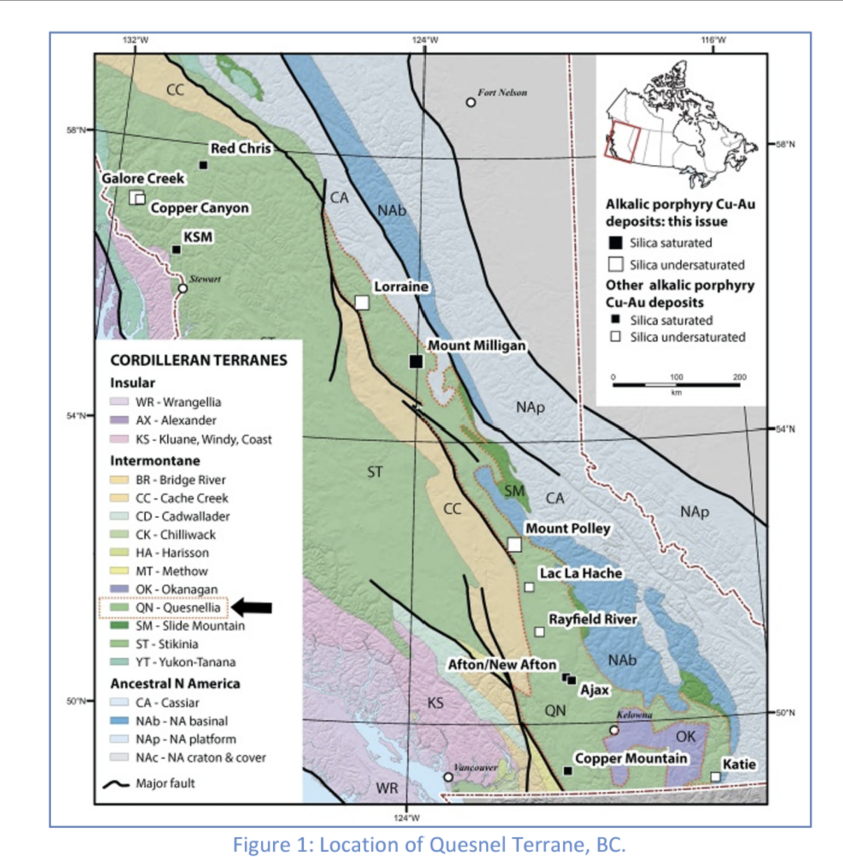

The Quesnel Trough, located in British Columbia, is a region of immense geological and economic significance. It is home to some of the most substantial copper and gold porphyry deposits in the world, making it a critical area for mining activities in Canada.

This article explores the importance of the Quesnel Trough, highlighting two promising exploration companies — Kodiak Copper Corp. (KDK:TSX.V)and American Eagle Gold Corp. (AE:TSXV) — and emphasizing the vital role copper plays in the economy of British Columbia and Canada.

Geological Significance

The Quesnel Trough, also known as the Quesnel Terrane, is an arc of volcanic sedimentary rocks from the Triassic-Jurassic period.

This region hosts several significant copper-gold porphyry deposits, including those currently being mined at Mount Milligan and Mount Polley. Geoscience BC, in collaboration with the BC Geological Survey, initiated a major program in 2007 to build a comprehensive geoscience database over the Quesnel Trough. This extensive data set facilitates the discovery of hidden resources, making it one of the most detailed in North America.

Geological Significance of Porphyry Deposits

Porphyry deposits are essential because they contain large quantities of copper and gold, often found together. These geological formations consist of granites or other igneous rocks with large, coarse-grained crystals set in a fine-grained, silicate-rich matrix.

The unique geological environment allows for the concentration of metals in economically viable quantities, making these deposits highly valuable for mining companies.

Strategic Importance in British Columbia

British Columbia is renowned for its rich mineral endowment, particularly its porphyry copper-gold deposits. These deposits are strategically important for several reasons:

- Large Reserves: British Columbia's porphyry deposits contain substantial reserves of copper and gold, ensuring long-term production capabilities. This makes them valuable assets for mining companies, providing significant quantities of these metals over extended periods.

- Stable Jurisdiction: The province offers a stable and favorable mining jurisdiction with an established infrastructure, supportive regulatory frameworks, and skilled labor. This reduces operational risks compared to regions with more volatile political or economic conditions. Approximately 80% of Canada's copper production comes from British Columbia, underscoring the province's dominance in the industry.

- High-Quality Ore: The ore quality in British Columbia's porphyry deposits is generally high, leading to more efficient and cost-effective extraction processes. Higher-grade ores require less processing and yield more metal, enhancing profitability.

Key Mines and Their Contributions

Several major mines in British Columbia highlight the region's significance:

- Gibraltar Mine (Taseko Mines): One of North America's largest open-pit copper mines, Gibraltar plays a crucial role in copper production, contributing significantly to the regional and national economy.

- Mount Polley (Imperial Metals): Known for its high-grade copper-gold porphyry deposit, Mount Polley remains a key player in British Columbia's mining landscape despite past operational challenges.

- Copper Mountain (HudBay): This mine is recognized for its substantial copper production and has undergone expansions to increase output and extend the mine's life.

- Highland Valley Copper (Teck): As the largest open-pit copper mine in Canada, Highland Valley Copper is crucial for the industry, employing advanced mining and processing technologies to maintain high production levels.

- Red Chris (Newmont): Notable for its large-scale copper-gold porphyry deposit, Red Chris, jointly operated by Newcrest and Imperial Metals, has significant exploration potential.

- New Afton (New Gold): Known for its efficient underground mining operations, New Afton produces both copper and gold, with modern infrastructure and innovative approaches contributing to its productivity.

Economic and Strategic Benefits

- Production Volume: These mines collectively contribute approximately 80% of Canada's copper production, solidifying the country's position in the global copper market and ensuring a steady supply of this essential metal.

- Economic Impact: The mining sector in British Columbia generates substantial revenue, provides employment, and stimulates local economies. It also attracts significant investment in infrastructure and technological advancements.

- Global Relevance: As global demand for copper increases, particularly driven by electrification, renewable energy technologies, and electric vehicles, British Columbia's copper production becomes increasingly critical.

Copper Market Fundamentals Driving Higher Prices

Several factors collectively support a bullish outlook for the copper market, indicating higher prices and sustained demand growth:

- Demand Surge: The transition to clean energy and electrification is significantly increasing the demand for copper. This includes its use in electric vehicles, renewable energy systems, power grids, and public transportation systems. The need for copper is expanding beyond traditional uses in construction and electronics to new areas essential for a green economy.

- Supply Crunch: There is a projected massive shortfall in copper supply by 2025 due to the lengthy and expensive process of developing new mines and prolonged periods of underinvestment in exploration. Mergers and acquisitions have been the preferred method for increasing reserves, slowing the industry's response to rising prices and exacerbating supply constraints.

- Resource Nationalism: Political instability and resource nationalism in key copper-producing regions can disrupt supply chains and elevate costs. Recent examples include disruptions in Peru and Panama, where government actions and protests have significantly impacted copper production.

- Environmental Concerns: Stricter environmental regulations and opposition to new mining projects delay the development of new copper mines. This regulatory environment complicates the expansion of copper production needed to meet the growing demand from the green energy transition.

- Inflation: Persistent inflation, driven by supply shortages and rising demand for electric vehicles, renewable energy technology, and AI, will continue to put upward pressure on copper prices. Additionally, future monetary policies, such as potential interest rate cuts by the Federal Reserve, could further weaken the U.S. dollar and boost commodity prices, including copper.

Kodiak Copper: Discovering Tomorrow's Copper Today

Kodiak Copper Corp. (KDK:TSX.V) is an exploration company focused on discovering new copper supplies in British Columbia, with a strategic emphasis on responsible and sustainable exploration.

- Strategic Assets: Kodiak Copper focuses on large-scale, underexplored assets in low-risk jurisdictions. Their primary project, the MPD Copper-Gold Project, is located in southern British Columbia. This recently consolidated porphyry project has district-scale potential and is road accessible with excellent infrastructure.

- Significant Discoveries: Drilling to date has proved extensive and high-grade mineralization at several porphyry centers, with multiple targets yet to be tested. The 2024 drill program is set to test multiple targets, building critical mass.

- Innovative Exploration: Kodiak Copper utilizes AI technology to optimize exploration and increase efficiency, a forward-thinking approach that sets them apart.

- Strong Financial Position: With a strong capital structure, $2M in cash (currently raising 2024 exploration funds), and Teck Resources as their largest shareholder (holding 9.9%), Kodiak Copper is well-positioned for growth.

American Eagle Gold: Promising Discoveries at the NAK Property

American Eagle Gold Corp.'s (AE:TSXV) NAK Property, located within the Babine copper-gold porphyry district of central British Columbia, showcases the region's rich mineral resources and excellent infrastructure.

- Proximity to Historic Mines: The NAK Property is near the past-producing Bell and Granisle open-pit copper-gold mines.

- Historical and Recent Drilling: Historical drilling since the 1960s identified a substantial near-surface copper-gold system. Recent drilling campaigns by American Eagle Gold in 2022 and 2023 have uncovered significant intervals of high-grade copper-gold mineralization, indicating deeper and more extensive zones than previously known.

- Significant Drill Results: Notable drill results include 302 meters of 1.09% Copper Equivalent within 606 meters of 0.74% Copper Equivalent and 900 meters of 0.50% Copper Equivalent from the surface.

- 2024 Exploration Program: The fully funded exploration program aims to prioritize high-grade mineralization areas, connect historical North and South Zones, extend exploration, and investigate untested targets. Teck Resources' 19.9% interest in American Eagle Gold underscores the project's promising future.

Conclusion

British Columbia's copper and gold porphyry deposits are vital to the global copper market due to their large reserves, high-quality ore, and strategic location. Major mining companies are drawn to these deposits because of their economic viability, significant production capacity, and potential for future expansion.

The continued development and operation of these mines ensure that British Columbia remains a key player in the global copper supply chain. Investing in companies like Kodiak Copper and American Eagle Gold offers strategic entry points into the booming copper sector, leveraging favorable market conditions and provincial support to deliver significant value and growth.

This article aims to provide a comprehensive overview of the importance of the Quesnel Trough and its contributions to the mining industry in British Columbia, promoting the potential of Kodiak Copper and American Eagle Gold as key players in the region's mining landscape.

| Want to be the first to know about interesting Base Metals, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp.

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.