Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) is viewed as an outstanding investment opportunity here for the simple reason that, as we will see in due course on its charts, it has virtually no downside and a whole lot of upside — and that will be the case regardless of what the sector as a whole does.

Before looking at the stock charts, we will swiftly go over the fundamentals of the company, which will be assisted by slides from its latest investor deck.

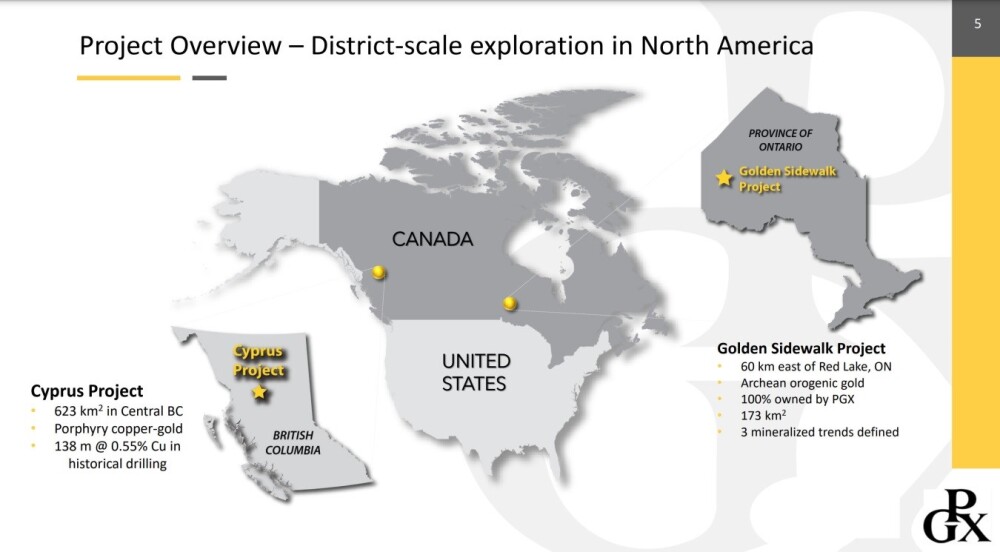

The company has two potential District Scale projects ongoing in Canada, the one in British Columbia in the west being the Cyprus Project which covers an impressive 623 square kilometers and the one in the center of the country being the Golden Sidewalk Project which is 60 kms east and Red Lake and has a land area of 173 square kilometers as show non this slide.

We do not normally dwell on personalities in these reports, but before going any further, this is a good point to mention that Prosper Gold has an experienced and outstanding management team.

This team includes Peter Bernier, an experienced prospector who in 2005 created Richfield Ventures. They made a major find in central B.C., for by mid-2010, drilling had defined a significant bulk tonnage deposit.

An initial resource estimate (indicated and inferred) containing 4.2 million ounces of gold was announced in March of 2011, and to cut a long story short, Richfield was bought out by New Gold in 2011 for $550 million, and New Gold has continued to advance the project as a potential large scale open pit mine.

You can read the full story about this discovery in Award Winning Team.

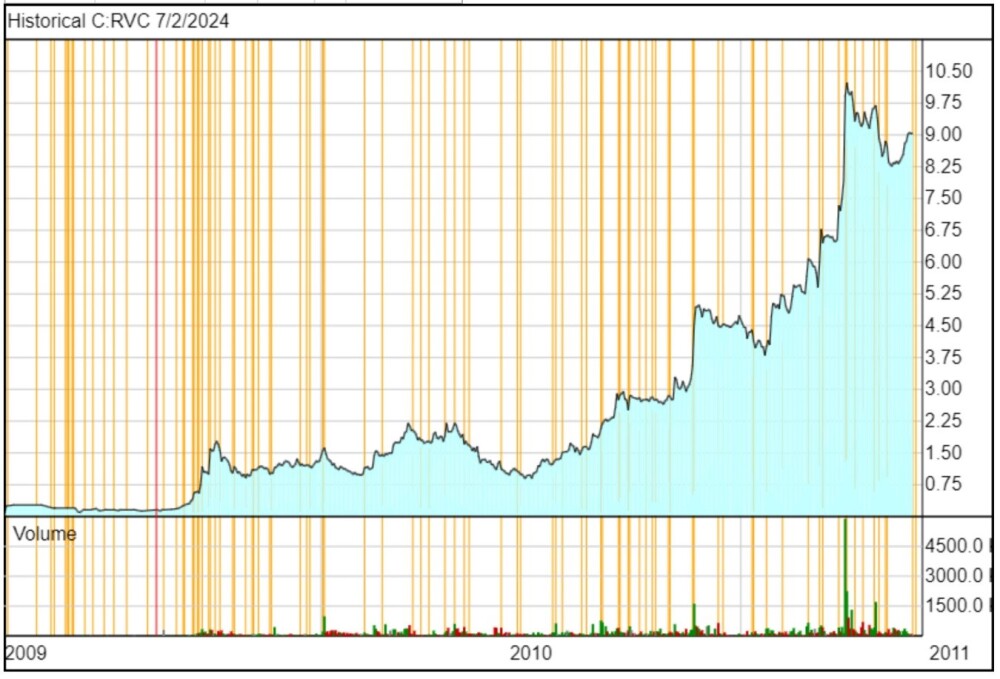

Needless to say, the effect of the discovery and the subsequent buyout on Richfield's stock was spectacular, as the following chart of it from the time shows.

The point is that people of this calibre are not going to mess around with something that has little potential which means that as they are part of the management team of Prosper Gold, it clearly has a very good chance of making a significant discovery or discoveries. After all, if Peter Bernier can do what he did with Richfield Ventures once, he can do it again.

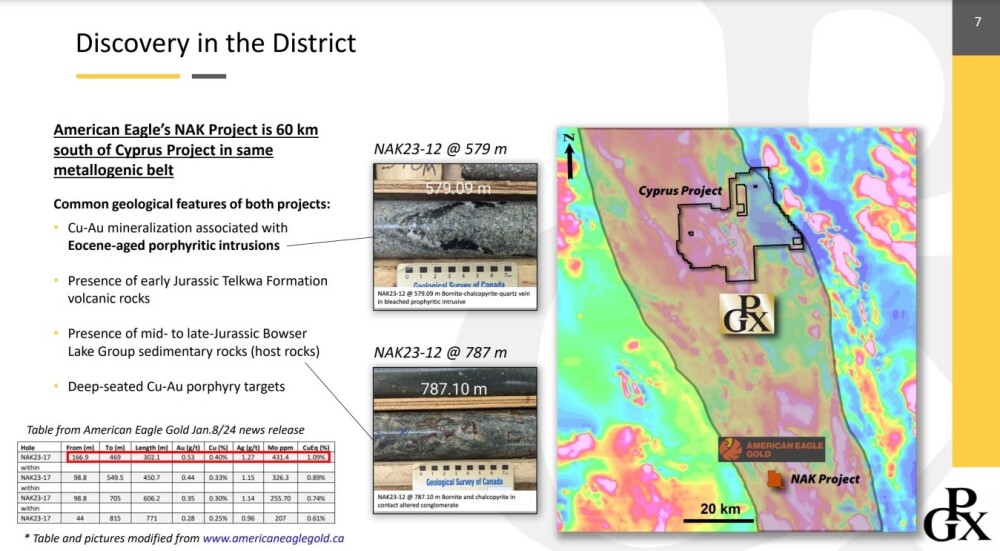

Before considering the Cyprus Property itself, it is worth noting that it is not far away from American Eagle Gold Corp.'s (AE:TSXV) NAK Project, which is 60 km to the south in the same metallogenic belt, where significant discoveries have been made. Whilst this doesn’t guarantee the same sort of results at Cyprus, it certainly augurs well.

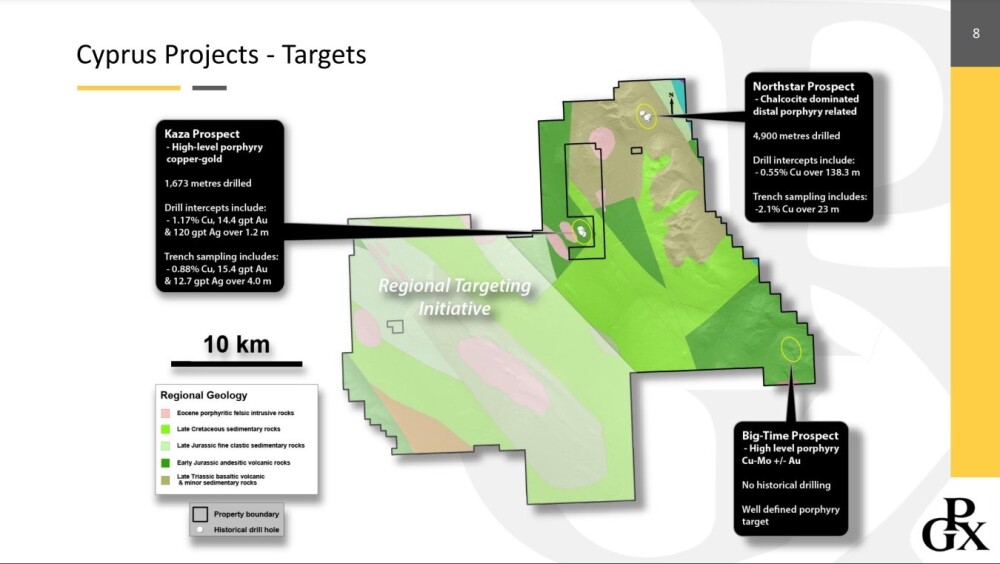

The following slide shows the geography of the Cyprus Project and details the main prospects within it.

Back in February, the company announced a massive expansion of this project to a land position of 61,880 hectares so that it is now one of the largest in the region. This is viewed as a very positive sign since the company would not have done this without good reason, and this announcement followed soon after the company entered into an option agreement to acquire 100% of the project.

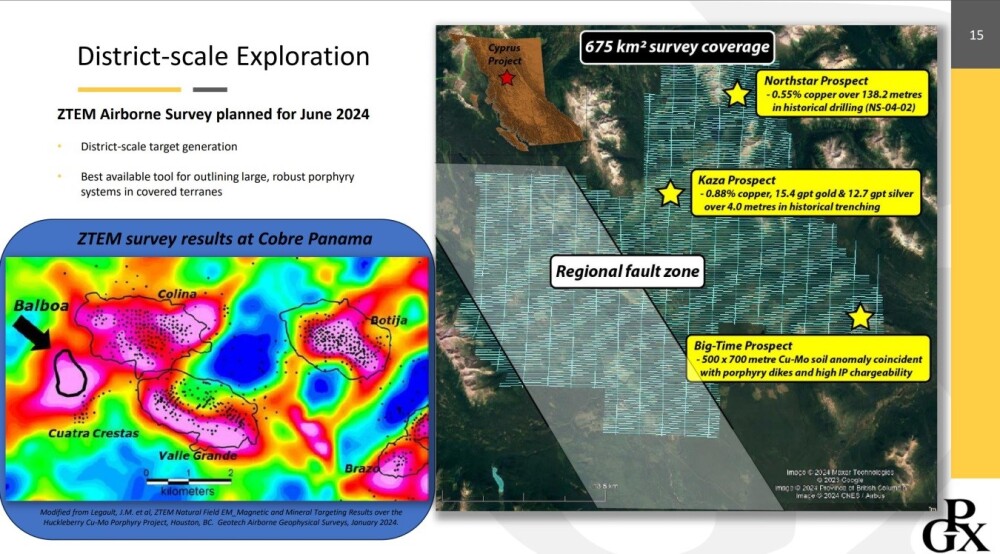

The company is currently undertaking a ZTEM aerial survey of the Cyprus Project and, pending results from this survey, could act as a catalyst for the share price. The next slide shows what such a survey uncovered at Cobre Panama.

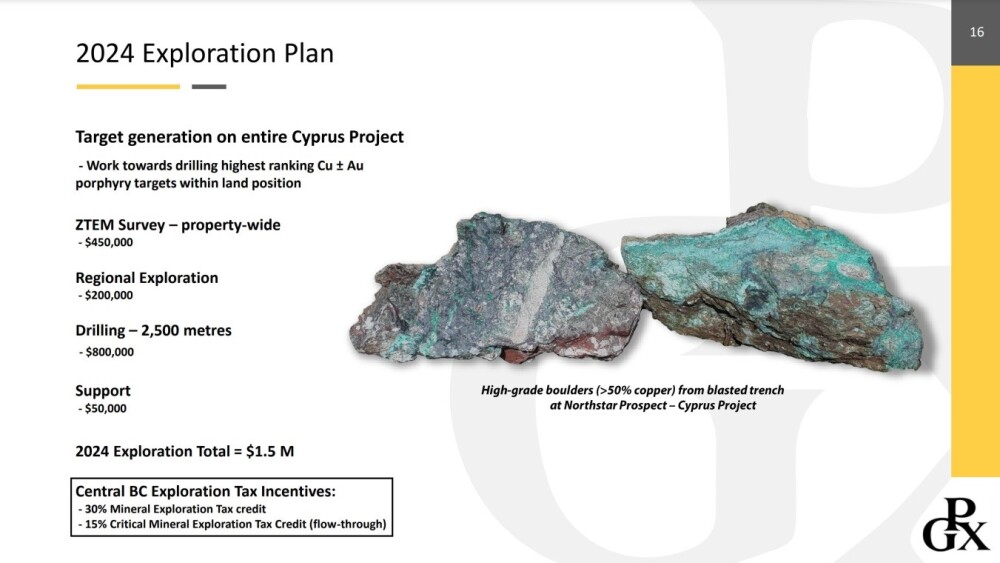

This next slide summarizes the 2024 Exploration Plan.

This last slide shows the share structure, and on it, we see that of the 40.8 million shares in issue, about 60% are in the float, meaning less than 30 million, which is a very reasonable figure given how long the company has been around.

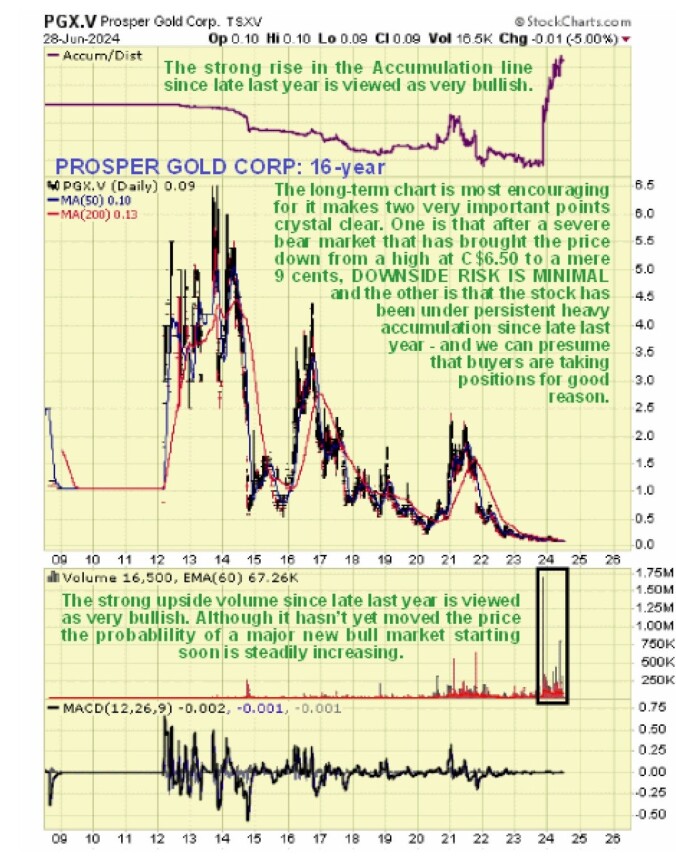

Now we will proceed to review the charts for Prosper Gold, on which we will quickly see that the case for buying the stock here could not be clearer or stronger, although as this is not a "momentum play" at this juncture, the emphasis is on accumulation rather than looking for quick speculative gain.

The long-term 16-year chart shows the entire history of the stock, and on it, we can see two points that, taken together, make a compelling case for buying the stock now. The first is that the long severe bear market from late 2013, which was punctuated by a couple of large and deceptive bear market rallies, has brought the price down from a high of CA$6.50 to a mere 9 cents, which means it is extremely cheap.

The second point is that the stock has been under persistent accumulation since late last year, with predominantly upside volume driving the Accumulation line, shown at the top of the chart, steeply higher in a rather spectacular manner. This is very bullish and is a sign that a major bull market is incubating.

What this means, in a nutshell, is that, for a stock of its type, Prosper Gold is a very low-risk investment with a very big upside potential.

The 5-year chart shows the latest leg of the bear market from the 2021 twin peaks, which has been severe, and how the rate of decline has slowed, not unnaturally, as the price has approached 0.

The most important point to observe on this chart is the big buildup in volume from last November through to the present, which is revealed to have been largely upside volume by the steeply climbing Accumulation line. This is very bullish and is an indication of the "Smart Money" position-taking ahead of a major new bull market in the stock.

It also means that once all available supply at this level has been soaked up, the price will take off higher. So buyers or would-be buyers now can be thankful that it has not already started to move.

An 8-month chart enables us to see that the decline was arrested by heavy buying back last November that temporarily led to the price breaking clear above both its main moving averages in January, but because it was not yet ready to begin a new bull market, it has drifted back down again to form a Double Bottom in recent months with the November lows.

Even though the second low of the Double Bottom was marginally below the first low in November, the marked predominance of upside volume since November that has driven the Accumulation line strongly and steadily higher is a powerful indication that a valid Double Bottom is forming and clearly, if this is the case, we are at an excellent point to buy the stock here, which has trivial downside and potentially huge upside from here.

A final point to make here is that this is not a "momentum play." Buyers should not expect it to go roaring up a few days after purchasing it, although it could. The emphasis is on accumulation at very low prices.

Having said that, the risk / reward ratio is exceptionally favorable now, with the potential to make huge percentage gains from the current level, especially if a significant discovery is made.

Prosper Gold Corp is therefore rated an Immediate Strong Buy for all time horizons.

Prosper Gold Corp.'s website.

Prosper Gold Corp. (PGX:TSX.V; PGXFF:OTC) closed for trading at CA$0.095, US$0.06 on July 2, 2024

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.