Nevada King Gold Corp. (NKGFF:OTCMKTS; NKG:YSX) has announced assay results from one angle reverse circulation (RC) hole recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. The hole was drilled immediately south of the West Atlanta Graben Zone (WAGZ) 200m south of the Atlanta Pit and represents the southernmost hole drilled to date into the axial portion of a large, northerly trending anticline designated the South Quartzite Ridge Target (SQRT).

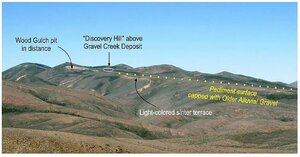

As announced by the company, the intercept of 6.28 g/t Au (gold) over 54.9 meters occurs in strongly altered intrusive rock starting 147.9 meters downhole, immediately below a non-mineralized, massive quartzite unit that caps the top of the South Quartzite Ridge Anticline. The hole was steeply angled at -85° southward along the anticlinal axis of the SQRT to test a large, low resistivity CSAMT anomaly occurring underneath the highly resistive quartzite cap. This axial zone aligns with major, high-angle faults controlling felsic intrusions and associated gold mineralization further north within the resource zone and is most likely a southern extension of the WAGZ.

The discovery highlights the district-scale potential of the site, with the new geological setting showing high-angle intrusions bounded by impermeable quartzite. This differs substantially from the existing Atlanta resource zone, indicating a broader scope for exploration. The current drilling program is testing the northern and southern extensions of the East Ridge Zone (ERZ) along a geophysical anomaly, further exploring the depth and width of the mineralization.

In related news, Nevada King has obtained a final order from the Supreme Court of British Columbia approving the proposed plan of arrangement to spin out all of its concessions and properties, except for the Atlanta Gold Mine Project, to its shareholders. This spin-out will be conducted through a subsidiary named SpinCo. Nevada King will grant SpinCo a 3.0% net smelter return royalty on all gold and silver production from Atlanta, including the resource area and non-core claims.

The arrangement was overwhelmingly approved by 96.30% of votes cast at the shareholders' meeting on July 22. Subject to the final customary closing conditions and approval by the TSX Venture Exchange, the arrangement is expected to be effective on August 1. Shareholders of record as of July 31, will receive one new Nevada King common share and one-thirtieth of a SpinCo common share for each Nevada King share held. Nevada King options will also be adjusted according to the terms outlined in the arrangement.

Striking Gold: The Promising Future of the Gold Mining Sector

According to Kitco on July 17, gold prices have surged to a record high, reaching US$2,487.40 per ounce, driven by a combination of bullish technical factors and expectations of a potential interest rate cut by the Federal Reserve later this year. This milestone reflects the strong performance of the yellow metal, with investors optimistic about further price appreciation in the near term. The Federal Reserve's potential rate cut is a significant driver, as lower interest rates generally enhance the appeal of gold, which does not yield interest.

A May report from Statista highlighted the enduring value and rarity of gold, noting that global mine reserves of gold increased to 59,000 metric tons in 2023. Despite fluctuations, gold production from mines worldwide amounted to approximately 3,000 metric tons in the same year, with China leading global gold mining, followed by Australia and Russia. This consistent production underpins the stability and reliability of gold as an investment.

Positive sentiment towards gold is further reinforced by its performance as a safe haven asset. According to Frank Holmes from US Global Investors on July 8, gold has shown a year-to-date rise of 12.8% in 2024, outperforming many major asset classes. The World Gold Council estimates that central bank demand contributed significantly to gold’s performance, with Goldman Sachs setting a bullish target of US$2,700 per troy ounce by year-end. This target is supported by strong demand from emerging market central banks and Asian households, highlighting gold's role as a reliable store of value amid global economic uncertainties.

On July 10, Matthew Piepenburg from Von Greyerz AG emphasized the strategic importance of gold as a global reserve asset, noting its increasing recognition amid ongoing de-dollarization trends. Piepenburg asserts that gold is replacing U.S. Treasury securities as a global reserve asset, reflecting a broader shift in economic strategies among sophisticated investors.

Key Catalysts Driving Nevada King Gold's Growth

The recent findings at the South Quartzite Ridge Target (SQRT) are a significant catalyst for Nevada King Gold Corp., showcasing the potential for larger mineralized targets within the Atlanta Gold Mine Project. The discovery of 6.28 g/t Au over 54.9 meters in hole AT24HG-41 demonstrates the potential for high-grade mineralization in the SQRT, suggesting a strong gold system similar to those found in other major Nevada gold mines. This intercept supports the hypothesis that the SQRT could host significant blind mineralization beneath the quartzite unit, opening up new exploration targets.

The company touted its use of Controlled Source Audio-Magnetotellurics (CSAMT) data as instrumental in identifying low resistivity zones correlated with mineralized high-angle intrusions. This geophysical method has been critical in pinpointing new zones of mineralization, with the potential for numerous additional targets throughout the Atlanta district. The systematic exploration approach, guided by advanced geophysical techniques, positions Nevada King to potentially uncover more mineralized zones within the district.

Cal Herron, Exploration Manager of Nevada King, emphasized the broader implications of these findings in a press release: “As our 2024 reconnaissance exploration program progresses, we now have numerous targets to chase in all directions from the current resource zone. Considering the strong intrusive tie to Au/Ag mineralization, the Company is well positioned to make more new discoveries.”

The ongoing exploration program and recent discoveries underscore Nevada King’s strategic approach to unlocking the full potential of the Atlanta Gold Mine Project. The identification of multiple exploration targets highlights the company’s commitment to expanding its resource base and enhancing shareholder value, positioning Nevada King for continued success in the mining sector

Expert Opinions on Nevada King

In his July 25th article for 321Gold, Bob Moriarty shared his insights on Nevada King Gold Corp.'s recent developments. Reflecting on his extensive experience visiting hundreds of projects and meeting over a thousand geologists, Moriarty noted the transient nature of geologists in the industry. He observed, "Geologists change companies as often as hookers change the street corner they are working depending on the weather and traffic."

Moriarty emphasized the significance of Cal Herron, Nevada King's exploration manager, and his pet theory, describing it as "the best call I have ever heard." He highlighted Nevada King's July 23 press release, which revealed critical information about the company's drill intercepts with gram/meter results exceeding 100. He cited Hole 44 from 2023, which showed 11.64 g/t Au over 108.2 meters, achieving a gram/meter score of 1257.

The most noteworthy discovery, according to Moriarty, was the 68.6 meters of 5.14 g/t Au and 16 g/t Ag from the South Quartzite Ridge Anticline. He described this as "the motherlode with a 1500-meter potential strike length," comparing it to a similar gold system owned by Kinross at Round Mountain, which produced 16 million ounces through 2022.

Moriarty stressed the importance of focusing exploration efforts on the South Quartzite Ridge, despite the challenges posed by the need for permits. He advised investors to carefully review the twelve-page press release, as it contained crucial information validating Herron's theory.

He also noted the upcoming spinout of all Nevada King projects, except for the Atlanta Gold Mine Project, into a new company called NV King Goldlands. Approved by shareholders on July 22, 2024, the new company will hold a 3% net smelter return royalty on all gold and silver production from Atlanta and will become the third-largest landholder in Nevada.

Reflecting on the project's history, Moriarty cited his visit in 2011 when it was owned by Meadow Bay. He noted that Meadow Bay acquired the project for US$5 million and some shares but later sold it to Nevada King for just US$1 million in 2019. Moriarty concluded, "I think NKG made the deal of a lifetime. Also, I think Cal Herron will be winning some awards for his theory."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Nevada King Gold Corp. (NKGFF:OTCMKTS;NKG:YSX)

36.32% of Nevada King Gold is held by management and insiders. Of this category, Collin Kettell holds 19.68% or 61.99 million, Michael A. Parker holds14.28%, at 45 million shares, and Craig A. Roberts holds 1.46% or 4.6 million shares.

Institutions hold 3.62%. The rest is retail.

Nevada King Gold has 315.09 million shares outstanding and 200.65 million free float shares. The stock has a 52 week range of US$0.1711 - 0.3550 and a market cap of $65.07M

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.