilometers of the more-than-35-kilometer mineralized trend, indicating substantial growth potential.

The project's location in Ontario, Canada, offers strategic advantages, including accessibility from the Trans-Canada Highway, hydroelectric power on-site, and support from local communities.

"Our drilling efforts will focus on assessing the potential of two high-priority targets, the Boundary Zone and the SW Extension, with the goal of demonstrating the growth potential for high margin ounces from surface to 200 meters depth," Henrichsen said.

This approach aligns with Goldshore's objective to enhance shareholder value through targeted exploration and resource development instead of dilution.

"If we are fortunate to move forward and follow the baseline studies and get permits, I think this will be one of Canada's great gold mines," Paes-Braga told Streetwise Reports. "And that's what we're here for."

The Catalyst: 'I Can't Find Any Money For It'

Paes-Braga said he found out about Goldshore last fall while having dinner with someone who had raised a lot of capital for the company and was "in a concerned state."

"'It's got such a great asset, you know, we've increased the resource over double,'" the man told him. "And he's like, 'I can't find any money for it.' And I just said, 'Well, that's ridiculous.'"

Paes-Braga said they hired a consultant to see if there was something he was missing, but there were "no fatal flaws."

Now the company is well-positioned with the price of gold in what many believe to be the early stages of a bull market, he said.

"All of a sudden, you wake up three months later, and gold is going through (US)$2,200, going to (US)$2,300, to (US)$2,400," he said. "And you're like OK, well, this asset is going to start to be really interesting."

The Catalyst: Gold Already in a Bull Market?

Gold hit a new high of US$2,483.35 last week, and many believe it is already in a bull market. It stood at US$2,382.70 Friday.

Some experts, like Bloomberg Senior Commodity Strategist Mike McGlone, have predicted that it will only be "a matter of time" before gold hits US$3,000.

Having a major effect is the increasing role of central banks buying the metal. The World Gold Council's 2024 Central Banks Gold Reserves Survey showed four in five respondents expected reserve managers to increase their gold holdings in the next year, the website reported, according to a report by Stockhead on June 18.

"Gold, now recognized as a Tier-1 asset, is being bought by central banks and sophisticated investors at objectively rising (historical) levels because it is a measurably superior store of value than any fiat currency or sovereign I.O.U.," Matthew Piepenburg wrote in his June 19 article, "The Decline of the U.S. Dollar: Navigating the Shift Towards Gold and Commodities."

The growing demand for gold is also fueled by global economic shifts. As Piepenburg observed, "Dozens of BRICS+ countries are conducting trade outside the U.S. dollar, using local currencies for local goods, and then settling any net surpluses in physical gold — which is priced more fairly in for settlements signifies a pivotal shift in global trade practices, further enhancing gold's status as a Shanghai compared to London or New York," he wrote.

Stewart Thomson, in an article titled "De-dollarization & Deglobalization: Got Gold?" pointed out the immense buying opportunities in the current gold market, noting, "The US$1228-$1033 price area was a gargantuan buy zone . . . and US$2150-$1985 is even bigger!"

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Goldshore Resources Inc. (TSXV: GSHR;OTCQB: GSHRF ;FWB: 8X00)

He also emphasized the critical support levels in the gold market, stating, "The US$2150-$1985 area is arguably the most important support zone in the entire history of the U.S. gold market," highlighting the market's resilience and strong foundation.

Ownership and Share Structure

The company provided a breakdown of its ownership, where 38% of Goldshore is held by management and insiders.

Institutions own approximately 15% of the company. The rest is with retail investors.

Goldshore also noted that 54% of the in-the-money warrants are held by management, insiders, and strategic partners, representing CA$4.94 million in potential funding.

The company reports that there are around 261 million shares outstanding, while the company has a market cap of CA$73.21 million and trades in a 52-week range of CA$0.09 and CA$0.31.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.