This morning, Tesla Inc. (TSLA:NASDAQ) and Alphabet Inc. (GOOGL:NASDAQ) are dominating as both reported earnings and both disappointed. both are also called sharply lower, with Tesla expected to open down $20.63 (8.37%).

The weakness is these two Mag Seven leaders are expected to take the Invesco QQQ ETF (QQQ:NASDAQ) down 1.31% to $474.05, so my two main short positions are starting to heal the ragged nerve endings that have been forced to endure the ridiculous "pump" that the hedge funds have colluded on to keep TSLA levitated.

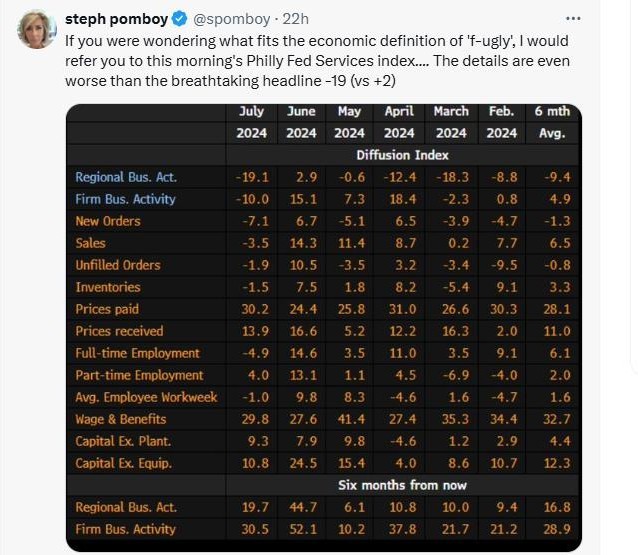

In fact, the entire U.S. market is ignoring rapidly weakening economic signals with no better evidence than yesterday's report from the Philadelphia Services Index, where "Regional Business Activity" plunged from +2.9 in June to -19.1 in July.

As MacroMavens Stephanie Pomboy tweeted out yesterday, it was "f-ugly."

Technology and small-cap stocks will not sustain current valuations if the economy rolls over into recession. In fact, former Fed governor Bill Dudley has written a Bloomberg article that has gone viral where he states that his "higher for longer" stance (that he has held for ages) has now done a one-eighty with him now calling for immediate rate cuts to avoid recession.

This is a major shift in analysis by Dudley, who was ahead of the curve back in 2022, calling for the Fed to raise back then while Jay Powell was talking about "transitory" inflation and still pumping liquidity into the system.

It is important for holders of precious and base metals positions because if the economy starts to nosedive, you can bet that the Fed will panic and plunge into monetary easing with a vengeance and that will move gold, silver, copper, and energy back into uptrends. Furthermore, it should also knock the NASDAQ out of the way as competition for the speculative dollar that typically gravitates to junior explorers and developers.

As for my put options, I now have 23 days until expiry, so with the big drops in TSLA and the QQQ, I am going to have to begin thinking about "legging out" (switching expiry dates) for both, so I am going to go by the "3-day rule" that I learned of years ago from an NYSE trader pal. It says that after unexpected events, either positive or negative, the market reaction takes three days to play out. This means that both TSLA and the QQQ should head lower through Thursday, and if it follows the pattern, a lower opening on Friday morning should mark the short-term low.

However, since I do not trust Elon nor his band of hedge fund henchmen, I will expect him to be on the phone screaming at them to "GET ME SOME BIDS!" so I will take profits on TSLA August $220 puts.

- Sell 20 TSLA August $220 puts at $12.00.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |