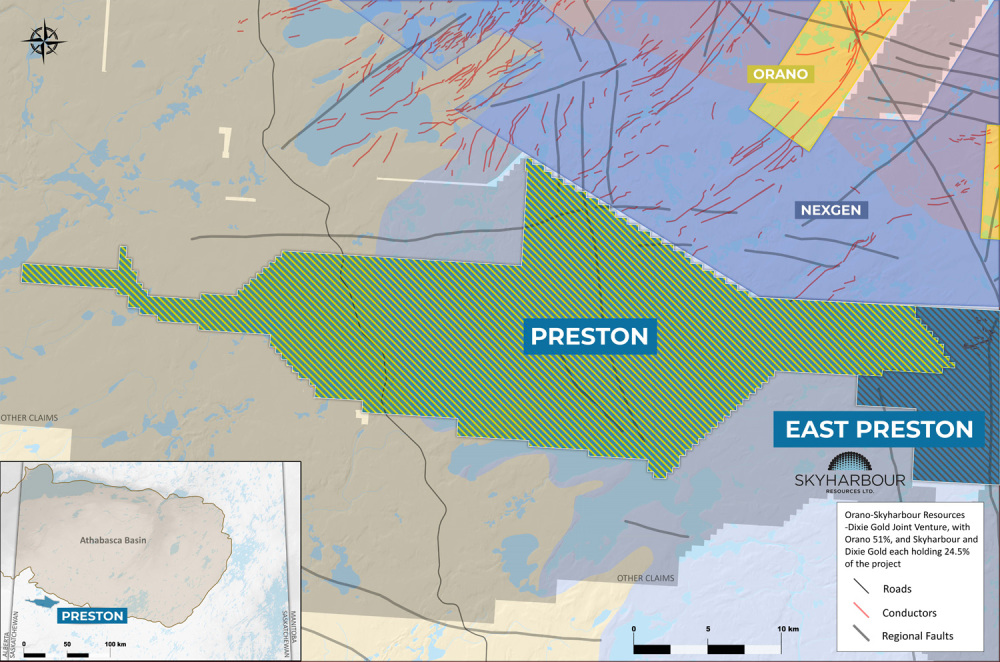

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE) announced that its joint venture (JV) partner has completed its geophysical program at the Preston uranium project in the western Athabascan Basin.

Orano Canada Inc.'s program included a ground electromagnetic survey and a ground gravity survey at the more than 49,000-hectare (Ha) project. Orano is now preparing for a spatiotemporal geochemical hydrocarbons soil sampling program at Preston this summer.

"The 2024 field programs mark the first exploration programs carried out by Orano at Preston since 2020," Skyharbour noted in a release. "The recently completed geophysics covered 35.6 km (kilometers) of ground Moving-Loop Transient ElectroMagnetic (ML-TEM), covering the Preston West target where there is a known conductor, along with the Preston Far West target where a reconnaissance survey was conducted. The ground gravity survey consisted of 2,295 stations and covered an area along the FSAN and FSANE trends."

Skyharbour said the final geophysical data from the field program is pending.

After fulfilling its earn-in requirements by funding a total of CA$4.8 million in exploration at the project and making cash payments, Orano holds a 51% interest in the JV project, with the remaining interest split evenly between Skyharbour and Dixie Gold Inc. (DG:TSX.V; YWRLF:OTCMKTS) at 24.5% each.

The project's potential is highlighted by past discoveries in the area, such as NexGen Energy Ltd.'s (NXE:TSX; NXE:NYSE.MKT) Arrow deposit, Fission Uranium Corp.'s (FCU:TSX; FCUUF:OTCQX; 2FU:FSE) Triple R deposit, and F3 Uranium Corp.'s (FUU:TSX) PLN discovery.

Soil Sampling Program Planned for Summer

Previous exploration at the Preston project has consisted of ground gravity, airborne and ground electromagnetics, radon, soil, silt, biogeochemical, lake sediment, and geological mapping surveys, as well as exploratory drill programs, Skyharbour has noted.

"Over a dozen high-priority drill target areas associated with multiple prospective exploration corridors have been successfully delineated through these methodical, multi-phased exploration initiatives, which have culminated in an extensive, proprietary geological database for the project area," Skyharbour said in the release.

"Over a dozen high-priority drill target areas associated with multiple prospective exploration corridors have been successfully delineated through these methodical, multi-phased exploration initiatives, which have culminated in an extensive, proprietary geological database for the project area," Skyharbour said in the release.

An SGH soil sampling program with over 1,100 samples is planned for this summer, with additional news forthcoming, the company said. The SGH program will cover a large area and is a cost-effective, innovative exploration technique being used in the Athabasca Basin to vector in on uranium showings associated with certain hydrocarbons.

The total budget for the multi-phased 2024 campaign is approximately CA$850,000, with Orano as the operator and Skyharbour as a minority, participating partner in the project, Skyharbour noted.

Skyharbour has an extensive portfolio of uranium exploration projects in Canada's Athabasca Basin, with 29 projects, ten of which are drill-ready, covering over 587,000 hectares of mineral claims. In addition to being a high-grade uranium exploration company, Skyharbour utilizes a prospect generator strategy by bringing in partner companies to advance its secondary assets.

Other partner companies include Azincourt Energy Corp. (AAZ:TSX.V; AZURF:OTC), Thunderbird Resources Ltd. (THB:ASX) (formerly Valor Resources Ltd.), Basin Uranium Corp. (NCLR:CSE; BURCF:OTC; 6NP0:FRA), and Medaro Mining Corp. (MEDA:CNX). More recently, two earn-in option agreements have been signed with Tisdale Clean Energy Corp. (TCEC:CSE; TCEFF:OTCQB; T1KC:SE) to option the South Falcon East project, as well as North Shore Uranium Ltd. (NSU:TSX) to option the Falcon project.

The Catalyst: Could AI Spark Nuclear Renaissance?

Uranium is a key element in the ongoing clean energy revolution. Currently, its price is US$83.60 after surpassing US$100 earlier this year, according to Investing News Network.

"Since then, prices have contracted but remain historically high," the site said. "As of mid-June, values were holding in the US$85.50 range."

But many are still calling for a uranium bull market, given a renewed focus on nuclear energy worldwide, is a possible source of power for the artificial intelligence (AI) revolution, IG Bank wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQX; SC1P:FSE)

"Amazon, for example, bought a nuclear-powered data center in the United States earlier this year, and Microsoft is pushing for small nuclear reactors (SMRs) to be contained within data centers," author Nadine Blayney wrote.

IG Bank noted that Morgan Stanley has estimated a nuclear renaissance could be worth US$1.5 trillion through 2050 in the form of capital investment.

Ownership and Share Structure

Management, insiders, and close business associates own approximately 5% of the company. According to Reuters, President and CEO Jordan Trimble owns 1.54%, and Director David Cates owns 0.70%.

Institutional, corporate, and strategic investors own approximately 55% of the company. Denison Mines owns 6.3%, Rio Tinto owns 2.0%, Extract Advisors LLC owns 9%, Alps Advisors Inc. owns 9.91%, Mirae Asset Global Investments (U.S.A) L.L.C. owns 6.29%, Sprott Asset Management L.P. owns 1.5%, and Incrementum AG owns 1.18%, Reuters reported.

There are 182.53 million shares outstanding with 177.73 million free float traded shares, while the company has a market cap of CA$69.36 million and trades in a 52-week range of CA$0.33 and CA$0.64.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Skyharbour Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Tisdale Clean Energy Corp. and North Shore Uranium Ltd. have a consulting relationship with an affiliate of Streetwise Reports and pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources Ltd., Tisdale Clean Energy Corp., Azincourt Energy Corp., and North Shore Uranium Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.