Nano Nuclear Energy Inc.'s (NNE:NASDAQ) stock has been making waves.

The company recently acquired the proprietary annular linear induction pump (ALIP) technology, employed in small nuclear reactors for cooling and heat transfer, from Dr. Carlos O. Maidana, physicist, research engineer, and chief executive officer (CEO) of Maidana Research, it was announced in a news release. Technology-driven Nano Nuclear is a U.S. company developing portable clean energy solutions and the related supply chain.

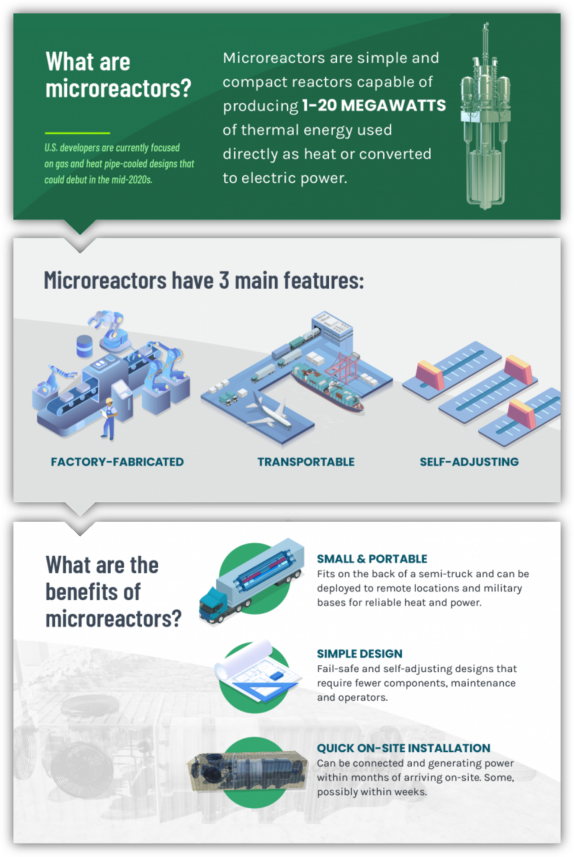

"This is an exciting development for Nano Nuclear as we believe this ALIP technology will enable even greater efficiency and savings for our ODIN microreactor once it enters commercialization," Executive Chairman and President Jay Jiang Yu said in the release. ODIN is one of the nuclear energy firm's two products in technical development. Microreactors, also known as small modular reactors (SMRs), are compact, portable, and work in conjunction with, but can be installed remotely from an electrical grid.

The ALIP technology will give ODIN, a low-pressure coolant reactor, a competitive edge because it allows electrically conducting liquids to be pumped electromagnetically, without mechanical pumps, the release pointed out.

"Our goal is to also see this technology commercialized within a year, which could lead to revenue generation by our company," added Yu.

The technology would be sold as a component for liquid metal and molten salt-based nuclear reactors, the company said. To that end, Nano Nuclear and, acting as principal investigator, Maidana will advance the technology toward two goals.

When Legg initiated coverage on NNE, he gave it a Buy rating and a target price of US$15, implying a 112% return from the price at the time of the report. However, NNE reached this target price on June 20 and closed at US$29.10 on June 25, 2024.

One is the creation of advanced electromagnetic pump solutions that enhance thermal management systems. The other is the attainment of Small Business Innovation Research's (SBIR) Phase 3, or commercialization, award status.

SBIR, a federal initiative, supports small businesses in conducting research and developing products with strong commercialization potential. Nano Nuclear will provide funding (about US$350,000) and other needed resources for this project.

The release noted that Nano Nuclear's ALIP technology could be used in sectors such as fission and fusion energy, advanced materials, space exploration, marine propulsion, and high-temperature and industrial processes. Thus, prospective users include TerraPower, Oklo, Commonwealth Fusion Systems, Tokamak, GE-Hitachi, Rolls-Royce Marine, NASA, and the U.S. Department of Energy (DOE).

Pursuing Four Lines of Business

Founded in 2022 and headquartered in New York, Nano Nuclear Energy is a "pre-revenue company focused on the nuclear SMR sector with operations being designed to both manufacture SMRs and develop a related supply chain, including consulting, fuel fabrication and delivery [of] advanced fuel, specifically high-assay, low-enriched uranium (HALEU)," described Michael Legg, an analyst at The Benchmark Co., in a June 14 research report.

"We believe Nano Nuclear is strategically positioning itself to be a leader in the SMR market and see significant potential over the coming decades," Legg added. "Given the nascent level of SMRs deployed today, we believe NNE has a first mover advantage."

The company is working on several lines of business concurrently. Along with ODIN, it is continuing to develop its solid core battery reactor ZEUS. One of its units will deliver about 1.5 megawatts electric and provide 20 years of power to 1,000 homes, noted Legg.

Because of these microreactors' small size, portability, and minimal need for safety oversight, Nano Nuclear plans to deploy many of them and then monitor and control them all at the same time via a centralized location, CEO James Walker told InvestorPlace, an investing and financial news site.

"This remote model accounts for security and operational concerns while ensuring that Nano Nuclear can rapidly expand its footprint to where it's needed most once commercialized and in full manufacturing mode," InvestorPlace Contributor Jeremy Flint wrote on June 21.

Also, the company is building out an end-to-end supply chain, from uranium mining to fuel fabrication to fuel transportation and finally to fuel delivery directly to nuclear reactors, through its subsidiaries, HALEU Energy Fuel Inc. and Advanced Fuel Transportation Inc. Already, it secured patented technology and is working on developing and commercializing its HALEU fuel, uranium enriched to between 5% and 20%, to small modular reactors, microreactor companies, national laboratories, military and DOE programs.

"We believe NNE's model could produce gross margins exceeding 40%," Legg wrote. "Fuel transportation has 35% gross margin potential, fuel fabrication 50%, and SMRs greater than 40%, long term," Legg wrote.

As for financing, the analyst noted that the company is in a strong position to receive governmental funding from various sources, such as the DOE and the Inflation Reduction Act.

The group of people in and behind Nano Nuclear is notable, Legg pointed out, for talented and experienced management, a high-profile advisory board, and partners in researchers at the Cambridge Nuclear Energy Centre and the University of California, Berkeley. Also, the company has connections within relevant U.S. government agencies, such as the DOE and its national nuclear laboratory system.

"I am very impressed with their world-class team of nuclear engineers, former senior U.S. military, government leaders, and corporate professionals," Maidana said in the release.

Just last week, one of Nano Nuclear's team was honored at the American Nuclear Society's Annual Conference 2024. Massimiliano Fratoni, senior director and head of reactor design, was awarded the Untermyer & Cisler Reactor Technology Medal, a recognition for outstanding scientific, engineering, or management contributions to the advancement of nuclear reactor technology. The award put the spotlight on and lent credibility to Nano Nuclear, the company said and could lead to additional working relationships.

Emerging Sector Expected To Grow

Global energy consumption is slated to continue rising over the next 25 years, according to the U.S. Energy Information Administration (EIA), which predicts a nearly 50% increase between 2018 and 2050.

"Global population growth, increased regional manufacturing, and higher living standards push growth in energy consumption beyond advances in energy efficiency," the October 2023 report noted.

Nations around the world are transitioning to decarbonization and clean energy. The tripling of nuclear capacity by 2050 was called for at COP28 last December. The U.S. Congress just passed the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act, which aims to promote new nuclear technologies, reported The National Law Review.

Against this backdrop, nuclear power generation is projected to grow between now and 2050.

Nano Nuclear Energy strives to stay at the center of this narrative. With its tireless commitment to innovation, there's no doubt that the company will play an even bigger role in shaping the future of not just nuclear energy — but of the sustainability movement, as well," Nick Kasmik of Investing.com wrote.

"Compared with 2022, global electric power generating capacity increases by somewhere between 55% and 108% by 2050, depending on the case," the EIA forecasts. "Electricity generation increases between 30% to 76% over that period. Renewables, nuclear and battery storage account for most of the growth in both global capacity and generation."

According to Straits Research, by 2050, the global nuclear power market is forecasted to reach US$45.31 billion (US$45.31B) in value, a 31.6% increase from US$34.43B in 2023.

As work continues globally toward establishing a sustainable energy system, a subsector of nuclear power is emerging: SMR-generated energy. The World Nuclear Association asserts that the world needs SMRs today and in the future.

"SMRs can complement large reactors by opening new markets and applications for nuclear energy — be it process heat, hydrogen production or electricity generation for small or remote grids," according to the international group. "As SMR designs reach commercial maturity, their role in decarbonization is expected to grow rapidly in the 2030s and 2040s."

InvestorPlace highlighted Nano Nuclear as a stock "ready to explode" and one that "stands to gain the most from a nuclear renaissance."

As for the microreactor technology market, by 2050 it is expected to reach a value of US$3.9 trillion, according to Research and Markets.

The international market research firm said, "SMRs represent a transformative force in the energy landscape, offering a combination of reliability, sustainability, and scalability. As efforts intensify to mitigate climate change and transition towards cleaner energy sources, SMRs stand poised to play a pivotal role in shaping the future of global energy generation."

An article by Investing.com writer Nick Kasmik pointed out Nano Nuclear's part in this sector, saying, "This is just the beginning. As we look to the future, the role of nuclear energy is set to evolve further — and Nano Nuclear Energy strives to stay at the center of this narrative. With its tireless commitment to innovation, there's no doubt that the company will play an even bigger role in shaping the future of not just nuclear energy — but of the sustainability movement, as well."

The Catalysts: Operational Successes

Nano Nuclear aims to start delivering uranium fuel in 2025, to commission fuel fabrication in 2027, and to ship its first orders of ODIN and ZEUS in 2029, all of which are major catalysts.

Meanwhile, other operational developments could move the stock. These include further acquisitions of complementary assets, commercialization of the ALIP technology, and, Legg noted, more partnerships and licenses, as well as receipt of additional government grants and nondilutive capital.

Further, the analyst wrote, "We believe the stock will benefit from increased knowledge and proliferation of demand for SMRs, as safety and use cases gain public acceptance as climate change initiatives favor emission-free energy."

Stock Blows Target Price Out of the Water

InvestorPlace highlighted Nano Nuclear as a stock "ready to explode" and one that "stands to gain the most from a nuclear renaissance." And that it did.

The Benchmark Co.'s Legg wrote earlier this month that it was bullish on Nano Nuclear.

"NNE's current focus on four key areas — original equipment manufacturing, fuel, fuel transport, and consulting — provide a diversified opportunity to invest in advanced nuclear technologies positioned for significant long-term growth over the coming decades," the analyst wrote.

When Legg initiated coverage on NNE, he gave it a Buy rating and a target price of US$15, implying a 112% return from the price at the time of the report. However, NNE reached this target price on June 20 and closed at US$29.10 on June 25, 2024, blowing the previous target price out of the water. On the same day, Legg put out an updated research note, revising his previous target price from US$15 to US$39.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Nano Nuclear Energy Inc. (NNE:NASDAQ)

Ownership and Share Structure

According to Reuters, management and insiders own 10.24% of the company.

36.96% is with strategic investor I Financial Ventures Group LLC, with 10.70 million shares.

The rest is with retail.

As far as share structure, Nano Nuclear has 28.95M outstanding shares and 15.29M free float traded shares.

Its market cap is US$455.44 million.

Nano Nuclear went public in May of this year and, management believes, is the first company focused on developing and designing portable nuclear microreactors to be listed publicly.

Since the initial public offering, its stock has traded between US$3.25 and US$16.50 per share.

| Want to be the first to know about interesting Clean Energy and Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.