Xplore Resources Corp. (XPLR:TSX; XPRCF:OTC) has been making moves as of late. On June 26, it was announced that Xplore Resources had finalized a deal they announced on June 6, 2024.

With this deal, Xplore Resources Corp. will grow its presence in the Root Lake area, which is known for its lithium deposits. Through this new deal, Xplore has the option to acquire the Root South property. This property is significant because:

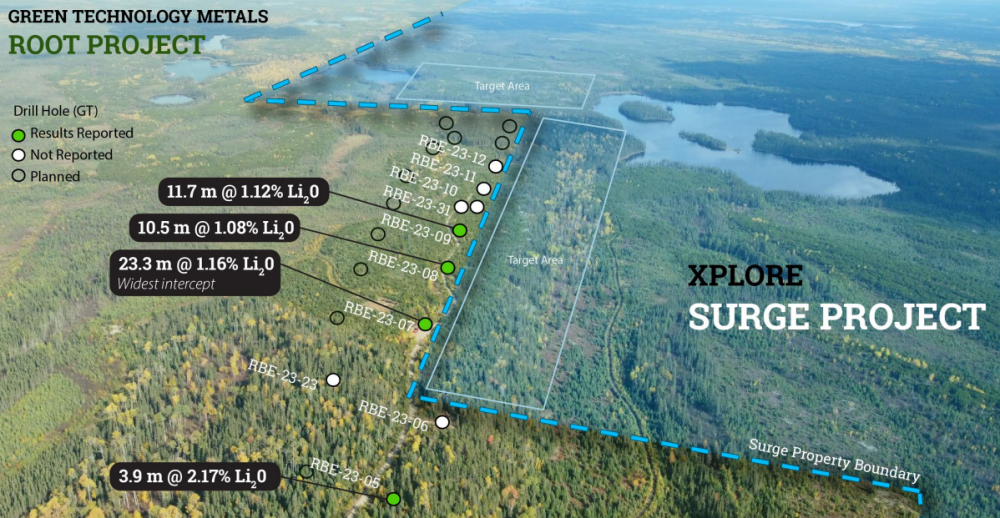

- It's right next to Xplore's existing Surge lithium project.

- It's also adjacent to Green Technology Metals Ltd.'s (GT1:ASX) Root Bay project. The Root Bay project is notable because it has a newly discovered lithium deposit. This deposit has been officially measured to contain 10 million tonnes of rock with 1.29% lithium oxide.

The Root South property that Xplore can now acquire is quite large. It consists of 175 individual claims and covers an area of 3,570 hectares (about 8,821 acres). This move will allow Xplore to potentially control more land in an area that's proving to be rich in lithium, which is a valuable mineral for battery production.

The agreement, made on May 30, 2024, is between Xplore Resources Corp. and three other companies: Lithium One Metals Inc. (LOMEF:OTCMKTS; LONE:TSX), and private companies Bounty Gold Corp., and Last Resort Resources Ltd.

In this deal, Lithium One Metals Inc. transferred all its rights and benefits from an earlier agreement to Xplore Resources Corp. This earlier agreement was made on December 20, 2022. Essentially, Xplore Resources Corp. is stepping into Lithium One's place in that original agreement from 2022.

In accordance with this deal:

- Xplore gets the right to buy 100% of certain mineral claims in Ontario, Canada. This right originally belonged to Lithium One.

- If Xplore starts producing minerals from these claims, they'll need to pay a 2% royalty to the original owners (Bounty Gold Corp. and Last Resort Resources Ltd.).

- Xplore has paid Lithium One CA$200,000 for this deal.

To complete the purchase of the mineral claims, Xplore needs to:

- Within a week of getting approval for this deal:

- Give 260,000 Xplore shares to the original owners

- Pay them CA$29,000 (they've already paid CA$19,000 of this)

- By January 11, 2025:

- Give another 530,000 Xplore shares to the original owners

- Pay them an additional CA$38,500

Xplore has also agreed to:

- Pay the 2% royalty to the original owners if they start producing minerals.

- They can reduce this royalty to 1% by paying the original owners CA$1 million.

Compelling Critical Metal Company

Headquartered in Vancouver, Canada, Xplore is an attractive investment opportunity for five reasons, Technical Analyst Clive Mand wrote in a May report. He listed them.

One, Surge spans 12,480 ha on the eastern extension of the Root Bay trend, near the Root South project, and is associated with lithium-bearing pegmatite at Green Technology Metals' newly discovered Root Bay deposit at its Root project, according to Xplore's 2024 corporate presentation. New results of Green Technology's drilling on its property near its border with Surge returned intercepts, including 23.3 meters (23.3m) of 1.16% lithium oxide (Li2O) and 11.7m of 1.12% Li2O.

Two, given the potential of its properties, Xplore is considered a likely takeout target, Maund pointed out.

Three, Xplore recently closed a financing, Maund wrote, "so this constraint on appreciation of the stock is no longer in play." Through a private placement, the company generated CA$2.1 million (CA$2.1M) in gross proceeds.

Four, the company plans to actively explore Surge.

The Catalyst: Start of Drilling

Xplore Resources President and CEO Dominic Verdejo expects a catalyst-filled period of growth ahead, he wrote in the release. The company told Streetwise that it has a seasoned team, a tight share structure, and an expert management team with extensive experience in the sector.

With permits now in hand, the Canadian explorer anticipates starting a 5,000-diamond drill program at Surge soon, which will be a critical phase for the company.

Details are yet to be released. Also slated for the project this year, according to its corporate presentation, are prospecting, mapping, and sampling, followed by outcrop stripping and, later in the year, generating additional drill targets.

Lithium Breakout Likely Soon

Maund's fifth reason for why Xplore is compelling is that a near-term rebound in lithium is likely after months of being in the doldrums. The expected breakout into a new bull market would rekindle interest in the sector.

Gerardo del Real, editor of Resource Stock Digest, wrote in a June 17 newsletter, "It's been a rough couple of months in the lithium space, but I do believe we're beginning to see a bottom."

Global demand for the critical metal is projected to continue its steady rise, which began in 2020, up to at least 2035, Statista data show. By then, demand will have reached an estimated 3,829,000 metric tons of lithium carbonate equivalent, a 317.5% increase over demand in 2023 of 917,000 metric tons.

The lithium market is projected to expand at a 20.4% compound annual growth rate (CAGR) to US$6.4 billion (US$6.4B) by 2028 from US$2.5B in 2023, according to Markets and Markets.

"Investors are going to need the best lithium stocks in their portfolio so that they can capitalize on the growing prices that growing demand is going to bring with it," wrote Managing Editor Jason Williams in the Wealth Daily newsletter last month.

Good Entry Point for Stock

Technical charts indicate Xplore's stock is at a good place to buy, Maund purported, and thus he rated it a "Strong Speculative Buy for all timeframes."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Xplore Resources Corp. (XPLR:TSX; XPRCF:OTC)

He relayed that the stock, which began trading in 2017, has hit two bottoms, one in late 2022 and the other a year later. Subsequently, however, it rebounded and rose to CA$0.20 per share. Since, the stock has been in a wide trading range, the pattern of which has taken the shape of a diamond.

"Diamonds can be either consolidation patterns or tops," explained Maund. "In the case of Xplore, this diamond is thought to be the former, a consolidation pattern that will lead to renewed advance."

Ownership and Share Structure

According to Reuters, management and insiders own 4.87% of shares. The rest is with retail.

Xplore has a market cap of CA$ 5,534,000 and 50,311,505 outstanding shares. According to Market Watch, it trades in the 52-week range between CA$ 0.08 and CA$0.20.

| Want to be the first to know about interesting Critical Metals and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Xplore Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Xplore Resources Corp.

- Katherine DeGilio and Doresa Banning wrote this article for Streetwise Reports LLC and provide services to Streetwise Reports as an independent contractor/employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.