In my July 10 update, I highlighted the breakout on the gold chart, and it signaled a break out of the downtrend, and a test of the May highs was likely and a possible summer rally.

With recent action to record highs, it is not strong enough to be called a clear breakout, and we could still be stuck in a trading range. That said, I am not ruling out the summer rally either.

A close at $2,500 or better would be a sure sign of another leg up in this bull market.

Central Bank buying in the physical market continues as the most bullish catalyst. There has been a modest increase in Comex open interest in the past two weeks, but net long positions have remained around the same. There has been a bit more interest in the ETFs but probably most positive is the gold stocks are starting to react, see more below.

There are quite a few making new highs, but there is still a lot of value in the sector and underpriced stocks. Junior explorers remain very weak. The market is looking at a Fed pivot, and I think they have it right now. Although I don't think there will be the big rate reduction the market wants, we will see a 1/4 cut and probably eventually a full 1 point.

Beyond that, it is most dependent on how the bond market reacts to the record and overwhelming government debt. Many countries are no longer buying U.S. debt and have switched to buying gold. There will be a lot of pressure on bond markets. The other factor is a probable recession, and this could be a bigger factor in pushing rates lower. Gold is also part of the market rotation that is occurring out of big tech and besides gold also into small caps as the Russel 2000 has had a strong move and is getting close to all-time highs.

The market is also starting to price in a Trump/Republican election win. We see this with a jump in right-wing media stocks like Trump Media and Rumble. Also, a flight out of solar stocks. They are below the level when Biden got elected.

SolarEdge Technologies Inc. (SEDG:NASDAQ) will lay off 400 employees, the solar panel inverter company said Monday. SolarEdge stock fell sharply, with other solar stocks sliding as well.

"The downturn of the market at the end of 2023 and beginning of 2024 had led to an accumulation of excess inventory in our distribution channels," CEO Lando said.

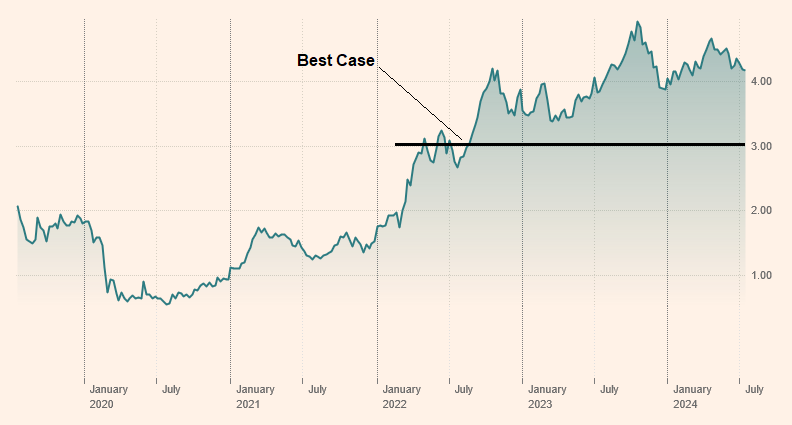

This is the second round of layoffs for SolarEdge in the past seven months. In January, the company announced layoffs for 900 jobs, or 16% of its workforce at the time. Here is a chart of the market barometer, the 10-year treasury yield. On interest rates, I see the most likely and best case a drop to around 3%. There is no way we will ever get back to those 1% or 2% rates in the pandemic.

Many of our gold stocks have had good rallies and are hitting new highs. I would say one of my favorite producer gold stocks to buy right now would be Calibre. SX; CXBMF:OTCQX)

Calibre Mining

Recent Price – CA$2.13 Calibre Mining Corp. (CXB:TSX; CXBMF:OTCQX)

Entry Price - CA$1.63

Opinion – Buy

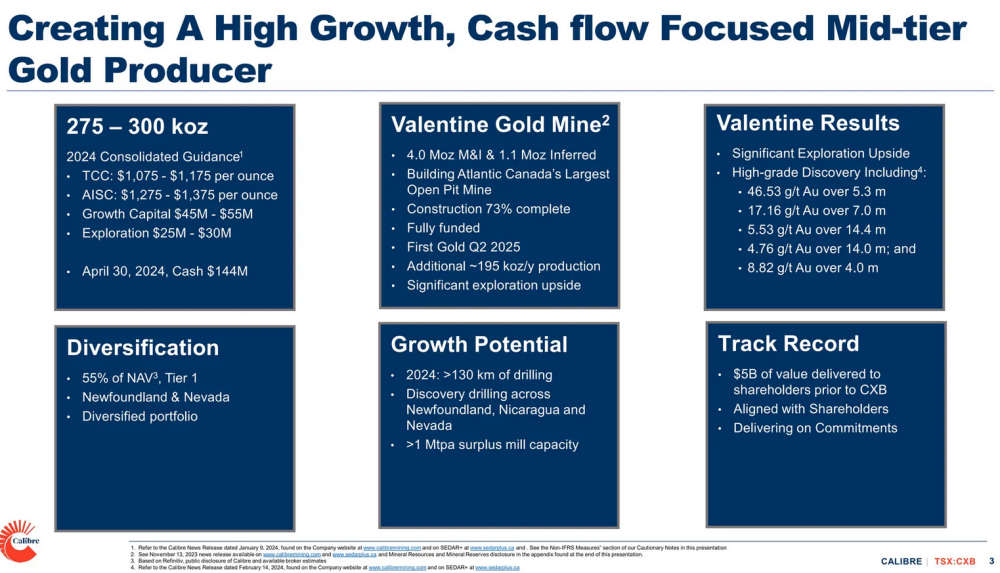

Calibre Mining Corp.'s (CXB:TSX; CXBMF:OTCQX) new Valentine mine is 73% complete and is going to add considerable production growth for the company.

First gold pour is expected in Q2 2025 and the market is not pricing this into the stock at this point.

Gold production in Q2 was 58,754 ounces of gold and Valentine will add about 45,000 per quarter.

This slide from their presentation gives a good snap shot of the company and growth profile.

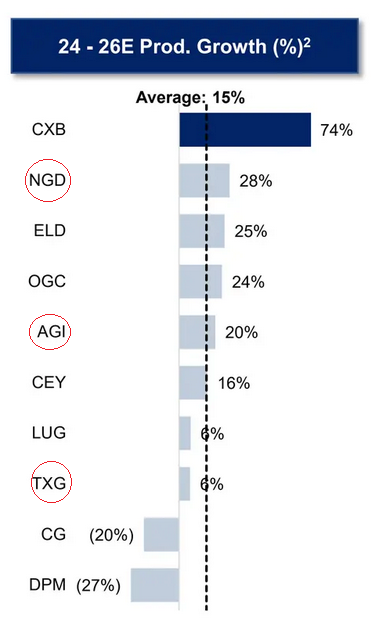

This is part of another graphic in their presentation. It shows the high growth compared to peers.

I also circle in red these growth peers that are on our list, so with Calibre we have four of them.

This week, Calibre announced a 100,000-metre resource expansion and discovery drill program at its 100%, fully financed Valentine gold mine in Newfoundland, Canada. The 100,000-metre diamond drilling program is in addition to the previously announced 50,000-metre ore control reverse circulation drill program at the Leprechaun and Marathon deposits and the 10,000-metre Winkie/RAB (rotary air blast) drilling program testing bedrock geology.

From the news release — Darren Hall, president, and CEO of Calibre, stated, "Valentine currently hosts a robust [greater than] five-million-ounce resource base across eight kilometers of the 32- 32-kilometer-long main Valentine Lake shear zone (VLSZ), which provides significant additional discovery opportunities from an extremely prospective array of exploration targets with a similar geological setting to the prolific Val d'Or and Timmins camps in the Abitibi gold belt. Between the two main shear zones, the VLSZ and the parallel Northwest Contact shear zone, there is a combined potential of up to 64 kilometers of high-value discovery opportunities. As we rapidly expand our knowledge base with incoming results, this exploration program is designed to confirm the vast potential of the Valentine mineral system. The district has the potential to significantly extend mine life and shape our considerations for the phase 2 mill expansion, aiming for increased throughput of the process plant. Our view has always been that Valentine will become a gold camp, and we believe a program of this scale will begin to uncover the incredible opportunity."

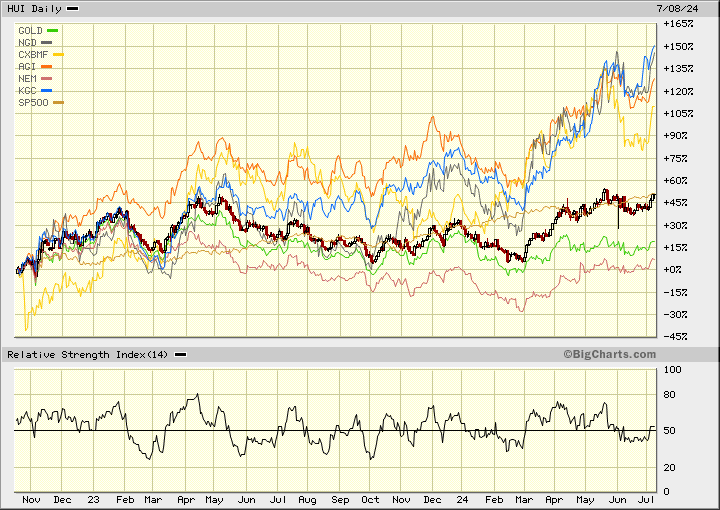

This chart is a bit busy, but it is the HUI gold bugs index since I called the bottom in October 2022. It has performed about the same as the S&P 500 but a lot of our gold picks have done way better. I want to highlight that Calibre in yellow, up about 107%, is at the bottom of our other picks, hence a Good Buy.

Also, I highlight Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Newmont Corp. (NEM:NYSE), which have been poor performers. Up only +20% and 8% respectively. I did not recommend Barrick, but Newmont is on the Millennium index.

The main point here is that it is these big gold stocks that the institutions first jump into in a bull market. The fact these have not moved much is a sure sign that most institutions have not bought into this bull market yet.

There is a lot of buying yet to come in and once more institutions come in, retail will then follow. It seems Eric Sprott agrees with me on the potential of RAMP.

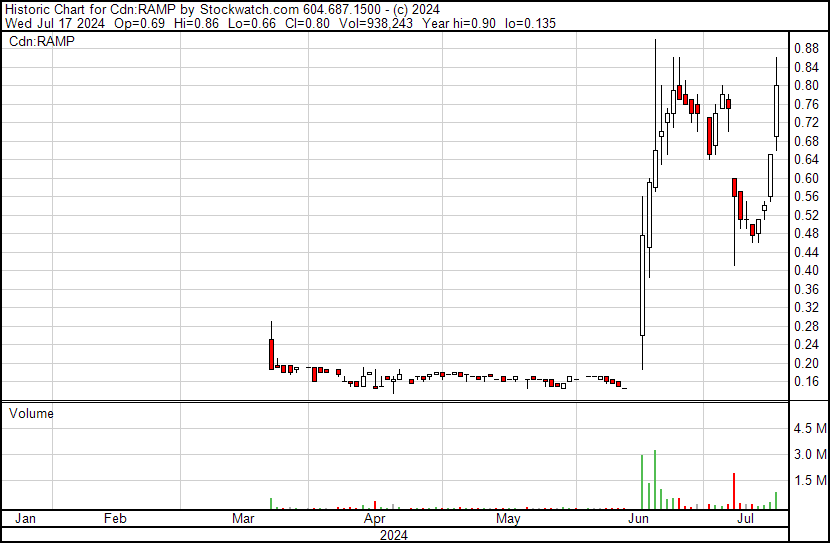

Ramp Metals

Recent Price - CA$0.80 Ramp Metals Inc. (RAMP:TSXV)

Entry Price - CA$0.47

Opinion – Buy on weakness

Wednesday, Ramp Metals Inc. (RAMP:TSXV) announced a non-brokered private placement financing of up to approximately $4,500,000 that will be led by Eric Sprott. The Offering is expected to consist of the issue and sale of:

- Up to 3,846,153 charity flow-through common shares (the "CFT Shares") at a price of $0.78 per CFT Share for gross proceeds of up to approximately $3,000,000; and,

- Up to 2,727,272 common shares (the "Common Shares") at a price of $0.55 per Common Share for gross proceeds of up to approximately $1,500,000.

We have had a few chances to buy around my CA$0.47 entry price, and this recent pop is why I have a buy-on weakness for now. Let's see when the next drill program starts.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Calibre Mining and Ramp Metals. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.