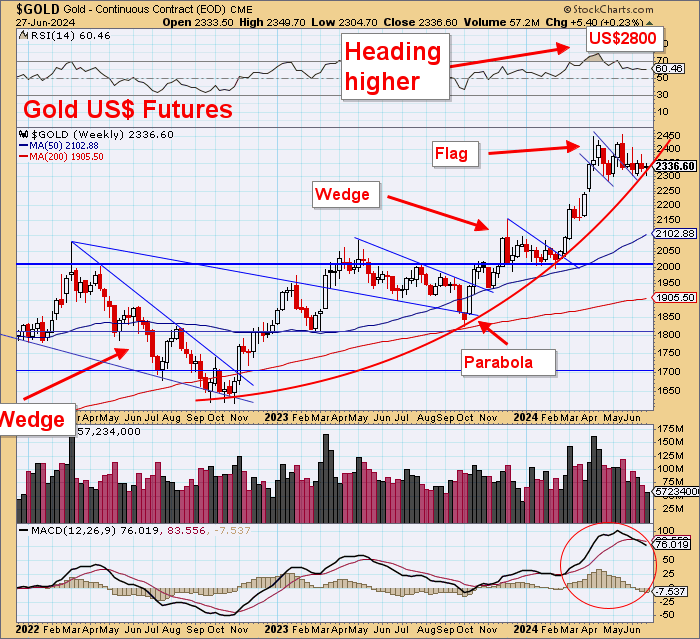

Gold holding above US$2300, wedge action in play, parabola still in place.

White metals are looking good. Silver is in a massive bull market. Platinum is turning up. Palladium is recovering. Currencies are very weak.

Gold

- Technicals holding gold >US$2300

- Parabola still working

- Gold in Yen and Euros technically strong

Gold Stocks

- Wedge break out

- Gold stocks vs Gold continues to improve

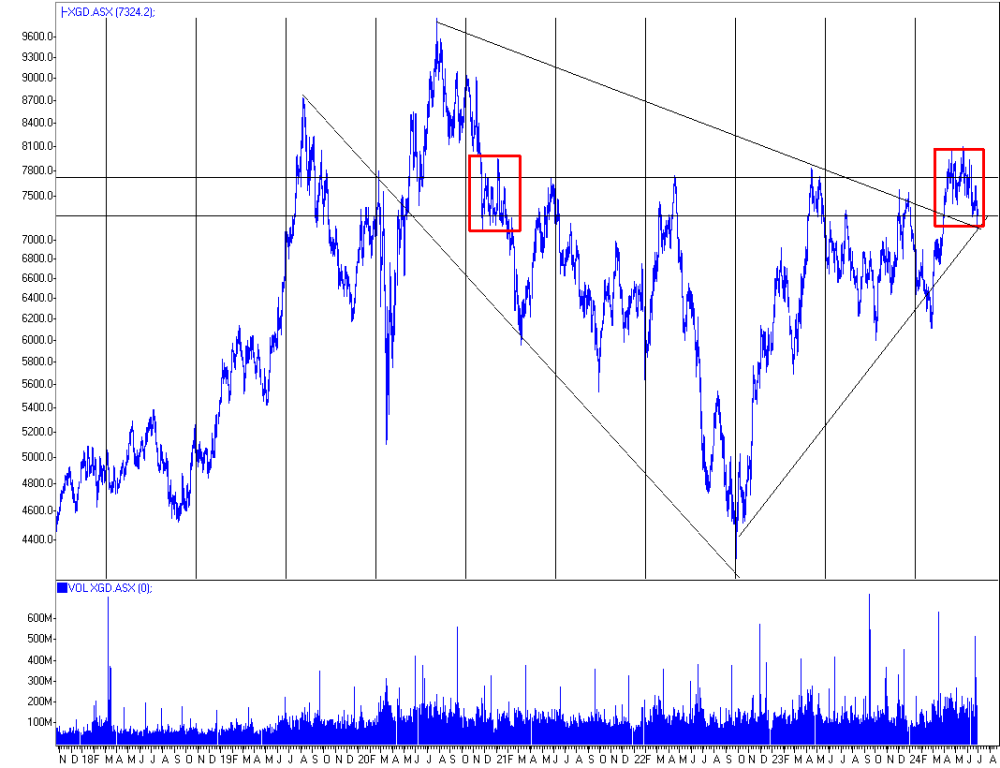

ASX Gold Index

- Holding in symmetry box

- EOFY bargains on sale

White Metals

- Silver

- Platinum

- Palladium

The resiliency of gold is very impressive. Trading tonight will be important for a weekly, monthly, and quarterly close will be important to watch. A strong close would be very good technically.

The US$ remains very firm as the Yen and Euro, in particular, continue to weaken and fall away.

Gold in those currencies is very close to all-time highs and looks strong technically. Gold stocks remain quite resilient as well. Gold stocks versus gold are performing very constructively and should be very strong in the December half of 2024.

The wedge is holding on for us here.

And likewise with the parabola.

This move by gold in Yen will soon produce another all-time high.

And the gold price in Euros has pulled back to that uptrend and is producing a very positive pennant that is pointing to new highs.

Gold Stocks

This wedge has broken to the upside and should produce another strong move very soon.

This is a very important breakout coming to us.

This index has had a breakout, a pushback from the 11-year downtrend, has back-tested, and now has produced a hammer.

Technically, it's very constructive.

There appears to be a head and shoulders trend reversal pattern established here.

The longer-term trend, of course, is extremely positive.

ASX Gold Index

It seemed we had a little weakness on Wednesday, but I think the EOFY sales will certainly end today.

Just as with the North American gold stock indices, this XGD is capable of making a very strong and rapid move.

White Metals

All these white precious metals look very sound.

The breakout through US$30 is very important, and this market is on its way.

Palladium has been frustrating with a few false starts, but it is supporting on the downtrend and will be heading higher.

Platinum is very constructive indeed, and you should expect this price to double over the next few years.

Head the markets, not the commentators.

| Want to be the first to know about interesting PGM - Platinum Group Metals, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.