Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGN0:XFRA) is a clinical-stage drug development company whose lead drug programs are focused on the effective treatment of chronic cough and strokes.

Yesterday, July 16, 2024, the company reported results from a study recently conducted with Ifenprodil, a potential treatment for chronic cough. These results came out as part of a multi-dose study conducted under the direction of a private U.S. drug development company, Seyltx, Inc., which recently acquired the ifenprodil research program from Algernon for US$2M and a 20% equity stake. The report stated that ifenprodil achieved a 93% reduction in median cough count in an acute guinea pig citric acid challenge study.

The study was designed to inform dose selection in Seyltx's planned Phase 2b ifenprodil human study, recently named SILINDA, in refractory chronic cough ("RCC"). Seyltx has also announced that patient enrollment in the study is expected to begin in early 2025.

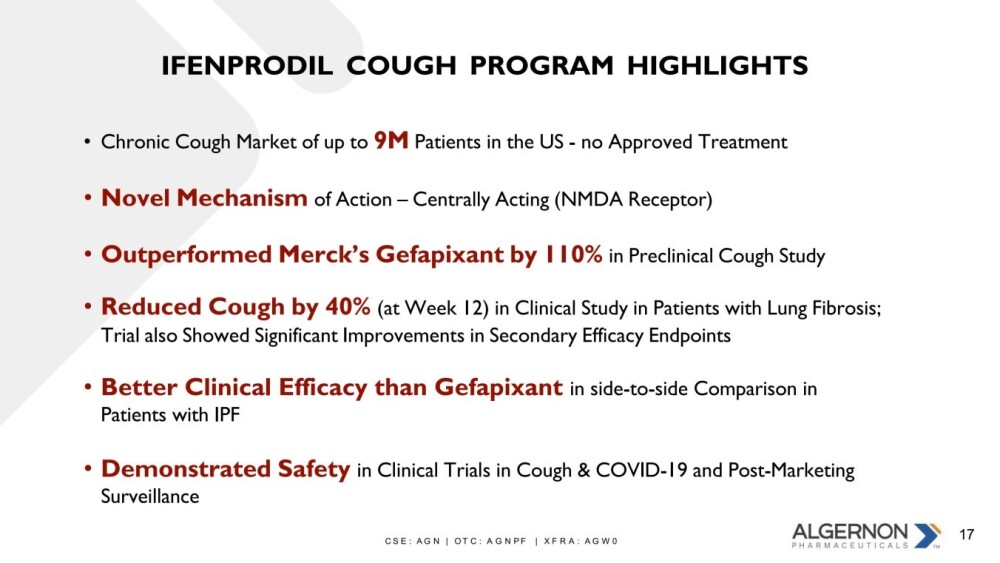

With this in mind, I wanted to give an overview of the company. Starting with chronic cough, chronic cough is a serious and widespread medical problem which is defined as a cough that lasts 8 weeks or longer in adults and persists despite treatment of the underlying disease and the treatment of it is big business.

For example, GSK bought out Bellus for $2 billion, which had developed the drug Camlipixant to combat chronic cough, as the following slide shows.

Merck bought out Afferent for $1.25 billion, which had developed the drug Gefapixant to combat chronic cough.

A lot of time, effort, and money goes into developing effective new drugs and treatments, which is why, when a company succeeds in developing them, big pharma companies are keen to buy them and prepared to buy them up at a good price, as we have seen in the examples above.

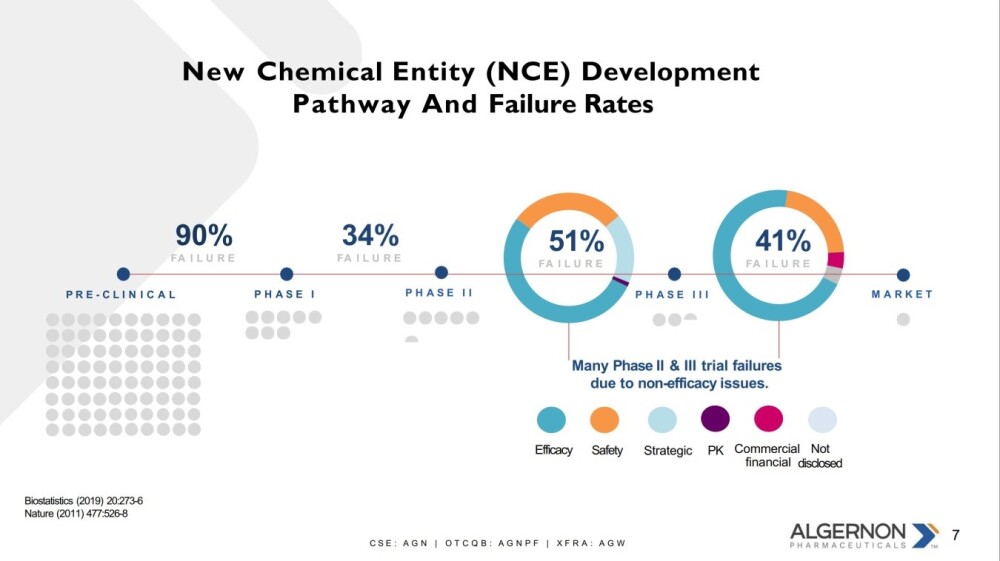

The development of new drugs and treatments is a long process that, even using a strict scientific approach, involves a lot of trial and error, and failure rates, particularly early in the process, are high.

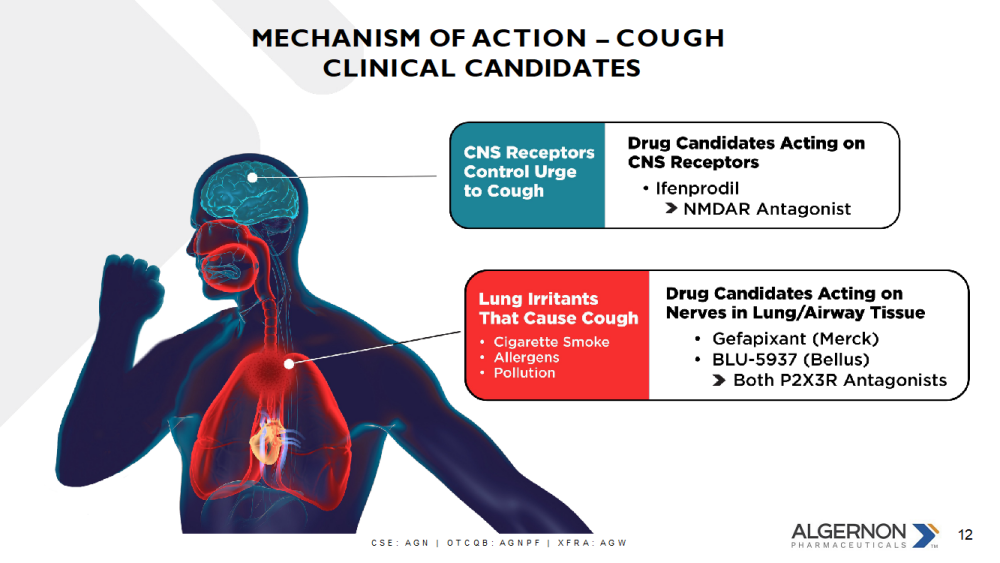

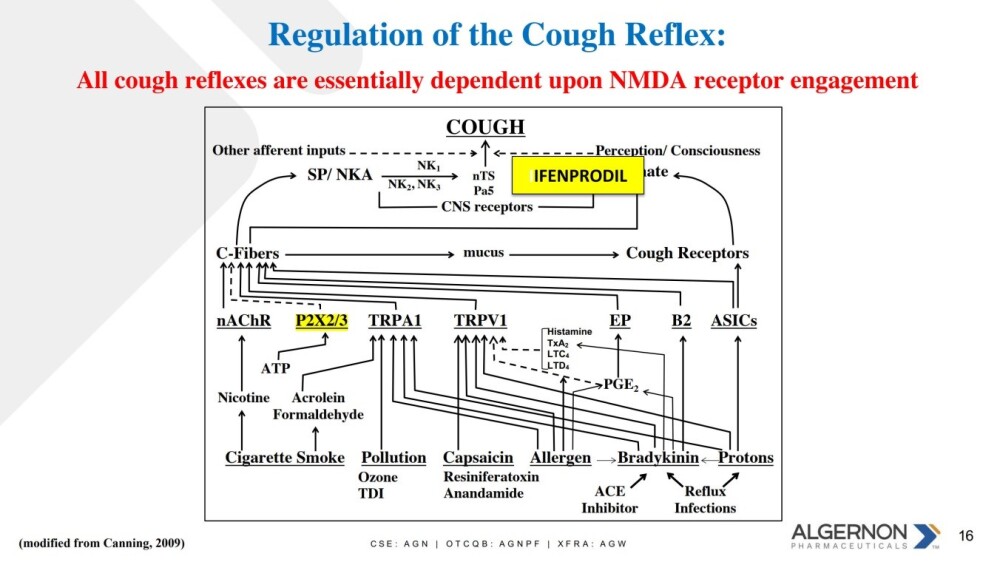

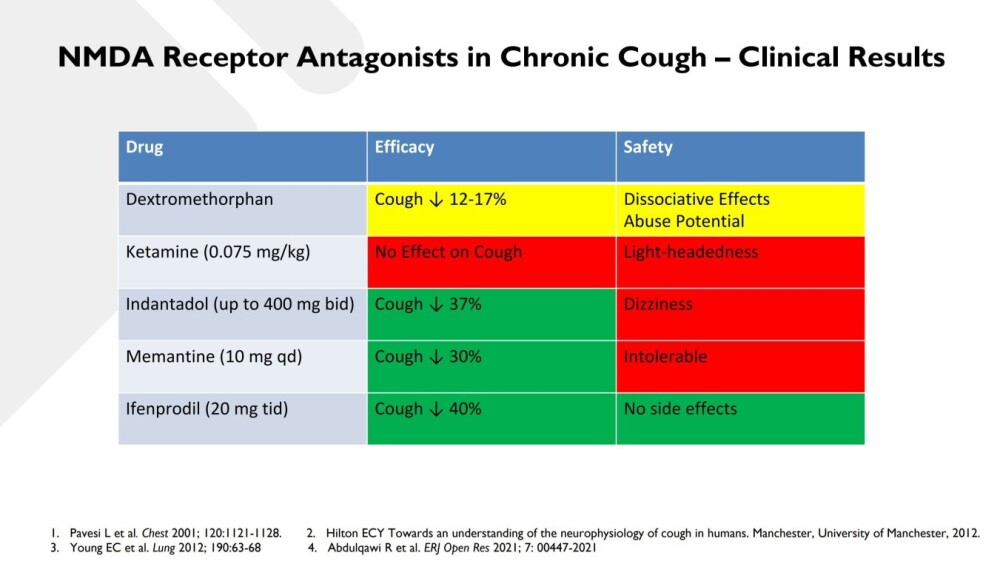

As shown on the following slide and mentioned above, Ifenprodil works on the CNS receptors to control the urge to cough in the brain. Bellus and Merck have already taken over companies that have developed drugs that act on nerves in the lung /airway tissue.

Here's where Ifenprodil comes into play.

And it has already demonstrated its efficacy.

And it's clearly more effective and safer than the other drugs on this list.

Algernon's Chronic Cough Research Program has already been sold for $2 million and a 20% equity stake.

Seyltx has also announced that patient enrollment in the study is expected to begin in early 2025, which gives some indication of the timing of the expected closing of the financing.

When Seyltx closes this financing, Algernon's equity value in Seyltx will increase accordingly. The financing will also signal that the SILINDA study will take place, which in itself will build value from the date the first patient treated until the full Phase 2b data set is reported.

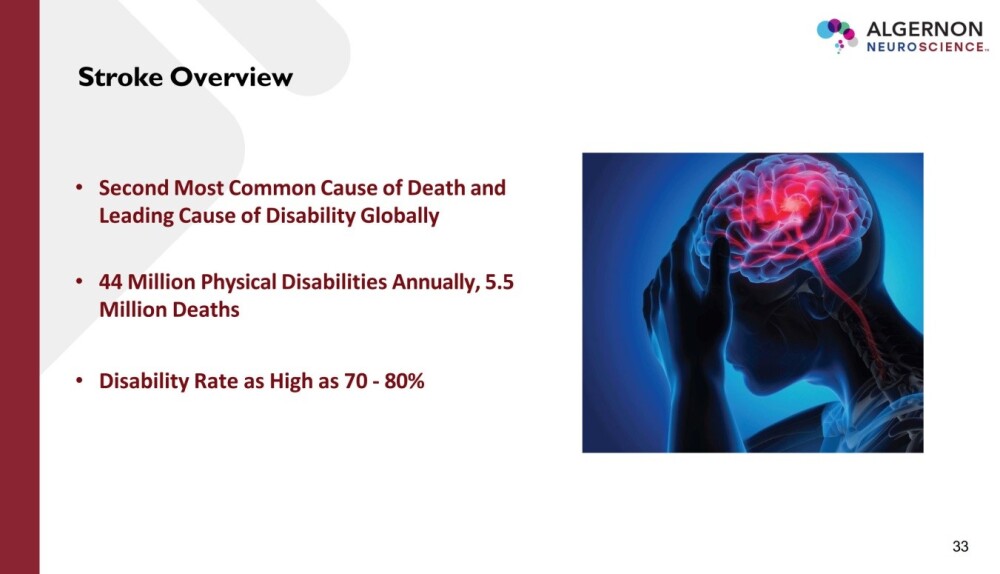

Algernon's other lead drug program is focused on treatment for strokes which it addresses through its 100%-owned Algernon Neuroscience subsidiary. The problems caused by strokes globally cannot be overstated as the following slide shows.

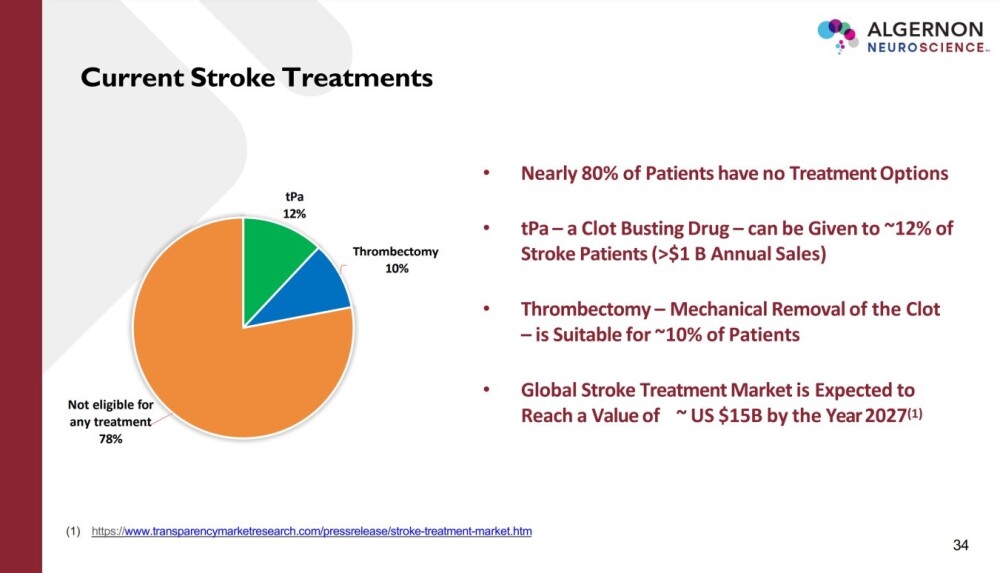

These are the current stroke treatments. . .

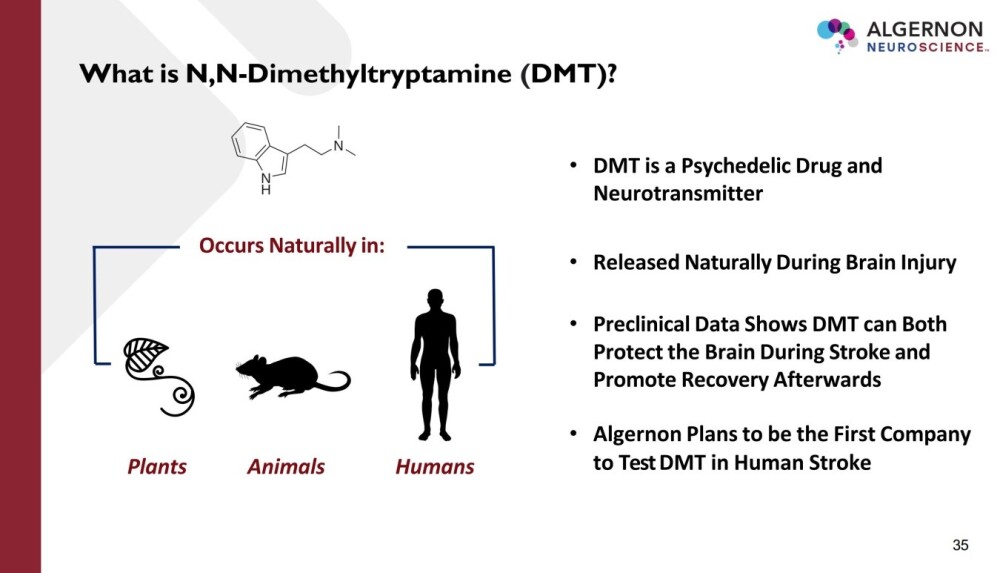

Algernon plans to be the first company to test the psychedelic DMT in treating human strokes.

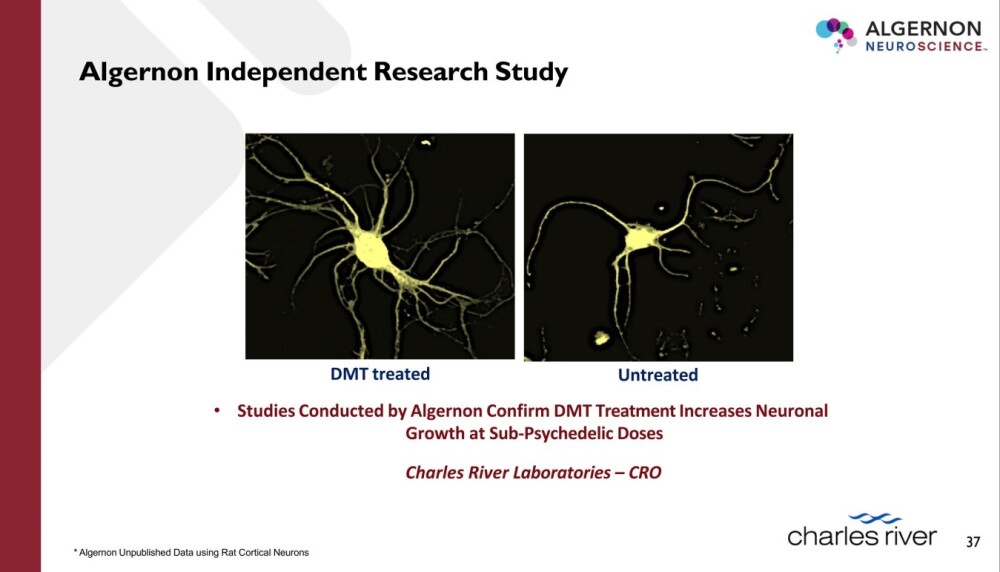

DNT treatment increases neuronal growth at sub-psychedelic doses.

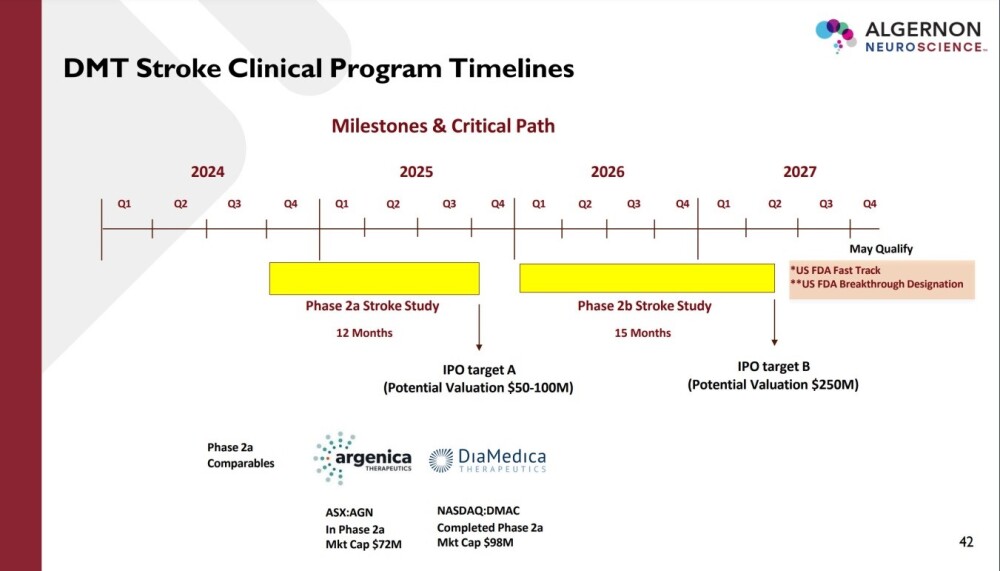

Here are the clinical program timelines for DMT.

So, in conclusion, we see that Algernon has two lead assets, being its 20% equity position in Seyltx, the U.S. company that acquired its ifenprodil cough program, and its wholly owned subsidiary Algernon Neuroscience, which is advancing DMT for stroke. This makes it very likely that it will either receive very substantial funding to further develop them and bring them to production or be bought out (taken over).

Either way, the result can be expected to be highly beneficial for its shareholders.

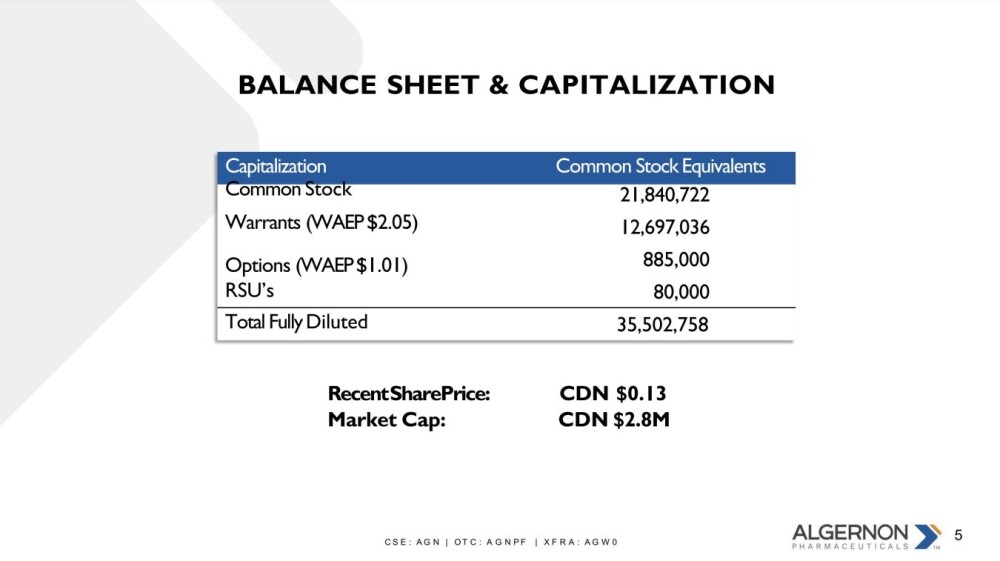

This slide shows the company's capitalization.

Lastly, this slide shows the company's biggest shareholders.

Now we turn to the charts to discover why Algernon at last looks ready to begin a major bull market.

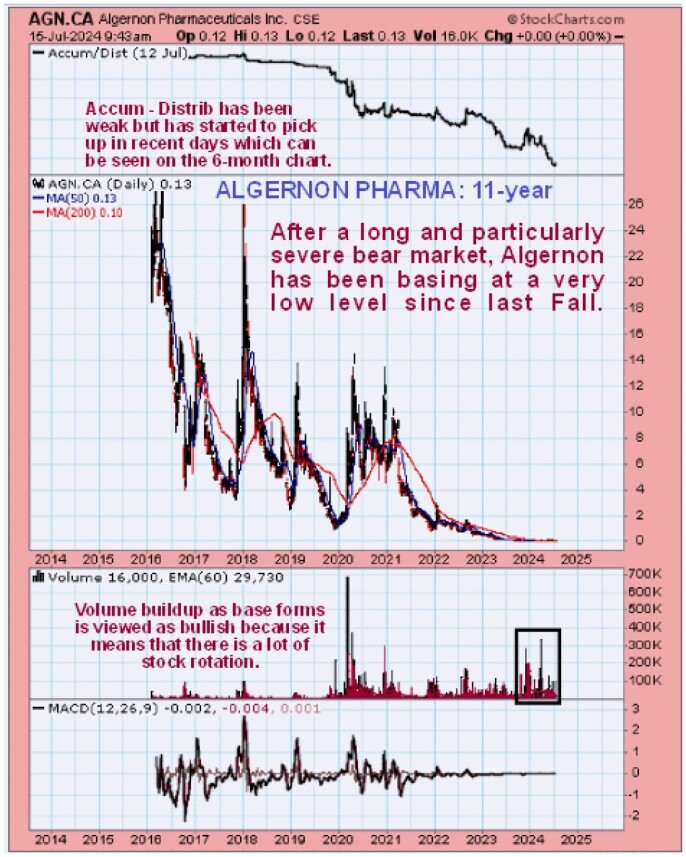

We start with the 11-year chart, which shows the entire history of the stock. On it, we can see that, apart from some wild swings, Algernon has essentially been in a bear market since its inception, and it has been a particularly severe one that has resulted in the stock dropping from a high at about CA$27 in 2016 to a low last November at just 5 cents, meaning that it had lost virtually all of its value and right now after starting to recover, it is still only at 13 cents.

It is not enough for us for the stock to be at a very low price — we need to see evidence that it is set to recover, and we will now proceed to see that on shorter-term charts.

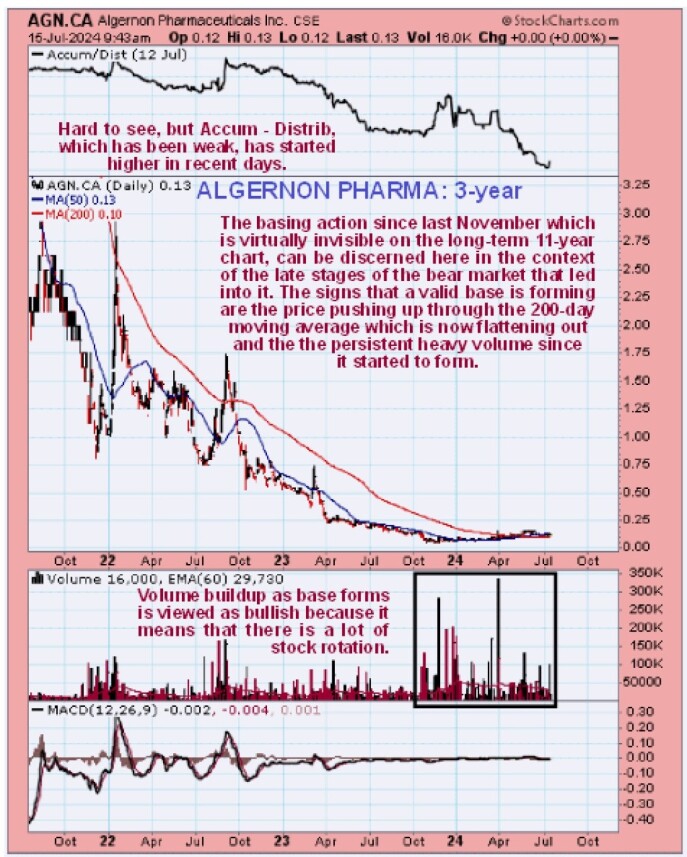

Zooming in via the 3-year chart enables us to see the basing action that has followed the descent into the lows during the latter part of the bear market last year. This basing action has been going on for long enough to allow the 200-day moving average to drop down close to the price and flatten out, a frequent prerequisite for a new bull market.

Another bullish factor to observe is the way that volume has built up as this suspected base pattern has formed. This shows that a relatively high quantity of stock has changed hands, which we can reasonably presume is from weak hands (selling for a loss) to stronger hands — investors who think that the stock is set to recover and will be less inclined to sell until they have turned a profit.

Turning now to the shorter-term 9-month chart allows us to see in detail all of the action from when the stock dove into the final low at 5 cents last November and the recovery that has followed. The action from the November low looks bullish. First, an Ascending Triangle formed, and the price broke out with a sharp stab higher on big volume towards the end of March.

Then, it consolidated for a while to allow its moving averages to converge, and in mid-May, it broke higher again with a technically significant move that took it well above its 200-day moving average. This advance quickly led to a bullish cross of the moving averages, and it got as far as resistance at the late March breakout move intraday high before a normal reaction set in that brought the price back to test support at the upper boundary of the earlier Ascending Triangle and near to the 200-day moving average and also at the lower rail of the tentative uptrend channel shown, and it is interesting to observe how the low for this corrective move was the intraday low of the large high-volume "spinning top" candle that formed on the June 21.

With a small base pattern forming in this area and the volume pattern increasingly bullish, a renewed advance up across the channel is to be expected soon.

This is, therefore, thought to be a very good point to buy, and Algernon Pharma is rated a Strong Buy here for all time horizons.

Algernon Pharma's website.

Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGN0:XFRA) closed for trading at CA$0.135, US$0.1028 on July 16, 2024.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algernon Pharmaceuticals Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.