Volt Lithium Corp. (VLT:TSV; VLTLF:US) announced a major operational milestone, scaling up its production capacity to 96,000 liters per day. This represents a 100-fold increase in their processing capabilities. The company's proprietary Direct Lithium Extraction (DLE) technology, verified by ALS Canada Ltd, has demonstrated lithium recoveries of up to 99% from oilfield brines, with concentrations as low as 31 mg/L. This achievement positions Volt to commence field operations in Q3 2024, aiming to become a significant North American lithium producer.

Alex Wylie, President and CEO of Volt, highlighted the potential of the Permian Basin in the company press release, which produces 19 million barrels of lithium-infused brine per day.

Wylie stated, "With the scaling-up of our Field Simulation Centre, we have accelerated the Company's trajectory to becoming a significant North American lithium producer."

This development follows a strategic investment from a U.S. partner, which closed on May 2, 2024, enabling the scale-up at their Calgary, Alberta Field Simulation Centre.

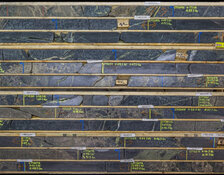

A Look At Lithium Mining and Extraction

The lithium sector has seen substantial expansion and diversification in recent years, becoming a critical component of the global energy transition. According to a June 25 report from Investing News Network, "the space has expanded significantly in recent years, and interested investors should cast a wider net to look at global companies."

This reflects the broader trend of increasing demand for lithium, driven by the rise of electric vehicles (EVs) and other next-generation technologies. As Forbes wrote on July 1, "The future will be powered by lithium, a metal that is the key ingredient for making lightweight, power-dense batteries used in next-gen technology like electric vehicles."

Technological advancements are also playing a crucial role. Direct lithium extraction (DLE) technology, in particular, is gaining attention for its potential to revolutionize lithium production.

As Reuters reported on July 10, "Eramet is attempting to use an innovative technique, known as direct lithium extraction, or DLE, in a race for cleaner, faster and cheaper ways to produce the metal with less water." This method could be critical given that "70% of the world's lithium is found in brine, rather than rock or clay."

Despite the positive outlook, the sector is not without challenges. According to The Investor Place on July 10, "the expected demand for lithium has led to an oversupply, which has led to a decline in lithium price." Companies like Albemarle and Sociedad Quimica y Minera de Chile (SQM) have faced earnings pressures due to these market dynamics. However, diversification and technological advancements offer pathways for sustained growth.

The Investor Place reported that "the strategic shift towards diversification and expansion into new markets could pave the way for sustained growth."

Catalysts Vaulting Volt Lithium

Volt's operational advancements are critical as they prepare for commercial production. As per the company announcement, the successful scale-up to 96,000 liters per day showcases the company's ability to handle large-scale lithium extraction from oilfield brines, leveraging its proprietary DLE technology.

Dave Kimery, COO of Volt, emphasized the company's position as a future low-cost commercial producer of battery-grade lithium, stating, "Volt's latest achievement positions us to help meet North America's expanding demand for this critical mineral, and to do so in a safe, environmentally sustainable and lower-impact manner."

The company's strategy to partner with existing producers in the Permian Basin allows Volt to utilize existing infrastructure, reducing capital costs and eliminating exploration risks. This partnership approach is expected to enable meaningful cash flow and production growth sooner than independent operations would.

Volt's phased scale-up approach, which includes extensive testing at their Field Simulation Centre, is designed to mitigate project execution risk and accelerate the timeline to full-scale commercialization. The first commercial modular unit is expected to process 100,000 barrels of brine per day, with full-scale commercial production anticipated by the second half of 2025.

These strategic developments, combined with the verified efficiency of their DLE technology, position Volt Lithium Corp. as a promising player in the North American lithium market, aiming to support the region's growing demand for domestically supplied, high-quality lithium.

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Volt Lithium Corp. (VLT:TSV;VLTLF:US)

Refinitiv provided a breakdown of the company's ownership and share structure, where management and insiders own approximately 15.54% of the company.

According to Refinitiv, James Alexander Wylie owns 8.73% of the company with 11.38 million shares, Martin Scase owns 4.94% of the company with 6.44 million shares, Warner Uhl owns 0.88% of the company with 1.15 million shares, Maury Dumba owns 0.49% of the company with 0.64 million shares, Morgan Tiernan owns 0.39% of the company with 0.50 million shares, and Kyle Robert Hookey owns 0.11% of the company with 0.14 million shares.

Refinitiv reports that institutions own 1.84% of the company, as Eagle Claw Investments Pty. Ltd. owns 1.07% of the company with 1.40 million shares, and U.S. Global Investors, Inc. owns 0.77% of the company with 1.00 million shares.

According to Market Watch, the company has 137.1 million shares outstanding and a market cap of CA$37.79 million.

It trades in the 52-week range between CA$0.16 and CA$0.40.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Volt Lithium Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.