Sunday marked the busiest day ever at U.S. airports, as Transportation Security Administration (TSA) data shows nearly 3 million airline passengers were screened. That broke the previous record set on May 24, the Friday prior to this past Memorial Day weekend. 171 of the 175 days (98%) tracked by the TSA so far this year — excluding February 29 since it was a leap day — have seen a greater volume of travelers pass through airport checkpoints compared to 2023.

A tally of 147 days in 2024 (84%) have surpassed 2019's figures, suggesting the U.S. is closer to a full recovery to pre-pandemic levels of air travel than ever before. This year marks the first time that TSA security checks to June 24 have surpassed those of the same period in 2019. If the 2024 growth trend was consistent through year-end, the increase in airport traffic over 2019 levels would be equivalent to more than 53 million passengers.

Indeed, the TSA sees the busiest days of the summer travel season yet to come. The agency expects to screen more than 32 million travelers during the 2024 Independence Day travel period that runs from June 27 through July 8, up is 5.4% YoY.

Friday is projected to be the first time TSA will screen more than 3 million passengers in a single day. Per Reuters, Industry group Airlines for America has said carriers plan to fly more than 26,000 flights per day this summer, marking an increase of nearly 1,400 (5.6%) over 2023 to accommodate for the increased demand for air travel. These figures would seem to show that airlines are experiencing a boom, but their financial performance has not been nearly as optimistic.

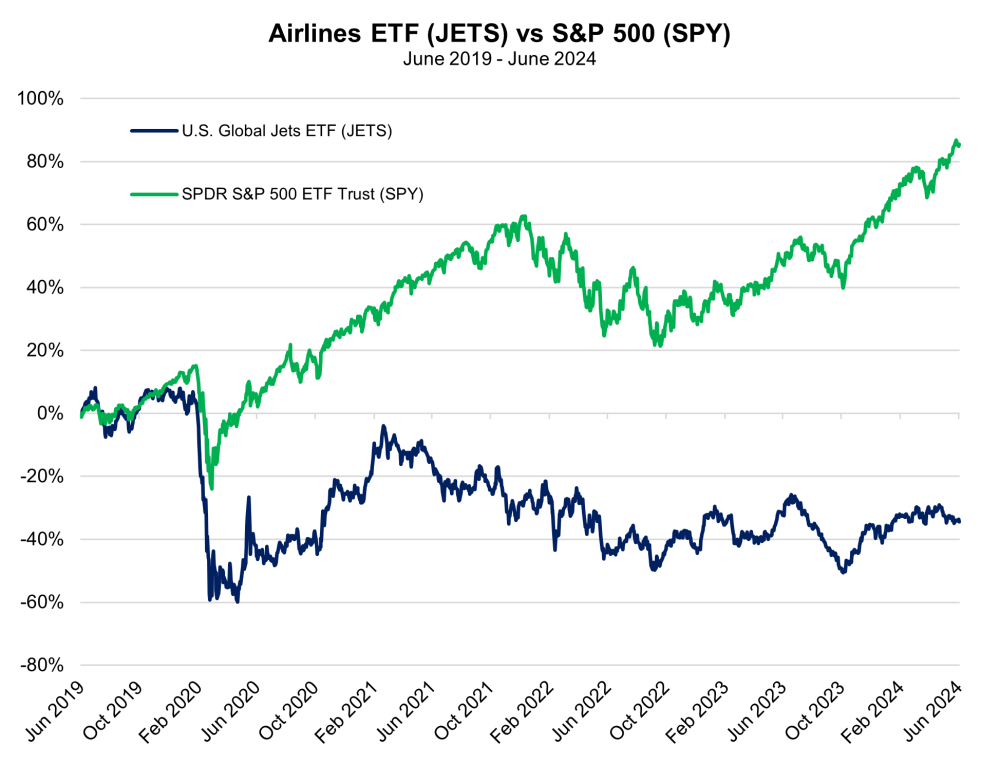

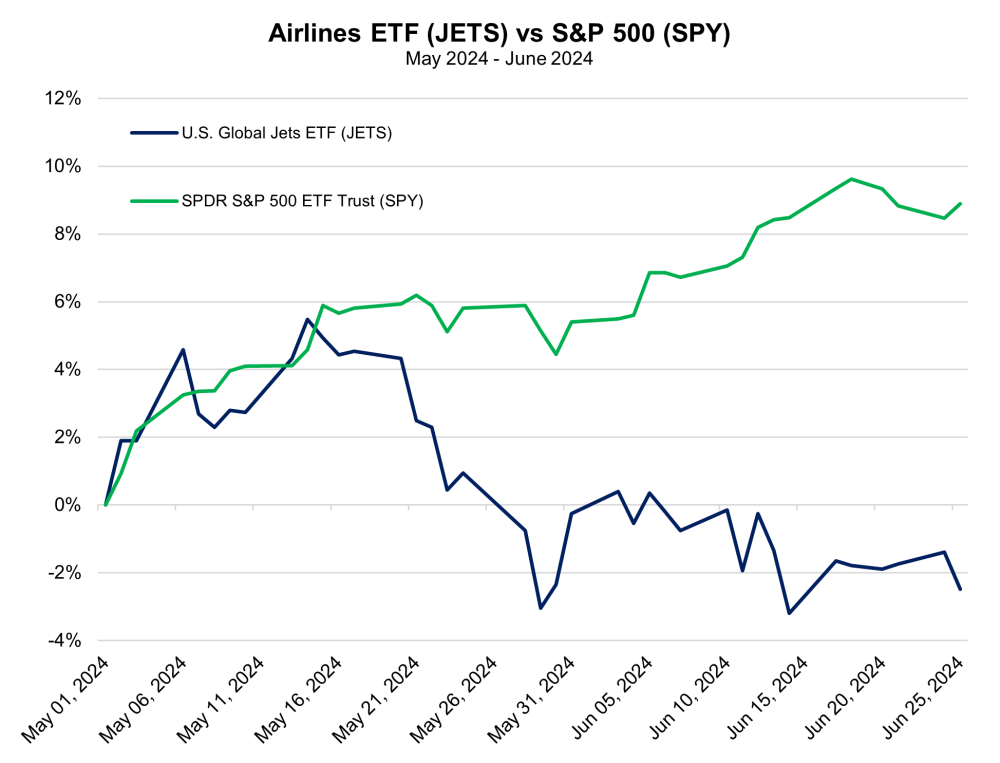

Shares of the U.S. Global Jets ETF (JETS:NYSEARCA), largely weighted toward North American airlines, are virtually unchanged over the past six months, vastly underperforming a 14% gain in the S&P 500. When that comparison is expanded to include the past five years, the discrepancy is far more stark, as JETS has fallen by more than a third. This largely reflects several trends that have compressed margins for airlines despite the gradual upturn in travelers. Two of the primary variables related to heightened costs are labor and fuel, which account for a majority of airlines' operational expenses at 31% and 22% each, respectively.

Fuel costs, which are particularly impactful for U.S. airlines that tend to avoid hedging their energy expenditures by agreeing on prices in advance, declined a bit in 2023 but are on the rise yet again. Jet fuel was relatively steady, around $80 per barrel throughout most of 2019, but today sells for roughly $100 per barrel, according to the International Air Transport Association (IATA). That tracks with a broader increase in crude oil prices over the same period.

A tight labor market and aggressive demands from workers associations has significantly impacted costs associated with the wages of airline staff over the past couple of years. Negotiations with the Air Line Pilots Association union led to United Airlines approving a new contract that includes pay raises of as much as 40% over the course of its four-year term last autumn. Earlier this year, Southwest Airlines agreed to an even steeper pay raise for its pilots, which will increase pay by about 50% over the next half-decade. Southwest followed that up with an 18% average pay increase for the ramp, operations, provisioning, and cargo agents. Ongoing talks between American Airlines' flight attendants union have seen the latter party reject immediate 17% wage increases in search of even steeper hikes to compensation — potentially as high as 33%.

While total airline passenger numbers have recovered to their pre-pandemic levels, the rebound in lucrative premium offerings like business-class travel has lagged. The latest forecast by the U.S. Travel Association suggests that, in inflation-adjusted terms, spending on corporate travel will be -13% lower this year than in 2019 — analysts cited by the Wall Street Journal predicted a -15% shortfall at the onset of the pandemic — and then remain flat.

Higher cost pressures have been exacerbated by a material slowdown in deliveries from American aerospace manufacturer, Boeing Co (BA:NYSE). MRP has closely followed the embattled company's self-inflicted woes for more than five years now. As we noted in May, Southwest Airlines, one of the most dedicated Boeing customers, announced recently that it would receive only 20 Boeing planes this year, barely a quarter of the 79 that were scheduled for delivery at the start of the year.

The Federal Aviation Administration (FAA) in February froze the production rates of Boeing's 737 planes at 38 per month until controls are assessed. That is -27% lower than its 737 output rate of 52 per month in 2018. These delays have forced Southwest to re-evaluate "all prior full year 2024 guidance, including the expectation for capital spending." Shortfalls in expected deliveries increases overhead as airlines are forced to continue employing old jets that likely need more maintenance and are much less fuel-efficient. The 737 MAX, for instance, consumes 15%-20% less fuel than other 737 models. It can also force airlines to choose between securing expensive, unplanned leases of planes to bolster their fleet or withdrawing from certain routes and markets.

The IATA expects global airlines to pull in nearly $1 trillion in revenue for the full year, a 9.7% jump over 2023, but expenses are projected to grow by a similar 9.4%. That will leave carriers' margins thin and returns on investment especially narrow when measured up against steep interest rates. The association sees a return on invested capital in 2024 at 5.7%, which it says is "about 3.4 percentage points (ppt) below the average cost of capital."

Charts

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.