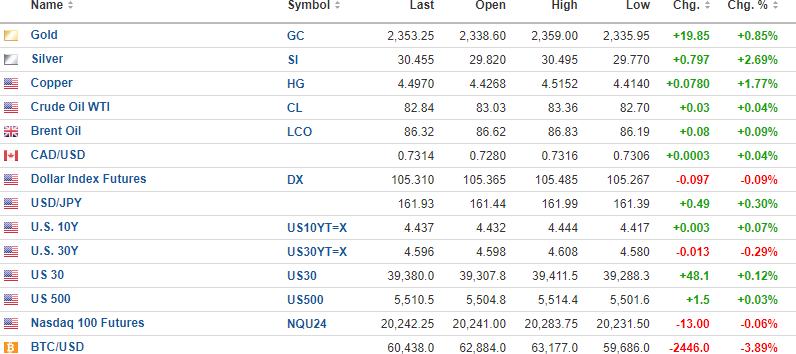

USD index futures are lower, taking gold (+.85%), silver (+2.69%), copper (+1.77%), and oil (+.04%) all higher.

Stock index futures are mixed. Bitcoin is down. U.S. markets close early (1:00 p.m.) and are closed tomorrow in celebration of U.S. Independence Day.

Jerome Powell spoke yesterday in Portugal and hinted at a "disinflationary trend" in the U.S. economy, which sent yields lower and stocks higher on optimism for a July rate cut.

SPDR Gold Shares ETF (GLD:NYSE)continues to oscillate between $215 and $220 (August Gold $2,330-2,380). With this morning's move above $216.19 (50-dma), it will probably head up to the $220 level (August Gold $2,380) before hitting any real supply. I should be trading this $5 range rather than simply holding the puts, but for now, I will wait to see if this rally gets fades by the 1:00 p.m. close and then decide whether to bail.

The month of July marks the beginning of the "Worst Four Months" of the year for the NASDAQ and that seasonality weighs favourable on my QQQ put position which still have a 45-day window until expiry.

Fitzroy Minerals

Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) closed at a new recovery high at CA$0.17 and is about to attract a new audience as CEO Merlin Marr-Johnson is set to be interviewed by a high-visibility podcast host shortly.

I am also getting inquiries from a U.S. group that has been largely absent from the Canadian junior resource group since 2021. They love what they are hearing about the recent FTZ acquisition (Buen Retiro) and wanted further clarification on the structure of the deal and funding plans.

There is substantive institutional interest in Buen Retiro that will allow the company to step up aggressively to further delineate the size and scale of this copper-gold ore body.

The chart would suggest that FTZ/FTZFF is getting somewhat overextended on a near-term basis, but I would contend that valuation is going to trump all technical considerations when the larger institutional investors finally get a glimpse of the Buen Retiro story. I think this company is close to getting into the acquisition loop by the same investor group that took Los Andes

Copper from CA$2.00 in 2020 to CA$19.00 by Summer 2023. Retail participation by the Millennial and Gen-X demographics has been muted at best, but that may be changing as copper-gold still reigns supreme as the "GO-TO" asset mix for 2024 and beyond.

| Want to be the first to know about interesting Critical Metals, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.