I was watching a National Geographic special a few nights ago featuring the behavior of sharks in all sorts of circumstances, including long-range hunting based upon scents given off by injured prey many kilometers away. It seems these marine beasts are able to follow the scent by swinging their heads side to side as they move through the water, repeating their natural swimming motion as they track down the food source. Once they arrive at the target destination, they are usually not alone and are often joined by competitor sharks in search of the same scent, and when they all arrive to find the carcass of a dead whale, they descend en masse upon the lifeless creature and reduce it to the scattered bone, cartilage, and organs.

With stock prices around the globe (with particular emphasis on the U.S. markets) trading at overextended levels by all measures of valuation, the manner in which massive groups of social media-driven investors descend upon the various names that comprise the "Mag Seven" is reminiscent of the manner in which those denizens of the deep descend upon prey. Relentless and savage accumulation of anything edible by a shiver of ravenous sharks reminds me of the ferocity with which traders seeking immediate enrichment dive into the risk pool with nary as much as a "shrug" at the concept of loss. It is, in fact, this investor complacency that has me so wary of a market that seemingly has no ceiling.

Also noticeable during these frenzies of marine feeding is the action of the remora, a suckerfish that travels out of the eyesight and jawlines of the sharks, usually underneath them, in wait for any shreds of food that might escape their gaping teeth. They do their utmost to stay hidden during the frenzies. With voluminous quantities of whale blubber for the taking, the remora hold no interest for the animated sharks. They receive little attention and get to feed only marginally as the larger predators have their way. In this respect, they remind me of where we are as gold investors, safe from harm by way of undervaluation but also bereft of sustenance because of all the attention being afforded to the larger fish.

There is a wonderful book written by Charles Mackay entitled Extraordinary Popular Delusions and the Madness of Crowds, in which the author debunks alchemy, the crusades, duels, economic bubbles, fortune-telling, haunted houses, the Drummer of Tedworth, the influence of politics and religion on the shapes of beards and hair, magnetizers (influence of imagination in curing disease) murder through poisoning, prophecies, popular admiration of great thieves, popular follies of great cities, and relics. In fact, the legendary stock market guru Bernard Baruch cited Mackay as his reason for exiting the stock market just before the 1929 Crash in October of that year. In the book, he also references three major manias of the 16th and 17th centuries, including the Dutch Tulip bulb mania of 1637, the South Sea Bubble (1711-1720), and the Mississippi Company Bubble (1719-1720).

There is no question to be asked regarding the action in today's stock markets. Valuations based on the cyclically-adjusted price-earnings (or CAPE) ratio for the S&P 500 is now higher than the pre-1929-Crash period that preceded the Great Depression. Stocks are not "cheap," yet speculators are piling into anything and everything related to artificial intelligence while basing investment decisions on "stories" rather than actual analysis of balance sheets or income statements. The only things that matter to today's mania-chasers are volume and price, and as long as markets have stimulus induced by both the central banks and the Treasury departments in full force, the liquidity it creates is directed to a handful of stocks.

When you are trained as I was in the field of securities analysis in the 1970s, you were taught to respect valuation because you were in an era (1966-1982) in which the Dow Jones Industrials traded in basically a 450-point range with the area just above 1,000 being the ceiling.

Investors were bludgeoned into a risk-averse mindset by the 1973-1974 bear market that saw 70% of the brokerage industry filing for food stamps. By the time I became a licensed securities salesman (as opposed to "wealth advisor" or financial consultant"), less than 4% of U.S. households held common stocks (versus 54% today). It was the exact opposite of conditions facing investors today. Thanks largely to forty years of profligate spending and coddling of the business cycle, none of which happened in the '70s, we now face an environment where both politicians and bankers do not use the unemployment rate or the trend of gross domestic product to gauge their effectiveness. They use the NASDAQ closing price as the only required barometer for performance.

"Let them eat cake" was the famous quote from Marie Antoinette before the outraged and starving masses lopped off her head. Well, "Let them make money day-trading" is the new mantra of the 2020s as inflation and inequality spread across the land. As anchors at CNBC rejoice these stock market hurdles are being shattered, I believe that is all coming to an end.

The current presidential election campaign illustrates in spades why such a generational divide is occurring. Not only is the bulk of the stimulus coming from the Fed and the U.S. Treasury winding up benefitting the upper 1% of income-earners, but it is also landing in the lap of the Baby-Boomers who are largely responsible for the ascendancy of the two candidates, one of which was born during WWII while the other was born the year after it ended.

With all of the money and all of the assets now being held by this+- aging demographic, there is no upward mobility allowed for the Millennials or the Gen-X-ers. These geriatric policymakers are letting the kiddies earn their "cake" through stock market support and stimulus. It seems to this author that they are using a handful of designated stocks (Mag Seven) to keep these youthful new voters happy until at least November in the hope that a 30,000 NASDAQ will sway the vote.

Lance Roberts made an excellent point this week when he said that the stock market looks like an iceberg, with the top 10% jutting out of the water looking fine, but where the submerged 90% looks ugly — and REAL ugly. In a note to subscribers this week, I continued to point to the failing leadership in Nvidia Corp. (NVDA:NASDAQ) falling more than $20 off its 52-week high despite new highs in the NASDAQ and the S&P 500 as evidence of deteriorating breadth.

Yet, thanks to a desperation rebound in Amazon.com Inc. (AMZN:NASDAQ), stocks eked out their fifth out of six monthly gains despite a late-session sell-off on Friday. This remains the primary reason that I believe that Millennials and Gen-X-ers are sticking with the tech sector. Staying with the 10% tip of the iceberg represents greater safety and predictability than speculating on gold or silver where the rewards of have been scarce and brief.

Gold

To coin another of Bob Farrell's rules (#5): "Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways."

If you consider the move from mid-February at $185 to mid-April at $225, the SPDR Gold Shares ETF (GLD:NYSE) moved $40 in less than two months, which was not exactly an "exponential" move, but it was a big one that certainly saw an extended overbought condition for most of April. Since then, it has been rangebound with $219-220 on the upper band and $210-212 on the lower band, while the all-important 100-dma has risen from $200 to nearly 208, making the downside target higher with each passing day.

Despite "going sideways," gold is correcting beautifully with silver dancing the Charleston along the $30 line and making me wonder whether that target of $208 is going to be met. Furthermore, I am starting to question whether a final downside probe takes out the 100-dma and plunges to the 200-dma at $196. Like the Edmonton Oilers this year, GLD has been extremely resilient and looks capable of exceeding the 52-week high at $225.66 during the next push.

So, I remain a "hedged bull" owning a great many gold developers but looking for another $7 downside in GLD or $70 in August Gold to complete the cycle.

Now, the question I keep getting asked is why Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) fails to catch a bid despite 100% ownership of the Fondaway Canyon gold deposit in Nevada where 2,059,900 ounces of gold worth $4.8 billion awards them a market cap of a paltry $20 million. The deposit is wide open along strike and to depth, with two new high-grade zones having been revealed during the 2021 and 2022 drilling programs.

The same can be said of the countless other juniors sitting on large resources of gold, silver, and copper, with trading volumes scraping the bottom despite brisk advances in their underlying commodity prices. It bears repeating that until markets begin to punish speculators in the non-resource bubble stocks and reward investors in companies that seek out, develop, and produce real assets, the junior gold developers will continue to be the remora of the financial sea, swimming unnoticed and underappreciated under the bellies of the sharks.

We should all be reminded that they will indeed have their day but to think someone will be ringing a loud bell to mark the beginning is folly at its best.

Base Metals

My favorite base metal explorer/developer is TSXV-listed Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), whose Chairman is Perth-based Campbell Smyth, a good friend and colleague who has been moving the FTZ chess pieces around the board lately in an effort to create "enhanced shareholder value" by installing new directors and replacing others.

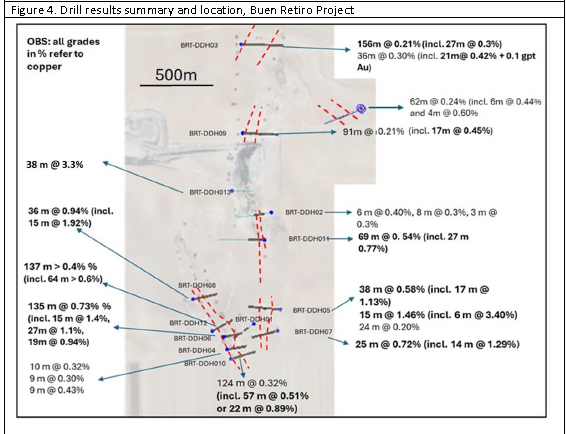

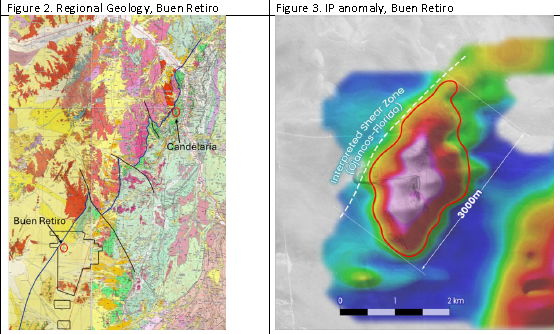

He has become quite active in Chile with two permitted but early-stage copper prospects plus a high-octane, huge potential gold exploration program called Taquetren, where Navidad discoverer Daniel Bussandri is carrying the ball. I own the stock for the Chilean projects, particularly the Caballos Project (scale, continuity, and grade appear to be lining up), but this week, I was blown away by the announcement that they have entered into an agreement to acquire the "Ptolemy Company," a private Chilean company that owns a project known as "Buen Retiro" which literally translates into "Good Retirement" in English. With 28,000 meters of drilling already completed, they have identified a 4 km.-long, 2 km.-wide zone of oxide copper mineralization believed to be an oxide "cap" underneath which extensive geophysics including aeromagnetic, induced polarization, and gravity survey have outlined what appears to be a massive anomaly (see below) exceedingly the footprint made by the Candelaria IOCG (iron oxide copper gold) Mine currently owned by the Lundin Mining Group (and just up the road).

The southern portion of the Buen Retiro deposit is believed to be "mega-breccia" IOCG with the northern half a flat-lying manto-style but all of it is SXEW-friendly given there is oxidized mineralization in both zones.

My excitement lies in the prospective outcome once the company fulfills all of the requirements laid out by the TSXV and then proceeds to drop half a dozen holds into the IP anomaly, which may, if blessed by the two lady goddesses of junior mining (Mother Nature and Lady Luck), result in the discovery of a sulfide zone similar in scale and grade to Candelaria, where 2024 guidance called for 170,000 tonnes of copper and 100,000 ounces of gold. Such a development would be a complete game-changer for all FTZ shareholders, and it was good to see that shareholders liked it and treated it like more than a "liquidity event" and bid the stock higher on 279,950 shares.

Until the Company files a 43101 report, they could not release the major portion of their 28,000 meters of drilling data that has some serious drill core intercepts at surface that would rival (and exceed) drill intercepts from my other two comparable copper explorers, American Eagle Gold Corp. (AE:TSXV) and Hercules Metals Corp. (BADEF:OTCMKTS; BIG:TSXV) both capped at CA$84m and CA$163m (respectively) versus Fitzroy at CA$13.6m.

At first glance, Fitzroy appears underpriced. That is because it is. A 10-bagger from current levels would still cap it, and under BIG:TSXV, and from what I see and hear, Buen Retiro is better by all measures.

[NLINSERT

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Fitzroy Minerals Inc., and American Eagle Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.