Since we last looked at Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA), there has been a disconcerting and unexpected severe decline in the stock, doubtless for capital markets reasons that has then been followed by an extraordinarily robust recovery over the past week or so, again for capital markets reasons since there has been no significant news out of the company and result is that the stock is back very close to recent highs, and so the original premise is looking correct especially as the powerful advance of the past week has major bullish implications.

Before reviewing the latest stock chart we will consider again why the company has such great growth potential.

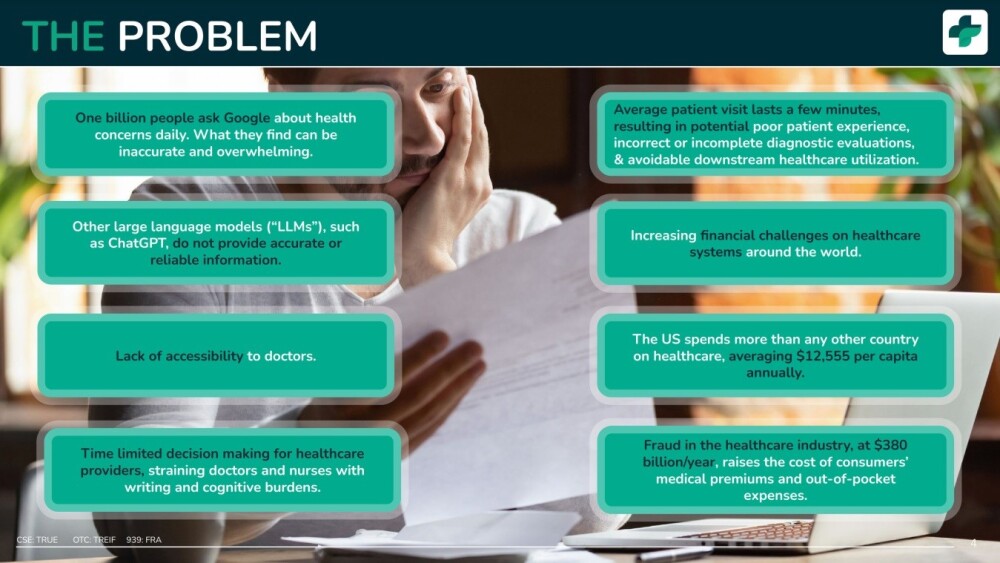

The inefficiency and waste in the healthcare industry is legendary, with patients sitting around in waiting rooms sometimes for hours waiting to see a doctor who, due to time pressure, often cannot spend an adequate amount of time with them, doctors, nurses, and other healthcare professionals burdened with mountains of repetitive paperwork and so, perhaps more than in any other field, the potential for AI to improve the efficiency and quality of life for all involved is immense. Following is a range of relevant and important sides lifted from the company's investor deck.

Treatment AI has positioned itself to be the central go to resource in the booming AI revolution in the Healthcare industry. This revolution is set to streamline the Healthcare industry, vastly reducing the time wasted by both doctors and patients as result of dealing with cumbersome and repetitive bureacracy and general matters and questions that can be much more efficiently handled by AI.

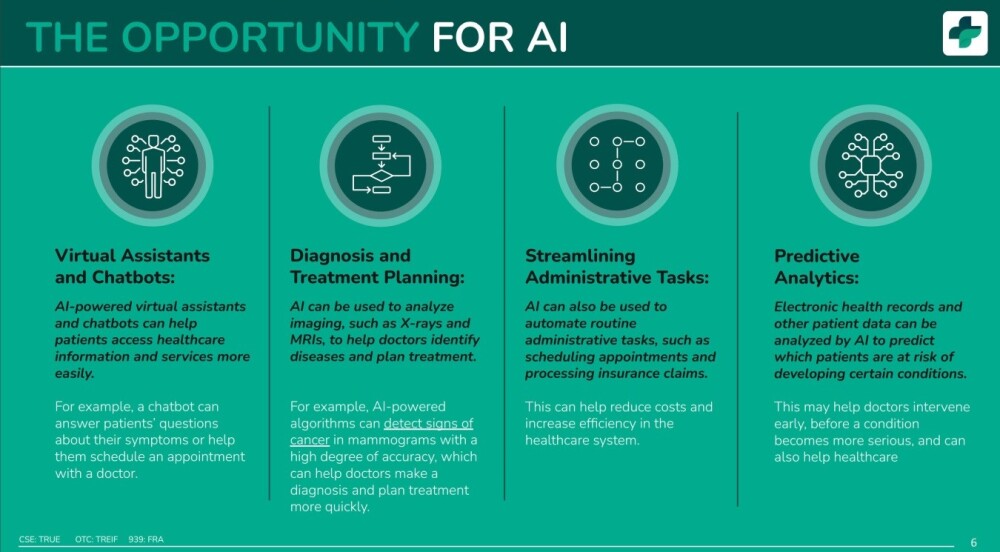

Here are the ways that AI can positively impact Healthcare

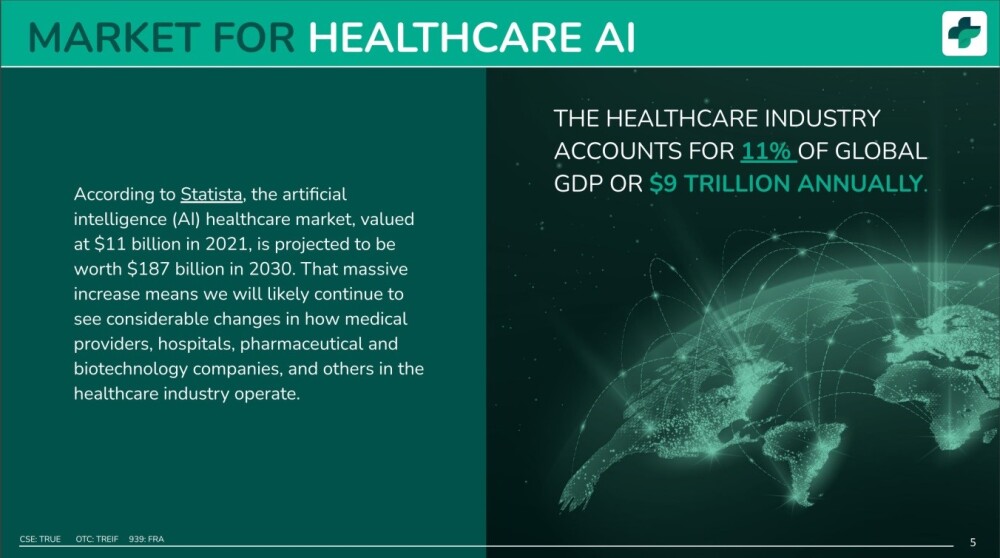

To quote the company “The AI health care market, valued at $11-billion in 2021, is projected to be worth $187-billion in 2030.

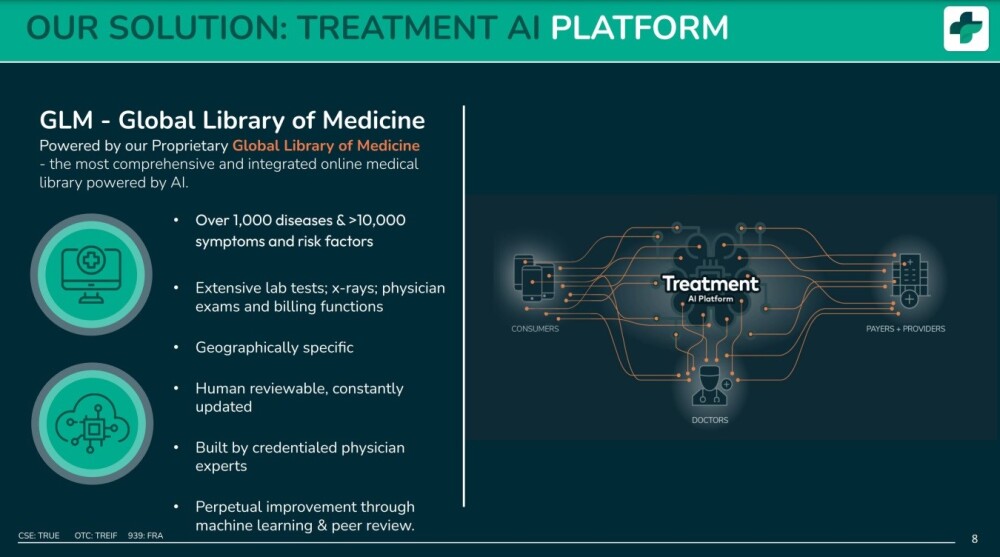

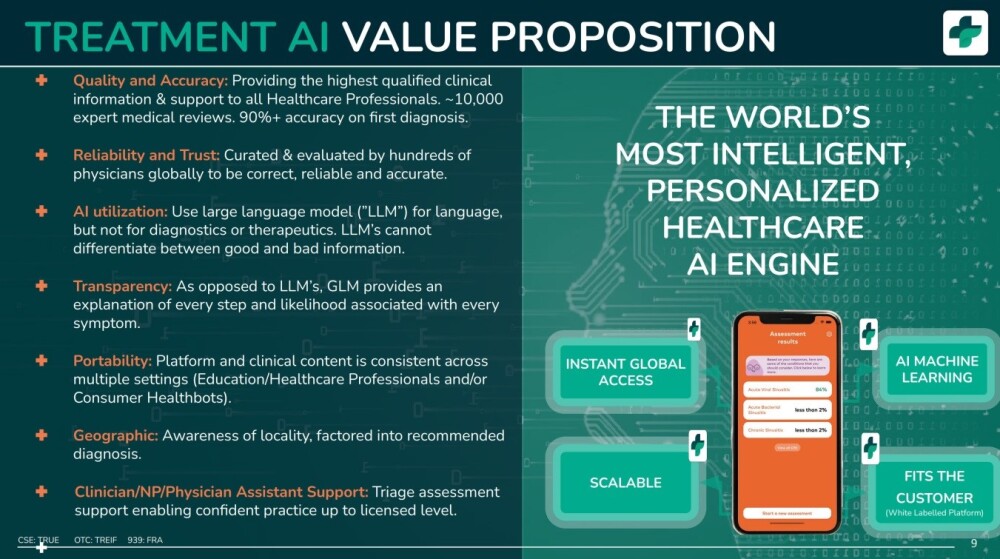

With the input of hundreds of health care professionals globally and utilizing proprietary algorithms, Treatment.com has created the most comprehensive and integrated on-line medical library powered by AI -- the Global Library of Medicine (GLM). The GLM provides the highest level of qualified clinical and support to all health care professionals, ensuring enhanced diagnostic accuracy and transparency in every step of support provided.

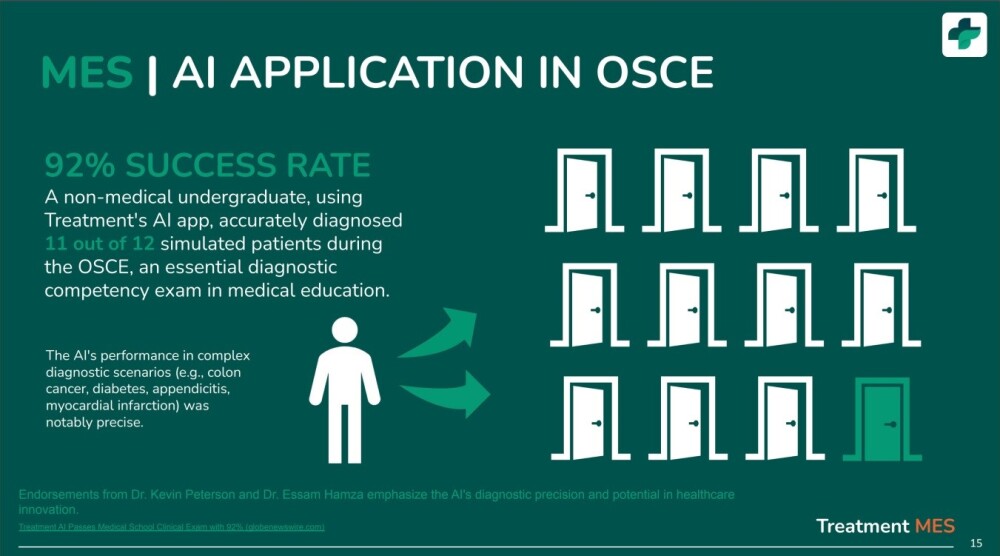

To underscore the accuracy of its platform, the company announced not long ago that its AI software passed a medical clinical exam, exceeding a 92-per-cent success rate.

Here are the characteristics and features of the Treatment AI Healthcare AI Engine.

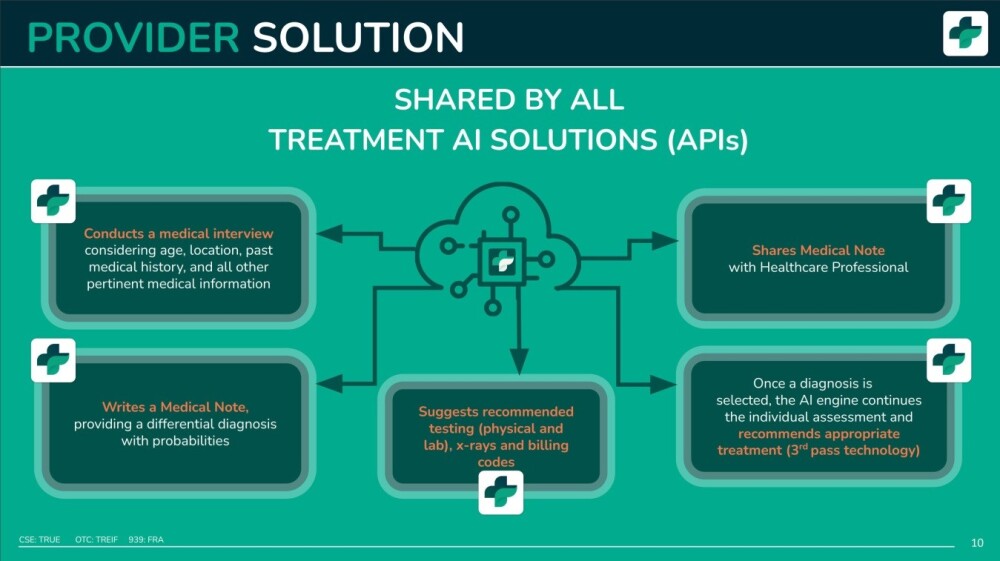

The following slide makes clear how the Treatmnt AI Engine streamlines and expedites the diagnosis and treatment option process.

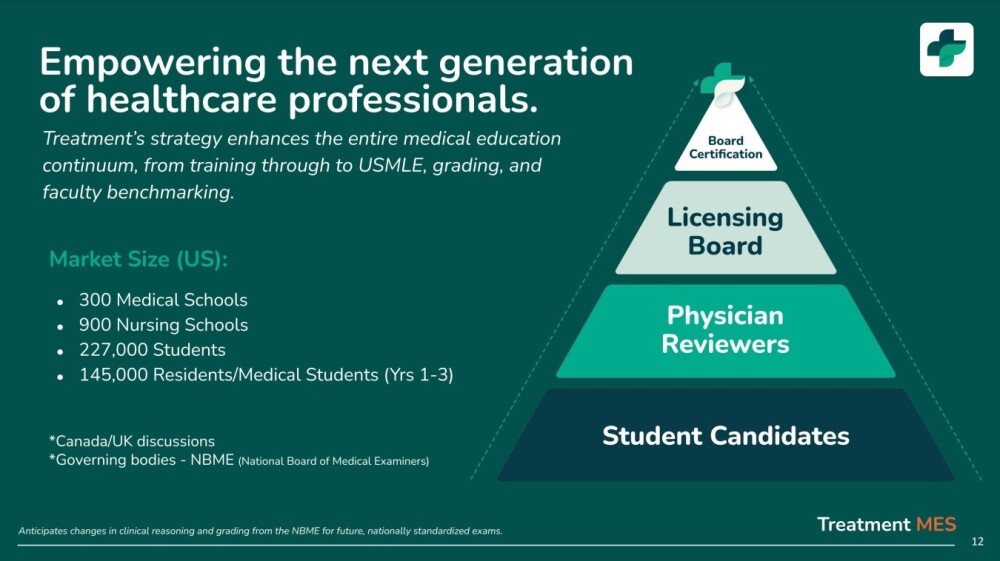

This slide shows how Treatment’s strategy enhances the entire medical education continuum and thus the enormous size of the market.

Note that slides not included here may be viewed in the <A HREF="https://treatment.com/wp-content/uploads/2024/04/TREATMENT-INVESTOR-DECK.pdf">the company’s latest Investor Deck</A> linked again here for convenience.

B

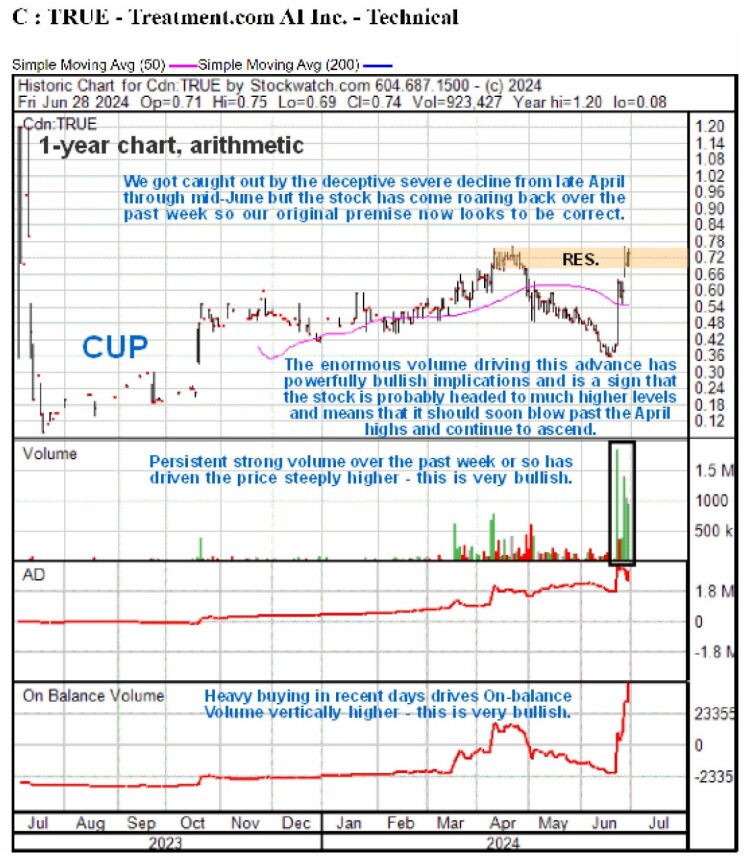

We can see this unusual down and then up action in the stock over the past two months on the 1-year chart below. The extraordinary strength of the recovery over the past week or so is readily apparent.

This rapid recovery has brought the price back up to resistance at the April highs, where it has paused in recent days, and the key point for us to note here is that the power of this advance means that this resistance is unlikely to stop it for long. This action in this stock, with little news to account for it, is taken to mean that "something is going on," and solely on technical ground, it implies that the stock is probably headed much higher.

We, therefore, stay long, and Treatment AI remains a Buy here, especially on any minor near-term dips, although it may not dip before continuing higher.

Treatment.com AI Inc.'s website.

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA) closed at CA$0.74, US$0.523 on June 28, 2024.

Want to be the first to know about interesting Biotechnology / Pharmaceuticals, Life Sciences Tools & Diagnostics and Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Treatment.com AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treatment.com AI Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.