Juggernaut Exploration Ltd. (JUGR:TSX.V) has initiated a drilling program on its 100% controlled Bingo property located in the Golden Triangle, British Columbia. The project is set to cover approximately 3,000 meters of drilling across 14 holes from seven pad locations within the 600-meter by 350-meter Bingo Main Zone. This follows the discovery of several new sulphide-rich outcrops, which prompted an expansion of the drill program.

Dan Stuart, President and CEO of Juggernaut Exploration, commented in the company news release, "We are excited to resume drilling on our Bingo property after the successful inaugural drill programs carried out in 2023. The comprehensive drill plan aims to expand the high-grade gold-silver-copper-cobalt mineralization along strike and depth." The new cobalt values discovered on the surface have increased the calculated gold equivalent (AuEq) values of the 2023 drill core assay results by more than 20%.

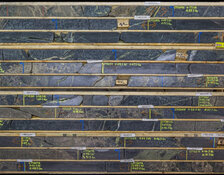

The program will focus on extending the known mineralization at the high-grade gold-silver-copper shear-hosted vein and exploring new cobalt-rich and native copper outcrops identified by the current mapping crew. Highlights from the 2023 drilling season include drill hole BI-23-01 intersecting 12.09 grams per tonne (g/t) AuEq over 5.11 meters and drill hole BI-23-04 intersecting 5.25 g/t AuEq over 10.12 meters.

Robust Growth and Strategic Policies Propel Metals and Mining Sector Forward

The metals and mining sector is a crucial industry dedicated to locating and extracting metal and mineral reserves worldwide. According to a July 20 report by Investopedia, "The metals and mining sector is the industry dedicated to the location and extraction of metal and mineral reserves around the world." These reserves are mined for profit and utilized in various applications, including jewelry-making, industrial uses, and investments.

Richard Mills, writing for Mining.com on July 12, highlighted the impressive performance of key metals in the first half of 2024, noting, "Silver is up 33% year to date (July 8), gold is up 15.8%, and copper has gained 19.1%." He further stated, "At the half-year mark, it appears that our prediction was bang-on." This positive trend is attributed to a combination of factors, including anticipated interest rate cuts by the Federal Reserve and a low-dollar environment that exacerbates shortages in metals like gold, silver, and copper.

The significance of metals and minerals extends to critical sectors such as renewable energy, high-tech electronics, and defense.

The Economic Times on July 23 quoted a government official stating, "Minerals such as lithium, copper, cobalt and rare earth elements (REE) are critical for sectors like nuclear energy, renewable energy, space, defence, telecommunications and high-tech electronics." This recognition of the essential role of these materials has led to policy changes aimed at boosting their availability and processing.

Metals have a wide range of uses, including both precious and industrial categories. Precious metals like gold, platinum, and silver are valued for their rarity and applications in investment and industrial processes.

Investopedia noted, "Metals include precious metals such as gold, platinum, and silver while industrial metals include steel, copper, and aluminum." Industrial metals are extensively used in construction, manufacturing, and technology industries, with copper being a particularly vital component. As Investopedia stated, "The price of copper is closely watched by investors since it can serve as an indicator of economic growth."

The economic activity drives the demand for metals, leading to increased extraction and production. This demand is bolstered during economic growth periods when industrial and jewelry uses surge, whereas a slowed economy typically sees a rise in the use of precious metals for investment purposes. This dynamic was echoed by Mills, who reported, "Gold prices are pushing higher due to a shortfall of mined gold."

Juggernaut's Catalysts

The discovery of highly economic cobalt values has been a significant catalyst for Juggernaut Exploration, prompting a revision of previous assay results and increasing the calculated AuEq values by over 20%. This revision has highlighted the potential for substantial economic returns from the Bingo property, attracting attention from investors and stakeholders.

As per the company, the expanded drilling program aims to further delineate the high-grade gold-silver-copper-cobalt mineralization along strike and depth. This includes testing additional shear zones and new showings discovered in 2024, potentially increasing the resource base of the property. The Bingo Main Zone has demonstrated strong mineralization with semi-massive aggregates and stockwork of chalcopyrite, pyrrhotite, and cobalt-rich sulfides, which remain open to the north, south, and at depth.

The company's strategic location within the Golden Triangle, a region known for its rich mineral deposits, enhances the potential for significant discoveries. The proximity to existing infrastructure, such as tidewater access and roads, facilitates cost-effective exploration and development. As Juggernaut points out, the team's mapping and prospecting efforts have positioned Juggernaut Exploration favorably for future success. The ongoing exploration activities, including the Double Down Hinge Zone, are expected to yield valuable data, guiding further exploration and drilling initiatives.

Expert Opinions

According to Ron Wortel, MBA, P.Eng., Senior Mining Analyst at Couloir Capital, in a report from July 16, Juggernaut Exploration Ltd. owns three highly prospective projects within and close to the Golden Triangle in Northwest British Columbia, a Tier 1 region known for significant discoveries and developments.

Wortel emphasized, "Each project is known to host high-grade gold-rich polymetallic discoveries that deserve additional exploration and resource assessment."

Wortel noted the strong financial backing from Crescat Capital, which holds just under 20% of Juggernaut's share capital. He reported that the company successfully raised CA$4.8 million in the first half of 2024 to fund its planned exploration programs. These programs include at least 6,000 meters of drilling on their Bingo and Midas properties. Wortel highlighted the potential of the Bingo prospect, which looks analogous to the nearby Surebet discovery of multiple high-grade shears and veins, and the Midas property Kokomo target, which shows indications of a high-grade VMS target similar to Eskay Creek.

He also pointed out that Juggernaut's ownership in the B-ALL Syndicate provides exposure to additional discoveries in Northwest British Columbia. Based on the company's initial discoveries, delineation, and further definition of mineralization at its projects, Wortel recommended the stock as a Buy with a fair market value target of CA$0.36, compared to the price at the time of the report of CA$0.10, projecting a 360% upside.

Wortel remarked, "The company's motto is 'on track for discovery,' and their work thus far shows a commitment to this cause for their shareholders." He added that the 2024 exploration programs are expected to expand the known zones of mineralization at the Bingo and Midas projects and identify other structures or zones showing the expansion of the mineralization inventory.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Juggernaut Exploration Ltd. (JUGR:TSX.V)

This includes initial drilling results from the Bingo project, drilling results from the Midas Kokomo VMS Target, and surface exploration results from both projects, all expected in summer 2024.

Wortel concluded that risk-tolerant investors looking for upside leverage to continued discovery and definition of gold, silver, and copper mineralization on Juggernaut's projects in Northwest British Columbia are encouraged to further evaluate the opportunity.

Ownership and Share Structure

According to the company, 70% of Juggernaut is owned by management, insiders, and accredited investors.

Crescat Capital owns 19.70% as an institutional investor.

The rest is retail.

Juggernaut currently has 127.38 million outstanding shares and 126.84 million free float shares. They have a 52-week range of US$.0.0700 - 0.2600 and a market cap of 16.659 million.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.