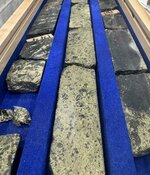

Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) has announced significant progress in its 2024 surface exploration program at the Tombstone Gold-Silver Project in southeastern Arizona. The initial results from the Contention pit area have confirmed substantial gold and silver mineralization. These findings corroborate the high-grade mineralization detected in earlier drilling campaigns from 2020 to 2023, underscoring the project's potential.

The initial results include impressive highlights such as 30.2 meters averaging 3.72 grams per tonne (g/t) of gold and 167.93 g/t of silver (5.82g/t gold equivalent) on Line B4, and 50.0 meters at 0.827 g/t gold and 54.08 g/t silver (1.50 g/t gold equivalent) on Line G1. These outcomes not only validate previous drilling data but also suggest a significant expansion potential for the mineralized zone. The fieldwork and sampling efforts are ongoing, with more assay results pending, which are expected to further delineate the extent of mineralization along strike and at the surface.

The Future of Precious Metals

The precious metals market has experienced substantial growth and is poised for continued expansion. In 2023, the global market size was valued at US$306.44 billion and is projected to grow to US$501.09 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 5.6% during the forecast period, according to a June 10 report from Fortune Business Insights.

This growth has been driven by increasing demand from the industrial sector, particularly for silver in photovoltaic manufacturing and gold in electronics. The depletion of fossil fuels and the rise of renewable energy solutions have propelled the demand for solar panels, further boosting silver consumption.

In his June 13 report, Technical Analyst Clive Maund stated that Aztec Minerals Corp. remained a "Strong Buy."

Investment in gold has been projected as the fastest-growing segment due to its low-risk factor compared to other commodities. The drop in gold prices during the COVID-19 pandemic provided investors with a lucrative opportunity to enhance their portfolios, contributing to the segment's growth, as reported by Fortune Business Insights.

Asia Pacific held a dominant share of the precious metals market in 2023, valued at US$160.37 billion, and is expected to maintain its leading position due to the extensive electrical and electronics industry and substantial gold consumption in China and India.

Precedence Research reported that the global precious metal market size was valued at US$265.26 billion in 2023 and is anticipated to reach around US$514.06 billion by 2033, growing at a CAGR of 6.84% from 2024 to 2033. Asia Pacific held the largest market share of 60% in 2023 and is projected to lead the global market during the forecast period. The region's market size was estimated at US$159.16 billion in 2023 and is projected to surpass US$311.01 billion by 2033 at a CAGR of 6.92% from 2024 to 2033.

Precedence's report went on to say that precious metals like gold and silver have traditionally been in high demand throughout the Asia Pacific region, especially in nations like China and India. Major hubs for precious metal trading are located in cities such as Tokyo, Singapore, and Hong Kong, making trading, refining, and storage of precious metals easier for both domestic and foreign investors. Emerging economies in the Asia-Pacific area, like Vietnam and Indonesia, are also becoming bigger players in the precious metal market, as highlighted by Precedence Research.

According to Barchart in a June 26 article, gold closed 2023 at over US$2,070 per ounce, continuing its bull market, and reached a new record high in Q1 2024. Silver also rallied, while platinum and palladium prices declined. Early Q2 saw gold and silver taking off on the upside, with gold and silver leading the bullish charge. The turbulent geopolitical landscape remained bullish for metals with industrial properties and long histories as safe havens, investment metals, and means of exchange.

What Experts Are Saying...

*In his June 13 report, Technical Analyst Clive Maund stated that Aztec Minerals Corp. remained a "Strong Buy" in its price zone, emphasizing its potential for a big discovery and the exceptionally positive outlook for the sector. Maund highlighted that despite a recent price drop, the stock was coming to the end of a normal post-breakout reaction and was expected to break out to the upside before much longer.

He noted the bullish Falling Wedge formation on the chart, which supported the expectation of a price breakout driven by the company's promising fundamentals and sector outlook. A large block trade involving EuroPacific Gold Fund's purchase of shares from the late Aztec founder Bradford Cooke's estate was described as non-sinister and part of normal market activity. Maund reiterated the "Strong Buy" rating, advising holders to stay long as the stock was positioned for a sustainable advance.

Timothy Lee, Mining Analyst at Red Cloud Securities, initiated coverage of Aztec Minerals Corp. with a BUY rating and a target price of CA$0.60 per share, according to a June 3, 2024 report. Lee stated that Aztec was advancing two mineral exploration projects, one in Mexico and one in Arizona, and was well-positioned to benefit from these advanced exploration-stage projects with known near-surface oxide mineralization and untested deeper potential. Aztec's projects in Arizona and Sonora, Mexico, were highlighted for being in well-established mining jurisdictions, surrounded by operating mines with good infrastructure access.

Lee reported that Aztec had drilled high-grade near-surface oxide mineralization at its 75%-owned Tombstone project, with highlights including 6.28 g/t AuEq (gold equivalent) over 32 meters and 3.39 g/t AuEq over 65.5 meters, emphasizing the promising results from the Tombstone project.

The potential for high-grade oxide results from Tombstone and near-surface oxide Au-Cu) gold-copper_ in a porphyry district at Cervantes positioned Aztec well for future exploration success, according to Lee. With rising precious metal prices, the market had picked up for explorers, and Lee wrote that Aztec was well-positioned to benefit from gold and silver as well as deeper base metals.

Lee also noted that Aztec had a strong shareholder base for a junior explorer, with the company stating that approximately 50% of its stock was tightly held, and strategic investment from Alamos Gold Inc. owning about 8.8% of Aztec's shares on an undiluted basis, emphasizing the company's solid financial backing and investor confidence.

Catalysts For Aztec

The 2024 exploration program by Aztec Minerals is set to be a pivotal year for the Tombstone Gold-Silver Project. According to the company, the program has already yielded promising results that enhance the geological understanding and potential for further discoveries. The ongoing sampling and geological mapping efforts are expected to identify new zones of broad, high-grade gold and silver mineralization. This is particularly evident in the Contention pit area, where the recent detailed lithological and structural mapping has revealed attractive mesothermal broad oxidized mineralized zones.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB)

Further catalysts specified in the news release include the upcoming results from additional chip channel and reconnaissance samples, which are anticipated to expand the known mineralization footprint. The geological modeling and 3-D evaluation of historic mine workings and drilling data are also crucial components of the project. These efforts will integrate geochemical, geophysical, and SWIR-Terraspec data to refine the exploration targeting and potentially unlock new mineralized zones. As Aztec Minerals continues to advance its exploration activities, the Tombstone project is positioned to deliver substantial value through the discovery of additional high-grade gold and silver mineralization.

Ownership and Share Structure

According to Reuters, Aztec Minerals has 108.95 million shares outstanding and 86.4M free float traded shares.

5.50% is with management and insiders. In this category, large shareholders include President and CEO Simon Dyakowski with 2.22%, and director Jim Schilling at 1.42%. 15.19% is with strategic investors. Notable holders are Alamos Gold Inc with 8.22%, Kootenay Silver Inc with 6.98% The rest is in retail.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on June 13, 2024

- For the quoted article (published on June 13, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.