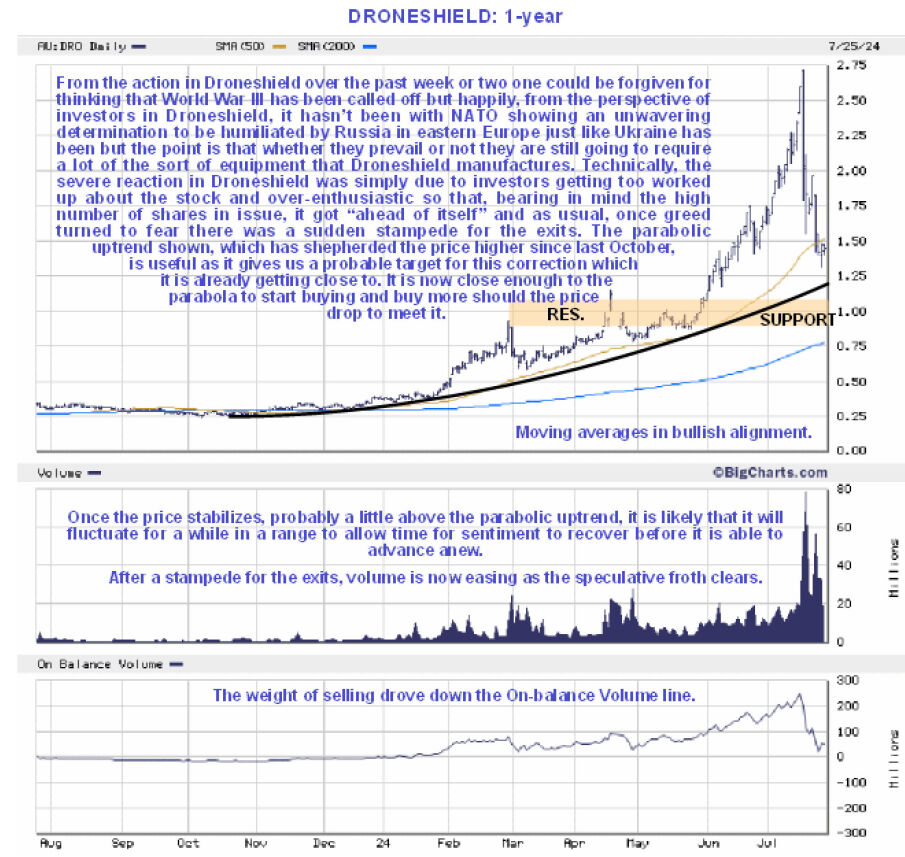

Although we sold DroneShield Ltd. (DRO:ASX; DRSHF:OTC) at a good profit in May, we sold too early and sadly missed out on a spectacular parabolic ramp, which was all the more impressive given the number of shares in issue. However, as we can see on the latest 1-year chart below, speculative interest became feverish, which drove the price into a vertical blowoff move — once greed turned to fear, investors jammed the exits trying to lock in what was left of their profits, and a precipitous decline ensued.

Naturally, someone had to be blamed for this, and a scapegoat was found in the form of Rodney Forrest, a Blue Mountains-based manager of a family office who apparently put out a tweet then gave an interview saying the $2.60-a-share company was on a "wild" valuation that "could end in disaster."

His expanded reasoning: that DroneShield's price-to-earnings multiple was (and remains) very high." This was the only reason found for the drop, but as we know from technical analysis, once a stock goes up like DroneShield had it was basically a balloon in search of a pin (or a lighted cigarette) or one Rodney Forrest who ought to feel very flattered that he has been ascribed such market moving powers.

But here's the thing, the company is still on a stellar growth trajectory that has not been changed one iota by the plunge in the share price over the past week or two. We'll now take a look at a couple of pages from the company's latest investor deck, which only came out a couple of days ago, to illustrate this.

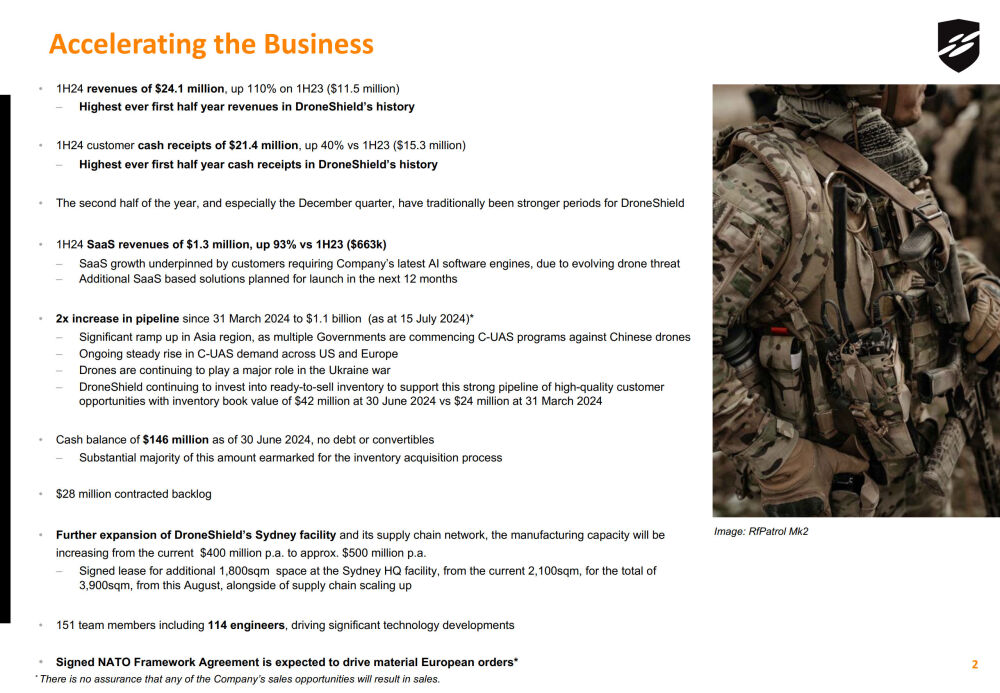

Our first page from the deck, page 2, shows the rapid growth trajectory of the company.

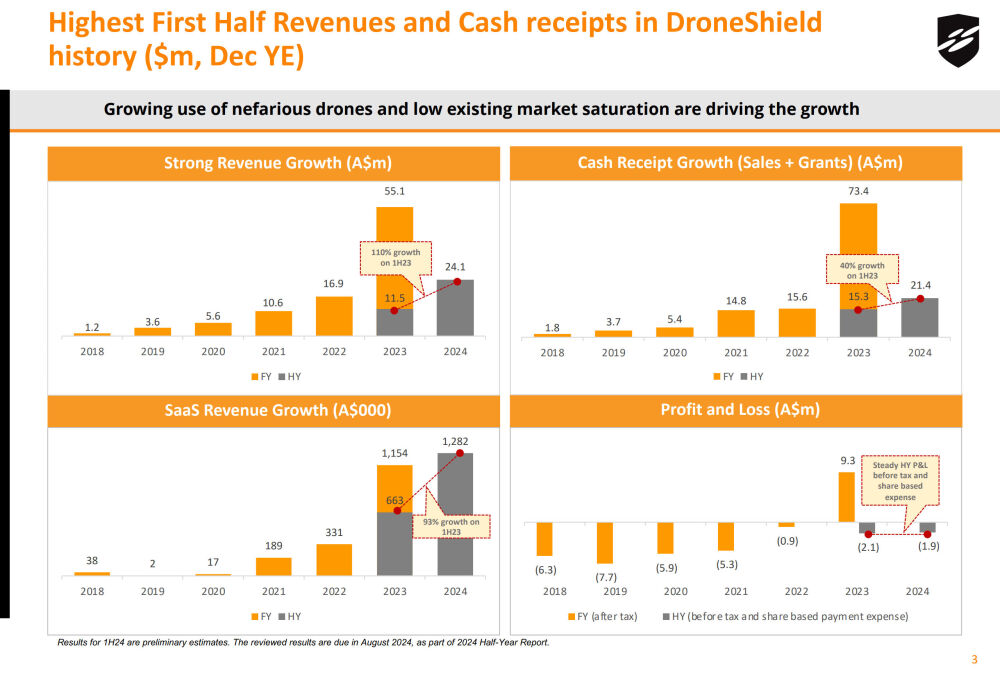

Our next page shows revenue and cash receipt growth during the first half of this year.

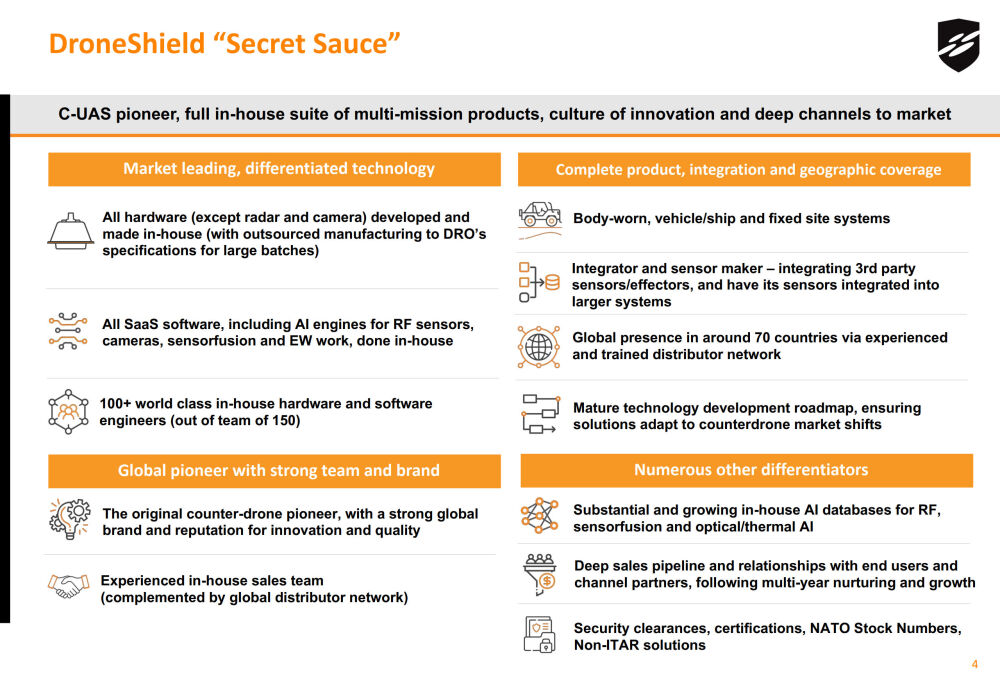

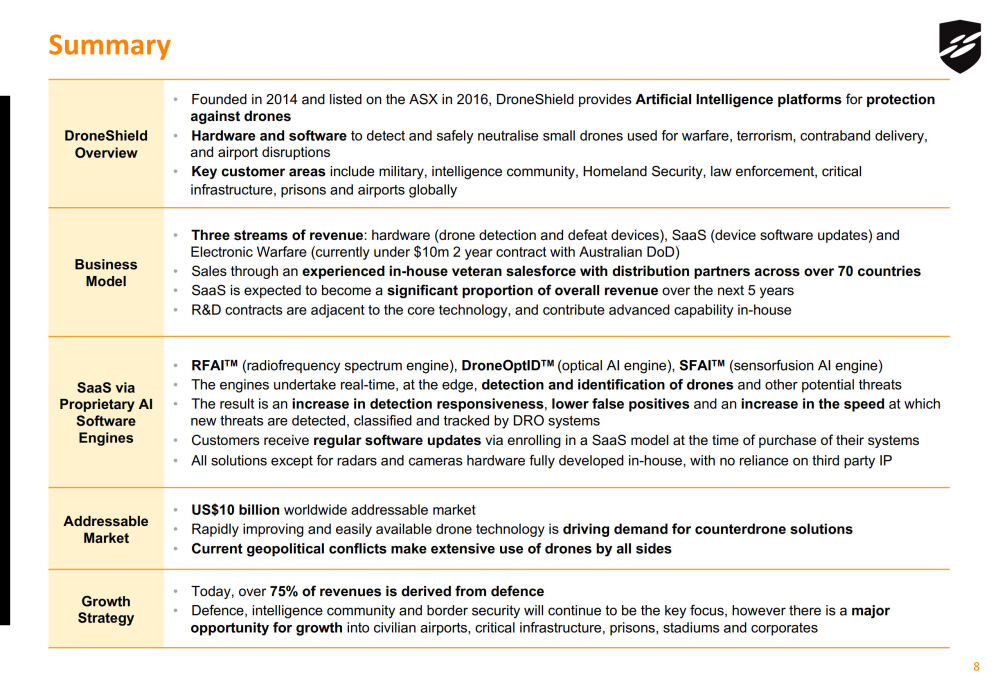

This page overviews the company's comprehensive business.

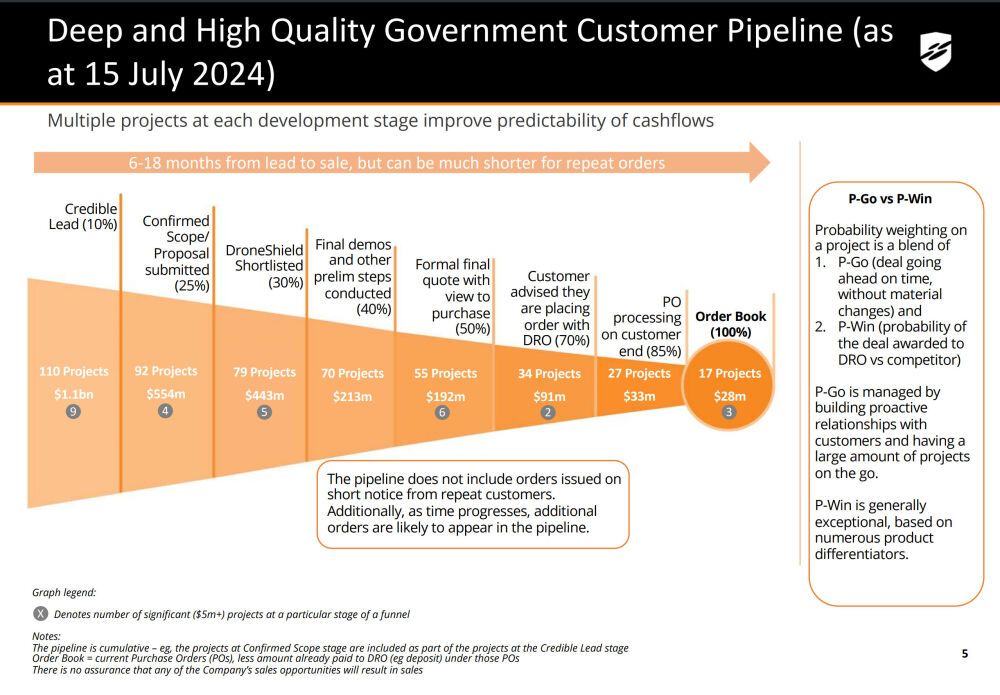

This page shows the government customer pipeline and its massive growth potential, which has a high probability of being realized.

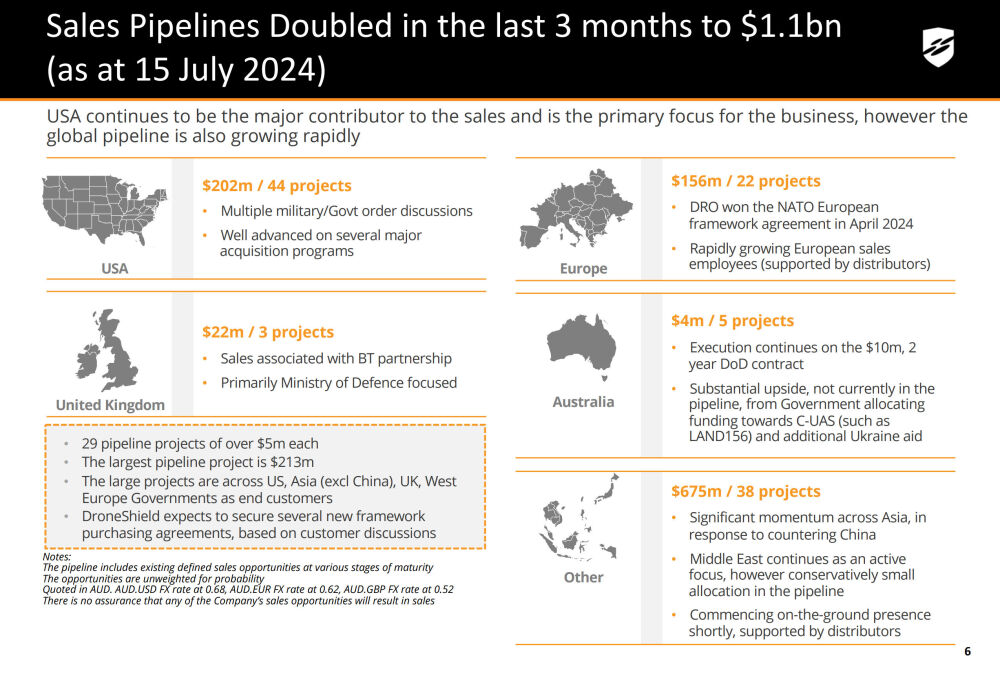

This next page shows the sales pipeline in different regions of the world.

This last page provides a summary of everything above.

It is therefore viewed as likely that once the speculative froth has cleared — and this appears to have been largely accomplished by the violent plunge of the past week or two — the stock will be free to advance anew, probably after a period of stabilization and base building to allow time for sentiment to recover and it is thought probable this will occur in the vicinity of or a little above the parabolic uptrend shown on our 1-year chart.

In conclusion, it is considered time to start buying DroneShield again, especially if it dips a little further into the parabolic uptrend boundary shown on our chart.

DroneShield's website

DroneShield Ltd. (DRO:ASX; DRSHF:OTC) was trading at AU$1.445 at 2:00 pm AEST on July 25, 2024, and closed at US$0.958 on July 24, 2024.

Want to be the first to know about interesting Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of DroneShield Ltd.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.