Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA) announced more brine assay results from its 15-hole Phase I shallow Geoprobe drill program at its Columbus Lithium-Boron Project near Tonopah, Nevada.

The company said it has now received all brine assays from the completed program with clay assay results pending for nine holes.

Canter said the results returned the highest grades to date, with the latest brine assay results including concentrations up to 3,140 mg/L (milligrams per liter) boron (B) and 76.4 mg/L lithium (Li).

The program also found two shallow aquifer horizons (less than 30.5 meters) that were intersected at similar depths in most of the drill holes.

"The latest brine results from this shallow interval have provided us with valuable geochemical data for our 3D model and deeper targeting, while consistently intersecting shallow aquifer zones and demonstrating the multi-commodity upside at Columbus," said Chief Executive Officer Joness Lang. "The exceptional boron grades near surface show significant mineral resource potential in the upper levels of the system, and the increasing downhole lithium concentrations further support our model and deeper drilling plans."

"The latest brine results from this shallow interval have provided us with valuable geochemical data for our 3D model and deeper targeting, while consistently intersecting shallow aquifer zones and demonstrating the multi-commodity upside at Columbus," said Chief Executive Officer Joness Lang. "The exceptional boron grades near surface show significant mineral resource potential in the upper levels of the system, and the increasing downhole lithium concentrations further support our model and deeper drilling plans."

Lang said the company plans a 10-hole follow-up Phase II drilling program in the coming weeks.

After Canter released the earlier high-grade results from the exploration campaign last month, Jeff Clark, author of The Gold Advisor, summed up his evaluation of the drilling in two words: "They hit."

"These first set of results showed there are strongly mineralized lithium-boron clays and boron-rich brines from shallow aquifers over 2 kilometers in strike," Clark wrote. "Elevated boron at or near surface is a good pathfinder for lithium at greater depth (where Canter's primary lithium-brine targets are), but management believes the shallow boron results are significant on a standalone basis."

In a recent video interview with Strategic Advisor Michael Gentile on Blaze Capital, Lang said the company sees the "potential to define significant boron mineralization domestically as a tremendous opportunity. We are just getting started with our phased drilling approach and look forward to more results from Phase I before probing deeper in subsequent campaigns set to commence in early Q3/2024."

A Dynamic Geochemical System

Based in Vancouver, British Columbia, Canter Resources is a junior lithium, boron, and critical metals explorer with two properties, now focused on advancing Columbus, its flagship asset.

The six new assay results at depths greater than 16.8 meters in the central grid of drill holes averaged 558 mg/L B, with two 651 mg/L B samples collected at 26.2 meters and 28.3 meters.

Canter also said higher-grade boron- and lithium-enriched brines were encountered in drilling located more than five 5 kilometers west of the central grid, demonstrating the potential for lateral continuity of individual aquifer horizons and widespread mineralization.

The company said the results pointed to a dynamic geochemical system in which boron preferentially precipitates in shallow zones, with the primary target zones for significant lithium concentrations remaining at greater depths in deeper aquifers and structural traps.

The brine results have been incorporated into the company's 3D model of the project and are being analyzed to help with deeper drilling there.

"The company's general thesis at Columbus, supported by deposit analogues plus historical and new data at the project, suggests boron-rich upper levels, overlapping transition zones (potential for both elevated lithium and boron concentrations), followed by an increase/decrease in lithium and boron, respectively, in deeper aquifer zones," Canter said in a release.

The Catalyst: Important Markets

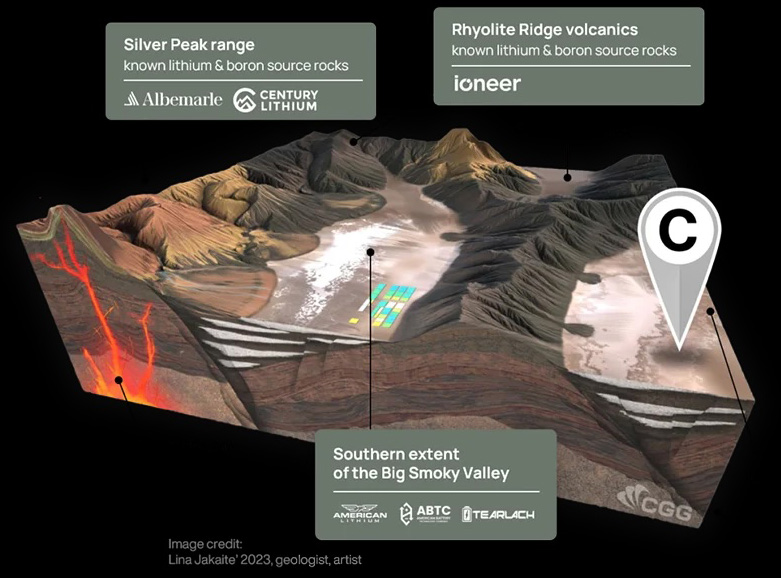

Canter said the presence of high-grade boron mineralization is "potentially significant" as the project hosted historical borax production and shares the same volcanic structure as Ioneer's Rhyolite Ridge Lithium-Boron Project.

"The boron market is rapidly emerging as a critical mineral due to its use in numerous high-tech and clean energy applications," the company noted.

Boron/borates are used in applications in agriculture, metallurgy, nuclear energy, and advanced materials, Mordor Intelligence noted. The increasing use of fiberglass in various end-user industries is also boosting demand for the element. According to the U.S. Geological Survey, borates are also used in abrasives, cleaning products, insecticides, insulation, ceramics, and semiconductors.

Demand for boron "is strong and growing with CAGR exceeding most forecasts of just a few years ago," Hallgarten + Co. also wrote. Further, demand is expected to outpace supply, thereby resulting in a fairly rapid widening of the gap between the two.

The Business Research Co. reports the global boron market has grown "exponentially in recent years" and forecasts it will reach US$7.99 billion this year, up from US$6.57 billion in 2023, reflecting a 21.7% CAGR. Rapid growth is expected to continue through 2028, at which time the market is projected to reach US$12.68 billion.

"Major trends in the forecast period include a focus on boron neutron capture therapy, boron in the aerospace industry, boron-based flame retardants, boron in nuclear power applications, sustainable mining practices," the report indicated.

Lithium is an important part of the energy transition as an important element in electric vehicle (EV) batteries and energy storage systems. It also strengthens alloys and serves as a high-temperature lubricant.

China dominates the market. According to Fortune Business Insights, it was worth US$22.19 billion in 2023 and is projected to grow to US$134.02 billion by 2032 at a compound annual growth rate (CAGR) of 22.1%.

"The growing adoption of hybrid and electric vehicles, high-drain portable electronics, and energy storage systems have boosted the growth of the overall market," Fortune Business Insights analysts wrote. "The increasing awareness of electric vehicles is attributable to the growing concerns about surrounding environmental pollution as EVs reduce carbon emissions . . . Li-ion batteries will likely play a major role in the highly electrified transport sector."

Lithium-ion batteries are "a crucial component in cleaning up the environment," the analysts said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA)

Ownership and Share Structure

According to the company, managers and insiders own about 9.6% of Canter Resources, and strategic investors (including the founding group and Michael Gentile & Advisors) own about 12%.

The investors with the largest stake are all insiders.

They are CEO and Director Joness Lang with 3.3%, Director and Strategic Adviser Warwick Smith with 2.14%, Director and Technical Adviser Kenneth Cunningham with 1.95%, Chief Financial Officer Alnesh Mohan with 0.97%, and Director and Technical Adviser Eric Saderholm with 0.58%, and Gentile, who owns about 4% personally.

Four institutions or funds, including Euro Pacific Asset Management, collectively hold 3%. Retail investors own the remaining.

The Canadian explorer has 51.29 million outstanding shares, 46.45 million free float traded shares with a CA$9.23 million market cap.

Over the past 52 weeks, Canter has traded between CA$0.07 and CA$0.99 per share.

| Want to be the first to know about interesting Critical Metals, Cobalt / Lithium / Manganese and Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Canter Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canter Resources Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.